Good morning!

CVS (LON:CVSG)

As far as I'm aware this is the only UK listed (let's see if I can spell it right this time!) veterinary chain. I last looked at it on publication of interims to 31 Dec 2013 here, and at 306p per share was wavering between thinking it was priced about right to a little too highly. The price now is a little higher, at 324p, giving a mkt cap of £187.7m.

There's no denying it's a good growth business, operating in an area where people are spending more on their pets - e.g. having operations done on animals, instead of 20+ years ago the norm was to put them down if anything serious went wrong with a pet's health. So it's all down to whether the valuation is reasonable.

The other issue is their Balance Sheet, which is horrible. When I last looked it had negative tangible assets of £30.8m, funded by £32.1m of net debt. The issue being that debt has to be repaid at some point, which is money that would otherwise be available for dividends, plus it has an ongoing (and likely to increase) servicing cost in interest payments and arrangement fees. Bear in mind that whilst interest rates may be low, a lot of banks are coining it in with excessive arrangements fees, a hidden cost. So debt is not as cheap as it might look at first. The other issue with debt is that it makes an investment much more high risk - if something serious goes wrong with trading, a highly indebted company immediately has its back against the wall, may breach banking covenants, and end up either going bust or having to do an emergency fundraising at the worst possible time & price, leading to heavy dilution. These are the reasons why I try to avoid highly indebted companies.

This morning's trading update sounds good. The key sentence says;

The Group will announce its full year results on Friday 19 September 2014 and these are expected to be in line with market expectations.

Jolly good. Lots more detail is given, but I'm not interested in that. All that matters now is the outlook statement. This is woolly, but positive-sounding;

The Board is encouraged by the recent improvement in like-for-like sales performance, the continuing potential for further acquisitions and the general progress in all divisions of the Group.

With a stretched Balance Sheet, and a desire to do more acquisitions, they will probably want to get the share price up, in order to pave the way for a Placing at a decent price. That's just guesswork on my part, but it's the usual pattern, so expect to see planted articles in the press saying how good the company is!

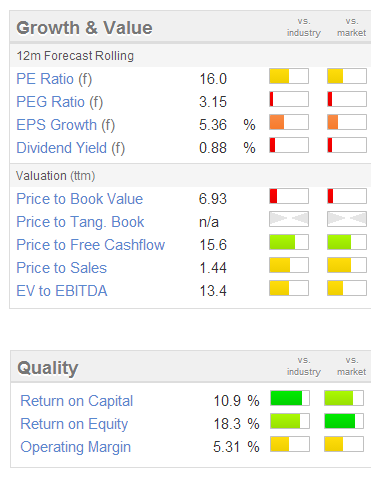

I'll look at it again if & when they fix their Balance Sheet, so a £30m+ equity fundraising would be needed to do that. Here are the valuation stats, on the left, although bear in mind that net debt is about 53p per share, so if you adjust for that the PER is knocking on the door of 20, which is too rich for me.

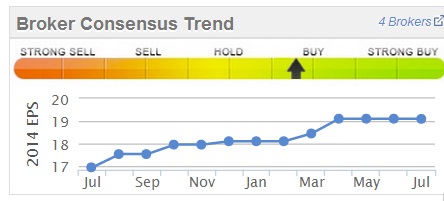

Although it's worth noting that the share price has been tracking broker forecasts up, in a series of modest upward revisions over the last year, as you can see from the nifty little Stockopedia graphic below, which I find very useful:

How bizarre, a tiny crawling insect has somehow managed to get into my PC's screen, and is crawling about in front of me, impervious to my attempts to wipe it away. Am trying to work out if it's real, or just something Google has put there to amuse me? There again the computer did come from Ebay...

Michelmersh Brick Holdings (LON:MBH)

Interim results to 30 Jun 2014 have been released this morning. The company describes itself as having three activities - specialist brick, land development and landfill.

At 74p the market cap is about £59m.

