Good morning! Markets in the US and Asia have been fairly well behaved overnight, so we're looking at an open here about level, with the FTSE around 6,551.

On Weds (10 Jul) I mentioned that Mission Marketing (LON:TMMG) looked potentially interesting. It dipped 12% on that day to 23p per share after a mild profits warning, although I still quite liked the look of it on valuation grounds. The price bounced back yesterday to just over 24p, and it is announced this morning that their Executive Chairman has bought 120,000 shares at 24p each, so that's a outlay of £28,800, which is enough to be meaningful in my view.

Generally speaking, any Director purchases under £10k, especially orchestrated ones where several Directors buy at the same time, are counter-productive, since it just looks like they want to push the share price up, but are not prepared to back it with any meaningful amount of money. But £29k is a decent enough slug of dosh to lay out in a small cap, so this one gets a thumbs up from me.

Quintain Estates And Development (LON:QED) announce that their JV to redevelop Greenwich peninsula in London, has secured three positive planning decisions. I gave up on Quintain shares a while back, as it became clear that their projects were so long term (20 years in the case of Greenwich), that it was difficult to see how shareholders would benefit.

Furthermore, I am more convinced than ever that UK house prices are a huge bubble that will inevitably burst when interest rates rise. If you look at mortgage payments relative to incomes, they are currently affordable. However, if you recalculate mortgage repayments at a more normal interest rate, then they become completely unaffordable.

This will inevitably lead to a deluge of sellers, especially "accidental" landlords who thought they were onto a good thing by letting out their old house rather than selling it, and making a big profit on the rent, and assuming that prices would keep going up forever. When interest rates go up, they will begin to feel real pain for the first time, and after a time lag, many of those properties will come on the market. As supply builds, and sellers become more desperate, prices will have to fall.

The idea that interest rates will remain at 0.5% until 2015 seems unlikely to me. The economy is spluttering into life again, and sooner or later our interest rates will have to rise to prevent a serious fall in sterling.

It is for these reasons that I am completely avoiding housebuilders, and residential property companies, as it seems likely to me that they will run into serious headwinds in 2014 or 2015.

Forbidden Technologies (LON:FBT) have successfully got away a Placing & Open Offer at 20p per share. It will result in the issue of 44.56m new shares at 20p, which is a sizeable deal, at about half the existing equity being issued in new equity.

I simply don't understand the £19m market cap here, as based on the historic numbers, you would struggle to value it at a quarter of that. So investors must be convinced of the growth potential for their cloud-based video editing software. It's not my sort of thing at all.

One of my favourite shares, Portmeirion (LON:PMP) announced yesterday that they are putting some of their cash pile to use. They have bought the long lease for their warehouse & head office building, for £3.9m. This will eliminate a cash outgoing of £306k p.a. for the rent.

The P&L impact is smaller, at £220k p.a.. I queried why this was lower, and the reason is that they are now depreciating the buildings they own over 50 years (not the land), and there is also a small offset for the lost interest received.

To my mind this is a sensible deal, as at the last reported Balance Sheet they had £7.5m in net cash, generating only £39k p.a. in interest income. So investing £3.9m of that in order to eliminate a £306k p.a. cash outgoing is clearly very sensible.

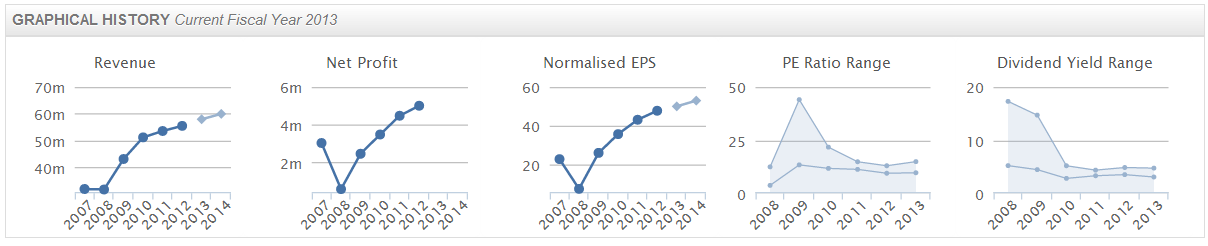

On the back of a positive write-up in this week's Shares Magazine, and possibly a positive reaction to the warehouse deal, the shares have ticked up a bit this week. I hold shares in Portmeirion, and as reported here a few days ago, have recently topped up my position. To my mind, the quality of the business: it's decent operating profit margin, earnings & dividend growth, plus the reliable nature of revenues from iconic product designs, and the bullet-proof balance sheet, deserve a much higher rating. It should be priced as a luxury goods business, on a PER nearer 20 in my opinion, not a forward PER of about 12 as it is at the moment.

There is a small pension deficit here, but it's only £5m, and is likely to disappear as bond yields rise, and in any case there is almost enough cash in the bank to eliminate it, even after this property deal.

Check out the useful graphical history charts on Stockopedia to see what I mean about the quality of the business at Portmeirion:

Alumasc (LON:ALU) was just beginning to look interesting when I last looked at it on 15 May after an in line trading update, with my comments being (and apologies for quoting myself, but it saves time by checking the archive here, and that's what the archive is there for!):

Alumasc (LON:ALU) issues an IMS today, which states that full year trading (they have a 30 June year end) will be in line with expectations. They describe the order book as "healthy". Might be worth a look? Although as I commented here on 5 Feb 2013, the valuation doesn't look quite so cheap when you factor in a fair bit of debt, and their pension deficit. I thought it looked fully priced at around a quid a share, but note that it's somewhat cheaper now at 88p. The dividend yield is starting to look interesting, at 4% forecast for this year, and 5.2% for next year.

