Good morning!

Looks like it's going to be a bounce day - with the futures up strongly, apparently due to positive Chinese economic data. Although there seems a great deal of scepticism over how much we can believe such data, in line with pretty much everything that comes out of China - e.g. the garbage that they have floated on AIM, along with fictitious accounts in many cases.

The big question for lots of us, is whether we should be buying the dips, or selling the rallies (or both!). There's no denying that the major indices have now broken the long up-trend which lasted from 2009 to 2015. Therefore, I detect far more caution amongst investors that I talk to regularly right now.

Also, bear markets are characterised by powerful rallies of course. So just because the market breaths a sigh of relief today, doesn't mean that we're out of the woods.

That said, prices of several good quality companies on my watchlist reached levels that I couldn't resist, and I went on a shopping spree yesterday, picking up more Zytronic (LON:ZYT) and a new purchase of Tristel (LON:TSTL). In the case of Tristel, I possibly jumped the gun a bit, due to perhaps "anchoring" to the previous, higher share price.

These soft patches in the market are a good opportunity to chuck out shares that you're not happy with, but have tolerated in your portfolio due to inertia. That raises fresh money for picking up some better quality shares at advantageous prices, where panic and sentiment-driven selling by others (perhaps people on margin call?) hands you a bargain on a plate.

dotDigital (LON:DOTD)

Share price: 50p (up 5.8% today)

No. shares: 293.5m

Market cap: £146.8m

Trading update - this email marketing software company updates the market for its estimated H1 figures to 31 Dec 2015 - the company has a 30 Jun 2016 year end.

Today's update contains numerous bullish points, but it's important to remain grounded by reinforcing that the title says "in line with market expectations". So all these positives were really already baked into the price.

A few key snippets that I noted down on my pad;

- H1 revenues up 29% to £12.9m (of which SaaS is £10m)

- Avg revenue per client up 31% to £525 p.m.

- Cash of £14.8m, just over 10% of the market cap

- 0.36p dividend - why so tight, when they have plenty of cash?

- US growth good, but from low base - up 84% to $2.1m

- Magento partnership sounds significant

My opinion - this is one of my favourite companies, and I regret having sold out too early, as I thought the valuation was getting too warm. It's since risen about another 50%!

If you take off the net cash, then the fwd PER is about 20, which given the strong organic growth is actually fairly easy to justify.

Overall then, it gets a thumbs up from me, and it's certainly staying on my watchlist, with a view to buying any dip down to say the 40p level, if markets overall sell off.

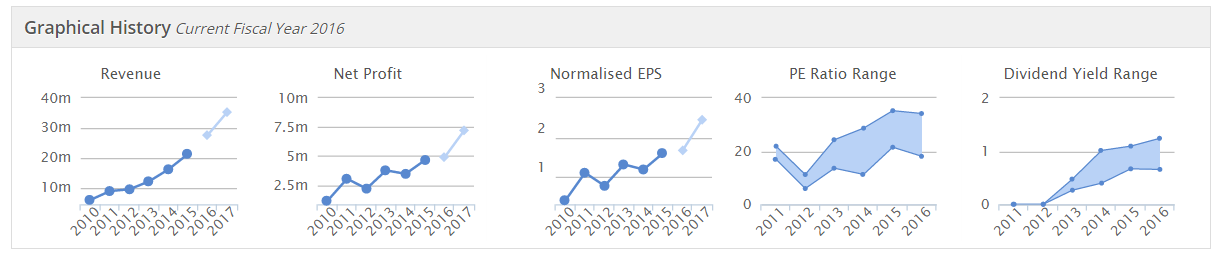

Note the very good track record historically of this company;

A word of caution though, when economies do go into recession, then it's marketing which is often one of the first things to be cut back, as customers hunker down to weather the storm. Therefore if the US economic wobbles at the moment do turn into a proper recession, which spreads to UK/Europe, then the strong growth at DOTD could well peter out. That, I'm afraid, would take the PER of 20 down to a significantly lower level, so you could see a double whammy of lower earnings, and a lower multiple, giving scope for this share price to perhaps halve?

