Good morning! Electrical cable manufacturer, Volex (LON:VLX 99p) issues an in line trading statement, despite market conditions that "remain challenging across all sectors". The turnaround plan, to focus on cost cutting and margin improvement appears to be working though.

They have reduced their annualised operational costs by $20m, so it makes you wonder how inefficiently the business was run in the past? At £62m this is a lot of business for the price, with turnover of $478m expected this year, and in the turnaround year, profits of $9m, giving normalised EPS of $0.17, or about 11p. So that puts them on a PER of only 9.

Brokers forecast a 35% rise in EPS next year (ending 31 Mar 2015), with the PER dropping to 7, and I wonder whether there is scope to beat that, given the significant cost-cutting going on?

Yes, it's fairly low margin business, but if things are run efficiently, there are profits to be made. Volex has maintained it's dividend, and the forecast yield this year is a healthy 3.7%. Also, it is good to see net debt has reduced significantly, coming down from $19.5m at the last year end (31 Mar 2013) to $10.8m at end Jun 2013.

Bizarrely, the shares have flat-lined at around 100p all this year, so it seems to me that pressure must now be building for a break upwards, based on today's reassuring trading update.

Volex also announces that it has appointed Nick Parker as CFO, formerly of WANdisco, so he knows a thing or two about getting investors excited about a share! Let's hope some of that excitement can rub off on Volex. Note how Volex has significantly under-performed the small caps sector (the beige line on the price chart below), so if things continue to do well, then I think this one could be a winner. Obviously that's just my personal opinion, so please be sure to do your own research.

It looks as if the open should be fairly quiet, with the futures indicating the FTSE 100 likely to open up about 6 points at 6,639. I note also that Gold has broken through $1,300 overnight, now priced at $1,315, which should mean the recovery in gold mining stocks continues. I hold a couple of these in the more speculative end of my personal portfolio, Medusa Mining (LON:MML 112p) and African Barrick Gold (LON:ABG 105p).

Private shareholders in ReNeuron (LON:RENE 2.8p) will probably be feeling pretty annoyed about the fund-raising announced this morning, which significantly dilutes existing shareholders, with a large Placing (for £25.3m) at 2.5p per share, a 17% discount to the previous market price.

I can understand why Placings are used for small fund-raisings, as they are quick & cheap to do. However, this is a material dilution, hence it should have been done via a Placing an Open Offer, to give existing private shareholders a chance to participate too.

I'm surprised at the market reaction to the in line trading statement from Volex (LON:VLX), with the shares currently down 8% at 92p, so I bought some more. It could be that some investors didn't like the comments about new product delays, although personally I disregarded those comments because they are overridden by the confirmation that trading is in line with expectations for the full year (ending 31 Mar 2014).

It's interesting how different people interpret statements differently, but for me the key factors are always what profits will be versus expectations, and what the outlook is like. To my mind the Volex statement today is fine in both regards, so I'm a buyer not a seller.

On 2 July 2013 I commented here on Sweett (LON:CSG 28.6p) as follows:

I've only given them the most cursory glance, but the accounts published today by Sweett (LON:CSG) look encouraging. They bounced from losses into profits for the year ended 31 Mar 2013, delivering 1.9 EPS, or 3,7p EPS on an adjusted basis. So at 20p a share they look potentially good value.

The dividend has been doubled to 1p, so that's a 5% yield - again looks interesting.

The balance sheet has some net debt, and a pension deficit, so that would need to be factored in. With a solid-sounding outlook statement, this might be worthy of some further research?

Anyone who followed up on that idea would now, three weeks later, be sitting on a 45% gain!

The group has issued a positive Q1 trading update today, saying they are trading ahead of expectations. They also state that results for this year (ending 31 Mar 2014) "will be significantly ahead of market expectations". That's very impressive, coming just four months into the year.

Stockopedia market consensus forecast shows 3.27p EPS for this year, so I would imagine significantly ahead must mean at least 4p? Hence even after today's rise to 29p, the shares could have further to go perhaps? Good yield too.

Microgen (LON:MCGN 135p) is a software company with an interesting history of generating very high profit margins, and returning cash to shareholders (equal to it's own market cap since 2008, they say).

Interim results today for the six months to 30 Jun 2013 look OK, with basic EPS flat at 4.2p, so assuming no seasonality that's 8.4p for the full year. With the shares currently down 6p on the day to 135p, that's a PER of 16.1, not exactly cheap for a mature, ex-growth company.

The market cap is £113m at 135p per share. They have net cash of £26.8m on the Balance Sheet at 30 Jun 2013, although as usual with software companies, some of that will be up-front payments from customers. The deferred income figure is not disclosed in these interims, but I see from the last full year notes that 80% of trade creditors was actually deferred income, at £14.3m, so a similar proportion at the interim stage means that about £12.3m of the creditors are deferred income (customer up-front payments).

