Good morning!

I walked into Brighton last night (from Hove) to check out the Caxton Arms - the venue for forthcoming ShareSoc monthly meetings. It's a very nice, quite small pub, with excellent food, and friendly locals/staff. The downstairs function room is quite small, but will serve our purposes for the presentations.

I sampled the various lagers on offer, and concluded that the San Miguel was the best. Then walking home, the lager made its presence felt, so I had to pop into The Connaught to use the facilities, and ended up spending the rest of the evening there, chatting to a lovely couple at the bar. I've hopefully roped them in to come along to the ShareSoc event, on Tue 13 Sept 2016 - to book your place (limited numbers, so early booking advised) please click here.

It amazes me how many pub operators miss the obvious factor for success - putting friendly & sociable people behind the bar, to create a nice atmosphere. Both the Caxton and the Connaught excel on this front. Elsewhere though, all too often one is served by a sullen minimum wager, who looks at you as if you're mad or dangerous if you try to strike up a conversation. Isn't that the whole point of pubs?

There are hardly any relevant results out today, which is handy, as I have a backlog from yesterday to catch up on. Yesterday's report spluttered to a premature halt, in a cloud of smoke, and shattered piston rings, unfortunately. So hopefully I can do better today!

Today I intend report on:

- Restaurant (LON:RTN) - new CEO

- Rotala (LON:ROL) - Interim results

- Cloudbuy (LON:CBUY) (this one should be good for a laugh) Interim results

- Speedy Hire (LON:SDY) - the plot thickens re EGM

also, from yesterday:

- Proactis Holdings (LON:PHD)

- ST Ives (LON:SIV)

- Produce Investments (LON:PIL)

- Premier Technical Services (LON:PTSG) - trading update

Restaurant (LON:RTN)

Appointment of new CEO - this is much larger than my usual level of mkt cap for these reports. However, it was one of my annual tips at this year's UK Investor Show presentation - at c. 270p. This turned out to be a very well-timed purchase, as they're now 414p. Although I took profits at 360p (twice actually, there have been 2 bites of this microwaved dinner, because it dipped back down to 270p again last month - actually I bought some at 240p on the morning of the Brexit chaos). So this share certainly doesn't owe me anything, it's been nicely profitable.

It's always worth reading every RNS for companies that interest you, because sometimes there are unexpected trading updates buried within an RNS about something else, as in this case. The final paragraph gives an update on current trading, which is reassuring;

The Company will announce its Interim results on August 26th. The business continues to trade in line with previous guidance. An update on the operating strategy review will be given at the Interim results.

Valuation - forecasts have been reduced several times, following a string of profit warnings. EPS for 2016 is now forecast at 28.7p, so with a share price of 414p, the PER is 14.4, which looks about right to me.

New CEO - the existing CEO has fallen on his sword, which is very much a good thing in my view. He wasn't performing well (remember the excruciating conference call a while ago?), so bringing in a fresh CEO from outside the group, makes a lot of sense to me. The new head honcho is Andy McCue - formerly CEO at Paddy Power.

Remuneration packages need looking at too, because they're obscenely high. Most people don't mind rewards for success, but in this case the rewards have been excessive, for lamentable performance.

My opinion - this group has lost its way, and allowed its main format to become tired. It needs a complete refresh, to catch up with competitors, in my view. In any form of retail, of which food/drink is one, you cannot stand still. Competitors are constantly innovating, and customers like that. To stand still is to go backwards, as RTN has discovered.

The shares have had a great run, and look priced about right to me now. Although there is the chance of a takeover bid here. Its strong balance sheet, with minimal debt, and lots of freeholds is perfect for a leveraged buyout. So that could bring more upside. Although for me, I've made my money on this one, so won't be going back in at the current price - it's up with events now.

Rotala (LON:ROL)

Share price: 65.9p (up 5.4% today)

No. shares: 42.2m

Market cap: £27.8m

Interim results, 6m to 31 May 2016 - I last reported on this bus operating company here in Apr 2014. That report is still relevant, as not a lot seems to have changed.

Revenue for H1 up 11.2% to £27.4m

Underlying profit before tax is up 8.6% to £1,135k.

