Good morning!

I'm back from my holiday, suitably refreshed. A big thanks to Graham for covering for me whilst I was away. It's worked so well, that we've asked Graham to join the editorial team. So he and I will be working together, to provide better coverage - 5 days per week, all year round (except bank holidays obviously) - and covering more companies too. Plus we'll be able to discuss each other's views too, giving additional thought on many stocks.

Please note that Graham and I are both writing today, so there will be 2 articles, marked Part 1 and Part 2. I will be covering BOO, LVD, VCP, and possibly more.

Graham is covering in Part 2 the following companies - IQE, IDOX, and BOOM.

Here is the link to Graham's article today.

Boohoo.Com (LON:BOO)

Share price: 118.25p

No. shares: 1,123.3m

Market cap: £1,328.3m

(I only hold a tiny, residual long position in BOO, having previously sold nearly all my shares)

Trading update & acquisition - it's a positive trading update. Key points;

- Continuing to trade well

- Revenue growth of between 38% and 42% in FY 17, against previous guidance of between 30% and 35%

- EBITDA margin of between 11% and 12% in FY 17, against previous guidance of around 11%

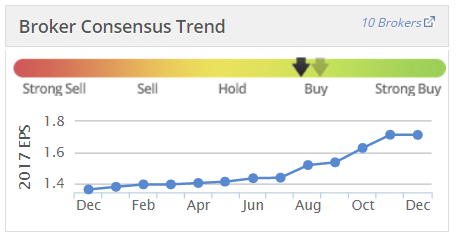

Therefore, we should expect to see further increases in broker forecasts, continuing a pattern of increases - something you often see with very highly rated shares. It's so helpful when companies give specific numerical guidance like this, rather than generalised text waffle.

All companies should give specific guidance like this. Although I accept that it's easier for retailers, as the figures are easy to predict. Whereas businesses which rely on large contract wins will struggle to give reliable guidance.

Acquisition of PrettyLittleThing - it's good to see the uncertainty & conflict of interest here has been resolved. PLT is a competing company, set up & run by the son of BOO's CEO. It's been clear for a while that PLT is an exciting growth company in its own right. However, that obviously creates a conflict of interest - not a problem when BOO was a private company, but a very serious problem once BOO is a listed company. You can't have the CEO's son running a very similar business on the side. Hence why a call option was included as part of BOO's float.

The call option gave BOO the right to acquire PLT for £5m, by Mar 2017. So clearly a decision had to be made, and there was only one possible outcome - BOO had to exercise the option, even though PLT is probably now worth multiples of the £5m agreed price.

The deal that's been done is a bit of a fudge. BOO is acquiring 66% of PLT, with founder management retaining the other 34%, providing they meet performance targets (undisclosed), and stay in place for 5 years.

As regards the 34% management stake;

At 28 February 2022, the boohoo Group will have the option to acquire this remaining 34% at market value3

Market value is to be determined this way in 2022;

3. The market value for the remaining 34% will be determined by a Big Four accounting firm. The consideration will be satisfied in cash and/or boohoo Group shares at the discretion of the Group Board.

A reduced consideration will be payable if Umar and the management team do not meet the necessary retention and performance criteria. If the boohoo Group does not exercise the option to acquire the remaining 34% of PLT by 28 February 2022, a dividend of up to all of the PLT distributable reserves at that time will be payable to all PLT shareholders including boohoo, pro rata to their shareholdings.

UPDATE: Broker forecasts - I've just seen some updated forecasts for BOO, as follows;

- y/e 02/2017: 1.9p EPS

- y/e 02/2018: 2.3p EPS (PER 55.7, based on 128p share price)

- y/e 02/2019: 2.8p EPS (PER 45.7, based on 128p share price)

As it's a Feb year end, the current year is nearly finished, so we should be valuing the company on the 02/2018 forecasts. A PER of 55.7 is certainly very rich, but it drops significantly down to 45.7 on the following year's forecasts.

If PLT kicks in decent profits from that point onwards, then there's scope for forecasts to keep rising strongly. The valuation is certainly high, but it's not bonkers, given the company's excellent track record, and ongoing international growth too.

My opinion - I think opinions will differ on this! My view is that it's probably a necessary way to lock in the PLT management - who have demonstrated that they are capable of largely replicating what BOO did in its early years.