So in reality, the net cash figure that is actually the company's own surplus cash, is about half the reported net cash figure of £26.8m, so about £13.5m by my estimate.

It's difficult to see where this business is going. If it's ex-growth, then a PER of 10-12 is probably as high as it should go, even allowing for some revenues being recurring, and thus higher quality.

Management seem to share my difficulty in seeing where things are going, as they are conducting a review of the business and it's options, with Investec Bank. Wasting money on expensive advisers is not my idea of searching out shareholder value. My advice (and this will cost them nothing!) is to either look for some good quality, reasonably-priced acquisitions, or to adopt a policy of returning 100% of earnings to shareholders each year, through a mixture of 50% dividends and 50% share buybacks.

As things stand, it's difficult to see much upside on these shares, so I'll move on.

I wasn't too keen on Tristel (LON:TSTL) when last reporting on them here, on 4 Mar 2013.

However, the company is looking a lot more interesting today, after a very good trading update.

They have swung from a £0.6m loss in H1 to a £0.9m adjusted profit in H2, that's some turnaround! No wonder the shares are up 20% today to 26p, which values the company at £10.4m.

A note of warning though, the company itself flags up sustainability of profits, saying:

Paul Swinney (CEO) said "We are delighted with the improved performance in the second half and, whilst we are conscious of the need to demonstrate that this performance is sustainable, we remain cautiously optimistic for the future earnings growth potential of the Company."

This seems to be hinting that H2 might have benefitted from some non-recurring sales perhaps? With small companies you have to watch out for big sales to stock-up on a product, which may not repeat, so that would need investigating before I begin to get excited about this one.

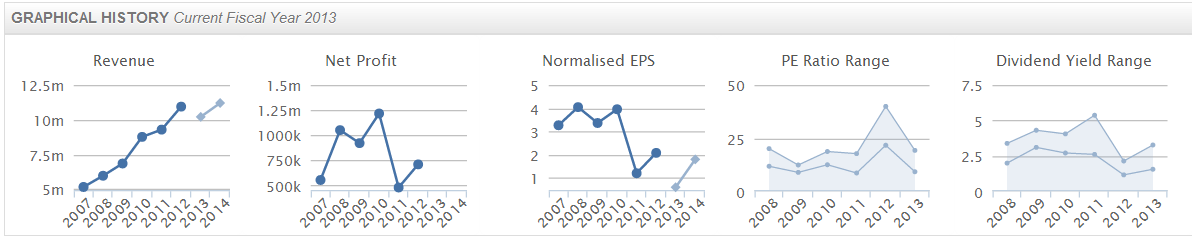

The company does have a history of being modestly profitable though, although somewhat erratic, as you can see from the historic graphs on Stockopedia:

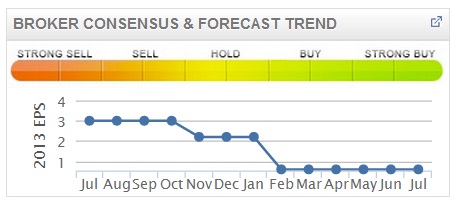

Also I note that consensus earnings forecasts have fallen from 3p to below 1p in the last 12 months (see chart, right), so the bar had been set pretty low following earlier disappointments.

Overall then, this one has moved from being something I would avoid, to beginning to look potentially interesting.

Software company Brady (LON:BRY) issue an interesting sounding trading update. Sales grew 23% for H1 of calendar 2013. Interestingly 57% of revenues are recurring, which is very impressive (i.e. less likely to have a profits warning if revenues are on longer term contracts, as opposed to one-off licence wins). They report net cash of £5.7m, usual caveats apply re cash reported by software companies - check deferred income before regarding it as surplus cash to include in Enterprise Value.

The trouble is, unless I missed it from reading it too quickly, they don't seem to say anything about profit vs expectations, which makes the trading update pretty useless from my point of view.

The valuation here all seems to hinge on substantial forecast increases in profitability, so it's not for me, as I'd need to see more evidence that forecasts are going to be met, before diving in. The forward PER of 11.7 looks reasonable though, and there is a dividend too, yielding about 2.2%. Might be worth doing some more research on this one, to understand the business better, and the shares have been a laggard in the last 12 months, trailing the market by 30% - call me old fashioned, but I like to buy laggards, not chase momentum, on a BLASH basis.

I have two company meetings to attend today, so had better wrap this up. One of them is a presentation by James Dickson of Vianet (LON:VNET), who as promised is taking more time to communicate with private shareholders, something I'm very pleased about.

There might still be some places available, it's at 6pm in Beckenham, organised as ever by David Stredder. His contact details are here. See some of you there!

Regards, Paul.

(of the companies mentioned today, Paul has long positions in VLX, MML, ABG, and VNET, and he has no short positions at all).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.