Interim divi up 10% to 0.8p. The final divis seem to be about double the interim, so the full year divi yield is around 3.4% - not madly exciting.

This sounds potentially interesting;

Group well positioned for opportunities arising from Buses Bill.

...the aims of the Government's Buses Bill have become much clearer since my last report to you. The effects of the Bill look to be very positive for your company, as I explain in more detail below.

I'm not going to start researching the Buses Bill - will leave that for someone else to do, as I'm not interested in buying any shares in this company. Rotala reckons it will be able to grow market share.

Balance sheet - is dominated by large fixed assets, and associated debt, as you would expect for a bus operator. Note that about a third of operating profit is absorbed by finance costs.

My opinion - it doesn't interest me. That's mainly because I try to avoid companies which operate in a Govt regulated sector - it's too easy for the goalposts to be moved.

Cloudbuy (LON:CBUY)

Share price: 7.4p (up 4.2% today)

No. shares: 130.4m

Market cap: £9.6m

Interim results, 6m to 30 Jun 2016 - as I thought, the company has reported another set of lousy figures.

Revenue of only £785k in H1 (down on both H1 and H2 2015)

Operating loss of £2.3m! (although this is improved from a £3.2m loss in H1 2015) - still nowhere near being a viable business though.

Cash of £1.9m, but also has debt of £2.1m

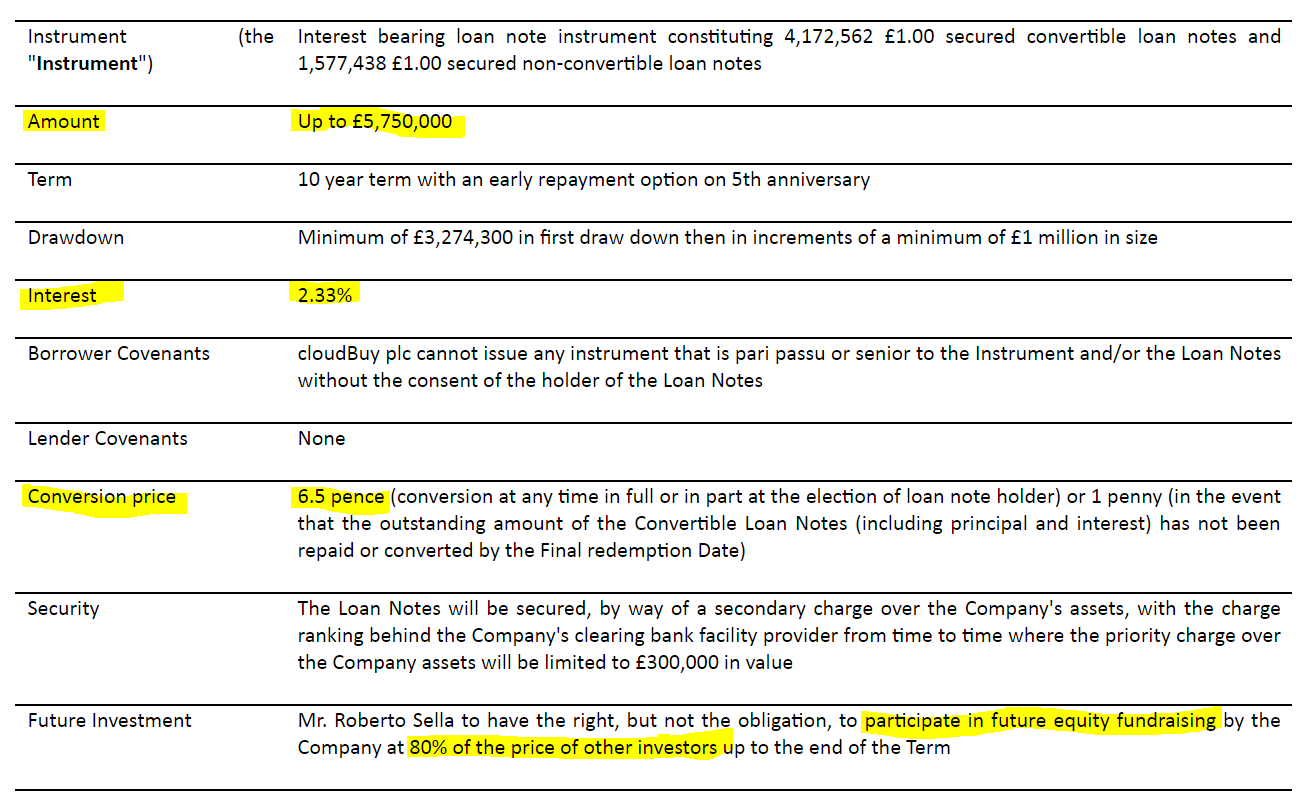

Cashflow statement shows £3m received from a convertible loan note - so it's worth checking the terms of that. h, I've just spotted note 4, which helpfully sets out the key terms, the most important of which I have highlighted;

Outlook comments - sounds as if there's not a lot of jam tomorrow, but possibly a jar of Bonne Maman in the middle distance?

The Company's realignment of its cost base will continue throughout the remainder of the year.

Revenue from projects already won should result in an increase in revenue in the second half of the year compared to the first and deliver a full year performance in line with last year, as well as providing contribution in the coming years.

Going forward, we believe that the current contracted mix of licenced business together with larger transaction based revenue projects will enable us to grow revenues in the medium term, whilst also developing further opportunities.

Contribution from new wins in the year should result in some increase in revenue in H2 over H1.

So basically, it's still losing money hand over fist, and it doesn't sound like that's going to change much for the foreseeable future.

My opinion - I think CloudBuy would have almost certainly gone bust by now, if it hadn't found a wealthy (and clearly very optimistic) benefactor - Roberto Sella - who seems to be a US fund manager.

