Good afternoon!

I updated yesterday's report in the evening for interim results from Inspired Energy (LON:INSE) - a business which looks like a smaller version of Utilitywise (LON:UTW) . Please click here to see that article.

I'm running a bit late today, so will update this article throughout the afternoon.

Costain (LON:COST)

Share price: 367p (up 5.9% today)

No. shares: 102.0m

Market cap: £374.3m

Interims to 30 Jun 2015 - the market has reacted positively, with the shares up nearly 6% today, reaching a new post-credit-crunch high - so nice for people who like paying more for their shares, on breakouts!

Revenue is up 17.4% to £621.1m (NB. six months figures)

Underlying operating profit is £13.1m - up 17.0% - note that's a tiny profit margin, at only 2.1% (although there was an H2 weighting to profits in 2014, and 2.6% was achieved in the FY 2014)

Adjusted EPS is 9.6p, up 4.3%, which has been impacted by the increased number of shares in issue (the weighted avg [fully diluted] has risen from 91.7m a year ago, to 104.7m now), being the tail end of the dilution effect from a £75.1m fundraising in 2014, which I reported on here.

Order book - good news here, as they report a record order book of £3.7bn, up 16%.

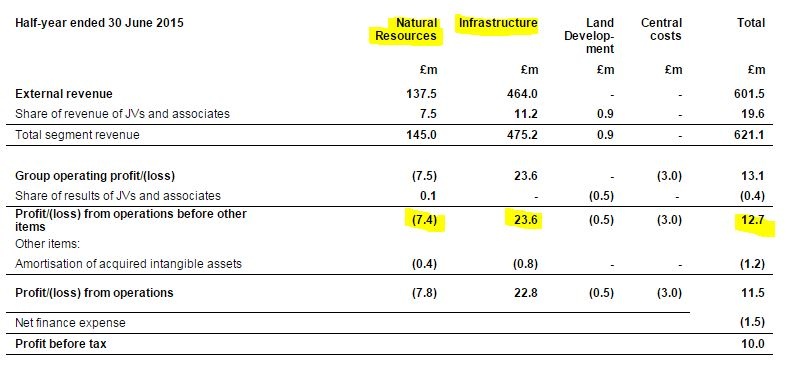

Segmental information - note 3 to today's accounts is interesting, as it shows that the Natural Resources division has performed badly, with a loss of -£7.4m (compared with a loss of -£2.6m in H1 last year), but this has been more than offset by good profit growth from their Infrastructure division (key figures highlighted below);

Also, note that the biggest part of Costain, its Infrastructure division makes a reasonable profit margin (before central costs) of 5.1%, so that addresses my main concern with this business, of its margins being too low. So for me the key issue now is finding out what they are doing to eliminate the losses at the Natural Resources division?

Dividends - the interim divi is up 15% to 3.75p, which looks consistent with broker forecast of 10.1p for the full year, as historically the final divi has been just under double the interim divi, which seems to confirm the seasonal bias towards H2 trading mentioned above. That's a 2.8% yield, which isn't particularly great for this type of company really.

Especially given that they raised £75m from shareholders last year, so a cynic might say that shareholders are just being given back a little of the money they put into the company last year! Annoying if you are taxed on your investment income too.

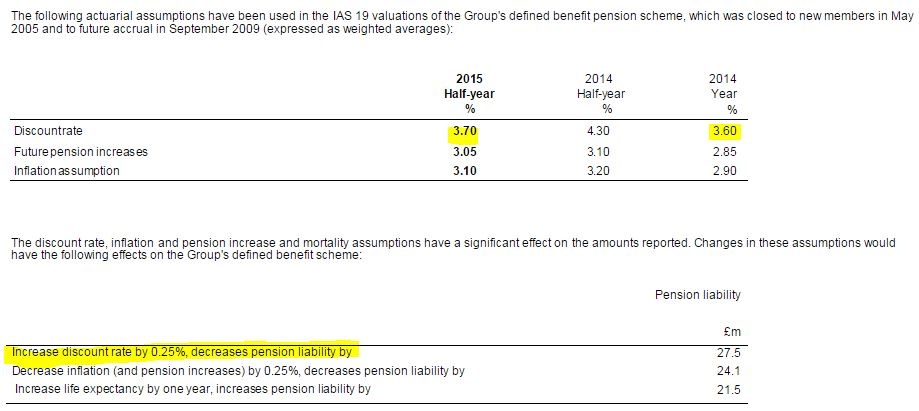

Pension deficit - note 9 gives more info about this. Note that it's a very large scheme, but the accounting deficit seems relatively modest, at £37.0m, on a scheme with £667.5m assets. There's an interesting table showing the actuarial assumptions (possibly the only time you'll ever see the words interesting, and actuarial, in the same sentence!) and how sensitive they are to small changes in the assumptions;

Note that the discount rate has risen slightly from six months ago, from 3.6% to 3.7%, so we could now be over the worst for pension deficits, providing asset values remain high. Of course if there's a meltdown in stock markets, and bond values, then pension deficits could once again become a thorny issue. For now though, it doesn't look a big problem at Costain.

