Good morning! It's very quiet for news this morning, so I could have had another hour in bed!

Goals Soccer Centres (LON:GOAL)

I last reported on this chain of soccer centres on 10 Mar 2014 when they announced a Placing to raise £11.4m, which was about 10% dilution to existing equity. I'm impressed that Canaccord successfully got the Placing away at nil discount to the previous night's closing price of 216.5p, which is most impressive. Nobody minds Placings that are at the market price, it's the deeply discounted ones, with no Open Offer for existing holders, that are objectionable.

The company had too much debt before the Placing, and arguably still has rather a lot now, but it's certainly in a much better position having strengthened its Balance Sheet. The roll out looks slow though, with only two new centres being opened this year, and three planned for 2015.

On current trading, the company today says;

In the period since we announced our results for the financial year ended 31 December 2013 trading has been satisfactory and in line with expectations. The Board remains confident of Goals' continued progress in 2014 and beyond.

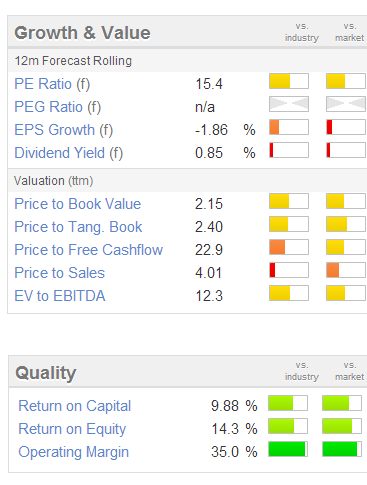

As you can see from the Stockopedia valuation graphics below, this share really doesn't look good value at the current price of 232p per share. Most bars are either amber or red, indicating that the share is expensive. Although note that it scores highly in the Quality section, which is why investors are prepared to pay a high price for the stock.

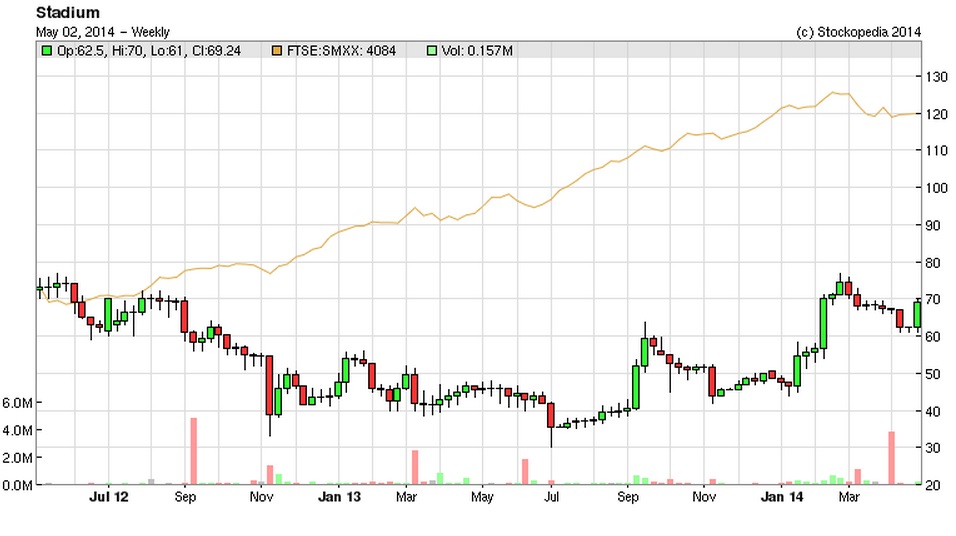

Stadium (LON:SDM)

This is a small electronics group, with a market cap of £20.4m at 68.9p per share.

The trading update today to coincide with their AGM sounds encouraging;

Trading in the first four months of the year has been in line with management expectations, and significantly ahead of the equivalent period last year. This improved performance is in part due to the reduced cost base following the restructuring carried out in 2013, and stronger trading, particularly in Asia and Power Products.

Consequently, the Board remains confident about prospects for the year.

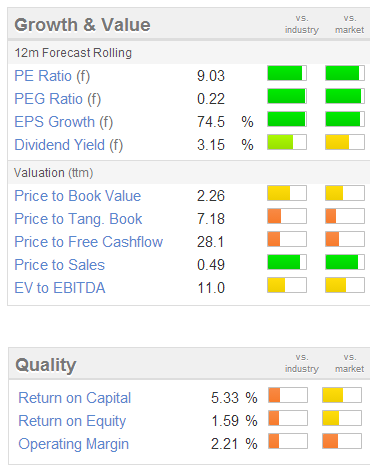

The shares look good value, with a forward PER of about 9, and a reasonably good 3.15% dividend yield, see the Stockopedia valuation graphics below;

However, caution is needed here as the big problem with this company is their pension deficit. I covered that in more detail in my last report of 11 Mar 2014. This pension deficit requires overpayments of £790k p.a. for the next three years, which is a large part of the company's profit & cashflow. Therefore one would expect the share to be on a low PER. Although I do sometimes wonder whether some investors are even aware of pension deficits, since it's astonishing how little research people do in a bull market.

£SSTY

There have been so many IPOs lately, that it's difficult to keep track. I've made money this year by shorting large & over-priced IPOs, and there has been a big change in market sentiment in the last two months, driven by a large cap sell-off in tech, and biotech stocks. This has meant that valuations are now becoming much more sensible for new issues, and on that basis I've been looking at some interesting new issues.

