Good morning, and apologies for running a little late today. So, it's a very strong day today again, with the FTSE 100 up almost 100 points at 6,650, driven by strong gains overnight in the US, something to do with the Fed delaying tapering of QE. Surges driven by this sort of thing make me nervous, as today's euphoria could easily turn into tomorrow's gloom, once things reverse. Anyway, as mentioned yesterday, I'm in careful mode at the moment, top-slicing some things that have gone up a lot, and generally playing it safe, as I want to have spare capacity to buy things on the next dip. Markets feel far too buoyant to me, especially in small caps, and it's very hard (but still possible) to find good value.

I see that the Indian overhang in Norcros (LON:NXR) has unexpectedly cleared, and the Non Exec, Vijay Aggarwal, connected with that former major shareholder (Lifestyle Investments PVT Limited) has resigned. This is good news, as it was a big overhang, and has also increased the free float hopefully, although we'll have to wait and see who discloses themselves as the new holders of the shares. Its re-rating continues, with the shares now up to 20.5p, and still cheap in my opinion. Patience has really paid off here, so I'm pleased to be still holding.

Next I am reviewing the interim results from Mission Marketing (LON:TMMG). This one almost made it into my portfolio, and I reported positively on it here on 10 Jul 2013, given that their profits warning on that day looked fairly mild, but didn't get round to researching it in more detail unfortunately. Pity, as it's gone up about 30% since then! I also noted on 12 Jul 2013 that the Chairman had spent almost £29k buying shares, which is useful in restoring confidence after a profits warning.

At the current price of about 29p the market cap is approx. £22m. So, turning to their results for the six months to 30 Jun 2013, the P&L doesn't look too clever, with turnover up 12.9% to £67.6m, but pre-exceptional operating profit down 30.0% to £1,934k. A £1,486k exceptional item wipes out most of the profit, and financing charges of £380k gets rid of the rest, to leave earnings at just above breakeven for the six months.

In fairness though, this should not surprise anyone, as it was pre-warned about on 10 Jul, when they announced the loss of a major client (B&Q), and another (Aviva) cutting back on their marketing spending.

In his quirky narrative, Chairman David Morgan describes the outlook like this:

With the difficulties of Addiction and Aviva now behind us, profitability is much improved and tracking in line with last year, no mean feat given the volatility in the market. We anticipate a strong second half and expect a similar result to that achieved last year.

So they made about £3m operating profit in H2 last year, so add that to the £2m made in H1 this year, and that means they should be on track to make about £5m operating profit this year. That's bang on what they said back in July, so it's good to see no surprises there. One feels more confident putting a valuation on a company when they demonstrate being able to forecast their own performance with reasonable accuracy.

Stockopedia shows the current year broker consensus at 5.5p EPS, which makes the PER very low at 5.3, but that consensus earnings figure doesn't look right to me, as it's too much of an increase on last year, when they actually look to be heading for a year slightly below last year, so I reckon a more plausible estimate for 2013 would be in the range of 4.5 to 5.0p per share. That makes the PER still cheap, at between 5.8 and 6.4.

It's also good to see them reinstate a small (0.25p) interim dividend, after a 5 year gap from paying divis.

Overall, I'm very tempted to buy, and this share looks like it will probably go higher, especially in a recovering economy, as marketing is just the sort of thing that companies will increase as things become more buoyant.

Chartists will probably like the bowl developing on this chart:

However, I just can't push the button, as it fails my Balance Sheet testing. There are negative net tangible assets of £8m. Also, current assets are less than current liabilities, being just 89% of current liabilities, which is a long way below my usual preference for at least 130% on that ratio. Although one could argue that a marketing company doesn't hold stock, so I should be more flexible perhaps?

Net debt has come down nicely by £3.5m, to £8.8m, but I suspect that's probably a seasonal low, so their £14.7m of bank facilities might be used to capacity at other times of the year perhaps? That introduces too much risk in my opinion, and even though I think money will probably be made on these shares, the Bal Sheet just isn't robust enough for me to put my dosh into these shares. It's probably an opportunity that I'm missing, so more risk tolerant investors might want to look at this one, doing your own research as usual, but it's not for me.