That's the downside case, which I'm not saying is going to happen, but it's important to work out the downside case, and consider what risk there is of that occurring. I'm very wary of paying a PER of 20 right now, when the economic outlook is uncertain.

Remember also that company results are backward-looking, so there's no guarantee that good performance in 2015 will necessarily continue in the future. Although DOTD is expanding into new geographic territories, so it could probably keep growth going, maybe at a slower rate, through this, even if its main markets slow down.

Overall, I like it a lot, but am not sure I'd pay the current price, when the economic outlook is becoming more uncertain.

XLMedia (LON:XLM)

Share price: 67.5p (up 7.9% today)

No. shares: 200.4m

Market cap: £135.3m

Trading update - on the face of it, everything sounds great - exceeding market expectations, although note that they focus on the (largely meaningless) adjusted EBITDA as a performance measure;

The Group has continued to deliver strong growth in the second half of 2015, building on the excellent performance in the first half as well as the addition of Marmar Media acquired in July 2015. As a result the Company expects to exceed current market expectations delivering annual revenues of at least $88.6 million and adjusted EBITDA of at least $28.2 million. This strong performance represents growth of approximately 75 per cent. and 66 per cent. respectively, compared to FY 2014.

Annoyingly, this means I have to check back to the last accounts to see what actual profit was. Looking back, I see that XLM capitalises a large amount into intangible assets - in 2014 that figure was $11.5m (shown on the cashflow statement), therefore as I expected, the adjusted EBITDA figure greatly overstates real cash profits - of course it does, that's the reason companies quote adjusted EBITDA!

My opinion - having said that, the rest of the accounts look believable. The other big red flag that usually comes with high levels of capitalised intangibles is excessive debtors - and that is not present here. The balance sheet has lots of cash on it, and the company has been paying generous divis - both are important pointers that reassure about the accounts probably being genuine.

Therefore to my mind, it seems to more fit the mould of Plus500 (LON:PLUS) rather than Globo - i.e. it looks like the profit, cashflow and cash are probably real, but as is usually the case with this type of Israeli company listed on AIM, the profits may not be sustainable - that's the big question that investors need to investigate. Remember Blinkx too - similar sector - that looked too good to be true as well, and the wheels came off there when the good times suddenly halted.

We saw with PLUS that regulatory corners were being cut, and we've also seen with almost the whole ad tech sector, many of which are Israeli, that their profits were unsustainable and killed off by ad blocking software.

So far, XLM seems to have dodged those bullets, but personally I remain highly sceptical about this company. It's overseas, and AIM - which is the biggest red flag you can get - because there's nearly always something wrong with most of them.

For the time being though, things seem to be going well at XLM, with upbeat outlook comments. So maybe this company might be the exception to the usual rule of avoiding foreign companies on AIM like the plague?

The Group expects to continue with its strategy of increasing scale and diversification, while focusing on enhancing its technological edge. We will continue to invest in technology in 2016 to further develop our in-house systems and infrastructure.

The Board believes that the Group's strong growth, combined with its technological abilities, position the Company well to further develop the business. Accordingly, the Board remains confident of the Company's future prospects.

STM (LON:STM)

Share price: 53p (down 18.5% today)

No. shares: 58.9m

Market cap: £31.2m

(at the time of writing, I hold a long position in this share)

Directorate change - the CEO is leaving;

STM Group Plc (AIM: STM), the multi-jurisdictional financial services group, announces that Colin Porter, CEO of STM, yesterday tendered his resignation to pursue an opportunity in a non-competing industry in the United States. Colin will serve his 12 month notice period to ensure an orderly hand over and will work closely with the Board to support the transitionary period. Alan Kentish, Director of Product & Business Development and formerly Chief Financial Officer at flotation of the business in 2007 and executive director since then, will assume the role of Interim Chief Executive Officer as of 1 April 2016.