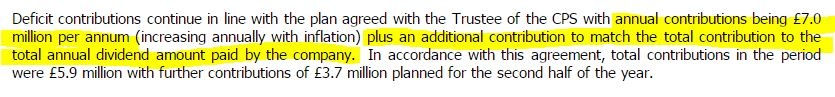

Having said that, the over-payments are considerable, so it is a material drain on cashflow at the moment. Note also the link to dividends, so this is an important effective restriction on increasing dividends further, so quite a nuisance really;

Narrative - key points that I've picked out are as follows;

- Customers are consolidating their supply chains, down to fewer, preferred providers, such as Costain - so a positive trend.

- Growth - organic and by targeted acquisition is planned

- Upgrading of UK's transport infrastructure is positive for Costain

- Rhead Group acquired after the period end (at £36m cost)

Outlook for FY 2015 is positive;

Following the strong start to the year, the Group is on course to deliver a result for the full year at the upper end of the Board's expectations. Reflecting the Board's confidence for the future, the interim dividend has been increased by 15%.

Natural Resources division - coming back to the poor performance here, the reasons given are;

- Additional provisions required on an old problem contract (Manchester waste disposal PFI contract from 2007)

- North Sea contracts being delayed due to decline in oil price

- More positively, the forward order book is flat at £1.0bn, and estimating/tendering activity levels are high

I can't see any specific commentary about if/when performance from this division will improve, but looking forward a couple of years, optimists might factor in a recovery in this division, which would lead to a material improvement in overall group results.

Balance Sheet - I've already mentioned the pension deficit above, which would only become a worry if, say global equity markets crashed, or some other financial crisis occurred which could make the deficit grow significantly, as it's a large scheme.

Net cash is strong, at £126.8m. There are huge bank facilities available, at £525m , with a Jun 2020 maturity date, so Costain looks to have considerable financial flexibility, which should be useful when dealing with large contracts, and will also help win contracts.

Paul Hill points out in the comments section below, that Costain's cashflow was poor in H1, with a £32.4m increase in receivables being the main culprit. This ties in with the company's previous comments in 2014 that the structure of contracts is moving away from up-front payments by customers, thus stretching cashflow.

Net assets are £110.6m, take off £29.6m intangible assets, and NTAV is reasonable at £81.0m, although for the size of business I'd say that's not a particularly strong capital base.

The current ratio is 1.15 - not great, but there is no long term debt, so in that context (and with large bank facilities available if needed) then I don't see any issues to worry about here, in the current climate.

Valuation - broker consensus is 20.4p for 2015, and the company says today that it's tracking towards the top end of the range, so consensus could edge up a little perhaps? Maybe 21p for this year? That equates to a 2015 PER of 17.5, which looks expensive at first glance.

However, I think we could value the business on a higher earnings level, given that the losses in the Natural Resources division should be eliminated in time. I see brokers are forecasting a jump to 25.2p EPS next year, and the Rhead acquisition is a further reason to expect earnings to increase. That brings the 2016 PER to 14.6 - more reasonable, but still high for this type of business.

My opinion - it wouldn't surprise me to see EPS rising towards the 30-40p level in a year or two's time. Today's share price of 365p would then look reasonably good value.

Although it's important to remember that this type of low margin, complex contracting business, really should not be valued highly (no more than a PER of about 10-12, I would say), as the Achilles Heel is contracts going wrong - which can be disastrously costly, as we've seen with nearly all of this type of business, sooner or later - ISG (LON:ISG) was the most recent one - but they practically all seem to have some problem contracts which dent results (sometimes badly).

I've warmed to Costain the more I've dug into the detail today, but for me, the price looks up with events now, and I can't see any reason to buy at this level. That's not to say it won't go higher - momentum buyers are driving lots of shares above reasonable valuations at the moment, but I'd say this one is starting to look fully priced now.

More earnings upgrades are likely though, and plenty of investors like to ride that wave, so it's the type of stock I would probably hold if I already owned it, but am not interested in buying at this stage - there could be better buying opportunity on the next general market wobble, so it's going on my watch list - a pullback to around 300p would be the sort of level where I would consider buying, but above that, risk:reward doesn't make sense for me personally.