One final point. With the market cap at £22m, and net debt at £8.8m, round that up to say £10m to perhaps be a more typical average throughout the year, and that means an Enterprise Value here of £32m. Although the Balance Sheet shows total goodwill on acquisitions of £70m. So one could argue that the shares represent good value, in that you're effectively buying a group that cost over £70m to put together, for less than half that price. A simplistic way of looking at it, and of course it depends whether the purchase prices paid were reasonable or not, but interesting nonetheless.

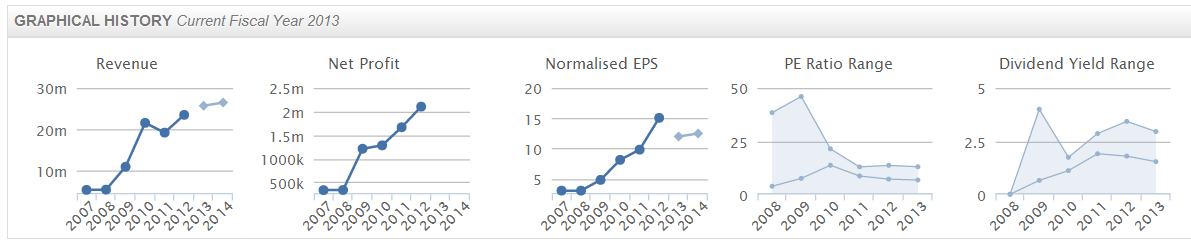

A reader has asked me to review today's results from Anpario (LON:ANP). Checking back in our archive here, I mentioned that the shares looked "reasonably priced ... but not a particular bargain" on 1 Feb 2013, when the PER was 12 at 128p per share.

I'd warmed to it by 17 Apr 2013, when my review of their 2012 results concluded:

"Readers might want to take a deeper look at this one, it looks promising, based on my superficial glance at the headline figures. I'm too busy today to spend any more time on it, but I would welcome any reader's thoughts on it, if you have time to do some research on it. Could be a GARP share, if that growth is sustainable?"

Then most recently a positive AGM trading statement was noted here on 27 Jun 2013, although again I concluded that the price was probably up with events at 167p.

So any readers who completely ignored my caution, and just bought the shares, would now be sitting on a fat profit, as they've now risen to 197p! So perhaps the lesson here is that good growth companies are more expensive, and you just have to pay up if you want to be part of it.

Anpario is a specialist animal feed producer. Their interims to 30 Jun 2013 published today look good. There's a 32% increase in underlying EPS to 6.94p (2012: 5.25p). Of the 20% increase in sales (to £13.0m), 13% was organic growth, and the balance due to an acquisition. So it looks like a proper growth business (you always have to be careful not to overpay for growth, if it's come from an acquisition, since that element of growth is obviously a one-off step up in turnover & profit, as the new subsidiary's figures are consolidated into group results for the first time).

The outlook statement is positive, saying that H2 has "started well", and that "we expect this growth to be maintained". So assuming a similar H1/H2 trading split to last year, then it looks as if this year should produce around 15p in underlying EPS. Although I note that broker consensus is only 12p, so perhaps H2 last year had some one-off gains? I'm not sure, that would be a key question to ask, because if they are heading for 15p EPS this year, then the shares are probably still good value at 197p, which would be a PER of 13. That's not an expensive price for a growth company, particularly one which as in this case, has a very strong Balance Sheet. There is no debt (in fact it has net cash of £5.6m).

So overall, I like the look of this. If anyone knows any more about the EPS query above, then please let me know through the comments below (NB, it is free to register to leave comments - there is an option for a free a/c with Stockopedia, but you have to look for it closely on the registration page, as that drives people towards paid accounts, for obvious reasons).

Finally, results from recruitment firm Networkers International (LON:NWKI) might be worth a look. I've had a very quick skim, and nothing very exciting going on, their interims are essentially flat vs last year's H1. The fwd PER is only 8.7 based on broker consensus forecasts, and their Balance Sheet looks reasonable, and the outlook statement says they expect a strong finish to the year, so looks potentially interesting.

That's it for today, I'll be on time tomorrow, promise!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in NXR, as does a Small Caps Fund to which Paul provides research services)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.