A CEO leaving usually rattles investors, which has probably contributed to today's sharp share price fall. I'll eat my hat if the outgoing CEO actually does serve the full 12 month notice period - companies always say that they will, but in practice they hardly ever do - it's just a fig leaf to justify the 12-month notice period payout that is standard practice these days. In my view, 12 month notice periods in Directors' employment contracts is just one of the many scandalous ways in which Directors rip off shareholders in corporate UK. The norm should be 3 months, not 12 months.

Trading update - this doesn't sound too bad - only slightly below expectations (aka. "broadly in line"!), and it's good that the company gives a specific figure for profit too, of £2.7m, a good increase on last year;

The Board announces that the Group has traded broadly in line with market expectations for 2015 of profit before tax of £2.7m (2014 actual: £1.7m). STM continues to invest in its business development infrastructure and product development capabilities, the benefits of which will be further seen in 2016.

My opinion - Edward Roskill made a good case for the bulls in this share in one of my audiocasts a while ago. Personally I wasn't convinced, so didn't buy any. There are certain aspects of this business that I'm not keen on - namely that nearly all its new business comes from one particular introducer, called De Vere.

Also, the business seems to have little historic profitability, but has hit upon a new and apparently lucrative source of profits, from QROPS (a particular type of overseas pensions). This gives too much concentration risk in my eyes, of one profitable product, and one main sales source.

Having said all that, the bull case is also interesting, in that the company is building a very sticky stream of recurring, profitable revenues. If that continues, with nothing going wrong, then the shares could go up, possibly?

On balance, it's a business that I don't particularly like, but the sharp fall today means that it's starting to look interesting, so I've picked up a tiny scrap of shares this morning, as a small punt, and to motivate me to do more thorough research on the company, although it will never become a significant holding in my portfolio.

There are no divis either, which I'm not thrilled about.

Fairpoint (LON:FRP)

Share price: 145p (up 4.7% today)

No. shares: 45.6m

Market cap: £66.1m

(at the time of writing, I hold a long position in this share)

Trading update - the company has used a weird system for making this announcement, resulting in their being no line spacing, so it's practically illegible. So I've had to copy/paste the text into Word, and add some spaces, to make it readable.

The upshot is quite encouraging, given that the background has been a big sell-off in the shares, on worries about changing Govt rules over compensation claims (especially whiplash);

Overall, the Group's adjusted* results are expected to show double digit growth against the previous year and are in line with market expectations.

The adjustments to profit look reasonable, being amortisation of goodwill, exceptionals, and changes in deferred consideration.

Valuation - broker consensus is 18.5p EPS for 2015, thus valuing the company at a PER of 7.8, which obviously looks very good value.

The reason it's cheap, is because of sniffiness about the group's activities, and also worries over future earnings falling, due to both the IVA and PPI activities declining, plus the more recent acquisitions of legal services possibly also seeing declines in profitability.

On this point, it's interesting that Fairpoint repeats that it reckons the changes might be advantageous for them;

We believe our platform provides us with a structural competitive advantage which suits forthcoming market changes. Overall, we are confident of our positioning and our growth prospects.'

Net debt - looks under control to me, so not a concern;

Group net debt as at 31 December 2015 was £13.6m (31 December 2014: £7.6m). This largely reflects the acquisition activity undertaken by the Group within its Legal Services business during the year and is comfortably within the Group's committed bank facilities of £25m.

Whiplash claims - more reassurance is given today, which is a good thing, because the last trading update dodged this issue.

This category of business, on a pro-forma basis, represented approximately 8% of the Group's revenues in 2015. As noted previously, the Group believes that its recently acquired Legal Processing Centre positions the Group advantageously to manage such legal work at low cost.

It may only be 8% of revenues, but if it's high margin work, then could be a much bigger percentage of profits - so again, the issue has been only partially addressed, but at least we're inching towards better understanding what is likely to happen in future.

My opinion - I'm not a fan of this type of business, and the sector has a propensity to deliver unwelcome surprises. However, Fairpoint looks well managed, and two thirds of its business is now legal services, with a focus on streamlining, and reducing the cost to consumers of seeking legal redress.

