Happy Friday,

Today I'm looking at Brainjuicer (LON:BJU), Character (LON:CCT) and Close Brothers (LON:CBG).

Paul, who is on his day off but can't stay away, will be covering MySale (LON:MYSL) and Bonmarche Holdings (LON:BON).

Paul also made a couple of late updates to yesterday's report.

That report now includes all of ST Ives (LON:SIV), Revolution Bars (LON:RBG), FreeAgent Holdings (LON:FREE), Portmeirion (LON:PMP), Mission Marketing (LON:TMMG).

Best regards

Graham

Brainjuicer (LON:BJU)

Share price: 675p (+13%)

No. shares: 12.2m

Market cap: £82m

It feels like just the other day that I last covered a trading update from Brainjuicer. Indeed, I covered it in the Dec 9 report; the shares rallied 7% that day when the company announced that results would be "above current market forecasts".

Amazingly, the shares are up by a further 27% since then.

But this is a "juicy" statement:

For the 12

month period, Gross Profit, our main top line indicator, increased by

some 27% to approximately £25.6m, driven primarily by continued strong

progress by our US business and an encouraging recovery in Continental

Europe.

Besides improving fundamentals, the share price rise also reflects an effective short-GBP position:

Excluding the impact of exchange rate movements the increase in Gross Profit was some 15%.

For me, the best thing about this update is the success in the Ad Test/Brand Tracking services. As I've pointed out before, and as the company reiterates today, these are "comparatively high margin and scalable quantitative services". Well, their contribution rose by 80%, to make up 39% of the company's total gross profit.

Back in September, I thought we were in store for a pre-tax profit here of c. £5.5 million, which I revised to c. £6 million in December. Today it announces that it is going to achieve c. £6.2 million.

In December, I forecast that cash at year-end would be "possibly in excess of £6.5 million". Amazingly, it has achieved £7.8 million. So it has beat everything I thought it was going to do.

This is a share I've been watching for quite a while, but failed to personally participate in the share price increase, despite always having a positive view of the company.

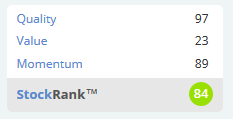

Unsurprisingly, the Value Rank is now looking rather poor:

This is going to continue to be awkward for me, as I'll continue to congratulate the company on its success and laud its merits, while admitting that I don't really know if the valuation makes sense.

Higher tax rates apply to business in the US, so that net income might end up a little over £4 million. For me, the market continues to apply a fairly high multiple to a lot of contract-driven, B2B work, which is difficult to predict.

Character (LON:CCT)

Share price: 490p (-6%)

No. shares: 21m

Market cap: £103m

A short update for the company's AGM, held today.

Whilst we are confident that the market expectation for

the 2017 financial year shall be achieved, we expect the results for

the first half to be lower than those reported in the comparative period

last year. In the four months to December 2016, sales were marginally

lower than the same period last year and as expected UK gross margin was

adversely affected by the devaluation of sterling... We are expecting both

our international and domestic sales to grow in the remainder of the

financial year.

So the company is fairly confident that the results since August have just been a temporary blip.

This is another company I rate positively. Of course it's a very different industry to Brainjuicer (LON:BJU), but the rating on Character (LON:CCT) puts it in "value" territory for me. While both companies yield c. 3%, Brainjuicer's dividend cover is between 1.5-2.0x, while Character's is covered around 3.0x!

Which makes this sentence unsurprising:

Our balance sheet, including cash position continues to

strengthen considerably; we shall maintain our progressive dividend

policy.

It makes sense that the shares would fall today after a disappointing few months, but this could be one to buy and hold for the long-term.

Remember that it's not an intellectual property owner, so the valuation rating should probably never get too high.

Close Brothers (LON:CBG)

Share price: 1444p (+1%)

No. shares: 150m

Market cap: £2,167m

I hope Paul will forgive me for covering another big-cap, but financials are one of my preferred sectors!

It's a solid update from this merchant banking group:

The Banking division has generated strong returns and profit growth during the period. This was driven by both higher income, with a stable net interest margin, as well as a lower bad debt ratio, as a result of continued good underlying credit performance and provision releases.

The loan book was up 2.3% over the period

and 9.3% year on year at £6.6 billion (31 July 2016: £6.4 billion),

driven by good growth particularly in the premium finance and property

businesses.

If you've seen "WINS" making a market in securities you've been trading, you've probably been contributing to Close Brothers results, as it owns Winterflood Securities.

Winterflood delivered a good performance, with strong retail trading activity throughout the period.

