Good morning!

Very quiet for results and trading updates again today, so another short report.

Universe (LON:UNG)

Share price: 9.5p (up 1.3% today)

No. shares: 220.3m

Market cap: £20.9m

Major contract win - I don't normally comment on contract win announcements, unless they look material to the business. Universe has won a contract to supply an EPoS system to the entire estate of 650 off-licence and convenience stores run (or franchised) by Conviviality Retail (LON:CVR) .

Revenue is expected to be £4.3m spread over 3 years, which isn't huge in the context of Universe already having forecast turnover of about £21.6m this year. However, I'm impressed that Universe has managed to win such a fairly big client, in a competitive tender, suggesting that its software is good. This deal should also act as a reference for further sales to other new customers.

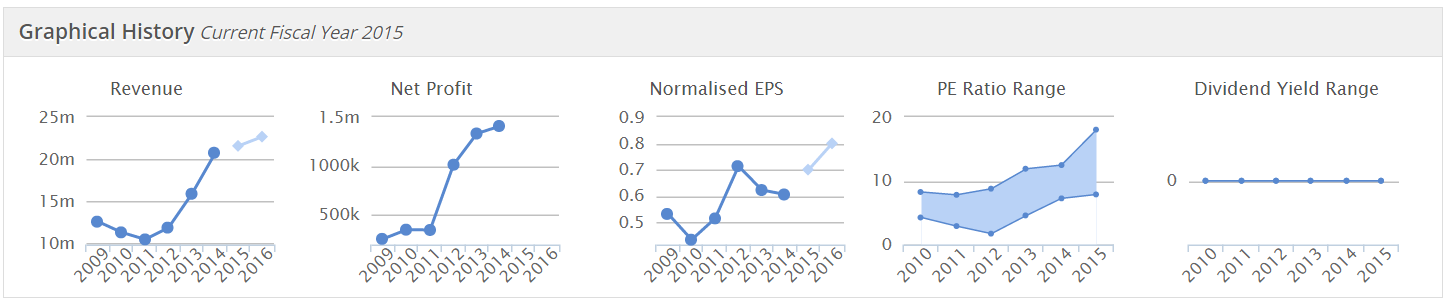

The StockRank here is very good, at 96, also the trend of performance over the last few years seems to be encouraging, so Universe might be worth a fresh look. The shares look priced about right for now (forecast PER of 12.1), but if there's good growth in the pipeline then perhaps earnings forecasts might rise in future?

The only caveat is that these shares have always historically been very cheap, so could easily revert to being on a PER of 6-8 again, if the future numbers disappoint. Also there are no divis, and the spread can be wide. So it's probably not for me.

Treatt (LON:TET)

Share price: 165p (up 2% today)

No. shares: 51.7m

Market cap: £85.3m

Trading update - a reassuring update, with the key bit saying;

The Board is pleased to confirm that the Group has performed well in the second half of the financial year and expects to report revenue and profit before tax for the year ended 30 September 2015 in line with its expectations.

Debt and forex are mentioned positively;

The cash performance of the Group has been encouraging, with net debt ending the year at its lowest level since 2006. The Board is also pleased to report that the FX strategy in place has prevented movements in FX rates during the year having a material impact on results for the year.

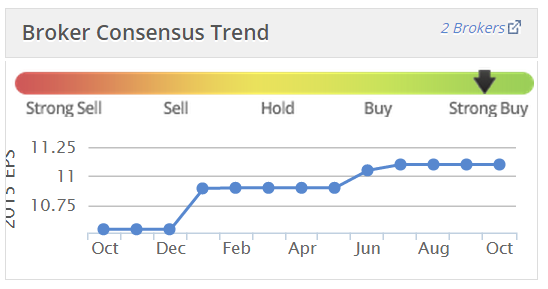

Valuation - Stockopedia shows broker consensus as 11.1p for the year just ended, and forecast 12.0p for the new year (ending 30 Sep 2016). I note that earnings forecasts have been slightly upgraded several times in the last year, which is usually a good sign:

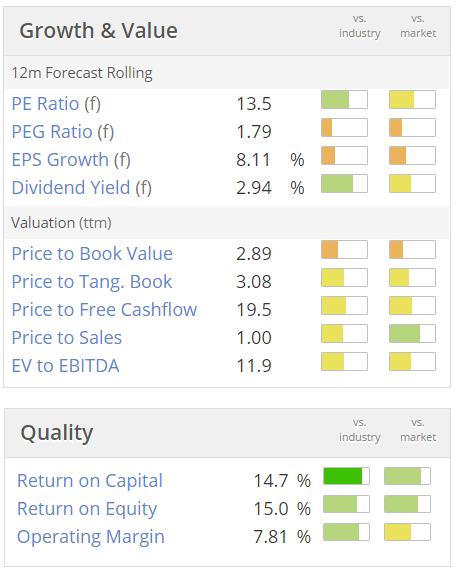

Dividends - there has been a good progression of divis in recent years, rising on average by 9.9% p.a.. Therefore whilst the forecast yield of just under 3% may not look terribly exciting, the trend has been for that to rise each year, so it looks more interesting on that basis.

My opinion - this share looks priced about right to me, but it might be worth digging into the detail a bit more to see what the future growth potential is like. The company has established quite a good track record in recent years, of steady growth, with hardly any new shares having been issued in the last 7 years - usually a good sign. It looks to me as if the shares are more likely to go up, than down, but there's possibly not enough upside to get me excited enough to want to buy.

The chart is looking potentially interesting too - is it limbering up for a fresh push higher? The level of support (where buyers overwhelmed sellers) seems to have moved up from around 130-140p, to around 160p in more recent months, as you can see from the chart below.

Volex (LON:VLX)

Share price: 61.7p (down 5% today)

No. shares: 90.3m

Market cap: £55.7m

As regulars will know, I've long been sceptical about this company's turnaround plan. In my view the high margins the company used to make, are probably gone for good. Now it's just a low margin manufacturer of cables, up against thousands of competing companies doing the same thing.

So the latest profit warning, earlier this week, was no surprise at all to me. The CEO, Christoph Eisenhardt, has been kicked out, rightly so, as I think he led investors up the garden path, particularly with all the bullish presentations that were apparently given at the time of the fundraising in Jun 2014 (without which I reckon this company probably would have gone bust).

Director shareholding - today we see an example of the worst type of Director buy - it's small (only £6,650), and comes shortly after bad news (a profit warning). There was a previous buy from the same Director, the CFO a few days ago, for 20k shares at 71.4p.

Brokers & PR people need to stop advising Directors to buy a few shares after a profit warning - it doesn't give investors confidence, quite the opposite actually - it just looks like a feeble attempt to manipulate the share price!

Whilst the profit warning doesn't sound too bad, with the CEO having gone, I expect there will be another kitchen-sink process, and yet more restructuring costs. Maybe another fundraising might be needed too? I'm steering well clear of this one, it's a can of worms I think.

Right, got to dash. Have a great weekend & see you back here on Monday morning!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions.

A fund management company with which Paul is associated may holds positions in companies mentioned.

NB. These reports are just Paul's personal opinions, and are not advice or recommendations)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.