So if BOO had bought 100% of PLT, as originally planned, then there's little doubt PLT management would have walked out, and set up their own, private firm to compete with the combined BOO/PLT group.

Therefore, my view is that I'd rather have them within the BOO group, properly incentivised to make PLT work well, than outside the group as another competitor.

Nobody bought BOO shares on the float because of the PLT call option. It was an aside, to deal with a conflict of interest. So in a way, this is a nice problem to have - PLT has done so well, that it is now a serious issue.

Some figures are given on PLT's performance to date, note the very rapid revenue growth;

PLT is expected to achieve revenue growth in excess of 150% in the financial year ending 28 February 2017 ("FY 17"), while being broadly breakeven at EBITDA level.

In FY 18, the Group plans to review and invest in PLT's operations, including its warehousing, to ensure the Company is well positioned for the future. Accordingly, PLT's revenue is expected to grow at a similar rate to boohoo's in FY 18

I don't understand the last sentence. Surely if BOO is going to invest in PLT, then its revenue growth should be maintained at a very high level?

UPDATE: I've queried the PLT growth rate with the company's advisers. The feeling is that, having achieved explosive growth to date, that it's prudent to plan for a pause for breath in PLT's growth rate, as it is assimilated into the group.

Customer service is paramount, so they don't want to drive the top line so hard that support functions are overwhelmed.

Also I think they want to pre-empt analysts getting too excited, and keep expectations grounded.

Overall, I think this deal will probably ruffle some feathers - i.e. people may say that BOO should have bought 100% of PLT, as it was entitled to. However, that misses the point that doing so would effectively destroy PLT, as its management would walk out.

In the circumstances this outcome isn't ideal, but I think it's probably a sensible compromise in order to retain talented management at PLT.

It will of course mean a further rise in forecasts, to reflect consolidation of PLT's results into the BOO Group from 3 Jan 2017.

UPDATE: the market seems to have seen the positive sides of today's announcement, with BOO shares currently up 6.5% to 126p. I'm sure that a rising share price will neutralise any complaints people might have about the terms of the PLT deal.

Lavendon (LON:LVD)

Update - things are getting more interesting here by the day. Shareholders are in the enviable position of having 2 competing suitors, who both wish to buy Lavendon.

Recommended offer - at 220p per share in cash, announced this morning, from Loxam. This trumps the previous, hostile bid from TVH at 205p per share.

Lavendon's Directors have recommended this deal, but as they hold only 0.55% of the company, their votes carry little sway. I presume that the Board would have consulted the big shareholders, and got their agreement before recommending the deal, but you never know.

I've searched today's announcement for the word "irrevocable", to see what level of institutional support there is for this offer. It appears 13 times, but only relating to the 0.55% Director holdings. There's no mention that I can see of any institutional shareholders having given any irrevocable undertakings to support the deal.

So it will be interesting to see if this 220p cash offer is the end of the matter. I suspect it probably won't be, because TVH are still very much in the running, having issued this update today;

TVH sets aside no increase statement - following hot on the heels of Loxam's recommended cash offer at 220p, TVH has this morning informed the market that it is considering its options. Its original statement that 205p was the highest price it was prepared to pay, has therefore been withdrawn.

Clearly then TVH is considering whether to submit a higher offer. Even if they do, who's to say that's the end of the matter?! Exciting stuff. Well done to people who held on.

My opinion - two or more competing bidders is a dream scenario for shareholders, as it makes it very likely that one or other bid will go ahead. Also it's more likely to maximise the price, given that the company is now really being auctioned off.

At 231p per share, the market is pricing in an increased offer.

In my view neither offer is generous. The stock market fundamentally mis-priced Lavendon, as I have said before these bids emerged. So the forward PER is still quite modest at 11.7. I don't think that's really much of a bid premium at all. It's more the case that the starting price was completely wrong, at about 130-135p level.

That said, if the recommended bid is rejected, the share price is likely to just slide back down. Therefore, if I still held, I'd be keen to exit if a higher bid, perhaps around 250p, is forthcoming.

Personally I sold out at 190-195, because I had no idea a competing bidder was lurking. Never mind, nobody ever went bust banking a decent profit!

