Please note that we had some technical problems, and this post disappeared on upgrading of servers. However, the techie guys have very kindly rummaged around for it on the old server, and reinstated it. We might have lost some posts in the comments area, due to this technical glitch, so my apologies if your comments accidentally vanished.

Good morning.

My apologies this report is a day late. I didn't have a very good week last week, so am spending the weekend catching up with the backlog.

Given that my output last week was below par, I've created some interesting additional free content for you today (Saturday), with renowned investor Richard Crow (aka. CockneyRebel). So here is our latest discussion about shares, and the markets. Over 30 stocks are discussed.

Stop Press! David Stredder has just texted me to say that the Directors of Lakehouse (LON:LAKE) are facing the music after recent profit warning at Mello Beckenham on Monday coming (21 Mar 2016). Should be interesting, I'll try to get along to that if I can (I hold a long position in LAKE).

Robinson (LON:RBN)

Share price: 168.5p (down 6.4%)

No. shares: 16.4m

Market cap: £27.6m

Results y/e 31 Dec 2015 - revenue was £29.1m - exactly in line with the last trading update which I reviewed here on 25 Jan 2016.

These accounts need to be read in the context of a major acquisition, of a Polish manufacturer of plastic packaging (called Madrox) which completed in mid-2014. Therefore the calendar 2015 figures include a full year of its (profitable) trading, whereas the 2014 comparatives only include half a year of Madrox's results. The purchase price for Madrox was £13.2m, so almost half the current group market cap.

Therefore group revenue and profit should be substantially up on 2014. So why was turnover only up 3.8%?

Revenues were £29.1m for the year, which represents a 3.8% increase on last year. The full year effect of the acquisition of Madrox added 18% to full year sales volumes whilst underlying sales volumes in the pre-existing businesses reduced by 6%. Two factors have significantly reduced reported revenues. Firstly, lower resin prices, which are passed on to customers, have resulted in lower product prices and, secondly, the weaker Polish zloty in relation to the pound has reduced the value of our Polish earnings when converted to sterling. The combined effect of these two is to reduce reported revenues by £2.4m.

The lower volumes in the existing businesses are mainly attributable to the previously reported lost contracts in our Lodz business in Poland which have now been replaced with new contracts, but these did not come on stream until towards the end of 2015.

This is all fine, because it's not news, it's just reiterating what the company had already told us on 25 Jan 2016.

Profit - I reckon the company is missing a trick presentationally, in that it's not highlighting adjusted (i.e. excluding amortisation charges) profit, as most companies do - although it is showing the amortisation charges as a separate line on the P&L.

So the reported operating profit (pre-exceptionals) of £2.4m (down from £2.5m prior year) could have instead been highlighted as adjusted profit of £3.2m (up from £2.9m prior year). Bit of a schoolboy error there in my view.

EPS - similarly with EPS, they've not shown adjusted EPS. So diluted EPS (excluding exceptionals) has dropped from 13.9p to 10.5p, which doesn't look very good at all. A higher tax charge seems to be part of the problem.

Brokers work on adjusted EPS, and consensus for 2015 is 14.4p, and FinnCap said in a flash note that the actual results had come out slightly ahead of their forecast.

So I think the company really needs to change the way it reports the figures, and make sure they are in future in line with the broker calculations - i.e. highlighting adjusted profit & EPS which strips out the amortisation charges. Maybe this is why the share dropped 6.4% on results day - because some investors may have thought the results were below expectations, whereas actually they're slightly above.

Dividends - a 3p final divi, brings the total 2015 divis to 5.5p, up 10% on 2014. That's a yield of 3.3% - not bad.

Balance sheet - the company used up its cash, and took on some bank debt to acquire Madrox (note that no new shares were issued, so no dilution - which is great, providing the company can manage the debt without getting into trouble).

Net debt was only £1.1m at the year end, but this looks like a favourable blip to me, as trade creditors seems unusually high (up from £4.9m last year to £9.4m this year). Also there is an earn-out relating to Madrox to pay, which has gone up by £1.7m due to its good performance, which is taken as an exceptional item through the P&L in 2015.

Cash is £4.7m, and bank debt is £5.8m, giving the net debt of £1.1m. Clearly that net debt is likely to increase when the Madrox earn-out is paid.

Still, overall the balance sheet looks fine to me - as Robinson is a decently cash generative business, and also has freehold property assets.

Cashflow statement - very good in both 2014 & 2015. The profits are real - this is a nice, cash generative business. I like it. Although note it's also quite capital-intensive, requiring c.£1m in capex in both 2015 & 2014.

Outlook - this is consistent with what they said in Jan 2016;

As we reported in our year-end update, the general economic conditions suggest a challenging year ahead with particular pressure on the major brands and the UK grocery sector. However, we have new business coming on stream and management is committed to both organic growth in sales and operational efficiency and through these we expect to deliver further growth in revenue and earnings.

