Good morning!

Sorry to have missed lots of friends at the investor show on Saturday, I wasn't able to make it in the end. Hopefully it was an interesting day for those that did attend.

Sprue Aegis (LON:SPRP)

Share price: 340p (up 8.8% today)

No. shares: 45.6m

Market cap: £155.0m

Interim results - the figures seem to have come in as stated in their last trading update, which I reported here on 13 Jul 2015. Key figures;

Revenue £56.5m (as indicated on 13 Jul 2015)

Operating profit before share-based payments of £242k came in at £9.0m, again in line with expectations

These are fantastic numbers, with revenue being up 137% against H1 2014, and profit more than triple the prior year comparative. Striking figures indeed, although profit would have been another £6.1m higher still, at constant exchange rates.

Excitement needs to be tempered by remembering that Sprue has benefited from exceptional sales in France, driven by legislation requiring smoke alarms. The company confirms today that sales are now softening in France, so this H1 2015 period does look something of a one-off bonanza. Although the following comments today about Germany sound interesting;

Continental Europe continues to offer significant sales opportunities for the Group. While sales into France are softening, the 10 year product replacement cycle in Germany is about to start and, in addition, two German states with approximately 10 million homes are required by law to fit smoke alarms before 31 December 2017. German customers typically seek increased levels of product technology with wireless connectivity and, therefore, the sales value of replacement product sales is potentially significantly higher than the value of previous sales.

The narrative has further upbeat comments about product development, and possible price increases to improve margins. The full year outlook is confirmed;

Subject to no significant net adverse foreign exchange rate movements between Sterling and each of the Euro and the US Dollar, the Group is on track to deliver full year results in line with market expectations.

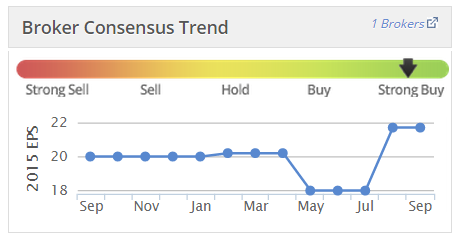

Broker consensus was raised after the positive trading update in Jul 2015, as you can see from the handy Stockopedia graphic below;

Valuation - clearly we can't sensibly value the company on this year's earnings, as it's a one-off bumper year, when everyone's feeling great about the huge increases in sales & profits. However one year's bumper results are next year's tough comparatives, so the market may feel less enthusiastic this time next year, when a sharp drop in profits is likely to be reported. No matter how well prepared the market is, declining profit isn't usually conducive to a rising share price.

A fall back to 17.1p is forecast for 2016. An optimist might say that figure could possibly be beaten, so maybe 20p. Put that on a PER of 15, and that gives us 300p, then add on the cash pile, of 63p per share, and a share price of 363p looks justifiable - a little above the current level of 340p, so overall I'd say these shares look priced about right, as you could argue that a discount should be applied to the cash pile, to reflect that it's lying dormant.

Balance sheet - looks terrific. There's no debt, and £28.9m in cash, or 63p per share, very material at 18.5% of the current share price. Although cash in the bank earning no return, is arguably of little value to shareholders, unless the company actually does something useful with it - e.g. an acquisition, or a special dividend.

Acquisitions are hinted at, but it sounds as if they can't find anything at the right price.

Dividends - the interim divi is raised from 2.0p last time to 2.5p this time, which looks very stingy to me. Although the final divi was 3x the interim divi last time, which suggests a 7.5p final divi this time, for 10p for the full year, a yield of 2.9%.

My opinion - I like this company, and the commentary today sounds encouraging.

Overall, I feel the share price at 340p looks about right, possibly with a little more upside perhaps, but expectations should stay grounded, given the one-off benefit in this period from bumper sales in France, which has had a massive overall positive impact on today's numbers. It's important to value the company on what the figures will look like after that surge in profit has been & gone.

Christie (LON:CTG)

Share price: 136.5p (up 2.2% today)

No. shares: 26.5m

Market cap: £36.2m

Interim results to 30 Jun 2015 - the company describes itself as - "the leading provider of Professional Business Services and Stock & Inventory Systems & Services to the leisure, retail and care markets". It's one of Lord Lee's favourite shares, which he mentioned at a Mello investor evening a few months ago.

The key P&L figures look good;

- H1 revenue up 8% to £31.7m

- Operating profit more than doubled to £1.7m (H1 2014: £0.8m)

- Basic EPS 4.18p

Positive forward-looking comments, including;

Encouraging end to the first-half creates expectation of a more balanced performance than 2014

Strong M&A activity and related financing activity continues into second half

Looking at 2014, H1 operating profit was £0.8m, and H2 was £2.9m, so performance seems rather lumpy. I imagine this is because most costs are fixed - e.g. employee remuneration is by far the biggest cost, at about two thirds of revenues.