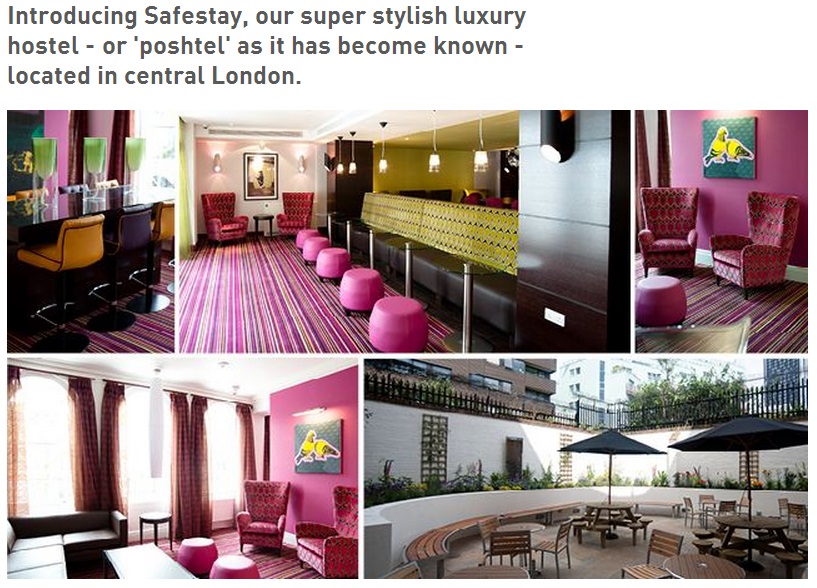

I spent an afternoon researching SafeStay, and think it looks potentially very interesting. The company operates a hostel in Elephant & Castle. The concept looks great - so instead of it being a flea-infested dive, like many other hostels for budget travellers, they have made it colourful, clean, and nicely fitted-out, whilst retaining the basic concept of being a cheap place to stay for budget travellers.

The first site is freehold, and is already operating profitably. I've done some Googling, and the customer reviews are all excellent, and it's clearly a concept that will work well in multiple locations. Their website is here. My only reservation is that the IPO proceeds are mainly being used to buy out an existing major shareholder, so the company will surely have to return to the market for more money once it has identified new sites to expand into? Although the beauty of their business model is that they can use bank debt to finance the refit of the building (their first site is the old Labour Party Head Office, so it's good to see that building being put to far better use now!), so once it is operating profitably as a hostel then the freehold can be revalued upwards.

More details are here in their First Day of Dealings announcement. The IPO price was 50p, and it has been creeping up this morning, now showing at 54p Bid, 56p Offer. I picked up a little stock at 53p a short while ago, to tuck away into my long term portfolio, as I think it looks an interesting concept, and the IPO has been priced sensibly in my view - the market cap was only £6.6m at the 50p Placing price.

Rex Bionics

This is another new IPO, and I went to a company presentation a little while ago. The product is extraordinary - it is a New Zealand company which has developed an exo-skeleton for disabled people to use, enabling them to walk again. Seeing a disabled paralympian get into the machine, and stand up, then walk in it, was breathtaking, and inspiring.

This is another new IPO, and I went to a company presentation a little while ago. The product is extraordinary - it is a New Zealand company which has developed an exo-skeleton for disabled people to use, enabling them to walk again. Seeing a disabled paralympian get into the machine, and stand up, then walk in it, was breathtaking, and inspiring.

The company has reversed into a cash shell called Union Medtech (OFEX:UMTP), and raised £ 10m in fresh cash to develop and market the product. The market cap of £25.7m on admission looks a bit toppy to me, given that the product is not selling in commercial quantities yet. However, it is hoped that with the big cash injection that the company will be able to properly market this revolutionary product.

It's the type of thing that you just hope succeeds, regardless of any financial consideration, as it's so obviously transformative for the lives of the people who use it. Each machine is nearly £100k, so if orders do start to build, then it could become a commercial success. The product is particularly useful for rehabilitation of e.g. injured servicemen, as well as for individuals who are seeking more mobility, where it also brings health benefits, both physically and psychologically from enabling disabled people to once again stand up. So definitely one to watch.

Redhall (LON:RHL)

This engineering company is on my bargepole list, as explained here on 6 Feb 2014. There's more bad news today, with further "exceptional" provisions. It's one thing after another with this company, and I'm amazed that the Bank have remained supportive.

On current trading the company says;

Trading to date remains in line with the Board's expectations, but further delays are being experienced converting major opportunities into contract awards. The Board considers that the impact of these further delays will result in a deterioration in the performance of the Group to a level below current market expectations but not materially so. The Board still expects to report growth in revenues and underlying profitability in the twelve months to September 2014.

So a bit of a mixed bag there. The FD has fallen on his sword, and is being replaced immediately by Chris Kelly, who was formerly the FD of Town Centre Securities. With very high bank debt relative to its size, this share is ultra-high risk in my view, so best avoided altogether. No doubt the Bank will push them to raise fresh equity once they have steadied the ship, and that could be at a deep discount. Or worse still, the Bank might do what they did with Silverdell, and just pull the plug. It's in the same sector, and has a worse Balance Sheet than Silverdell did when it went bust. So why take the risk?

Nothing much else has caught my eye this morning, so I'll wrap it up.

Just realised it's a Bank Holiday on Monday, which is a bit annoying - I find 2 days of the markets being closed quite enough, so by the 3rd day I'm twitching away in need of an adrenaline fix! You know you're in the right job when you cannot wait for Monday morning (or Tuesday after a Bank Holiday)!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in SSTY, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.