Good morning!

Not a great start to the week - my main PC has presented me with the blue screen of death again this morning, so there will be a long wait for that to gird its loins and actually start working. Luckily I have a backup PC.

There are a few things which have caught my eye this morning;

Safestay (LON:SSTY)

Share price: 61.4p

No. shares: 19.2m + 15.1m Placing = 34.3m (+ up to 1.6m in Open Offer)

Market cap: £11.8m pre-Placing, £21.1m post-Placing (but pre-OO)

(at the time of writing, I hold shares in this company)

Placing, acquisition & restoration on AIM - shares in this growing hostel company were suspended on 22 Jul 2015, when an announcement was made indicating that the company was seeking to raise £15m in equity (thus more than doubling its market cap), and a new £8.5m loan, in order to buy a hostel in Milan (£6.3m) and Edinburgh (£14.9m).

The shares have come back from suspension this morning, so can be traded again. Details of the fundraising are given, as follows;

Placing of 15,071,452 shares at 62p (a discount of about 7p, or about 10% from the price when they were suspended) to raise £9.34m gross, and £8.24m after expenses. What?! They've paid £1.1m in expenses - that's crazy - that's a ridiculously high 11.8% of the money raised which has gone already - to advisers. Nice work if you can get it, but a lousy deal for the investors who put the money in, and a lousy deal for existing shareholders, as it effectively means we're being diluted at 54.7p, not 62p.

If the company is going to do more fundraisings, it urgently needs to find a cheaper way of doing them, by e.g. making a list of people what want to invest in the next Placing, and getting a cheaper adviser to contact them direct next time. I can't see why the costs would be more than £0.1m, let alone £1.1m, just to arrange a few meetings, and draw up some documents, which is basically all that a Placing involves. It's meant to be a quick & simple (and cheap) way to raise money, so it would be interesting to find out what's gone wrong here, that management have allowed such staggering adviser costs to accrue. It signals to me that management here are not very shrewd, which is worrying for a property company.

Open Offer (1 for 12) - I'm very pleased to see that existing shareholders are being offered a chance to participate in the fundraising too, with 1.6m shares being offered in this way, on the basis of 1 new share for every 12 already held.

Given the high level of dilution from the Placing, a 1 for 12 Open Offer looks a bit stingy, but I suppose shareholders can buy more in the market if they wish, as the share price has fallen down to the Placing price. Therefore take-up in the Open Offer might be quite limited, although it does enable medium sized shareholders to top up their holdings, who might otherwise struggle to buy in size in the market, as the shares are illiquid.

See how the latest fundraising has taken the share price back to where it was a year ago:

Milan hostel - this proposed purchase has been dropped, as investors didn't like the idea. That seems sensible to me - much better that Safestay remains UK focused whilst it's small. Europe can be tackled later, once the brand is widely established in the UK. Also, Italy would not have been a good choice, due to difficulties in managing it remotely, and the structural problems & low growth in Italy.

Edinburgh hostel - this is going ahead still, and is a big property, with 132 rooms and up to 615 beds. It has a 12 year contract with Edinburgh University to provide student accommodation in term time, and then those rooms become additional hostel rooms in the student vacations. That sounds a good business model, although I imagine maintenance capex would be quite high, with the pummeling that student parties will give to the fixtures & fittings!

This hostel generated turnover of £2.7m and EBITDA of £1.0m in calendar 2014, which to my mind puts a question mark over the wisdom of paying £14.9m for it. Once capex is taken into account, and the costs/hassle of managing it, I'm dubious whether this transaction is good for shareholders. If trading improves substantially once it has been re-branded & refreshed, then fine, but on the existing performance I'd say it looks a marginal decision.

Trading update - details on current trading are given in note 10 of today's announcement.

The company has added extra management, and warns that this will impact profit in calendar 2015. However, it started charging for breakfast in Jun 2015 at existing sites, which will have a positive impact on profit. These effects are not quantified.

Elephant & Castle is trading well, with EBITDA up 20% on turnover up 5.5%.

York is still trading behind expectations, so the general manager is being replaced, and more sales & marketing resource is being made available.

Holland Park is due to open shortly. Initial enquiries are encouraging. This looks a lovely building, and I might try it out myself at some point.

Head Office - further additions to staff are planned for H2 of 2015.

My opinion - my finger is hovering over the sell button, for the small amount of shares I currently hold in this company. It's a terrific concept - stylish & comfortable hostel accommodation, but my worry is the central costs seem to be escalating as more hostels are added, thus diluting or negating the operational gearing of more sites.

That said, once the brand is more established in multiple locations, it may add value to each site that is bought.

Growth is proving highly dilutive for existing shareholders, and inevitably more shares will need to be issued for additional sites, so it's difficult to see how the shares can gain much traction, when up against a headwind of repeated discounted Placings.