Valuation - as they talk about a "more balanced performance" this year, then we might perhaps be looking at 8-10 EPS for the full year? There don't seem to be any broker forecasts available. So the current PER is probably between 13-17, hardly a bargain given the small size of the company & it's cyclical/lumpy nature of profitability.

Balance Sheet - oh dear, this is where it goes wrong for me. It fails all three of my balance sheet tests, as follows;

Current ratio - is poor, at 0.98. Whilst not at a crisis level, this does indicate a company which relies on the support of its bank to provide day-to-day borrowing facilities. In itself that's not necessarily a problem, but I prefer companies like Sprue Aegis above, which has a big surplus cash pile.

Net assets - are negative at -£5.9m. I usually expect this number to be positive before investing, with only the occasional exception. Furthermore, that figure includes about £2.5m in intangible assets, so writing them off takes NTAV down to -£8.4m, which is not a good position for a company that isn't particularly profitable.

Pension deficit - this dominates the balance sheet, at a liability of £13.7m, although the deferred tax asset of £3.8m probably offsets this partially. It's quite tricky working out how the accounting is done for pension funds, as every company seems to present the figures in a different way. However, from what I can make out, there seems to be an overpayment of £429k in H1, over and above the P&L pensions charge.

The bulk of the pension deficit seemed to appear in 2014, when the deficit ballooned from £4.8m to £14.0m, so it could be the sort of deficit that will rapidly decline again once interest rates rise, whenever that might be.

However you look at it though, this pension fund is quite big relative to the fairly modest profits made by the company, so it will continue to be a drag on cashflow, and thus limit the dividend payments.

Dividends - the company looks on track to pay about 2.5p to 2.75p this year in full, so a yield of only about 1.8% to 2.0%, which isn't madly exciting, especially as you'll probably lose your first year's divis just to pay for the bid/offer spread in buying the shares to begin with.

My opinion - all in all, whilst the P&L shows a good improvement against last year, everything else looks rather unimpressive to me - specifically the weak balance sheet, debt, and a thumping great pension deficit. The divis are small, and whilst the outlook is positive, this follows quite a few years of lacklustre performance, so the company should be doing well in this cyclical upturn.

I just can't see the attraction of this share at all. to be honest, unless I've missed the point somehow?

Escher Group (LON:ESCH)

Share price: 212p (up 6% today)

No. shares: 18.7m

Market cap: £39.6m

Interim results to 30 Jun 2015 - this software company is headquartered in Dublin, and describes itself as - "a world leading provider of point-of-service software for use in the postal, retail and financial industries". Note that it reports in US$.

- Revenue up 7% to $11.85m

- Profit before tax up 202% to $1.26m

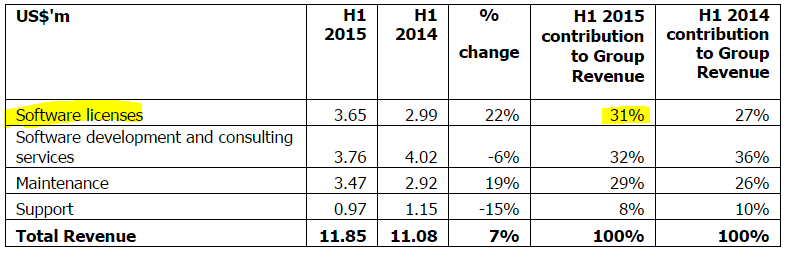

The trouble is, as you can see from the table below, Escher is highly dependent on high margin software licence revenue. Therefore the vagaries of when they win sales, and can recognise licensing revenues, means that there's no discernable trend to the company's performance. That makes it nigh on impossible to value! One good year's profits could be followed by a loss the next year, if they don't win enough contracts.

The answer to this is to migrate to a SaaS model, which is what the best software companies have, or are doing. This involves taking some pain up-front (foregoing licence revenue), but building a steady stream of future income instead. Unfortunately, that doesn't seem to be happening at Escher.

Worse still, of the $3.65m licensing revenue in H1, $2.4m of it (66% of the total) related to one customer, where a key milestone was reached, triggering the recognition of licensing revenue.

Generally speaking, I like to invest in software companies which are higher margin than this, and which are structured so that all their fixed costs are covered by SaaS income, with any additional licensing revenue being icing on the cake. Escher doesn't seem to fit that model.

Balance sheet - this looks odd, in that the company reports cash of $7.8m, and bank debt of $10.5m, giving net debt of $2.7m. Clearly that wouldn't make sense at all, since it would be so inefficient in terms of paying excessive & unnecessary interest on the borrowings, whilst receiving probably little to nothing on the cash balance.

