Good morning!

I'm still in Manchester, having stayed in a hotel overnight, after an excellent visit to the HQ of Boohoo.Com (LON:BOO) yesterday afternoon, and dinner with 4 of their buyers & their Operations Director. It fully lived up to my expectations - this is my favourite stock for the next few years (and one I hold personally, obviously).

When time permits, possibly this weekend, I'll post a separate article all about the company, and my visit. So just grabbing a spot to write an abbreviated morning report, having just asked the hotel to let me have a late checkout.

Norcros (LON:NXR)

Share price: 193.5p (up 7.8% today)

No. shares: 61.0m

Market cap: £118.0m

(at the time of writing I hold a long position in this share)

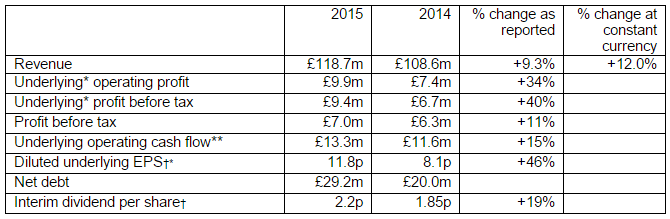

Interim results to 30 Sep 2015 - as a holder of this stock, I'm really pleased with these figures. The highlights make impressive reading, although as with all companies, the highlights section is very much putting the best foot forwards;

The narrative says that all parts of the business have improved performance in H1 this year. Acquisitions have helped boost the numbers, and seem to have been good acquisitions at reasonable prices.

The downside with any group that grows through acquisitions, is that the balance sheet gradually becomes increasingly top-heavy with intangible assets. That's the case here, but it's not at a problem level, in my eyes. Also net debt appears still to be at sensible levels.

Note the pension deficit is quite large here, requiring ongoing cash over-payments of about £2.2m p.a., so the valuation should be adjusted down to take that into account (although it looks as if the market has gone completely overboard in adjusting for this, as the forward PER now looks anomalously low).

Outlook - this is really encouraging, in that the company today says;

With our strong brands, leading market positions and continued self-help initiatives focused on market share gain the Group is well positioned to make further progress. Given the strong first half performance and momentum within our businesses, the Board now expects the Group to achieve underlying operating profit marginally ahead of market expectations for the year to 31 March 2016.

I don't recall this company getting ahead of market expectations in the last few years, so this seems a positive development. It has the look & feel of a group that is beginning to make good progress, after several years of management sorting out legacy problems.

Valuation - this just seems far too low to me, even allowing for the pension deficit;

My opinion - it's a boring company, but so what? Boring is good! There seems to have been an overhang in the market for several years, although I notice that Gervais at Miton has been a big buyer, and is up to 15% now, so hopefully he might have cleared the overhang?

To my mind this share is clearly worth 300p+ on a forward PER basis. So the current price of 193.5p seems a pricing anomaly to me. Who knows when the market will eventually correct to a more sensible valuation? It's been stuck down at this level for ages now.

The growth strategy could well be the catalyst to trigger a re-rating here, as management are building a really good track record of good acquisitions at the right prices. That is driving up EPS very nicely now, and it looks like next year's EPS should be 25p+, as it will benefit from a full year of the acquisitions. Surely a PER of 10-12 is justified? That means 250-300p looks a sensible price target range, with divis being paid along the way. I don't understand why this share is only 193.5p right now, that just doesn't make sense to me at all.

FW Thorpe (LON:TFW)

Share price: 215p

No. shares: 115.7m

Market cap: £248.8m

AGM trading update - today this lighting group says;

...currently we see a mild softening in some of our markets with others faring well. The sum of the whole, we are confident will provide a satisfactory result for the current year."

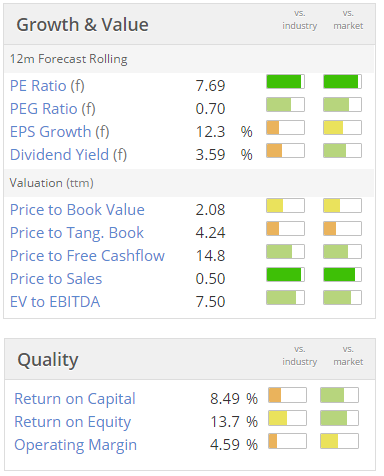

How to interpret this? Overall it sounds OK, with the "satisfactory result" comment. However, this share has re-rated significantly in the last year, and now appears to be on quite a high rating - note that the figures below are based on trailing twelve months (ttm), since no broker forecasts are currently shown by Thomson Reuters, who provide the data for Stockopedia.

