Good morning! It looks like a fairly nasty open is in the offing, with the FTSE 100 futures indicating a 100 point drop to 6,252, on the back of some comments made by Ben Bernanke in the USA last night, about tapering QE later this year.

Silverdell (LON:SID) has issued a positive-sounding contracts win announcement. They go on to say that, "of the £12.1m of contract wins, at least £2m is scheduled to fall in the current financial year". All well and good, but in the context of £136m forecast turnover for this year (ending 30 Sep 2013) that's not material, so I suspect this announcement contains a strong element of getting some positive PR out there, to re-build investor confidence after the damage done by an ill-conceived Edison research note a little while ago.

I'm also intrigued by the announcement today from Helphire (LON:HHR) which states that the Court has approved their capital restructuring, designed to allow them to resume the payment of dividends. A special dividend of 0.165p per share has been declared, which is just under a 4.9% one-off yield.

They also include positive news on a further reduction in debtor days (which is the bane of companies in this sector, supplying car hire to insurers) to 127 days. It's not a company I've been following, but on a closer look Helphire has pulled off a remarkable resurgence. They have wiped out almost all of their debt, through the issue of new shares at 2.5p, and amazingly the Banks doing a debt for equity swap, and writing off almost all of the remaining debt. So it now looks financially strong, and is profitable again.

I suspect there could be good upside on the current share price, although I loathe this sector with a passion, having lost around £250k on Accident Exchange shares a few years ago. For that reason I won't be tempted back into this sector by anything, no matter how good it looks on paper. Although one has to admire the skill of management at Helphire having so comprehensively turned around an apparently doomed company. On that basis alone they are possibly worth backing.

Management have a target of £7.5m operating profit for year ending 30 Jun 2013, so at a market cap of £53m, with net debt of only £1.1m, the shares could still be cheap? DYOR as usual of course, I don't hold any, but am tempted to have a dabble here at 3.4p per share, because there could well be a positive reaction to the results announcement in Sep 2013, when people see that the Balance Sheet is now actually very strong, with effectively no debt.

I changed my mind on Helphire, and decided to buy a few at the open, for 3.5p. It's funny how your feelings can change quite rapidly as you're digesting news & figures, but in the end I suddenly realised that it being debt-free, and having got debtor days down to only 4 months, and trading in line with expectations & resuming dividends, was all pretty good considering the market cap is only £53m.

Sorry if that sends contradictory messages, but that's just how it is with shares - especially at the market open the position is fluid, and people who are able to digest information quickly and accurately, and make quick decisions, can end up doing very well. I think that is particularly the case with profits warnings, where it's often the people who move quickly to sell at the open who escape with the least damage.

Whereas investors who pore over the detail, and worse still dither when the news is clearly bad, or even worse still who refuse to accept that the bull case was wrong & become emotionally attached to their shares despite bad news (we've all done it!), end up nursing greater losses. Such investors usually also defer selling, and end up selling right at the bottom some time later (been there, done that too!).

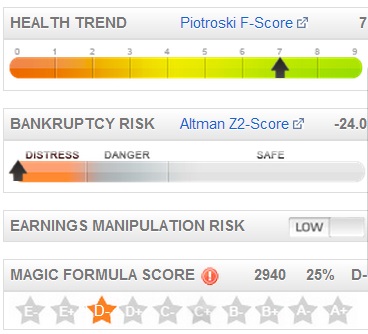

Shares in PuriCore (LON:PURI) have had a 10% boost this morning from a decent-sized contract win announcement. I like this one, and hold a few in the more speculative niche of my portfolio. It's risky though, and is showing a poor Altman Z-score, indicating potentially high risk of insolvency. I reviewed the accounts a while ago, and thought it looked reasonably OK, because they had converted their loan notes into shares, and done a Placing in Jan 2013. Therefore the poor Z-score is probably no longer relevant in this case, but it always pays to check the bank of 4 indicators on the StockReport (as shown in the picture on the right).

Getech (LON:GTC) has been on my watch list for a while, and I've taken the plunge this morning and bought a small amount at 57p. I like buying shares on days like today, when the market is heavily down, especially where that coincides with positive news from a company, as in this case. Getech have announced a "major data sale" which is only actually $962k, but this is a small company (market cap of £16.3m at 56p) and gross margins are very high. They sell exploration data to oil companies.

The beauty of buying on a down day, is that everyone else is hunkered down and not reacting to positive news announcements generally, so this means there is less competition, so it's easier to buy the quantity you want, at the price you want.

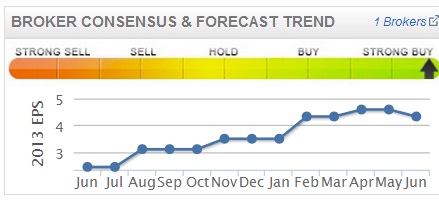

Note from the graphic on the left, how Getech has seen steady growth in broker consensus EPS forecasts for this year.

Since I've been following this indicator on Stockopedia, it seems to provide a very good pointer towards companies which might out-perform against forecasts. It generally points to companies which are on a roll in terms of underlying trading, and if they are also reasonably priced, then they could turn out to be good investments possibly?

So a steadily rising chart here indicates companies which are doing well, and hence seeing their earnings forecasts upgraded multiple times. Brokers will usually be fairly conservative in growing earnings situations, since they don't like anticipating sales growth beyond what has already been announced.

There is a positive trading update from Cyprotex (LON:CRX), a company that is new to me. They seem to be a specialist pharmaceuticals testing company, if that's the right terminology? Their H1 trading is ahead of market expectations, and with an H2 bias to their seasonality, total revenues of £9.5m, and operating profit of £0.8m are expected for the year. Top marks for a nice clear trading statement too, setting out the actual figures for what market expectations are - I wish all companies would do that. All too often it's a real struggle to interpret and unpick the meaning of trading statements, which is just wrong & results in misunderstandings.

Overall with a share price of 4.6p and 0.3p EPS expected for this year, the PER of 15.3 looks stretched to me, for such a small business. The trouble with things this small, is that they tend to be heavily reliant on a few large customers, so the risk of a profits warning is high. Also there is no dividend, so at a first glance it just doesn't appeal to me, despite solid current trading.

Right that's about it for today. I see that Gold is being massacred today, down $61 to $1290 at the time of writing. As I've always maintained, Gold is absolutely not a safe haven, it's actually a wild speculation. Of course fiat currencies will devalue over time, but at nothing like the rate that justified Gold rising multiples of its lows to anything like the current price. After all, it's just a shiny metal whose main use is decorative.

I did have a small flutter on some gold producers, but sold most of them first thing today, as my timing seems to have been excruciatingly bad. Anyway, no significant harm done.

See you same time tomorrow.

Regards, Paul.

(of the companies mentioned today Paul has long positions in: HHR, PURI, GTC, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.