Good morning!

Speedy Hire (LON:SDY)

Share price: 73p

No. shares: 521.9m

Market Cap: £381.0m

Trading update - for the year ended 31 Mar 2015, this all looks solidly on track;

Various other details are given, including comments that the losses from their Middle East division have been stopped, with nearly all loss-making operations sold or closed down.

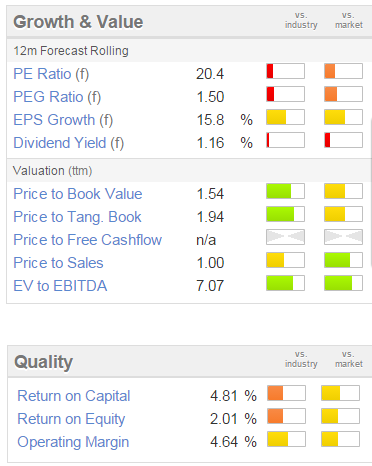

Valuation - based on current broker forecasts, the shares look very expensive to me (a PER of about 12 is the level that I would consider to be a sensible valuation);

Of course broker forecasts are frequently wrong, so we shouldn't take them as gospel. However, to justify a PER of 20.4 for a business that has quite a bit of gearing, then you would have to assume quite a big out-performance against forecast is on the cards.

Maybe the turnaround measures have not yet been factored into broker forecasts? Although with a £381m market cap, one imagines the brokers have taken some time to make the numbers realistic.

My opinion - it looks over-priced to me. The dividend yield is lousy, at just over 1%, and a price to tangible book of nearly 2 also seems quite a stretch for an equipment hire business.

Note from the two year chart below the profit warning just over a year ago:

Dialight (LON:DIA)

Share price: 759p (down 3% today)

No. shares: 32.5m

Market Cap: £246.7m

Trading update - for Q1 of the calendar year to date. The update begins positively on trading for Q1;

However, it then goes on to introduce significant doubts on a number of fronts. Firstly, it sounds as if production is inefficient;

Comments of this nature usually mean site closures, redundancies, etc. So probably some restructuring provisions are in the pipeline. However, from a shareholder point of view, improving profitability is a good thing, providing the short term cash costs are not too onerous. There is also disruption to the business to take into account - restructuring doesn't always go smoothly.

Net debt at 31 Mar 2015 is reported at £8.9m, That's quite a bit worse than the net cash of £0.6m reported at 31 Dec 2014. Although the balance sheet overall is absolutely fine, no issues there, other than a small pension deficit.

H2 weighting - this is somewhat perplexing. If trading in Q1 has been good, why are they expecting the year to be H2-weighted? This suggests to me that current trading in Q2 must be poor. It's difficult to see any other explanation. So this could be a deferred profit warning, which is often the case when management say they are expecting a strong H2 bias to trading;

My opinion - I don't currently hold this share, but there are enough uncertainties and possible problems ahead flagged in today's update, that I would have probably sold first thing this morning. A forward PER of 17.1 doesn't allow any room for anything to go wrong.

Caretech Holdings (LON:CTH)

Share price: 242p

No. shares: 62.0m

Market Cap: £150.0m

Trading update - for the half year to 31 Mar 2015. This is my first review of Caretech in these reports. It provides out-sourced social care (e.g. facilities for disabled people, etc) for local authorities.

The key part of today's statement says;

Mention is made of a successful Placing of 10m shares at 210p in Feb 2015.

Dividends - the yield is about 3.5%, and has been growing at an average of about 11% p.a. in recent years.

My opinion - I narrowly averted a disaster a few years ago, when I realised late in the day that Southern Cross Healthcare was going to go bust, so I sold their shares in the nick of time. Southern Cross was a care home operator (for the elderly), so pretty similar to what Caretech does, in terms of business model.

What killed off Southern Cross was leases with automatic annual rent increases (of c.2.5% from memory), colliding with local authorities under severe cash pressure, flatly refusing to agree to increases in charges. Also, occupancy levels are key in this sector, since so many premises & staffing-related costs are fixed. If occupancy falls below a critical point, then profits vanish.

Looking at Caretech's figures, my main worry is that it is too profitable. Sooner or later the local authorities might catch on to this, and refuse any fee increases, or even demand fee reductions.

On the positive side, Caretech seems to have a substantial freehold property portfolio. Therefore it won't be subjected to rental increases on the freehold properties, since they are owned rather than rented. There is a lot of debt though, so unless hedging arrangements are in place, then it would be vulnerable to interest rate rises.

Overall, there's no denying this stock looks superficially cheap (on a PER basis). However, having had one very close shave in this sector before, I'm wary of going near it again. Social care budgets are being slashed by many councils, although on the other hand Govt policy of giving individual budgets to families, so they can choose their own care provisions, might work to Caretech's advantage possibly?

It's a bit of a minefield this sector, so careful research is definitely needed. You can never be sure that today's profits will continue in the future, due to changes in Govt & local authority policy & budgets.

I'll do a bit more this evening, but for now I have to return from London to Hove, and catch a few rays! Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.