Good morning! The big small cap news this morning is an update from Silverdell (LON:SID). The shares were completely unexpectedly suspended on 2 July, pending clarification of the group's financial position - which is nearly always code that the company is bust.

It just didn't stack up in this case, and indeed on 3 Jul, after doing my research, I commented here as follows:

... It appears that there has been some sort of disastrous sequence of events concerning a Winding-Up Petition for a fairly trivial amount of money, which appears to have triggered much bigger problems with the Bank and/or the Court in some way, and has resulted in a subsidiary of Silverdell, Kitson's being put into Administration.

We don't know what will happen next, but it sounds to me as if there's some chance that the situation could be salvageable. We'll have to wait & see what their next announcement says.

Whilst almost all other (bulletin board) commentators had written the company's obituary, and mulled over why investors had been foolish to buy the shares, It now looks as if my reading of things was correct! The situation does appear to have been salvaged, as the company has belatedly issued a statement this morning indicating that:

The Board is pleased to confirm that discussions with the Group's bankers, HSBC, have reached a satisfactory outcome. HSBC has confirmed that it remains supportive of the business and will be providing additional short term facilities to the Group.

The Board also confirms that Kitsons is the only Group company which is in administration, and that all other Group companies continue to trade as normal.

So the most likely next steps are that there will be a more detailed explanation, and the shares should be restored to trading, and in all likelihood will open substantially lower. I suspect there will need to be an equity fund-raising fairly soon too, because Silverdell had a stretched Balance Sheet to start with, and after all these shenanigans it is vital that they strengthen their finances to help restore confidence.

We also need to know what the hell went wrong, who is going to take the blame for it, and what they have done to ensure nothing like this ever happens again.

Another share we've discussed here at length is Vianet (LON:VNET). Their AGM statement issued this morning is a mixed bag. It says Q1 has been slow (as expected, they say), but that good operational progress has been made, which gives them optimisim for the medium & long term prospects. So nothing new there really.

However, I do like the more robust message about the Government's proposed Statutory Code, where they say:

The Board remains conscious of the uncertainty surrounding the Government's proposed Statutory Code for Pub Companies and the adverse impact the proposals for controlling beer flow monitoring contained within the Code might have on our business. Our response to the consultation has been submitted, the Group's leadership team is now actively engaged with MPs and other stakeholders and is pleased to be receiving a good response at this stage. Whilst it is a very unwelcome distraction, we are optimistic that the reasoned, evidence-based strength of our argument will result in a positive outcome.

That sounds reassuring to me, and confirms my view that the chances of beer flow monitoring equipment being banned by the proposed Statutory Code are extremely unlikely. Today's statement also reiterates that the Group remains strongly cash generative.

My view is that the Statutory Code is bound to cause some disruption this year, due to taking up so much management time. I believe the threat will probably be fought off successfully, but we may have to wait until autumn or winter for the outcome on that (it's meant to be 90 days, but with the volume of responses being 6,000+, and summer holidays, etc delays are likely).

There is bound to be some impact on this year's figures too, since it might defer some contract renewals, although I understand that all but one of the Group's major customers for beer flow monitoring equipment had already renewed long-term contracts prior to this issue arising. So the recurring revenue streams are secure. There are likely to be additional legal costs, and some impact on growth in other areas too, from the distraction of fighting the Statutory Code threat.

All in all though, bad news is in the price already, and at 71p I think the shares are good value - there's a sustainable dividend yield of 8%. The EPS forecast for this year of 14p looks like pie in the sky, I would imagine a figure in the 8-10p range looks far more likely. So that makes the PER about 7-8, which again looks good value to me, given that this should be a low point for the group's profits.

Shareholders' patience is certainly being tested to destruction with Vianet, but I take a 1-2 year view with almost all my positions, and I could certainly foresee these shares being a lot higher once the regulatory threat has disappeared, and progress has been made in the three potential growth areas (vending, fuel monitoring, and USA expansion for iDraught). In the meantime I'm happy to collect in the 8% dividend yield (the shares are currently ex-divi for the big final divi payment in August).

There is good news from Getech (LON:GTC) today. As reported here on the day, I bought a few on 20 June at 57p after positive newsflow, and am showing a good profit on that already, as they've risen to 74p on this morning's positive trading statement. The company reports a "strong performance", and says that results for the year ending 31 July 2013 will exceed current market expectations for both revenue & profit.

