Good morning! A quiet day for news today, so this report will be a bit shorter than usual. It looks like we should have a fairly strong open, with the FTSE 100 Futures showing an open up 35 to 6,707. As I've mentioned before, smaller to mid caps have been greatly out-performing the main index, so we are really in a roaring bull market for smaller caps, and it's making me feel worried about a correction. So pesonally I'm being incredibly selective about opening new positions, and am looking to top slice on things that are getting ahead of themselves. Although in fairness, I'm happy with all my current holdings & see good upside in them all.

There's nothing earth-shattering on the RNS this morning, so I won't rush out any comments by 8 a.m. as usual (apart from this), but will take my time & look at results from Fiberweb, and a couple of others. More updates throughout the morning.

We could see more buying today on AIM stocks, as people top up on their favourite holdings in advance of the Monday's pretty important move to allow AIM stocks into ISAs. That has to be bullish for AIM stocks, as it means a potentially huge amount of fresh money coming into the market, that has previously been forbidden from buying AIM stocks. Opinion is divided over whether this will benefit more staid AIM stocks, or the more racy ones? I'm not sure, but think it will be both actually.

So, let's look at Fiberweb (LON:FWEB 75.5p). It's a specialist industrial fabrics group, which I've not reviewed here before.

At last night's close of 73p, and with 173.58m shares in issue, the market cap was £126.7m. The shares are up 4% this morning to 75.5p, so that takes the live market cap up to just under £132m.

The company issues its interim results today, for the six months to 30 Jun 2013. Revenue is down 7% on the equivalent prior year period, at £151.6m for the six months.

What immediately strikes me is that they have two divisions, one of which, the technical fabrics division, looks good, with turnover of £105m for the half year, and underlying operating profit of £10.7m, which gives a healthy operating margin of 10.2% (10% or above is the sign of a decent business, with pricing power, in my opinion).

However, the other division, called Geosynthetics, whatever that is, looks a waste of time, with £46.6m turnover but only £0.3 underlying operating profit. It's not a one-off either, as the profit was identical in H1 of 2012 too. I'd better double-check the last full year results, just to make sure it's not due to a heavy seasonal bias to trading?

OK, geosynthetics made a £4.2m full year underlying profit in 2012, but a £3.6m underlying loss in 2011, so it doesn't look good even on a full year basis.

Going back to the interims, overall they have made margin improvements, and trimmed quite a bit off administrative costs, so that despite the 7% fall in turnover, underlying operating profit was up 8.9% to £8.6m.

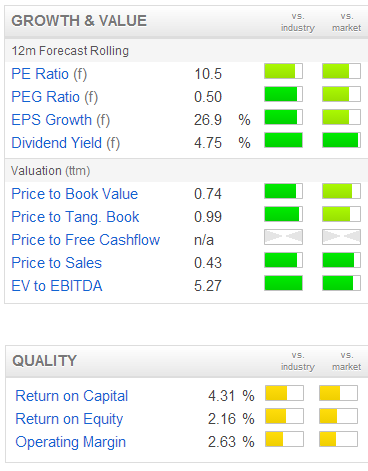

Underlying EPS is 3.2p, so double that for the full year, and it looks to be around 6.4p, so at 75.5p per share, that gives us a current year PER of 11.8, which looks fairly reasonable to me.

Next let's do a quick Balance Sheet review. Well that gets a thumbs up. NAV is £184.5m, well above the market cap, and even after intangibles of £48.2m are written off, NTAV is £136.3m. The structure of the Balance Sheet looks fine to me. So current assets of £104.0m is 168% of current liabilities of £61.9m (as a rule of thumb, I like this ratio to be over 100%, and over 150% is generally very sound).

Finally, there is nothing much in long-term liabilities, only £7.4m, being £4.0m pension deficit and £3.4m deferred tax. The pension deficit would need checking, to ensure it's not one of these iceberg situations where a much larger problem lurks.

There is a £40m loan facility available until Mar 2017, but it doesn't seem to have been drawn down at all, and indeed they report a healthy net cash position at 30 Jun 2013 of £14.5m.