The good news for shareholders is that their trading statement today is more upbeat, saying that "underlying group profit before tax for the year will be ahead of management's previous expectations".

Cashflow has also been good, with net debt expected to be c.£8m. Their order book remains strong at £44m.

So all looks pretty good. The shares are up 17% this morning to 110p.

It's difficult to say whether they represent good value or not, as we don't know by how much they are likely to exceed expectations. Consenus forecast for y/e 30 Jun 2013 is 9.4p normalised EPS, so at a guess I would say they might come in actually in the 10-11p range perhaps? So the shares are probably on a PER of about 10 after this morning's rise.

Net debt of £8m is fairly material, in the context of a £37m market cap.

Checking back to the last interims, the pension deficit was £13.7m at 31 Dec 2012, so again a fairly material creditor there, so I would want to read all the notes about the pension fund in the last Annual Report before even considering buying the shares.

The valuation doesn't look particularly appealing to me, but it depends on what you think the prospects for trading are like - if continued improvements in trading are likely, then the shares could be cheap based on future profits. I don't know anything about the business, so do not have a view on that, but it might be worth looking into, as the figures are showing a company that's performing well.

There are two announcements today from Lombard Risk Management (LON:LRM), a software company to the financial services sector.

They announce a smallish Placing, to raise £2.6m through Placing 23..6m shares at 11p. In my opinion, there are five things to check with all Placings;

My checklist for assessing Placings

1. What is the discount to the market price? The smaller the discount, the better, as a small discount demonstrates that there was good demand for the Placing shares. A larger discount means the company is desperate & struggled to raise the money. Also, existing shareholders don't want to see new shareholders getting cheap new shares, and there is the danger they will "flip" the shares for an instant profit, so a large Placing discount will tend to pull down the share price post the Placing, and act as an anchor on the future share price.

2. What dilution is there? i.e. how many new shares are being issued, relative to the existing number of shares. Again, less dilution is better for existing shareholders. More shares in issue means that EPS falls proportionately, as do dividend payments, etc., so generally dilution is a bad thing. The exception is where a company is investing in something that is so good, that the returns from the investment outweigh the impact of dilution (a good example of that recently was Newriver Retail (LON:NRR) doing a large Placing, but to invest in high yielding property, which should not dilute existing EPS or DPS, once the funds are invested).

3. Who is taking part in the Placing? Providing points 1 & 2 above are acceptable, then I like to see Directors taking up a meaningful number of shares in a Placing. The more skin in the game, the better (up to about 15-20% of the total issued share capital, which is the point where Director holdings become too dominant). I also like to see known shrewd investors taking part.

4. Are the adviser fees reasonable? Frankly, Placings do not involve a lot of work. I've taken part in a few, and they are quick & easy to do. So fees over 5% are taking the proverbial, but you sometimes see fees as high as 10% for very small Placings. At that level companies are better off doing Placings privately, with angel investors, or groups of High Net Worth (HNW) investors, by-passing the expensive City firms.

5. What are the Placing proceeds being used for? Each situation is different, so that needs separate analysis. Generally speaking though, if the funds are being raised to make a sensibly priced, earnings enhancing acquisition, then that is good. Other good reasons would be to strengthen a weak Balance Sheet, and to invest in new products which have genuinely exciting potential.

Going back to the Placing from Lombard Risk Management (LON:LRM) today, it passes tests 1 & 2 above, in that the discount is modest at 6.4% to the previous mid-market price. It is not unreasonable for people buying large blocks of shares in an illiquid company to ask for a bit of a discount, to compensate them for the illiquidity. A discount under 10% is OK in my view.

As regards dilution, the existing number of shares is 232.6m, so the issue of another 23.6m is slightly over 10% enlargement of the share capital, which again looks fine to me.

As regards point 3 above, there is little detail of who is buying the new shares, other than the disclosure that a new Director, John McCormick, is expected to be appointed in Oct 2013, and is buying £500k of the Placing shares. Interestingly, he is currently Chairman & CEO of Royal Bank of Scotland in Asia Pacific. So a heavyweight banker joining the Board, and buying a decent slug of shares in itself should excite some investor interest. He must see potential here.

As regards fees, I can't see any reference to what the net proceeds are.

The reasons given are: to accelerate product development, to provide additional working capital, and (same thing really) to strengthen the balance sheet.

(note: my computer just crashed, so I'll carry on updating this article, even though the 11am email is about to go out!)

Turning to the other RNS from Lombard Risk Management (LON:LRM) today, it's an AGM statement. I was initially excited on reading this statement, as it says that trading since the (31 Mar) year end has been in line with expectations. There have also been new licence wins in recent days, including a major Asian bank, and to Bank Leumi (never heard of them) in the UK and US.

The PER looks very attractive at 7 for this year, and 6 for next year, and they should now be cash positive. So I looked through the most recent accounts, but the trouble is (as with a lot of software companies) Lombard Risk are capitalising their software development costs. This actually creates almost all the adjusted profit. Adding back the development spend, they hardly make any profit at all.

In fairness to the company, they are not trying to conceal this, quite the reverse - it is stated clearly in the headline figures to their last set of accounts.

So on balance, I'm not prepared to value the business on a profits measure that strips out a large part of their costs, which I would argue are essential costs for a software company. The moment you stop developing the products, you wither away & die.

OK, that's me done for the day, and the week. Wishing everyone a pleasant weekend, and see you back here on Monday morning, from 8 a.m., which is when I start publishing these articles in stages, between 8 a.m. and 11 a.m., which is when the email goes out. There's a link to the email list below each article.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in PMP and NRR, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.