Positive

- H1 operating profit up from £0.1m to £1.4m

- Balance Sheet fixed with Memorial Production Partners LP (FRA:10M) Placing at 45p in Nov 2013

- Net debt greatly reduced, from £18.7m to £5.3m

- Recovering demand, industry brick stocks at "lowest level in living memory"

- Average price increases in H1 of 12.8% vs last year's H1

- Likely to exceed market expectations for full year

- Cost inflation "relatively benign" (especially energy)

- Capacity increase of c.20% in pipeline (at Freshfields Lane site)

.

Negative

- No dividends, but intending to resume divis "within the foreseeable future"

- Upside looks priced-in already possibly?

.

So lots of positive points, and certainly very interesting industry dynamics with demand outstripping supply, and years of under-investment in the industry meaning the prices are now going up, which augurs well for continued good trading at Michelmersh.

Although clearly a £1.4m H1 profit, double that to £2.8m for the full year (assuming no seasonality) doesn't look particularly exciting for a market cap of £59m.

Although there are also significant freehold property assets at this company to consider, with property development upside, which is mentioned in today's update. Therefore in my opinion the company needs to be valued on a sum of the parts basis - so put a valuation of whatever you think it's worth on the brick business (which is highly cyclical remember, so should not be put on a racy valuation of peak earnings), then add the discounted value of the property assets on top.

I don't know enough about the property side of things to be able to value that, hence the company as a whole. The chances of a big spike up in the price of bricks is an interesting angle on it though;

Capacity in the industry is largely fixed and can only be increased through significant investment and the availability of appropriate consented mineral reserves, which requires long term planning. Margins are still not at a level where the industry is enjoying normalised levels of return on capital such that there is adequate return for new investment in this vital industry.

WH Ireland (LON:WHI)

I'm increasing the number of conference calls on results day with Directors of interesting companies, whenever possible. The CEO & FD of stockbroker WH Ireland kindly spared some time for me this morning, to run through some Q&A. My personal preference is to have the presentation slides emailed to me in advance of the call, run through those on my own, and then just spend 15-20 minutes doing Q&A on the phone call. It also saves me a trip into London, so is an efficient use of time.

I should also add that I'm biased, as WH Ireland is my main personal broker, as I like the levels of service, and don't mind paying a bit more commission than online - well worth it in small caps, as just the improved spread can often cover the extra commission. Plus WHI have been very helpful to me in many other ways - e.g. ringing me on a profit warning, and executing a trade 30 seconds faster than everyone else - can occasionally save thousands, or letting me use their meeting room to meet companies when I'm in London, flagging up interesting companies to me, etc. Most private investors greatly undervalue the services of a proper broker, and make the false economy of using discount brokers - which are fine for mid to large caps, but not so good for small caps where a more specialised approach is needed.

Anyway, interim results for the six months ended 31 May 2014 show a good improvement against last year, but the profit is still small - up from £59k last year H1 to £470k this year H1. The company seems to have a strong H2 bias to trading, and the pipeline for H2 is described as "robust", so that trend is likely to repeat this year.

The relatively new CEO is doing a lot of sensible-sounding things to focus the business on its core activities, and preparing it for increased volumes, which should drive operationally geared improvements in profitability.

Providing equity markets remain reasonably healthy, then WHI should do alright, and it notes today that next year's results should benefit from changes already made (e.g. bringing in new teams of brokers, who take time to migrate across their clients), so they have had some up-front costs this year.

On a PER basis the shares don't look cheap. Also the divi yield is modest, with divis only reinstated in 2013.

However, with £2.7bn funds under management ("FUM"), then the old fashioned 2% of that as valuation might be another way of looking at it, which would suggest a potential valuation of £54m, versus the market cap of £25.8m at 108p per share currently. My feeling is that a higher & more consistent level of profitability would be needed before the 2% rule could be applied here, but the company seems to be moving in the right direction, with a sensible strategy, in my opinion.

The shares have almost doubled in the last year, and are probably high enough for the time being.

That's all there is time for today.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.