Good morning!

RM (LON:RM.)

There is a trading update this morning from RM, which is an educational IT and resources group. Its trading performance in the first five months (of an unusual 30 Nov year end) is described as strong, and for the full year outlook it says;

As a consequence, adjusted operating profit for the 6 months ending 31 May 2014 is anticipated to be higher than the comparable period last year, notwithstanding the restructuring of Education Technology referred to above. The Board expects that the Group's seasonal bias of profits towards the second half of the financial year will be much less pronounced than last year, but nevertheless now anticipates that adjusted operating profit for the year to 30 November 2014 will be materially higher than its previous expectations.

At the moment broker consensus is for 8.15p EPS this year, so "materially higher" must surely mean something nearer to 10p EPS? Therefore at 129p the PER is probably starting to look reasonably good value. Although it all depends on whether profits are sustainable - as this business has had somewhat erratic profits in the past, making it hard to value.

The forecast dividend yield is about 3%, which is worth having.

Unfortunately there is a fairly material problem here with an old pension fund deficit. This had a £53.5m deficit for funding purposes at the last triennial valuation on 31 May 2012, which requires £3.6m p.a. deficit recovery payments by the company. Remember that such payments don't normally go through the P&L, so have to be paid out of profits/cashflow, and therefore reduce the amount available to be paid in dividends. The company also has to pay some costs related to the pension fund, so the total cash outflow last year, shown on the cashflow statement, was £4.4m. So when you adjust for this factor, maybe the shares aren't good value after all?

Care is also needed with the apparently large cash balances held by this company, as it's not really their money - it's customer money which has been paid up-front by them. As we were discussing yesterday with Renew Holdings (LON:RNWH), that's all fine providing customers are happy to continue paying in that way, but things can change unexpectedly. So one should be prudent how these things are viewed, in my opinion.

Overall then, it doesn't appeal to me.

Alliance Pharma (LON:APH)

I don't normally report on pharmas, as they are too difficult to value - you have to understand the products concerned, and their outlook, expiry of patents, etc. However, this one has a simple business model which I do understand - they buy up the rights to drugs and medicines which are too old and/or too small scale to interest larger pharmas, then milk them as cash cows.

The problem with that business model is that they have to keep buying up new products, in order to replenish ones that are withering away. The shares have just traded sideways for the last four years, and it's difficult to muster any enthusiasm for the company. It pays a reasonable dividend of about 3.4%, but if there is little prospect of a capital gain, then you might as well look for a better dividend yield in larger caps, where 5% yields are available.

An AGM statement issued today is reassuring, with the key bits saying;

Following a robust performance in 2013 when Alliance grew revenue to £45.5 million and increased pre-tax profits by 11% to £12.0 million, trading in the first four months of 2014 has been in line with expectations, with revenue of £15.2 million...

...We expect trading performance this year to be in line with our plans. We continue to work towards delivering further earnings enhancing acquisitions to outperform those plans.

Let's hope their plans are aligned with market expectations! Slightly odd use of language there - I wish there was some standardisation of trading statements. A tick box system would be better - i.e. are you trading in line with market expectations? Yes/No.

There is a lot of green on the Stockopedia valuation & growth graphics, which is good. However remember that PER is flattered by debt. So in this case the company has a fair chunk of bank debt, which would raise the PER to about 12-13 if the company were cash/debt neutral. Therefore it's probably priced about right in my view.

If they acquire some game-changing new products cheaply, then these shares might become more attractive. It just feels a bit stale at the moment. That said, from this price there could be, say 20-30% upside?

Actual Experience (LON:ACT)

This is an interesting company, and one to watch. The company floated on 13 Feb 2014, a day which I remember well because a friend had told me this was a very exciting company and I should try to buy some stock at the open. The price on admission was 54.5p, so I put in an order to pay up to 72p. Then I had to go into a meeting, and by the time I rang my broker mid-morning to see whether we had got a fill or not, he told me that I'd have to pay around 300p to get any shares! Needless to say, I declined. That has to be a record (at least in this current bull market) for going to a gigantic premium on listing?

