Good morning! Another interesting morning too, with lots going on. I'm increasingly looking for opportunities in the oil sector, and over the weekend I did an oil sector special audiocast, with an expert in the field, Paul Curtis. Click here to listen to me interviewing him yesterday. There's no angle on these audiocasts, they're free, with no advertising. I just enjoy doing them, and think they are interesting, and other people seem to like them.

Stop Press: Mello Beckenham, at Sea Salt restaurant, is next Monday, 19 Jan, and the company presenting is a micro cap HML Holdings (LON:HMLH) which is a property management company. Please see the usual webpage here for details on how to reserve a place.

SkyePharma (LON:SKP)

Share price: 284p (down 17% today)

No. shares: 104.8m

Market Cap: £297.6m

For more information, there is a link embedded in the picture of their website above. Just click on the nice lady looking wistful as she is about to take a pill.

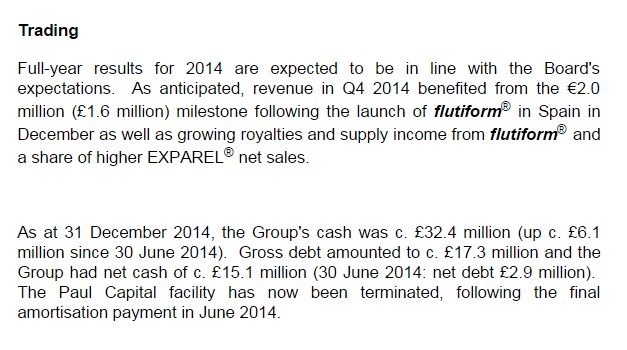

Trading update - this sounded fine to me when I first read it, but the market seems to disagree, with the shares currently down 17% to 284p, so I've clearly missed something that the market doesn't like. It's encouraging to see that they are trading in line with expectations, and that the net cash position looks fine;

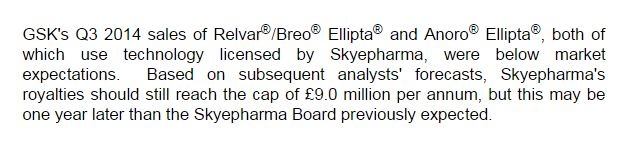

This bit sounds mildly negative;

R&D spending is set to rise, from around £4.5m in 2014 to around £10m in 2015. Is that negative? I wouldn't say so - a drug development company should be spending money on R&D, so it seems odd if this point has triggered the sell-off today.

The Directorspeak at the end sounds positive, so all in all, I'm not terribly sure why the market has marked down these shares so heavily today. I'm wondering if this might be a good opportunity to top up? Think I'll wait until I've seen some updated broker notes, as it's important to know you own limitations - pharmas are not an area that I know well enough to get heavily involved in. Although the figures do seem to show SKP as being a potential GARP share (growth at reasonable price).

UPDATE: I've read some broker research now, and it seems a combination of factors have made quite a big difference to forecasts, with 2015 EPS forecast being reduced by about a third, from about 28p to 17p. So that explains the share price drop this morning. Although the longer term outlook still sounds good, and the valuation hardly seems demanding, at 16.7 times revised 2015 EPS. I'm inclined to sit tight, rather than buy any more.

I imagine the company could make an attractive takeover target at this valuation.

Lamprell (LON:LAM)

Share price: 96.7p (down 14% today)

No. shares: 341.7m

Market Cap: £330.4m

This engineering company serves the oil sector, mainly fabrication & refurbishing of oil rigs. It won't come as a surprise that the company has warned on profit, as this sector is being decimated with capex cuts from the oil producers, in response to the collapse in the oil price.

Trading update - the company today reports on a strong finish to 2014, "...slightly ahead of expectations". But it then goes on to say (fairly obviously) that such a strong performance will not be replicated in 2015, due to a weaker market.

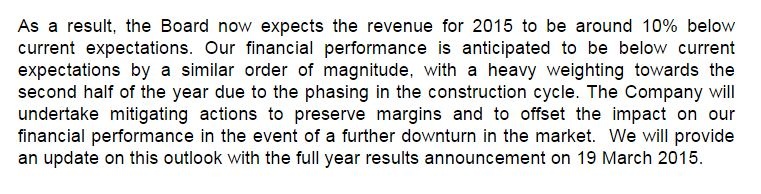

So the company is guiding down expectations for 2015 as follows;

Balance Sheet - the company makes reference to its strong Balance Sheet a couple of times in today's update, and it looks like the equity refinancing in 2014 was done in the nick of time. Checking the last interims, I like Lamprell's Balance Sheet - it had net current assets of $290.3m at 30 Jun 2014, which was a current ratio of a healthy 1.65.

The only long-term creditor was $36.2m pension deficit. So overall the company looks soundly financed, which is vital to consider when looking at oil services companies, as the big question is whether they will survive this downturn in business, if low oil prices last for some time?

My opinion - I haven't looked at this company for a few years, so am rusty on it. There might be some attraction in the shares at some point, but in the current environment I think it would be very brave to try to call the bottom.

In my view, to be on the safe side, you really have to consider that the company is not likely to make a profit at all going forwards, once existing orders have worked their way through. Indeed, it could be heavily loss-making. Even if oil prices do recover, the producers are going to be screwing service companies on price for some time, one would imagine.

Therefore this is not a falling knife I am tempted to catch. I think this type of company would need to look insanely cheap before I'd be tempted, and it's nowhere near that point yet, in my view. That said, today's losses could be tomorrow's gains. If/when the price of oil does recover, then there could be a backlog of capex from oil producers for companies like Lamprell to benefit from perhaps? It just seems probably too early to dive in yet, in my (non-expert) opinion.

Has the share price gone down enough to reflect the dramatically lower oil price?

NetDimensions Holdings (LON:NETD)

Share price: 85p (up 9% today)

No. shares: 38.8m

Market Cap: £33.0m

Trading update - the wording of today's update is very similar to the same time last year, with the key part saying;

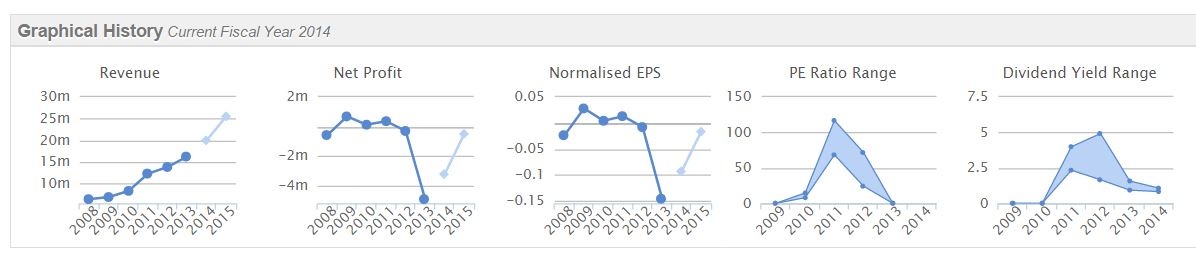

It's still loss-making though, and the historic performance looks uninspiring;

My opinion - I don't know anything about the company, it seems to be an online training company for staff? For Malaga Inc (BER:33M) market cap I'd want to see profits & divis. There is a tiny divi here, but it still appears to be loss-making, judging from today's statement, so I can't see any reason to spend any more time researching it.

(of the companies mentioned today, Paul has a long position in SKP, and no short positions. A fund management company with which Paul is associated may hold positions in companies mentioned).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.