Punch Taverns (LON:PUB)

(at the time of writing, I hold a long position in this share)

Takeover speculation - I noticed that the share price here had shot up this morning, so called my broker to ask if they had seen any information to explain it (no RNS, at the time of writing). He advised me that apparently Sky news is reporting that Heineken may be interested in buying Punch. He then quipped "Britain up for sale, with sterling at this level". Quite. Exciting times for investors though.

With the share price now up 21% to 156p, the company will have to issue an RNS to confirm or deny the press rumour.

I shall report back once we have some news.

We had a discussion at Mello Beckenham recently, looking at potential takeover bids. I mentioned Punch Taverns (LON:PUB) and Enterprise Inns (LON:ETI) (I hold long positions in both) as both being special situations, where a bidder might see an opportunity to restructure their debt onto lower interest rates. That would transform their profitability - as both are currently loaded with expensive borrowings.

I've topped up my holding in ETI this morning, as if a bid does appear for PUB, then I see obvious read-across which should boost ETI's share price too. Both have heaps of freeholds on their balance sheets, although it's questionable whether book value is realistic or not. Although bear in mind that plenty of pubs have good alternative use values - I looked at a boarded-up pub in Cheshire, which some friends were hoping to buy for c.£300k. The agent told us that a supermarket had bid over £600k for it. So don't assume that failing pubs are necessarily a liability, in some cases they could be a windfall asset.

UPDATE: Here's the RNS - Possible offer for Punch Taverns - Punch has received TWO takeover approaches.

Patron Capital Advisers LLP/ Heineken - Punch is in "advanced discussions" regarding a possible cash offer at 174p per share. It is conditional on the Board recommending it.

Emerald Investment Partners Ltd - this sounds like an earlier stage approach, but is for a possible higher cash offer, of 185p.

The Emerald Proposal is conditional on, amongst other things, arranging committed financing, confirmatory due diligence, and the recommendation of the Board. The Board is in discussions with Emerald regarding the Emerald Proposal.

My opinion - this is turning out much like Lavendon, with 2 competing potential bidders. Hence I'm sitting tight, indeed have bought some more today at 170p. I wonder if we might see the competing bidders raise their price to 200p+? That's what I'm hoping. What an exciting year this is turning out to be!

A couple of quick comments before I finish.

Victoria (LON:VCP) (at the time of writing, I hold a long position in this company) - Acquisition - this buy & build group is picking up another acquisition in Australia, a manufacturer & distributor of underlay and hardwood flooring.

The acquisition is costing £20m, funded from existing debt facilities, so will be earnings enhancing. The multiple being paid is a fairly modest 5.7x EBITDA.

Post-acquisition, the key measure of group net debt : EBITDA multiple will be less than 2x, which seems OK to me.

My opinion - I was late to the party here, but very much like the strategy. The charismatic Chairman, Geoff Wilding, has already transformed the group, and doesn't seem to have put a foot wrong with a series of excellent acquisitions.

So expect further forecast increases, following this latest acquisition. As long as the debt doesn't get out of hand, then it's difficult to see much downside here. Remember that VCP's UK operations are a big beneficiary of weaker sterling too, as it makes them more competitive versus competition mainly from Benelux.

TP (LON:TPG) - this share is up 21% today to 6.1p. I've never heard of this company, but discover that it used to be called Corac, and has a fairly dismal history as a listed company. Note that the chart is characterised by large spikes up, followed by disappointments.

Nevertheless, the company has issued a bullish update for both 2016 and 2017, based on a strong order book & improving margins.

The TP Group Board is pleased to announce that the business performance in FY16, in terms of EBITDA, is likely to significantly exceed current market expectations.

In addition, subject to the receipt of expected payments, the Group's year-end cash position is also likely to exceed expectations. The Company expects to make a further update in January 2017 and to announce audited results for the year ending 31 December 2016 in April 2017.

In addition, due primarily to recent contract wins and a strong order pipeline (including the two sole source MoD contracts announced in July and August 2016) the TP Group Board is pleased to confirm that it expects the outturn for the 2017 financial year, in terms of EBITDA, will be materially ahead of current market expectations.

Sounds interesting. Maybe this share is worth a fresh look?

That's me done for today!

I think it will probably be both me & Graham reporting again tomorrow (Thu). Then just Graham on Friday, as I have a bit of a monster Xmas party to go to tomorrow evening, so am planning a lie-in on Friday morning.

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.