Note that the Stockopedia computers have excelled themselves again - this one has a StockRank of 99. The algorithms are certainly not infallible, but they do seem to be working very well at the moment, in identifying a lot more winners than losers.

Stock Spirits (LON:STCK)

Share price: 188.9p (up 3.6% today)

No. shares: 200.0m

Market cap: £377.8m

Interims to 30 Jun 2015 - this is a new company to me, and describes itself as, "a leading Central & Eastern European branded spirits producer". The shares have had a full listing in the UK since Oct 2013. After a good first year on the market, the shares fell out of bed in Nov 2014 on a profit warning, and have been drifting down ever since - so yet another IPO that went wrong. Makes you wonder why it listed? Did they know problems were on the cards perhaps? I've no idea, but you do wonder, when newly listed companies warn on profits.

I think all IPOs have to be treated with a great deal of suspicion, as such a high proportion go wrong - after all, vendors will naturally want to sell at the time & price where they most benefit. Taking the other side of that trade is usually a mug's game. Especially at the moment - many (or maybe most?) city advisers are only after the fees, and don't seem to care about the quality of things they list. You can only play that game for so long before there won't be any buyers left. Perhaps buyers should insist on advisers' fees being deferred for two years, and only payable if there hasn't been a profit warning? Why not, it would certainly focus minds.

Today's H1 figures look dreadful (note they report in Euros):

- Revenue down 21.6% to E108.0m

- Pre-excpetional operating profit down 77.6% to E5.2m

No wonder the shares have performed badly in the last year! Although the share price is up today, so clearly the market was expecting this, or worse.

The CEO explains the poor performance like this;

"As reported at the time of our AGM in May, the disruption in the supply chain and aggressive competitor pricing in Poland following the excise tax increase in January 2014, resulted in a very poor first quarter for the Group. Trading in Poland improved significantly in the second quarter, but not enough to fully offset the poor first quarter. All other markets have traded in line with our expectations. Therefore as expected, the Group's overall results for the first half of the year 2015 have been disappointing. In line with our strategy we remain committed to managing for value and margin rather than chasing uneconomic volume market share and therefore continue to focus on new product development, premiumisation of the portfolio and effective customer and channel management. Whilst there are risks facing the business from continuing aggressive competitor pricing and erratic customer ordering patterns, we currently believe that our full year EBITDA will be within the range of €60m to €68m...

Hmmmmm. That just says to me that they have a lousy business model. Do I want to invest in a company where profits can suddenly drop by three quarters because they encounter a few problems? No.

I see there is E4.3m in finance costs on the P&L, and E1.0m in finance income on the P&L, which together wipes out over half operating profit. The finance income is mostly (E854k) forex gains, whilst the interest payable is mostly (about 90%) on bank debt & amortisation of fees. So the company have a fair bit of debt.

Balance Sheet - as I suspected would be the case, it's a weak balance sheet. A few key points;

Net assets of E351.7m includes intangibles (mostly brands) of E360.3, so removing those makes net tangible asset value negative at -E8.6m, which is obviously weak, but not disastrous if profitability can be restored.

Current ratio - this looks strong at 1.9, however that's because it excludes nearly all the substantial bank debt, of which E151.7m sits in long-term creditors.

So net current assets of E104.5m might look good, and create a healthy current ratio, but it's funded through long term bank debt of E151.7m. Therefore, overall it's a weak financial position, especially since profits have collapsed. That said, banks often apply a Net debt: EBITDA covenant, and that would still be reasonable here, based on the statement from management that they expect full year EBITDA of E60-68m.

Although H1 EBITDA (pre-exceptionals) was only E10.8m, so that full year EBITDA forecast looks very ambitious - is it realistic I wonder? Checking back, there was an H2 weighting to profits last year, but it doesn't look enough to make the full year figures attainable.

Net debt (net of E72.3m cash) wasn't at crisis levels, at E92.0m, but it's higher than I would like to see at a company which is struggling on profitability.

Debtors - jumps out at me as looking too high, at E108.7m. H1 turnover was E108.0m, so even allowing for Debtors including VAT, and turnover not, I would have expected Debtors to be half or less H1 turnover, maybe E50m or less. Not E108.7m. Why are Debtors too high? It's a big red flag - I very much dislike big Debtors, it's usually a sign of problems under the surface.

Dividends - the forecast yield is unexciting, at about 2.1%

My opinion - I've seen enough. I definitely would not invest in this company, it looks financially weak, and if profits can almost collapse when a few problems emerge, then it's got a lousy business model and/or lousy management.

I'm not convinced full year forecast earnings will be achieved, so would want a very low PER to tempt me in. At about 15 times this year's forecast earnings, the price still looks far too high in my view. The company has made good profits historically, but whether that is sustainable looks questionable.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.