My other worry about the hotels sector generally is that AirBnB is becoming much more widely used. I've asked a few people in my network, and a lot of people are using it, very successfully, to find affordable accommodation anywhere in the world, often at a fraction of the price of hotel accommodation. So that's bound to be an increasing headwind for hotels - maybe not significant at the moment, but I could see it building to something very large, in time.

Hostels are different, in that they are often large groups, e.g. school trips, so AirBnB would not be appropriate for them, so SafeStay has a good niche, and I like the branding & design of their hostels. So on balance, I'll probably sit tight with my SafeStay shares, and see how things progress over the next year.

Ubisense (LON:UBI)

Share price: 107.1p (down 3.5% today)

No. shares: 36.3m

Market cap: £38.9m

Interim results to 30 Jun 2015 - this company warned on profits on 30 Apr 2015, and again on 3 Jul 2015 (my report is here) so poor figures were expected for H1, hence why the share price is only down 3.5%.

However, there's no disguising the fact that these are dreadful results. Turnover has dropped heavily, from £17.3m in H1 last time, to £10.4m this time, and an operating loss of £2.0m last time in H1 has become a huge loss of £7.3m this time.

A somewhat better picture can be painted if you start stripping out costs that you are happy to ignore, e.g. £1.9m in non-recurring costs (mainly restructuring costs, and exiting from Korea & Philippines). So adjusted EBITDA is negative, at -£3.65m.

Balance sheet - Net assets has barely changed, at £21.0m (£21.1m a year ago), but in that time the company has increased share capital by £9.6m, so it's actually burning a lot of cash, and I wonder if investors will be prepared to keep pouring money into this company?

Ubisense still has bank debt. A loss-making company should not have bank debt - it makes things too risky. At the moment cash balances exceed bank debt, but continued cash burn is likely to erode that safety margin.

Debtors looks high, at £10.1m, which is almost the entire turnover for H1. I'd want to know what has caused that, so for the moment it's a red flag.

Restructuring - this has reduced the cost base by £2m p.a., which based on these numbers doesn't look enough.

Contract slippage is blamed for the disappointing H1 results.

Sales pipeline sounds encouraging, but with such poor H1 results, I'm not sure how much reliance should be placed on this optimism?

The good pipeline of Solutions opportunities to be closed in the second half, including contracts that have slipped from the first half, together with a strategic focus on accelerating partner channel development to expand business scale and reach, give confidence on the full year outturn

Outlook - at this stage, the company is making reassuring noises, but they have to really, don't they?

Ubisense has started the second half of 2015 with a lower cost base and a refreshed market focus through the RTLS and Geospatial business lines, and a commitment to complete the market exits outlined. The Group has entirely assessed its order pipeline, including the Solutions contracts which slipped from the first half, and is comfortable with the level and deliverability of this pipeline. This together with the decisive action taken on costs, the benefit of which will be felt in the second half, means that the Group is confident it is on track to deliver full year results in line with the Board's expectations, notwithstanding the disappointing first half performance.

My opinion - I don't share management's confidence that they will deliver the full year results, given the poor track record. I think the market should brace itself for the possibility of another profit warning in the autumn, which would then probably mean another cash call in 2016.

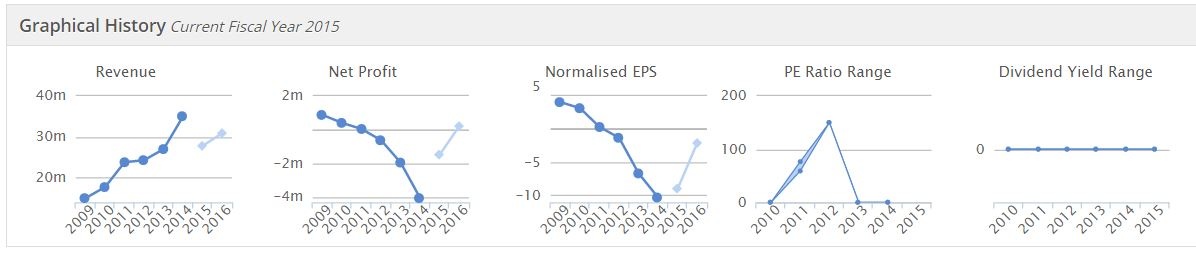

Overall then, I wish them well, and hope they succeed, but it's not something I want to risk my money punting on. Forecasts show a recovery, but look at the historic track record of constantly declining profits (into losses) and worsening EPS - see the Stockopedia graphics below.

With dreadful interim results in the bag now, it looks a tall order to expect even half-decent full year results.

I think this share could be a disaster waiting to happen, so needs to be viewed as extremely high risk in my opinion.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.