Based on its dismal performance to date, I expect more of the same. So as Mr Sella's money is burned up over the next year or two, then one imagines he's likely to tighten his grip on the company, and could easily take control.

The strategy looks crazy - trying to set up eProcurement projects in multiple countries.

So a lousy performing company, with a horrible funding structure. What could possibly go wrong? Bargepole. In my view, the equity here is probably going to end up worth zilch in the end. Why take that risk?

Speedy Hire (LON:SDY)

Share price: 39.85p (up 2.2% today)

No. shares: 523.4m

Market cap: £208.6m

(at the time of writing, I hold a long position in this share)

Response to Toscafund EGM requisition - the plot thickens even more!

SDY has not rolled over, but come out fighting.

Speedy's "Independent Board" unanimously & strongly recommends shareholders vote AGAINST the EGM resolutions (to sack the Chairman & appoint a new Director, David Shearer).

Circular from Speedy to its shareholders is here. Key points:

- Extensive consultation with Toscafund - 11 meetings

- EGM is a costly distraction

- Toscafund trying to push Speedy into a merger with HSS Hire (LON:HSS)

- Defends the performance & strategy of Jan Astrand (the Exec Chairman)

- Chairman planning on stepping down to Non Exec anyway;

Following an encouraging first quarter of the current financial year and indications that the Group’s recovery is continuing into the second quarter, the Board has agreed with Jan Åstrand that he will return to a non-executive role with effect from 30 September 2016.

Speedy seems amenable to appointing David Shearer to its Board as a NED. However, Shearer insisted on the prior removal of Jan Astrand before he would join the Board. Speedy refused this precondition, hence the impasse, and EGM requisition.

A chart shows improvement in revenue per employee.

The summary is worth reading in full;

6. SUMMARY AND RECOMMENDATION

The Independent Board believes that Speedy’s recovery is now established, as evidenced by the improving revenue trend, and is a direct consequence of Jan Åstrand’s immediate and urgent responses to the downturn in trading in June 2015.

In view of the progress made to date, the Board has agreed that the time is right for Jan Åstrand to return to a non-executive role.

With the business now stabilised, and in anticipation of the successful turnaround of your Company, the Board, which has already been significantly strengthened by the appointment of Robert Contreras, Robert Barclay and Chris Morgan, will be giving consideration to the appropriate structure and composition of the Board to take Speedy into the next phase of its development. This will ensure transparent, structured and orderly succession planning, minimising disruption to the business.

