Good morning,

I hope you're all well rested.

There was an interesting discussion in the comments last week about general conditions in the market, and particularly small cap valuations.

I'm certainly not in a position to give financial advice to anyone through this blog, but I'd hope that most readers can afford not to worry too much about general valuation levels (which I acknowledge are currently much higher than average).

That's because I think excellent returns are reserved for those people who can afford to hold the best stocks for the longest periods of time, riding out corrections and bear markets and re-investing dividends along the way. There may be a few who can time the market well, but I think the simplest way to succeed is just to buy and hold good stocks for as long as possible (it's worth reading 100 Baggers by Christopher Mayer on this point!)

That doesn't mean ignoring valuation completely. Of course you never want to dramatically overpay for your stocks. But if you're not leveraged and you have a long time horizon, and you took care not to pay too much at entry, then doing nothing nearly all of the time after that sounds like a great strategy to me.

Remember that most of the financial services you use rely on the fees generated by activity, those fees being deducted directly from the value of your portfolio.

And when you're not invested, you don't get to receive the dividends and the internally-generated compound returns which are the basis of financial wealth-building.

In practice, most investors are not good at market-timing.

So it's better just to sit back and let the companies you've invested in do the work, in my book.

Rather than selling anything in fear of an approaching bear market, I'd be more inclined to passively allow the cash position in my portfolio to build up over time, if I can't find any individual stocks I want to buy. So my strategy is to (hopefully) buy more when the markets are cheap, not to sell when the markets are expensive.

But of course the strategy which suits your personal situation may differ. If you're leveraged or if your time horizon is shorter, then you probably have to act differently.

For what it's worth, a poll I conducted on twitter recently saw the majority of respondents saying that they would increase their equity weighting if the markets crashed from current levels. Good! Easier said than done, of course.

Really excellent reader contributions, as always.

Regards

Graham

Fevertree Drinks (LON:FEVR)

- Share price: 1702p (unch.)

- No. shares: 115.2m

- Market cap: £1,960m

Another ahead of expectations update, though this one has not moved the share price:

Fever-Tree remains the pioneer and market leader of the premium mixer category and the momentum seen in 2016 has continued in the first four months of 2017. Given the strong sales in the period to date, the Board anticipates that the results for the full year ending 31 December 2017 will be comfortably ahead of current market expectations.

Damian Cannon covered Fevertree in depth earlier this month here and of course Paul has been covering it too, so I won't spoil the broth by saying what's already been said.

Of course it's a little strange that the share price has not responded positively to an "ahead of expectations" update, but I guess investors must already priced in an upgrade?

One fact which might possibly have gone unnoticed: the key competitor to Fevertree, Schweppes, is owned by the US-listed Dr Pepper Snapple (US:DPS), which is held by Terry Smith's concentrated investment fund at Fundsmith.

So all sorts of interesting diversification/pairs trades possibilities available to Fevertree investors via DPS, for those who are happy to deal in US stocks.

Velocity Composites (New listing)

New flotations are always interesting to me, even if I don't plan to participate. It's fun to see new stocks as they hit the market, and it tells us something about valuations in particular sectors too.

Following on from the financial software company mentioned last week, this time it's an industrial business which makes machines for aircraft part manufacturers, focused on improving efficiency and reducing waste. It operates from a large facility in Burnley.

The admission document is available online (here) and the basic facts of the placing are:

- £10 million gross raised by the company

- £4 million raised by exiting shareholders

- £30 million market cap at the placing price.

As a general rule, it's good to see flotations used to raise funds for the company and not purely to let some shareholders out the door! Admission is planned for Thursday.

Scrolling further through the admission document, the following are the claimed savings to aircraft manufacturers by using Velocity's services:

• material spend reduction of approximately 10-53 per cent.;

• reduction in indirect support staff costs;

• reduction in cost of non-quality products;

• reduction in stock going ‘out of life’; and

• reduction in capital equipment spend.

In addition to these savings, customers also gain the following:

• material increase in productivity;

• increase in productive cleanroom floor space;

• full material traceability and regulatory compliance; and

• better payment terms resulting in improved cashflow.

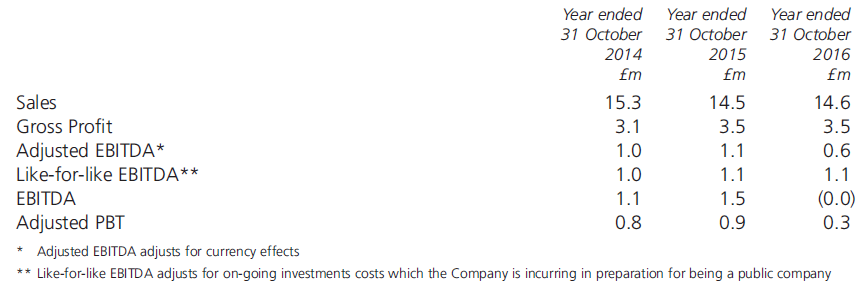

And here is the summary financial table:

So historic PBT is not too large versus the proposed market cap. Furthermore, in the Outlook section, management expresses "a high level of confidence" in the current financial year, but also warns that results "are likely to be heavily weighted towards the second half with substantially all profits being generated in that period".

That's due to typical seasonality, a growth programme to shift toward aircraft whose production is now increasing, and a new site opening.

So I'm not sure about valuation based on the historic numbers, and results for this year are far from certain.

At least with an extra £9 million (net proceeds) of cash, you can argue that the pre-existing business is valued at "only" £21 million. And if it puts the cash to good use. with plans to develop a leading R&D centre in North West England, then it could potentially generate good returns for shareholders.

Let's keep an eye on its progress.

Bilby (LON:BILB)

- Share price: 66.5p (+11%)

- No. shares: 39.7m

- Market cap: £26m

A positive update from Bilby, the public sector building support services provider:

The Group is pleased to announce that as a result of its leading reputation and continued focus on operational excellence, a number of existing clients broadened the scope of work to be undertaken by Bilby companies in advance of the Group's year end. Additionally, customers that had awarded work to Bilby which was set to start in the current financial year, requested the Group commence work earlier than previously anticipated. The Group's year end audit is underway and the combined result of these developments means that in the year to 31 March 2017, Bilby expects to achieve EBITDA of not less than £3.6million.

Nine times out of ten, you read about customer delays slowing down results. It's great to read about customers asking for work sooner rather than later for once!

I wrote critically about this stock in December, arguing that further acquisitions would lead only to more exceptional costs and more complexity.

No further acquisitions have yet been executed, business has picked up, and the shares are up by 50% since then, so you can argue on that basis that I got it completely wrong.

If you can get comfortable with the strategy and with the sector, then perhaps it's worth a look. I'm not sure what Bilby's USP is from an investment point of view and I've been hurt too much by companies chasing acquisition-led rather than organic growth, so it's not for me.

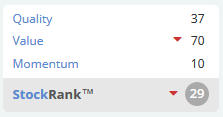

The StockRank makes sense: less than average quality, good value and terrible momentum.

That's all for today, I hope this was interesting!

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.