Good morning!

The falling main Indices seem to be rubbing off on small caps, which was bound to happen sooner or later. In particular, I've noticed that some of last year's fashionable growth stocks, which had run up to racy valuations, seem to now be coming back down somewhat.

With the lack of liquidity in many small caps, it doesn't take a lot of incremental buying or selling to move the price a lot. Therefore inflated prices can be a bit of an illusion - the price is on your screen, but you couldn't sell any decent quantity for that price.

In my first report of this year, I commented that investors had become complacent, and that it looked a good time to take some money off the table, because growth stocks in particular had seen a very strong 2015, and seen a one-off re-rating to a much higher PER. Perhaps we're now seeing a bit of mean reversion, with investors less willing to price growth stocks to perfection?

It's always worth thinking about risk:reward. If something is fully priced already, where's the upside? It might continue rising on momentum in a bull market, but are we still in a bull market? The jury's out on that, but it's starting to look like the beginning of a bear market to me, or at best maybe just a sideways market.

Proactis Holdings (LON:PHD)

My latest CEO interview was recorded yesterday - here's the link.

Hopefully my interviews give a flavour for the type of people running companies that I like, and allow us to dig into key issues - with most questions submitted in advance by readers. If people like them, I'll keep doing more.

Mothercare (LON:MTC)

Share price: 218.5p

No. shares: 170.8m

Market cap: £373.2m

Trading update - this was issued yesterday, but I overlooked it, so given my focus on retailers, let's go back and check it out.

I like the summary box (see below) at the start of the RNS - anything which helps investors quickly assimilate the key points is very helpful, since we have so many announcements to absorb rapidly whilst still bleary-eyed, between 7-8am - the most important hour of the day. Providing of course that the summary is accurate, and not just cherry-picking the positives! (often these things do get over-PR'd! Which of course is counter-productive)

UK - the additional bullet points on this read positively - LFL sales of +4.2% (for the 13 weeks to 9 Jan 2016). Online sales are now over a third of UK sales, impressive.

International - this is the larger part of the business, and it makes all the profit. So performance here matters more than the UK, and it's not good. LFL sales were -1.3% in constant currency, which due to adverse forex movements translates to -9.5% in sterling terms.

I understand that Mothercare's overseas operations are mainly franchisees & JV partners, so that should limit the downside risk for the UK plc, since the franchisees absorb most of the financial risk from worsening trading. Although as we saw recently with Laura Ashley Holdings (LON:ALY) (in which I hold a long position), the UK plc can suffer bad debts if franchisees go bust, as happened with Laura Ashley's franchised Australian operation leaving it with a £1.2m bad debt recently.

Back to MTC, overall, the trading update conclusion is OK;

"Overall Group performance remains in line with market expectations, with our UK performance further improving and International continuing to be challenging."

The company has an end March year-end, so there probably won't be any nasty surprises now, given that peak trading is out of the way.

Outlook - pretty meaningless waffle really;

"We remain firmly focused on our strategy to build our businesses both in the UK and internationally and our vision remains clear - to be the leading global retailer for parents and young children."

My opinion - there's a turnaround in play with the UK division, with an overhang of under-performing stores being either closed, or refurbished, so that's a positive, and it seems to be working, and should drive further profit improvements as the loss-making stores drop off.

However, the UK part of the business has been loss-making recent years, so I'm not sure what profit potential there is once it's been turned around? Certainly the brand is extremely well-known, but in the internet age, do we really need a company like Mothercare? Although I suppose with baby products, parents are understandably ultra-protective, so there must be the reassurance of buying from a trusted, long-standing brand, where products have (presumably) been safety tested, and sourced from bona fide manufacturers, not Chinese knock-offs.

The international division has been the big money spinner historically, but that's now not performing terribly well, which puts a dampener on things.

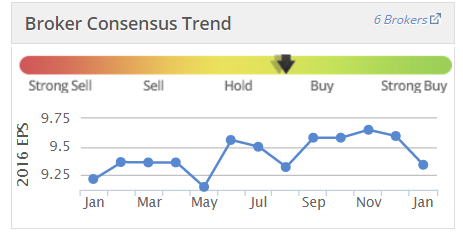

It's valued at about 23 times current year earnings (3/2016), dropping to c.15 times 3/2017 earnings. Overall I think that looks probably about the right price, for a reasonable, but not spectacular turnaround situation. Therefore at the current price, I'm neutral on this stock.

Note also that the brokers consensus forecast has meandered up & down in the last year, again suggesting that the turnaround is a bit more hesitant than people thought last year.

Bonmarche Holdings (LON:BON)

Share price: 183.5p (up 4.6% today)

No. shares: 50.0m

Market cap: £91.8m

Trading update - the context here is that this ladieswear retailer issued a mild profit warning on 16 Dec 2015, which I reported on here. The company also announced the departure of its CEO, who presided over the IPO, which is clearly a negative, since the institutions which bought into the IPO were clearly backing her, as much as the business. That could create an overhang in the shares, if the replacement CEO fails to win the same level of backing.

Today's update is reassuring, and the shares have seen a relief rally this morning, that things have stabilised, with the key point today being;

The Company's financial position remains sound and the Board's expectations for the full year are in line with the guidance issued on 16 December 2015.

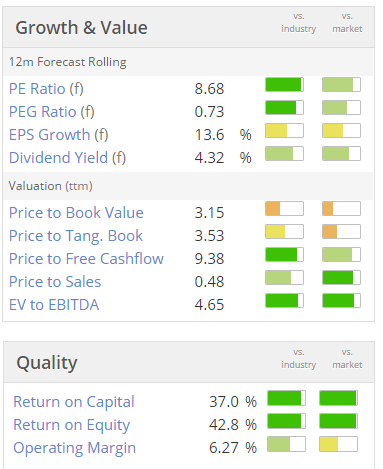

Valuation - as you can see from the usual Stockopedia graphics, it looks good value. All the more so given that the balance sheet is strong, and it pays out nice divis.