Fixed assets are large, at £88m, so I'm having a quick look at the 2012 Annual Report, to see what's in there, specifically if there is any freehold property. Good, there is some property, with a Net Book Value (NBV) of £20.8, so that further de-risks the Balance Sheet, to a point where this thing looks safe as houses to me.

Fixed assets are large, at £88m, so I'm having a quick look at the 2012 Annual Report, to see what's in there, specifically if there is any freehold property. Good, there is some property, with a Net Book Value (NBV) of £20.8, so that further de-risks the Balance Sheet, to a point where this thing looks safe as houses to me.

Whilst I had the Annual Report open, I've also checked Note 24, on the pension fund, and it shows total scheme assets of £56.0m, and total scheme liabilities of £61.5m. So that looks fine, no disasters lurking there.

The cashflow statement shows that all the operating cashflow was consumed in capex, so clearly a capital intensive business, which is probably why its rating is modest, and also the lack of growth would be another factor why the shares look good value.

Broker consensus is for 6.3p EPS this year, so they are on track to do that.

The all-important outlook statement today says:

The Group expects an improved like-for-like sales performance in the remainder of the year, with growth in construction products and the impact of enhancements to the product range in filtration and technical specialties.

We expect performance for the full-year to be in-line with Board expectations and look forward to making further progress towards our medium-term financial targets.

That sounds fine to me.

Brokers expect at 18.4% improvement to 7.43p EPS next year, which would bring the PER down to about 10, which really does look good value to me, for a well funded group.

Next, let's look at dividends. It paid 3.86p each year from 2007-2010, then cut the divi to 3.0p in 2011. However, it was increased to 3.2p in 2012, and 3.33p is forecast for 2013, with 3.57p forecast for 2014. Those forecast payments are covered roughly two times.

So that looks good too. That means a 4.4% dividend yield this year, rising to 4.7% next year, and who knows with Western economies hopefully growing sustainably by then, this could be a chance to lock in a healthy & growing yield?

49% of group turnvover is in the USA, whose economy is now recovering. Another 9.5% is in the UK, where I'm more bullish than most about economic recovery, which in my opinion has now taken hold. Germany is an important market, at 13.8%, which should be OK. Whilst 27% comes from France & Italy, which are more of a concern over the macro picture.

Overall then, as you've probably gathered, I think this looks an attractively-priced share with good value characteristics, of a healthy dividend yield, reasonable PER, and a strong Balance Sheet. It probably won't shoot the lights out, as it looks a mature, and fairly boring business, but should benefit from the economic cycle improving in its main markets.

NB> This is NOT a recommendation, or advice, it is just my personal opinion. Please do your own research as usual.

I'm impressed with results for the year ended 30 Apr 2013 from toy company Casdon (LON:CDY 60p). I recall they published good interims six months ago, and I put in a call to the company to discuss them. The response was as if I was an alien calling from another planet! Talk about paranoid. The share ownership structure reinforces a sense that it's not really a proper public company, but is really a family-owned business that happens to have a Listing.

It's a real minnow, so very illiquid, but the shares are up 11% to 60p today. That takes the market cap up to £3.3m! It cannot possibly be cost effective to have a stock market Listing for such a small company, although it might be a big benefit when dealing with customers & suppliers, I've heard other companies say this - they get taken much more seriously by people by being a publicly listed company, as nobody checks the market cap!

The risk of a de-Listing is too high for me, but for people who like to dig around in the nano-cap space, this looks a nice little business, which has just reported more than doubling of profit to £549k. I seem to recall some of the H1 sales were one-offs though, so not sure how sustainable that is?

Things might be looking up for K3 Business Technology (LON:KBT 110p) - there's a positive sounding contract announcement this morning. Its Balance Sheet is too weak for me to invest, but perhaps they are turning the corner, after a period of poor performance? Must be regarded as high risk though, until they fix their Balance Sheet.

OK, I'm done for the day, and the week.

Have a good weekend everyone & thanks for reading & commenting.

Regards, Paul.

(of the companies mentioned, Paul has no long or short positions.

A Fund to which Paul provides research services, has a long position in FWEB).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.