Good morning!

It's quiet for results again today, so I've had a lie-in. Therefore please refresh this page from time to time, the full report should be up by about 2pm today.

Manx Telecom (LON:MANX)

Share price: 188p

No. shares: 113.0m

Market Cap: £ 212.4m

Trading update - sounds reassuring, with the company trading in line with expectations. Various other details are given about developments.

The shares have done well since floating just under a year ago, and the main attraction is the generous dividend yield. Although the company has quite a bit of debt, so I rejected it personally after looking at the figures a while ago.

I'd be a little concerned about possible monopoly and regulatory issues, which is why I never invest in utility companies.

I've never been to the Isle of Man, apparently it's a beautiful place, and of course Top Gear often film there, on sweeping & largely deserted country roads with stunning scenery.

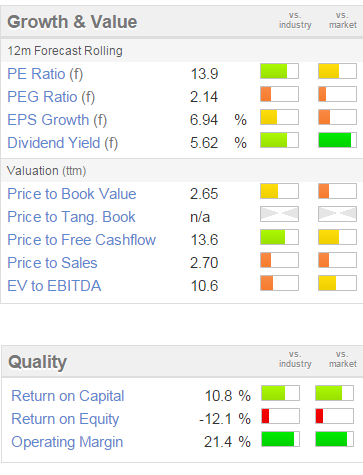

It has a StockRank of 76, and note the high operating margin below, and the good divi yield. Although the "n/a" against Price to Tang. Book is a red flag - that usually means that tangible book value is negative.

eg Solutions (LON:EGS)

Trading update - the company says it's "marginally ahead of consensus expectations", and the outlook comments today sound positive.

It's a difficult company to value at the moment. I've spoken to the outgoing CFO a couple of times at investor events, and they're on a big sales push, and migrating to a SaaS revenue model.

I'm intrigued by this company, and think it might have good potential, but it's educated guesswork really, as with a lot of small caps.

Accsys Technologies (LON:AXS)

A positive update from this innovative wood products company has put some life into the shares today. This stock looks expensive, and I believe there are issues with production capacity, but the update today sounds encouraging.

In particular I like that they are expecing cashflow breakeven in the current quarter.

Speculative, but worth a look, in my opinion.

Elektron Technology (LON:EKT)

An update today from this electronics manufacturer sounds potentially interesting. The company has struggled in recent years, with a tired product portfolio, but it reports improved trading in H2 today. Might be worth a deeper look perhaps?

Trakm8 Holdings (LON:TRAK)

Shares of this niche telematics company are up 7% today on a £1m contract win announcement. The company seems to be going from strength to strength. I was very impressed with management on a conference call a couple of years ago, and remember thinking that they sounded like the sort of people who should be running a much bigger company. The shares are up 5-fold since then. I've probably missed the boat on this one, so am reluctant to buy now.

Lidco (LON:LID)

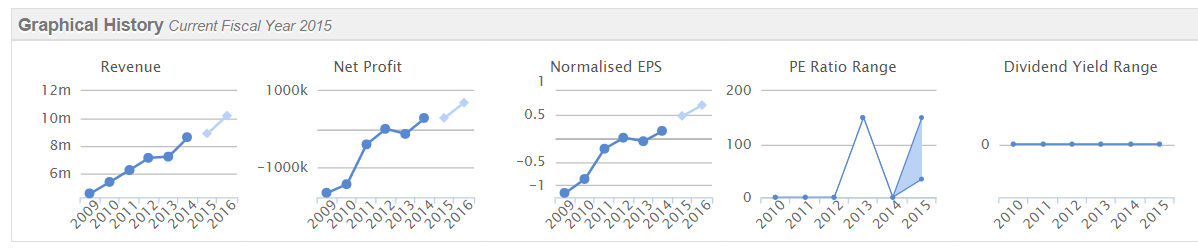

A trading update today sounds reasonable. The company appears to be making gradual progress, as the Stockopedia graphs below indicate:

The update today says profit will be "broadly in line", i.e. slightly below expectations.

The first company that puts out an RNS which actually says profits are slightly below expectations, instead of this "broadly in line" nonsense, will be an automatic buy in my view, as it will demonstrate searing honesty from management!

Ab Dynamics (LON:ABDP)

The company has won a £2.3m Govt grant to expand. Good news. This is an interesting company, and note that it scores very highly on Stockopedia's Quality scores.

My only concern is lumpiness of orders. Other than that, it looks a good company.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.