Good morning!

The Equities First Holdings scandal continues - I note that Optimal Payments (LON:OPAY) has come out with guns blazing this morning, issuing a reassuring trading update, and making further comments re the incorrectly disclosed Director dealings via EFH, saying;

In relation to the loan and pledge agreement I entered into with Equities First Holdings, LLC, I can confirm that I entered into the agreement outside of a close period, the loan was taken for the purposes of liquidity and it is my absolute intention to repay the loan when it falls due.

The main problem with the EFH "loans" is that they are not really loans at all. Legal title to the shares is transferred to EFH by the Directors entering into these transactions, in return for a payment. That is a sale, simple as that. It would undoubtedly trigger a CGT tax liability. However, it is a sale combined with an option to repurchase the shares at an agreed time & price.

Another key issue is that EFH "loans" are non-recourse. Therefore, the Directors concerned are NOT obliged to repurchase the shares at all, it's entirely optional.

So these EFH facilities should be disclosed as a Director sale, with all terms disclosed. The Directors who look particularly bad over this EFH scandal are the ones who tried to window dress these sales as if they were purchases - i.e. making simultaneous buys of shares, in order to make it look like a Director purchase, rather than a Director sale. That stinks to high heaven! I believe that at best, these Directors have been very foolish to transact with EFH.

Some similar transactions with UBS were flagged up over the weekend, with 3 fully listed companies, including Telecity (LON:TCY) for a Director who has since left apparently. I looked into these 3 Director loans (secured on shares they own), and they look different to the EFH deals to me - the key difference being that the stock is only pledged, but not transferred to UBS unless/until a Director defaults on repayment. So those are not a disposal of shares, they are just borrowing against their shares, using the shares as security. Very different.

Latchways (LON:LTC)

Share price: 731p

No. shares: 11.2m

Market Cap: £81.9m

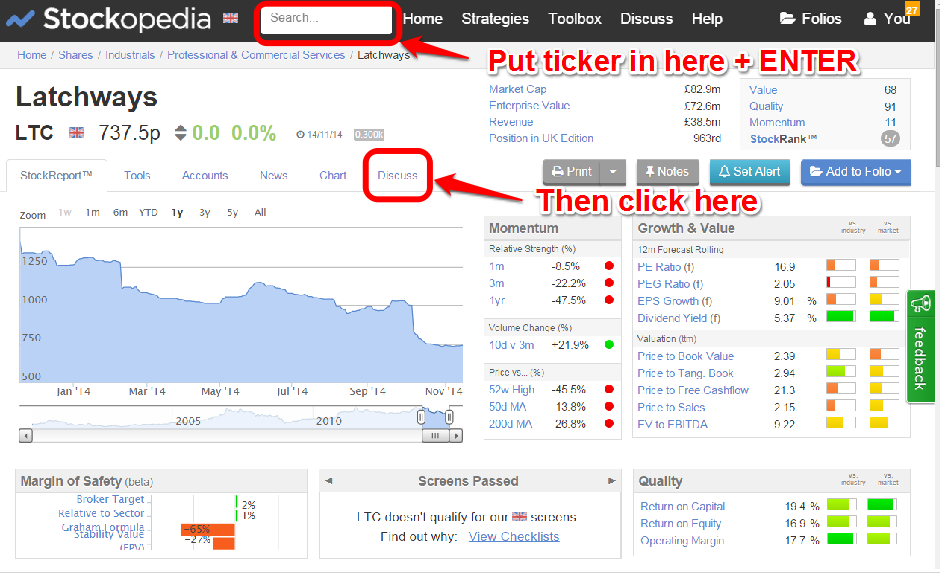

Consulting my previous notes here, which you can do by following the steps shown below;