The shares have since drifted back to 199p, still almost four times the float price, which equates to a market cap of £56m. Interim results out this morning are like a bucket of cold water though - turnover was only £272k for the six months to 31 Mar 2014, generating a loss of £836k - although that includes £450k one-off costs associated with its AIM flotation.

There was £3.6m cash in the bank as at 31 Mar 2014.

So the entire market cap rests on future hopes for what the company might be able to achieve. It's a spin-out from a University, and has some novel way of analysing & rectifying computer systems apparently. It was explained to me, but I didn't properly understand what it is they do.

The company sounds upbeat in today's report, saying;

Recent trading reinforces our view that our addressable market is global and vast.

On balance I feel that it's too early stage for me, and I'd like to see more evidence of decent profitability before taking the plunge. The very high market cap doesn't leave any scope for disappointment.

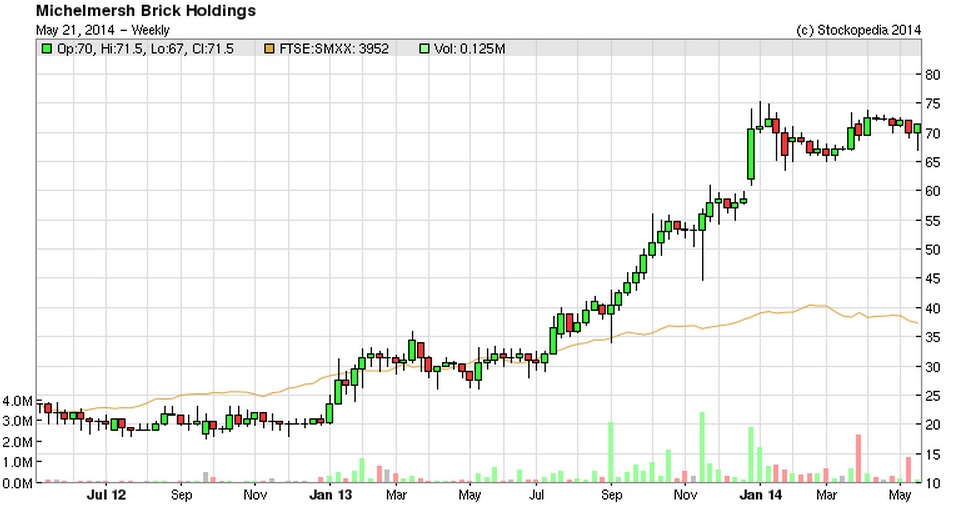

Michelmersh Brick Holdings (LON:MBH)

The company describes itself in a broader way now, saying it is, "the specialist brick, land development and landfill company". Nice to see a good clear description for once from a company, in easy to understand language. Instead of it being described as perhaps: a solutions and vertically integrated partner of choice to the construction and environmental management sectors. Do I get an MBA for thinking up that goobledygook?!

Joking aside, it sounds as if things are going very well for this company;

With the peak sales months still to come, the Board is forecasting continued strong trading and high demand for its premium product. Due to these circumstances, the Board expects the Company to exceed current market expectations for the year to 31 December 2014.

The company fixed its Balance Sheet with a Placing in Nov 2013, and has surplus property assets I believe, although I'm not up to speed on the current position with regards to property.

It's worth pointing out that at the moment broker consensus is for only 1.25p EPS for 2014, so at 72p the forward PER was very high at 58! So you would really need EPS to come in about 3-4 times ahead of existing broker forecasts to make the current share price stack up on a PER basis. Although it depends what value you ascribe to the property side of things - this type of share is probably best seen as a hybrid between a rather marginal manufacturing business making bricks, and some property assets.

With bricks in short supply, and barriers to entry, the bricks side of things sounds like it's doing well now. So the market was probably correct in pushing this share price up in anticipation of this trend. It's had a huge move upwards though, so personally if I held, I'd be scrutinising the valuation carefully, to ensure it hasn't run ahead of itself.

Seaenergy (LON:SEA)

This company has today announced a ship management contract, but since no financial details are given, then it's difficult to know how to interpret this.

My view remains that the R2S subsidiary is the only interesting part of the business, and their other activities seem to dissipate the value in R2S by burning the cash it generates. So very much a situation where combining some questionable, early stage businesses with one good business, actually creates a negative valuation effect overall, at the moment.