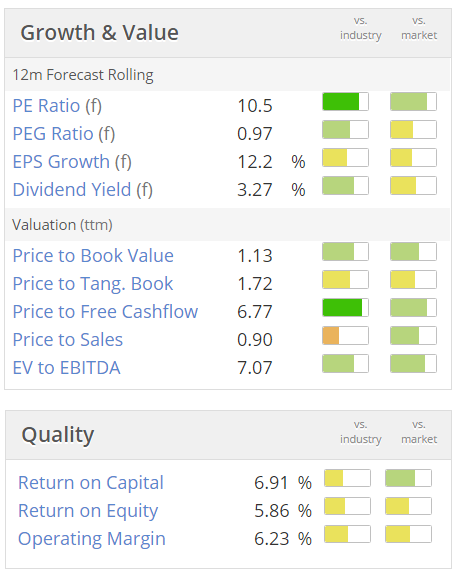

Valuation - this share looks good value, and note that it also has a StockRank of 98.

My opinion - it looks good to me. I won't be buying any personally, as in the past it's proven extremely illiquid to get in & out of, even in small size. Pity, as if the share was more liquid, it's very much the type of thing I like to hold - a conservatively-run, family business (much liked by renowned investors Lord Lee, and David Stredder) as long-term holdings.

With a cautious outlook, and industry headwinds, it's perhaps difficult to see much upside on the share price immediately, but I could see it revisiting 200p in the next year, and maybe higher after that, who knows?

The trouble is, the market wants growth stories at the moment. Value shares like this tend to just languish - this has really moved sideways for about the last 30 months. Is that enough to excite investors? Probably not. So you're not likely to see the PER rise much from 10.5, that's the trouble.

You could then get into the revolving door shareholder syndrome, where the share price never goes up much, because existing holders get bored and sell, thus creating a steady trickle of sellers, that snuffs out any enthusiasm from new buyers.

Ideagen (LON:IDEA)

Share price: 49p (up 3.2%)

No. shares: 178.9m

Market cap: £87.7m

£4.9m Contract and Trading Update - a very positive-sounding announcement, but on closer inspection, there's nothing new in it.

The £4.9m contract was pre-announced on 19 Nov 2015, so it's been signed now - good, but not a share price-changing announcement.

Current trading - identical wording is used to that from Nov 2015, so nothing has changed really;

The Board is also pleased to report that trading in the second half of the year has remained strong with full year revenues and adjusted EBITDA expected to be significantly ahead of last year and in line with market expectations.

My opinion - I can see why some people like this share - the contract wins keep flowing, and thus builds recurring revenue.

Although personally, the profits are not clean enough for me - a lot is coming from capitalising development spend, and growth is heavily boosted by acquisitions. So it's not for me.

Hellenic Carriers (LON:HCL)

Share price: 2.25p (down 35.7%)

No. shares: 45.6m

Market cap: £1.0m

Proposed De-listing - this financially distressed operator of dry bulk carriers (ships) confirms its intention to de-list from AIM. It's suprising that the shares fell 35% on the news, because the company had previously announced its intention to de-list with its results on 2 Mar 2016.

Looking briefly at those results, it's quite clear that this is a zombie company - dead in all but name (without support from its controlling shareholders anyway). The losses it's racking up are horrendous, and the balance sheet so burdened with debt, that the equity can only sensibly be seen as worthless.

It's always worth checking the ownership structure, and in this case the 2 dominant shareholders together own 73%, so they get to decide what happens.

The reasons given by the company for de-listing look perfectly sensible to me, so this is not a case where small investors are losing out. The Directors are taking the only sensible course of action, by de-listing;

The primary objectives and perceived benefits of being quoted on a public market are to gain access to capital and create a liquid market in the Company's Ordinary Shares. If these objectives cannot be achieved efficiently and cost effectively, the Board has a duty to reconsider the merits of a listing. The Board has reached the view that the Company does not enjoy any of these benefits.

In the current financial climate as described above, and taking into account the Company's low market capitalization and the costs of maintaining the listing, it has become evident that it would be economically sensible to proceed with the Delisting.

There are costs associated with maintaining the Company's AIM listing, including the annual fees payable to the London Stock Exchange, nominated advisor's fees, and other related professional costs. Cancellation of the AIM listing will significantly reduce administrative expenses and management time required in connection with being a publicly listed company. The Board considers that reducing overhead costs and freeing up management time so as to focus on the operation of the Company's business in challenging times will be beneficial for the Shareholders as a whole.

Presumably they have tried to raise fresh funding from AIM, and found nobody interested. Hardly surprising when you look at the company's accounts.

My opinion - I think the floodgates are opening, with hundreds of tiny companies likely to de-list in the next couple of years, especially in the resources sector, where many juniors really have to reason to continue in existence. With little to no access to funding, there's no point in maintaining a listing.

Investors should carefully check our portfolios for any micro caps with no viable business model. That type of share is highly likely to de-list, so the question has to be asked whether it's better to salvage what's left while the share remains listed, or end up with a worthless bit of paper in a private company?

Right, all done now. I hope you have a pleasant & relaxing weekend.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.