The spreads in the small-cap market are a source of annoyance to me, but buying CBG is one way of accessing the profit stream they create!

Outlook

"Given our performance year to date, we are confident in delivering a strong result for the first half as well as a good outcome for the full 2017 financial year."

My opinion

I think this is a very solid business, which has proved its worth through good and bad times.

Return on equity is excellent, at c. 19% over the past two years, and with a very attractive net interest margin of more than 8%.

In general, the non-bank financials are far more interesting to me than the banks, because they don't waste capital on low-margin activities.

For example, Lloyds Banking (LON:LLOY) is guiding for a net interest margin (NIM) of c. 2.7% this year.

Barclays (LON:BARC) earns NIM of 9% and ROE of 18% in Barclaycard, but in the Personal & Corporate Banking division, it earns NIM of 3% and ROE of 12%.

So I generally stick to non-bank financials for potential investment opportunities, and CBG is one I'd consider. It's currently paying a yield of 4%, which is well-covered.

(This section is from Paul Scott)

Bonmarche Holdings (LON:BON)

Share price: 82.5p (up 4.4% today)

No. shares: 50.0m

Market cap: £41.3m

Trading update – covering Q3, and the year to date (the company has an end March 2017 year end).

This value ladieswear retailer has had a dismal year so far. So in that context, the update today is much improved;

Sales for the 13 weeks ended 24 December 2016 increased by 3.3% against the corresponding period in FY16, and store LFL sales increased by 0.8%.

Sales for the 39 weeks ended 24 December 2016 decreased by 1.3% and store LFL sales decreased by 5.3%.

So the trend for LFL has dramatically improved, back to slightly positive, from deeply negative earlier in the year. Remember also that the dismal Q1 & Q2 sales will present a nice soft target for the company to hopefully beat in 2017.

Gross margin has also improved noticeably, which is excellent news;

A less promotional stance was taken throughout the quarter and whilst this impacted overall sales volumes it resulted in stronger gross margin performance, with product gross margin in the quarter 2.2% higher than in last year's corresponding period.

Investors generally tend to pay too much attention to LFL sales, and not enough attention to gross margins – which can have a dramatic impact on profit. So this is good news, and 220bps on the gross margin is a hefty amount.

Outlook comments are positive;

The Company's financial position remains sound and the Board's expectation for the full year is unchanged, with our expectation being that the Group's pre-exceptional PBT is likely to fall within a range between £5.0m and £7.0m.

Hooray, the company has given a range of likely profits for this financial year – well done, and thank you – this clarity makes life so much easier for investors. Everyone should be doing this.

Valuation – given the above update, we can rely on broker consensus for this year, which is 12.0p EPS. Therefore the current year PER is 6.9. That looks good value, especially as the company does indeed have a strong balance sheet. So this is an exception to the usual rule that claiming to have a strong balance sheet often means the reverse is actually true, as we saw with 2 companies in yesterday’s SCVR.

Dividends – is the 9.5% dividend sustainable? Usually a yield that high is a signal that market expectations are too high, or that profits are unsustainable.

In this case however, my number-crunching suggests that the company actually could continue paying divis at this level. Providing trading doesn’t deteriorate further of course. Mind you, divis are a policy decision, so the company may decide that it’s prudent to lower the divis in future, which would probably be negative for the share price.

My opinion – I’ve got mixed feelings about this share. Today’s update is good – they have steadied the ship. However, the RNS notes that online sales are poor, and I generally worry about the survival prospects for retailers who have not managed to crack selling online as well as in physical stores.

The benefit from selling online is obvious – you get 100% geographical coverage, far wider than a store network. So even people out in the sticks can buy from a website. Also, there’s a chance of some overseas sales, although probably not material for a value retailer like this.

As we know, all retailers are up against serious cost headwinds, due to the lower sterling:dollar rate making imported product (basically everything that they sell), increases in staff costs, possible business rates increases, the list just goes on & on. To cope with this, retailers have to be generating LFL sales increases to absorb the cost increases. If they don’t, then an operationally geared fall in profits can decimate the bottom line.

All the while, online competitors are skimming market share from the High Street incumbents. That said, at the value, middle-aged end of the market in which BON operates, I imagine internet competition is less intense.

In normal market conditions, I would have probably hit the buy button today. However, I’m not going to, because we’re in a market that just isn’t interested in value shares, and declining sectors such as this. So how much upside can there be on this share? I don’t know, but maybe not much. That said, it’s bound to catch the eye of dividend income seekers.

Overall, I have to say it’s very tempting to pick up a few at this level. It depends whether the turnaround in trading continues, or not, and that’s the key bit of information which we can only guess at.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.