As a small shareholder, my view is that the group should be dismantled, with all the questionable bits disposed of, get rid of the group structure altogether (including the entire plc Board), and just have R2S take over the Listing - because it is profitable and high growth, so would command a higher valuation as a standalone company.

If management want to keep the group as it is, then I think they really do need to properly set out how value is going to be created from the other activities. It's too vague at the moment, and feels like, oh we'll try this & this, and see if it works. I'm not trying to undermine anyone, just giving a personal opinion. The current strategy isn't convincing enough, in my view. However, their R2S subsidiary is clearly an exciting growth company, hence why I hold the shares. And management deserve credit for having identified the potential at R2S and bought it.

Panmure Gordon & Co (LON:PMR)

I don't usually cover companies in the financial sector, but do occasionally look at brokers, as they are simple businesses to understand, and have simple Balance Sheets.

Panmure Gordon has looked very good value to me for a while, yet there seems virtually no interest in the shares at all, despite the company reporting positive trading several times. It's a big name broker, and is involved in lots of fundraisings, IPOs, etc. So it's perplexing why it only has a tiny market cap of £23.6m at 152p. The shares are near their 12-month low too, despite positive trading updates.

I bought some shares in it after calendar 2013 results were published on 25 Mar 2014. What these showed was a pre-excpetionals profit of £2.7m. There were then exceptionals of £1.2m (relating to closure of their US operation), and share based payments of £349k. So having cleared out of problem areas such as the US, the outlook for the future seems pretty positive.

This is confirmed in an AGM statement this morning, which reads positively in my view, saying;

Panmure Gordon continues to make encouraging progress in 2014, building upon the Company’s improved results in 2013. This has resulted from decisive management action to re-structure and re-focus the business, allowing it to take advantage of more favourable market conditions.

Since the start of the year, the Company has enjoyed strong growth in revenues in both the primary and secondary markets, in particular leading a number of high quality transactions for corporate clients. This has had the desired positive effect on profitability.

We entered 2014 stronger than at any point in many years, and as the Board indicated at the time of the announcement of our 2013 results, we plan to resume the payment of dividends in 2015 should market conditions and the firm’s profitability be maintained for the full year.

I can't find any broker forecasts for Panmures, but if you take last year's figures and increase them a bit, then it seems to me sensible to be thinking in terms of perhaps a profit in the £3-5m range. If they do achieve that, then the market cap of £23.6m is going to look a bargain.

The Balance Sheet is excellent too - no debt, and it has net tangible assets of £18.3m, i.e. 78% of the market cap is backed by tangible assets, and those are predominantly liquid assets too. Hence risk:reward looks really good to me here - there is asset backing to protect the downside, plus they are trading well, and there's no analyst coverage so the market hasn't noticed! (yet).

Downside risks are that the IPO/Placing side of things could now dry up after a very busy period. Although I think that's unlikely - there is still room for IPOs, but they have to be quality businesses, and priced sensibly. Panmures seem very active, and I've noticed them cropping up in lots of deals lately. I was a little taken aback at the size & opulence of their London office when I dropped in to see them about something a few months ago - so I wonder whether costs are under enough control, and the potential lease liability?

Some investors may not like the existence of a dominent 43% shareholder.

On the plus side, dividends should be resumed next year, so overall I think it's an interesting share at this price. Bear in mind though that the bid/offer spread is very wide, and it's illiquid. So (ironically!) a good broker is needed to buy the shares inside the spread.

Note that shares in Arden Partners (LON:ARDN) and my broker, WH Ireland (LON:WHI) have had quite a bit of press coverage lately, drawing attention to them, and the shares have re-rated considerably. Whereas Panmure Gordon & Co (LON:PMR) seems completely off the radar, and hasn't re-rated at all, despite two positive trading statements - see comparison chart below of these three small market cap Listed brokers over the last year. This clearly shows how Panmures (the bottom, drak blue line) has not re-rated at all, whereas its peers have both almost doubled in the last year. That looks like an anomaly to me, but as always please be sure to DYOR.

Right, got to dash now, as conference call just about to start. See you tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has long positions in SEA and PMR, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.