In my view, highly rated shares can't have any question marks over them, so in this case it's possible that the share could now drop back a bit more.

Ubisense (LON:UBI)

Share price: 60.5p (down 27% today)

No. shares: 36.4m

Market cap: £22.0m

Profit warning - yes another one, that makes 3 this year, I think.

The problems in the German car industry are mentioned;

The RTLS division has been materially impacted by the recent well-publicised challenges facing the Company's large automotive customers, in Germany especially, and this has resulted in the downscaling, delay or cancellation of certain major deployment contracts and a likely lengthening of customer decision cycles in the wider industry.

Helpfully, the company does quantify the likely figures for this year;

Due to these unforeseen circumstances, there is a risk of a material revenue and subsequent profit shortfall against previous guidance for FY15. The Board's estimate is that second half revenues will now be in the range of £12.6-14.6 million (as against first half revenues of £10.4 million) and that full year FY15 revenues will therefore be in the range of £23-25 million. This range of outcomes should result in at least a small positive adjusted EBITDA for the second half, before non-recurring costs, but an adjusted EBITDA loss for the full year FY15.

Bear in mind that the H1 figures were dire - I reported on them here, on 17 Aug 2015, where I concluded that, "I think this share could be a disaster waiting to happen, so needs to be viewed as extremely high risk in my opinion.". So I hope that no readers got caught on this one.

Cost-savings - annualised cost savings of £2m have already been implemented, and another £3m is in the pipeline, which look to be very deep cuts, and will of course involve exceptional costs.

Bank debt - this is my main concern. Loss-making companies shouldn't have bank debt, as it's too risky. This situation sounds tense to me;

Cash conversion this year has been adversely affected by restructuring costs and extended payment terms on certain contracts, impacting the collection of receivables. Gross cash at the end of October 2015 was £4.8 million, with £5.3 million drawn under the Company's available debt facilities, giving a net debt position of £0.5 million. The Company expects to remain in a gross cash, but net debt position, as at 31 December 2015. Management is in regular dialogue with its principal lender, HSBC, who remain supportive and in constructive discussion to support the Company's on-going requirements. The Board is determined to ensure that the Company's cash outflow situation is rectified though improved cash conversion in 2016, coupled with the benefits of the recent and current cost alignment initiatives.

My opinion - it seems obvious to me that this company will almost certainly have to do an equity fundraising to replace some or all of the bank debt, which could end up being on punitive terms for existing holders. That makes the shares uninvestable in my view. There's a bigger question as to whether this is actually a viable business or not?

Communisis (LON:CMS)

Share price: 44.25p (down 15% today)

No. shares: 207.5m

Market cap: £91.8m

Trading update - this statement has triggered a 15% drop in share price, so it must be a mild profit warning. Reading it, I think the market has possibly been a bit harsh in marking down the shares by 15%.

The Group expects to deliver results for 2015 that reflect double-digit growth in adjusted operating profit, improved free cash flow and increased adjusted earnings per share when compared to 2014, but slightly below previous expectations, due specifically to the performance of Life. Otherwise trading in the Design, Produce and Deploy divisions is in-line with expectations.

Given that Life was acquired in Jan 2015, I do wonder if they were sold a pup?

In Design, Life, the Group's shopper marketing agency acquired in January 2015, is taking longer than anticipated to contribute its projected earnings, due to some reduction or deferral in spend by existing clients and to the phasing of certain new business opportunities. Nevertheless Life's pipeline for 2016 is building and the strategic rationale for its acquisition remains clear, with synergy opportunities emerging as the Design and Deploy segments offer their combined services to brand owners.

Outlook - the CEO's comments today sound reassuring;

"Communisis will show good growth overall and increased cash generation in 2015, despite being held back in the short term by a slower than expected start at Life. Recent contract wins and renewals together with the health of our pipeline, provide positive indicators of the Group's prospects for 2016."

My opinion - if you like the company, then the 15% drop today might be a chance to nip in and buy some discounted shares.

Personally, I find the balance sheet far too weak to consider this investable. There's a lot of gross debt, and a hefty pension fund deficit. When you write off intangibles, the NTAV is heavily negative. Also, I'm not convinced that direct marketing the old fashioned way, by junk mail basically, is the right space to be in, with so much ad/marketing moving online.

![5644c2d280db5FW_Thorpe_valuation].PNG](https://images.stockopedia.com/user-images/node-111333-5644c2d280db5FW_Thorpe_valuation%5D.PNG)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.