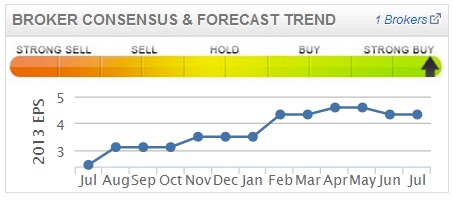

Broker consensus is currently 4.3p EPS and 1.4p dividend for y/e 31 Jul 2013. So that would put the shares on a fairly lofty 17.2 times earnings. However, remember they are saying today that forecast EPS will be beaten, although they don't say by how much.

I would guess that EPS might drop out about 5p, so if that's correct then the PER is 14.8, which is not an amazing bargain, but the growth trajectory of profits here is strong, and a lot of revenue is recurring I believe. Also the margins are extremely high (they sell data & services to natural resource companies), so each additional sale of data drops mainly through to the bottom line. They have an impressive client list, which is building, hence why profits are rising fast. Growth companies deserve a high PER, if that growth is sustainable. Check out the Stockopedia graphical history:

Bearing in mind that the 2013 estimate has been exceeded, the "Normalised EPS" chart will actually be steeper than indicated (as the lighter coloured dots/line are market estimates). So I'll be happy to hold.

Getech has net cash on the balance sheet, and pays a dividend too, both of which are key investing criteria of mine.

Interestingly, Getech is another example of a company where the useful Stockopedia chart of broker consensus forecast trend clearly flagged up early that the company was doing well.

This seems to me a key indicator that I must follow more closely, as it appears that broker upgrades seem to happen cautiously, and that one upgrade is often followed by more. Look how much Getech's EPS was revised up in the last year. Last summer brokers were expecting around 2.5p EPS, and a year later they have reported out-performance against forecasts of 4.3p!

Shareholders in Vindon Healthcare (LON:VDN) have made a 34% gain today, on news that the company is in advanced stages of a possible agreed takeover from Source Bioscience (LON:SBS) at 13.7p. The strange thing about this announcement is that the possible buyer has not yet arranged the financing to do the deal yet! That's the first time I've seen that happen, and frankly it's pretty bizarre. Surely one should have the cash in the Bank before attempting to agree a cash bid for another company?

For that reason, if I held these shares, I'd take the money & run in the open market, at this morning's price of 12.3p, rather than wait for a bid from a company that doesn't yet have the cash to do the deal. Source is currently finalising a Placing & debt facility in order to finance this deal. So why have they announced the possible bid before the funding was all finalised? Very strange.

Next I'll take a look at results for the year ended 30 April 2013 from Ideagen (LON:IDEA). They're not the easiest set of accounts to interpret, as there's lots going on (acquisitions, a Placing, etc), so I might need more time to digest these.

Revenue is up 63% to £6.5m, with organic growth having been 25%. Diluted adjusted EPS is up 34% to 1.49p, which looks to be as near as makes no difference to broker forecast consensus of 1.5p EPS.

So the shares are on a PER of 13.8 at 20.75p per share, providing you accept the adjustments to EPS as being valid. In this case they have adjusted out share based payments, amortisation of acquisition intangibles (which I assume means goodwill only), and exceptional items. So that looks OK to me, as the adjusted figures seem to reflect the performance of the underlying business, which is what we want to see.

The commentary from the company says that they are 6% ahead of adjusted EBITDA forecasts.

They point out strong recurring revenues (it's a niche software company), that current trading is in line, and that cash balances are high, at £6.4m, which is about a quarter of the market cap. Here is the chart since it's Float in July 2012:

The CEO presented at a Mello investor evening earlier this year, and I recall finding his presentation interesting. This does look a potentially good investment, but I would need to go through and understand the figures in a lot more detail. As there was a relatively large Placing in Dec 2012, that will act as a drag on EPS in the current year.

They seem to have possibly capitalised £350k of development spending, judging from the cashflow statement, but I'm not sure as it just says "payments for intangible assets", so I'd like to have a proper breakdown of the intangible assets of £7.7m, which is not given.

On balance then, it looks potentially interesting, and I'll do some more research on this one, but will probably wait to see the detail in the Annual Report before buying any shares in it.

OK, that's it for today, run out of time for the 11 a.m. email (link below for anyone who would like to join up, to ensure you never miss any reports).

Regards, Paul.

(of the shares mentioned today, Paul has long positions on VNET, GTC, and has no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.