Good morning again! Paul might not find it necessary to write today, as news is likely to be quiet.

As is customary before Christmas, the LSE closes this afternoon at 12:30.

Redcentric (LON:RCN)

Share price: 84.25p (+1.5%)No. shares: 147.2m

Market cap: £124m

Interim Results to 30 September 2016

This technology services provider has been at the centre of an accounting misstatement issue, as discussed by Paul here.

I also recommend this article by Mark Bentley at ShareSoc.

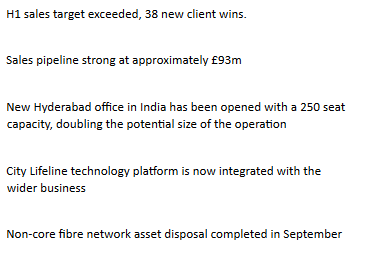

Today's H1 2017 results are quite positive on the operational side:

The financials are a lot more mixed, however.

Accounting problems tend to affect public valuations in a dramatic way. This is largely to do with questions around integrity but also because they make the act of valuation itself far more complicated.

For example, today's announcement includes restated H1 2016 figures, which need to be compared with the original figures as published here.

Here's a selection from today's results:

- Revenue up 2.0% to £53.0m (H1 FY16 restated: £51.9m)

- Adjusted EBITDA* up 16.6% to £9.1m (H1 FY16 restated: £7.8m)

- Statutory profit before tax £0.3m (H1 FY16 restated: £2.5m loss)

- Net debt £34.4m (31 March 2016 restated: £37.8m)

And here are the effects of the restatements for the year ended March 2016:

- Revenue restated at £103.3m vs £109.5m (reduction of £6.2m)

- Adjusted EBITDA* restated at £13.0m vs £25.8m (reduction of £12.8m)

- Statutory operating loss restated at £4.4m vs a profit of £8.4m (reduction of £12.8m)

- Statutory loss after tax restated at £5.2m vs a profit of £5.2m (reduction of £10.4m)

For me, these changes make it impossible to value the company in a sensible way. We can think about applying an earnings multiple to a £5.2 million profit, but we can't do the same for a £5.2 million loss!

To give credit where credit is due: despite the disastrous nature of recent events here, the company seems to have dealt with it in a very professional way. A forensic review is underway, a new CFO has been appointed, and the latest interim results have been produced, along with restated numbers, in a reasonable timeframe.

An explanation of what happened:

A number of accounting policies and practices,

specifically those in respect of cost accrual, cost deferment and

revenue recognition had been incorrectly applied and other accounting

errors and misstatements had been made. To date there has been no

evidence of theft and the misstatements are attributable to profit

overstatement over a number of years with revenues being overstated and

costs understated in broadly equal proportions.

It looks as if the debt position has been manipulated:

Following restatement of cash, trade creditor and trade

debtor balances at 31 March 2016, net debt was £37.8 million. Net debt

at 30 September 2016 was £34.4 million. Despite these adjustments

the Group's restated net debt position as at these dates was not

representative of the underlying position as although technically

correct from an accounting perspective, there was significant stretching

of creditor payments in particular around operating cost items. The

average month end net debt position over the eight month period to 30

November 2016 was £42.0 million and better reflects the Group's

underlying net debt position over the period.

Dividend: Unsurprisingly, the Board has resolved not to pay a dividend.

Bank support: Banks have given covenant waivers for prior periods, and are discussing future covenant levels. They are said to remain supportive!

My opinion:

I've managed to work my way through most of this announcement, but it's slow work. As I said, things get complicated in a situation like this!

Even those on the inside will have found it very difficult. The RNS says that "a level of judgement has been applied" - in other words, there is no objective answer to fixing what has gone wrong.

On valuation, I'm a bit perplexed as to why the market cap remains so high.