The Independent Board does not believe that Speedy should merge with HSS at this time as Toscafund is advocating. Your Company’s recovery is progressing well and to engage in any sector consolidation would potentially put that recovery at risk.

For the purposes of Rule 2.8 of the Takeover Code, Speedy continues to have no intention of making an offer for HSS.

My opinion - this puts a very different light on things.

As a Speedy shareholder (!), I definitely don't want SDY to buy HSS. HSS has an absolute car crash of a balance sheet, with way too much debt, so they can dig themselves out of that hole. I don't want my shareholder funds at SDY being used to bail out a competitor with an insolvent balance sheet.

Given that Jan Astrand has already agreed to step down to Non-Exec, then that seems to have largely resolved the issue, without the need for an EGM.

It will be fascinating to see how this pans out. I can't vote in the EGM, as my position is held on a spread bet. However, based on today's statement from Speedy, I would be voting against the EGM resolutions.

Moving on now to yesterday's announcements which I missed, let's catch up on those:

Proactis Holdings (LON:PHD)

Share price: 119p

No. shares: 39.8m

Market cap: £47.4m

(at the time of writing, I hold a long position in this share)

Trading update - for the year ended 31 Jul 2016.

It's in line with expectations;

The Group has delivered substantial progress in all of its growth opportunities and expects to report revenues of approximately £19.4m (2015: £17.2m), an increase of 13%, with adjusted1 EBITDA of approximately £5.3m (2015: £4.8m), an increase of 10%, in line with expectations.

I really don't like adjusted EBITDA as a performance measure, and have no idea why Proactis quotes this figure. It can be highly misleading at software companies, in my view due to capitalised development spend - which is a real cash cost, and can't just be ignored.

Looking back at previous accounts, it looks to be capitalising development spending at about £2m p.a. Therefore I would be happy to adjust the £5.3m figure above down to £3.3m, being adjusted EBITDA after expensing development spending. That's an approximation to the real cashflow (before tax), in my view. Financing costs are minimal, so that can safely be ignored.

Various other details are given, about new contracts won, etc, which sounds positive.

On a PER basis, broker consensus is 6.67p 2015/16, and 8.16p in the new year, 2016/17. So at 119p, the PER of 14.6 is not particularly demanding, at 14.6 times the new year's earnings forecast. That seems fair to me.

The upside excitement with Proactis, is the potential for roll-out of its new product for networking its clients' supplier bases, and offering them an accelerated payment facility. Proactis has taken the opposite approach to Tungsten (LON:TUNG) in that they're offering a cheap and simple service, which only costs suppliers £50 p.a. each. So the idea is that large numbers of suppliers are likely to sign up. It's being trialled at the moment with Screwfix - and Screwfix is actually paying the £50 per supplier, to get them all onto Proactis system.

My opinion - I think of this share as the thinking person's Tungsten! It's well managed, profitable, cash generative, and has an exciting new service with considerable potential, thrown in for free. What's not to like about that? This is a (small) long-term holding for me, and I reckon it has good risk:reward characteristics.

I also like that Proactis has excellent visibility of revenues & hence earnings. Revenue for 2016/17 of £17.7m is already contracted - close to total turnover for last year.

Management seem to have a keen eye for decent bolt on acquisitions too.

Interesting to note that this share hasn't yet recovered much of the Brexit plunge, despite yesterday's in line update. Could be an opportunity, who knows? Although maybe the market is waiting to see more evidence that the new services are going to work, before giving the share another leg up?

Premier Technical Services (LON:PTSG)

Share price: 80.6p

No. shares: 88.1m

Market cap: £71.0m

(at the time of writing, I hold a long position in this share)

Trading update - everything sounds fine at this niche services company;

...although H2 has just started, the Group is trading in line with recently upgraded market expectations for the financial year ending 31 December 2016. The directors look forward to providing a full update on the Group's progress in the interim results announcement in September.

The group goes on to say that Brexit does not appear to have impacted on its ability to win contracts, and it has a healthy order book.

My opinion - I'm impressed with management here. They seem to run a tight ship.

Bolt on acquisitions seem to be excellent value, and are earnings enhancing.

ST Ives (LON:SIV)

Share price:

(I'll update this later, am having a snooze now)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.