At a lowly multiple of earnings, the big question is to what extent earnings will be resilient in future?

Divis are good here, about 5% yield, and the StockRank is strong, at 97. So it's worth considering I would say. Personally I'm happy to run with my smallish position in it, but probably won't be adding any more for now.

I ran out of time earlier, so here are some quick comments on other companies reporting today:

Judges Scientific (LON:JDG) - shares are up 6.1% to 1445p today. The company puts out a trading update for calendar 2015. This sounds good;

As reported at the half year the Group experienced a difficult first quarter, with order intake recovering to a satisfactory level in the second quarter. This improvement in order intake across the Group was sustained throughout H2 2015. Consequently the Board anticipates that the final results will show a return to organic sales growth with trading comfortably in line with market expectations.

The year 2016 has started with a solid order book at 11.9 weeks (organic: 11.4 weeks against 9.9 weeks at the start of 2015) and a more encouraging outlook on exchange rates.

Broker consensus is for 100.8p EPS for 2015. Presumably "comfortably in line with" means slightly above? So it looks like the 2015 PER is about 14, and with a positive-sounding outlook, I can see why this share rose nicely today.

Overall, I think it looks priced about right for the time being.

Johnston Press (LON:JPR) - underlying EBITDA and net debt are said to be in line with expectations.

Total revenues fell 7% year-on-year. Circulation revenues are also down 7%.

I remain of my long-standing view that the equity here is probably worth zero. This is because, by my calculations, the remaining cashflows from this dying sector probably won't be enough to repay the debt, and service the pension fund.

It's a value trap in my view. That said, there can be lucrative dead cat bounces on the way down with dying companies, and with the equity just a stub now, greatly out-weighed by net debt, and the pension deficit, then it's perhaps an interesting share to punt for the gamblers out there!

Quantum Pharma (LON:QP.) - bad luck to the people who were bottom-fishing here, based on an apparently low PER. There's a profit warning today, but it's only a mild one for the year ending 31 Jan 2016 - adjusted EBITDA (since when did this become the main performance measure?!) is expected to be c.£12.7m, versus market consensus of £13.4m. Quite a small miss, given the extent of share price drop recently.

However, there's more bad news - delays on product launches, of about 12 months;

By the end of the current financial year to 31 January 2016, the Board expects that five regulated products in the Niche Pharmaceutical division will have been launched rather than the ten products anticipated at the half year results in October 2015. The other five regulated products are now due to be launched during FY 2017.

Various other details are given. I don't have an opinion on this share, it's a new one to me. I'll review the accounts when they are published on 10 May 2016.

MySale (LON:MYSL) - (at the time of writing, I hold a long position in this share) - quite an encouraging update - the company reports a significant turnaround, from heavy losses in H1 LY, to EBITDA positive (here we go again!) of A$1.5m in H1. A 250bps improvement in gross margin is good news.

It has plenty of cash too - A$30m, or A$51.1m underlying cash (what is the difference?! Surely cash is cash?)

My opinion - I like this share (obviously, as I hold some personally). I'm in it for the turnaround, which seems to be happening. So all looks good to me. Management are experienced in the sector (crucial), and Philip Green is a major shareholder, and pre-IPO backer - so it's probably going to work.

SCS (LON:SCS) - this one has taken me completely by surprise - a very good trading update;

Trading over the key Christmas and January sales period remained strong within both ScS and House of Fraser, resulting in total like-for-like order intake for the 25 weeks ended 16 January 2016 up 8.8%. This is a pleasing result against tough comparatives in the previous year.

As a result the Group expects to report profits significantly ahead of current market expectations for the year 2015/2016.

This has been reflected in a 16.7% rise in share price to 178p today.

All done for today, see you in the morning!

Regards, Paul.

(of the companies mentioned today, I have long positions in: ZYT, TSTL, STM, FRP, and MYSL. I hold no short positions in companies mentioned.

These reports are my personal opinions only, which will sometimes turn out to be wrong, and sometimes right. My opinions are subject to change without notice.

Please always do your own research, as we do not give recommendations on this site)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.