The current share price gives it an enterprise value of £166 million, for a fairly mature business which made a multi-million pound operating loss last year, has only scraped a tiny statutory profit over the last six months, and is going to suffer a lot more short-term costs and headaches associated with these accounting mistakes.

Even if the adjusted EBITDA was £9.1 million for the latest period, I'd have no interest in paying anything remotely resembling a normal earnings multiple for this. For me, the share price is still about double what I'd consider to be fair value.

When the dust settles, perhaps it will make a good case study for clues or red flags for spotting accounting problems.

NATURE (LON:NGR)

Share price: 11.5p (-16%)No. shares: 79.3m

Market cap: £9m

Significant Oil & Gas Contract Win

A regular reader has asked me to mention this tiddler, whose share price closed 150% higher yesterday after the announcement of a contract win.

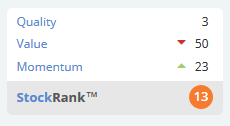

It's a small wastewater treatment company which has been unprofitable for the past several years, and it has a StockRank of just 13.

In general, it's a great idea to avoid investing heavily in companies with very low StockRanks. They tend to be speculative - so you can win big occasionally, but there is also a good chance you will lose 100% of your investment.

Based on some online comments, investors are hopeful that this is a portentous contract win:

Nature Group PLC (AIM:NGR) the provider of port reception facilities and waste treatment solutions for the oil, marine and process industries, is pleased to announce that its Oil & Gas division has been awarded a major contract by an international oil company ("IOC") for the provision of containerised slop-treatment units in the Central North Sea.

The contract is for the deployment of multiple treatment units and will commence on 1st January 2017 for a period of 5 years. The overall contract value is estimated to be at least £5 million.

For context, the company generated £6.2 million of revenues in H1 2016.

At those results, it was revealed that the company had a cash position in late September of £0.7 million, with a further £0.3 million in working capital facilities. The pre-tax loss for the period was £0.9 million.

My opinion:

This sort of stock goes into my "too difficult" basket. Maybe it will generate more oil company contracts, and start generating positive financial results again. But that's just not something I'm going to be able to figure out without a lot more research and information, I'm afraid.

I can't find much else of interest this morning, so all that remains is for me to wish you a Merry Christmas. I hope you had a profitable 2016, and that 2017 will be even better!

Thanks for reading.

Graham

Just an after-thought from me (Paul) too. Thanks to Graham for covering the above.

Another announcement caught my eye;

NetDimensions Holdings (LON:NETD)

Share price: 73.6p

No. shares: 51.3m

Market cap: £37.8m

Trading update - an intriguing announcement from this software company.

Sales revenue for the period is expected to be above US$26M.

In addition the Company is anticipating that adjusted EBITDA will be approximately US$2.0M.

This compares favourably with the interim results, when the company reported $10.5m revenues, and a $0.8m adjusted EBITDA loss.

Therefore, deducting one from the other, H2 must have been $15.5m revenue (up 48% on H1), and a significant move from loss into profit (at the EBITDA level anyway).

Looking at the consensus forecast shown on Stockopedia, it looks as if this upturn was expected - with a forecast of $26.5m revenue.

I've checked the cashflow statement, to see if the company is aggressively capitalising development spend (which would make EBITDA meaningless). It's not, which is good news - only $12k was capitalised last year.

Balance sheet - is strong, with a large net cash balance of $11.2 when last reported at 30 Jun 2016. Although bear in mind that deferred revenue of $7.5m reflects amounts that customers have paid up-front for. Treat that how you wish, I'm just flagging it.

Possible takeover bid? - this is intriguing;

On 5 October 2016, the Board of Directors of NetDimensions ("the Board") also announced that it had received an approach which may or may not lead to an offer being made for the entire issued share capital of the Company.

The Board is in advanced discussions with interested parties and further announcements will be made in due course.

That seems a fairly direct steer that a takeover bid could happen.

My opinion - I don't know this company at all well, but I think this announcement looks interesting.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.