Outlook - quite reassuring;

In the short period since Christmas, demand has trended towards more normal levels. The Board's view of the expected outcome for the year is unchanged and it therefore reiterates its expectation that the PBT will be within the range of £10.5m to £12.0m."My opinion - I'm tempted, as it does look good value. On the other hand, the uncertainty created by the CEO's departure probably justifies some discount.

If I was going to buy, then now would be the time, since Xmas trading is in the bag, current trading is alright, and the valuation is modest. I just feel that, with markets looking very wobbly at the moment, I'm not minded to open any new positions which are marginal. Things have to be shouting "bargain!" at me to persuade me to buy at the moment. This share is cheap, but it's not a particularly good business in my view, and it being perhaps 10-20% under-priced isn't enough of a discount to make me want to take the plunge. It's very close though - in more buoyant market conditions I would have bought some today.

Finsbury Food (LON:FIF)

Share price: 113p (down 0.9% today)

No. shares: 128.0m

Market cap: £144.6m

H1 trading update - this wholesale baker reports for its interim period to 26 Dec 2015.

This sounds upbeat;

The Board is pleased to report that since the positive AGM trading update in November 2015, strong trading performance has continued throughout the Christmas period. Total Company sales revenues grew to £156.6m, an increase of 46% on prior year. This includes like for like* growth of 7.4% over the first half of the prior year. The UK Bakery division grew by 6.1% on a like for like basis and the Overseas division, the Group's 50% owned European business, grew by 18.8%.

The group has been acquisitive, hence why the total sales growth is so high, at 46%. Although organic growth is still pretty good, at +7.4%. The company says this growth has been "hard won", in "challenging" markets;

Consumer markets remain challenging and organic growth has been hard won, requiring significant promotional investment, NPD and fresh layers of infrastructure.

Just a small request. If companies are going to use a TLA* perhaps they could be so kind as to asterisk them, and provide an explanation below, just in case readers are not familiar with a sector term, or are having a mental block.

(* TLA = Three Letter Acronym)

Outlook/Directorspeak - a bit waffly, but sounds positive;

"Performance in the period has been strong, for both the Group as a whole and also, importantly, on a like for like basis. We continue to operate in an environment with external pressures, however through the Group's leading position in the market, its diversified product and customer base, and its ongoing investment in the business, we are confident that we can continue to drive growth and deliver value for our shareholders."

My opinion - the trouble with this announcement, is that the only hard information is on sales. There is no mention of margins, nor profit versus expectations. Therefore it falls short of giving investors the information we need to make an informed decision.

Instead we have to decipher the announcement, looking for clues. It seems to be pointing towards increased costs (the bit about promotional activity), possibly lower margins (mention of external pressures), and increased capex.

We have to just assume that the company is trading in line with market expectations, since it says "performance ... has been strong", but I would have much preferred a shorter, and more precise statement, just telling us how performance compares with market expectations, and what the outlook is like for the full year performance versus expectations.

It's not good to put out an announcement that goes round the houses, and leaves investors worrying that they might have missed something. It's much better to be concise, and direct, in my view.

Overall, the valuation looks about right to me - the fwd PER is 12.6 (using Stockopedia's blended 12 months from now calculations), divi yield is 2.6%. I'd say that the share price is probably now up with events for the time being, having had a good run.

Quartix Holdings (LON:QTX)

Share price: 260p (up 7.2% today)

No. shares: 47.2m

Market cap: £122.7m

Trading update - for the year ended 31 Dec 2015. This looks good, with the key part saying;

...both revenue and profits are anticipated to be ahead of market expectations...

The interesting thing is that the growth seems to be organic. Strong organic growth, at high margins, can have an explosive impact on profits, so this looks an interesting company, despite the high PER.

I liked the look of it when last reviewed here on 1 Jul 2015, when the shares were 190p. As I mentioned then, the company looks good, and worthy of more research. It looks pricey at first sight, but if the products are taking off strongly, then growth could surprise on the upside, as indeed it has with today's update. Looks potentially interesting.

And finally, a few quickies, as time is almost up (I have another CEO interview to record shortly)

T Clarke (LON:CTO) - (I hold a long position in this share) A reassuring update today - full year results for 2015 are in line with expectations. More detail given on new project wins.

Dialight (LON:DIA) - underlying operating profit in line with expectations. Revenue impacted by oil & gas sector downturn. Looking to outsource production & reduce inventories. £10-12m exceptional costs, and more in 2016. Net debt reduced to £3.8m. "Remains a lot to do". "Confident in the medium to long-term" - so implication, not confident in the short term! My view - share price still looks too high, pricing in recovery before it's happened.

eg Solutions (LON:EGS) - big faller today. Missed full year revenue target - fallen from £8.8m to £7.6m. Company says it will be in line despite this, at breakeven. £3m net cash, thanks to a recent Placing. The elephant in the room is the CEO - specifically her remuneration, which has been grotesque in the past, although it's gone from insanely high, to now just very high for a small company with a generally lacklustre financial track record. Complete bargepole job for me.

All done for today. Have a great weekend! I think we all deserve a rest after the barrage of RNSs we've had to face this week, and wobbly market conditions too.

Regards, Paul.

(as usual, these reports are just my personal opinions only, and are never recommendations or financial advice.

I hold long positions as specified above, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.