Perhaps there might be some technical reason why the debt can't be repaid using the cash, but I'd say the more likely explanation is that the cash is probably not typical of the average throughout the year, but is probably a seasonal spike that flatters the real position most of the time. Therefore I'd be inclined to view this company as having gross debt of $10.5m, hence quite highly indebted, rather than the more comforting but perhaps not typical position of net debt of $2.7m.

The P&L interest charge of $600k in 2014, and $314k in H1, would approximate to about a 6.0% p.a. interest charge, which implies that the $10.5m debt is drawn down pretty much all the time. That's a large chunk of profits being eaten up by interest on debt, all of which helps explain why the company doesn't pay dividends.

Debtors - this looks too high - not just at 30 Jun 2015, but at the 6 & 12 month prior comparatives too. Given that turnover was $11.9m in H1, I would have expected debtors to be less than half that amount. However debtors is actually $9.2m, so that's a red flag for me - because excessive debtors can often be hiding a problem - maybe a customer(s) that is refusing to pay over some dispute, or the debtors might relate to sales that have been booked too aggressively?

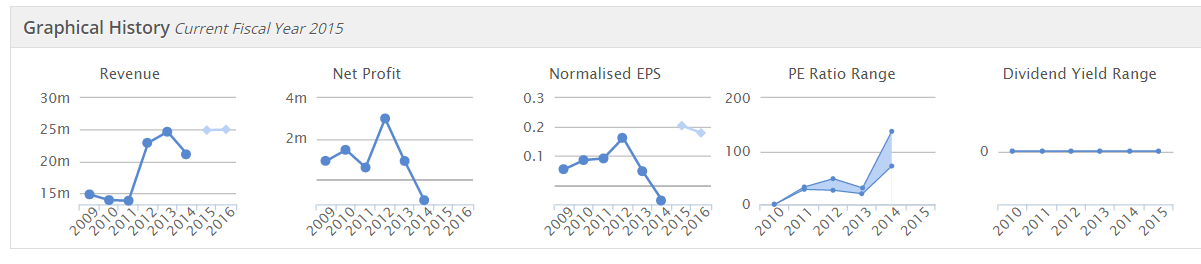

My opinion - the quality of the client relationships must give this company considerable strategic value, so I wouldn't be surprised if it ends up a bid target for a larger group. However, on a standalone basis the results look too erratic - see graphic below;

There's no trend to profits, and turnover appears to be flat. Also, note there is no dividend, and the balance sheet looks wobbly to me - with too much gross debt, and apparently excessive debtors - both warning signs for me that this share is quite high risk.

All in all therefore, it's one I feel safest steering clear of.

Plant Health Care (LON:PHC)

Share price: 98.5p

No. shares: 71.7m

Market cap: £70.6m

Interim results to 30 Jun 2015 - these are very weak figures;

- H1 revenues down 3% to $3.2m

- Operating loss $3.1m

- Net cash $12.6m (down from $19.4m a year earlier!)

Pretty scary numbers - I'd say the £70.6 market cap is an accident waiting to happen. Jam tomorrow companies need to demonstrate rapid growth, but there doesn't seem to be any growth here!

Outlook - an improved H2 is anticipated;

First half revenue from our commercial products was in line with expectations and we anticipate a strong second half resulting from the seasonal uplift in the last quarter as well as the replenishment of stocks in the distribution channel. The Board believes that the investment in additional commercial business development resource and the ability to gain access to new markets and distribution channels will begin to contribute to our 2016 performance.

Doesn't exactly sound scintillating, does it?

My opinion - bargepole job I'm afraid. Jam tomorrow companies hardly ever deliver what they say they're going to deliver. My investment performance has improved considerably since I stopped getting sucked into jam tomorrow things. At least this one has enough cash for the time being.

AGA Rangemaster (LON:AGA)

It looks like Whirlpool have withdrawn from the battle to take control of Aga, so last week's premium to the existing 185p bid from Middleby has gone up in smoke today, with Aga shares down 12% to 184.5p.

The Middleby deal looks certain to go through now, and gives shareholders an excellent exit route, given that the gigantic pension fund looked set to swallow up all the company's cashflows for the foreseeable future.

Interesting factoids;

AGA touts famous backers including British chef Jamie Oliver and Mary Berry, a judge on "The Great British Bake Off," a British Broadcasting Corp. program. Its hulking and expensive stoves heated by a constant source—at one point coal, now more often natural gas or heating oil—have become one of Britain's quintessential brands.The Aktiebolaget Gas Accumulator was designed by Swedish scientist and Nobel Prize-winning physicist Gustaf Dalé n in 1922. The company started selling ovens on a commercial scale in 1929.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.