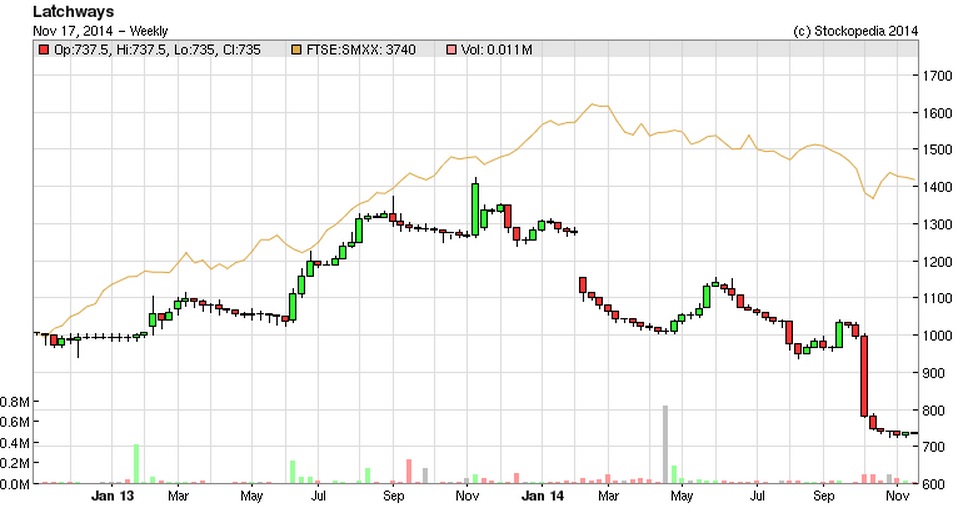

My last report on Latchways (a safety devices maker) was here on 7 Oct 2014, reporting on a rather nasty profit warning. At 830p I concluded that the valuation looked expensive, based on much reduced earnings outlook for the current year ending 31 Mar 2015. That was the right decision (not to buy), as the price has since dropped by another 99p.

Interim results - for the six months to 30 Sep 2014 are published this morning. They seem to be in line with expectations - delivering 17.3p basic EPS for H1 (none of this adjusted nonsense, I'm pleased to say). Double that to annualise it, and that's about 35p EPS, which is exactly what I guesstimated in my last report. on 7 Oct. Broker consensus is 33.6p for this year, rising to 49.4p next year.

Outlook - I can's see anything much in this outlook statement to justify the big increase in EPS forecasts for next year, this all sounds a bit waffly;

We share our investors' disappointment in these results. Economic activity in Europe will take time to recover and therefore we are looking elsewhere for growth. The other setbacks that we have suffered this year are temporary in nature and are in the process of being resolved. In the meantime the underlying business remains robust with strong cash flows and a solid balance sheet.

Looking to the medium term, we see significant potential for our existing products such as Wingrip and our Vertical systems given the groundwork currently being laid with new prospects, whilst our ground-breaking new products provide us with the wherewithal to change the face of the global SRL market. International prospects offer growth opportunities and we are reshaping our sales team to realise this potential. North America remains a core market which will resume growth once current overstocking issues have worked through.

Valuation/ My opinion - due to the somewhat half-hearted nature of the outlook statement today, I can't justify factoring in any recovery of earnings yet. Hence I would be inclined to value it on a PER of about 12 times this year's earnings, so 12 * 35p EPS = 420p, plus a bit extra for the very strong Bal Sheet.

I think all the cash can be regarded as surplus, since there is plenty in stock & debtors (debtors look a little too high actually), so net cash of £10.4m is 93p per share, so adding that on to the 420p above, I would value this company at 513p. That's 30% less than the current share price. So effectively, 30% of the current share price is a premium anticipating a recovery in earnings. Is that reasonable? I don't think so, so will pass on this one. It's going on the watch list, but I'm only interested at an entry price of c.500p.

Camkids (LON:CAMK)

Just a quick comment on this Chinese footwear maker, as I have a blanket ban on all Chinese companies in my portfolio, because the figures cannot be relied upon.

Trading update - the company warns on a deteriorating outlook for 2015 for the Chinese economy.

I'm surprised that the shares are down 23% today, as the PER of 1.8 suggests that the market didn't believe the figures to start with.

I maintain my bargepole rating on this, and all other Chinese stocks on AIM. Surely de-listing is the inevitable end game? Maybe the odd one might be genuine? But how can you tell? Why take that risk at all?

Majestic Wine (LON:MJW)

Interim results - for the six months to 29 Sep 2014 are out today. Can't say they look inspiring in any way.

Profits are down a little, and the outlook statement talks about 2015 being a year of investment.

So it looks to me as if they are struggling to maintain their competitive position. There must be no end of competition from supermarkets relentlessly discounting, and online wine retailers with lower overheads than Majestic.

For that reason I imagine Majestic will be fighting a permanent uphill battle, and could see their own quite strong operating margin gradually erode.

On the other hand, the brand name is good, and many people would rather deal with an established bricks & mortar company, plus online sellers have heavy postage costs to contend with - plus sometimes bottles smash in transit, when you order online - it's not very nice to receive a parcel of shattered glass, in a wine-soaked cardboard box!

I can't get excited about it, even though the valuation looks reasonable, and the divis are good. This downtrend in the share price looks firmly established;

Nothing much else of interest today, so I'll sign off.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in OPAY, and no short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.