Good morning!

Inland Homes (LON:INL)

Share price: 70.7p (up 2.6% today)

No. shares: 202.2m

Market cap: £143.0m

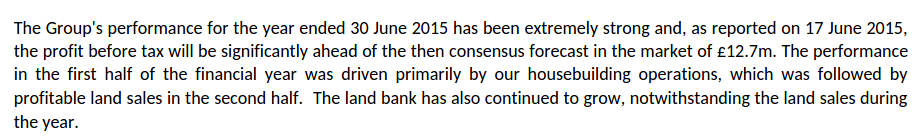

Trading update - this covers the full year to 30 Jun 2015. It all sounds very positive, with the key paragraph saying this;

A lot more detail is given, and the Directorspeak sounds positive:

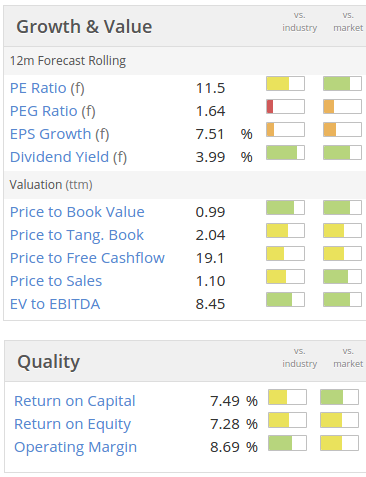

My opinion - I like this company, and it seems to be on a roll. There are rich pickings to be had in land & property development at the moment, and there's no doubt the Directors here know what they're doing.

However, it's also important to remember how cyclical housebuilding is, and how inflated prices in the South are - so the party won't last forever. I will need to see the full figures, when they are released in Sep before being able to assess whether the shares are still good value or not. Most housebuilders are looking richly priced in comparison with net assets now, but that's justified to a certain extent because land is in the books at cost, and is often worth more at open market value, and much more once they've built a house on it.

Mothercare (LON:MTC)

Share price: 265p (down 7.5% today)

No. shares: 170.7m

Market cap: £452.4m

Q1 trading update - I used to be negative on this stock, due to its poor performance and weak balance sheet, plus legacy issues such as onerous leases, and a pension deficit. However, I took the shares off my bargepole list on 30 Apr 2015 at 222p, because the company did a big refinancing, thus addressing my concerns.

Astute investor/trader Richard Crow made a good case for the shares in one of my audiocasts with him, pointing out that new management have a good track record in the sector. Although I considered buying some shares, the valuation looked to have got a bit ahead of itself, so I decided not to. Therefore I'm interested to see if this morning's dip might be a buying opportunity?

The company says that overall trading in Q1 was "in line with expectations".

It sounds as if the UK is trading well, but international not so good, with sales in constant currency down 1.3%, and when currency headwind is added into the mix, international sales were down in sterling terms by 4.8%.

Online sales in the UK are noteworthy, at +23.9%, so clearly their online strategy is working well.

The Directorspeak sounds a tad cautious, in particular;

"It is still early days in our turnaround and we recognise that there is still much to do. Our vision remains clear - to be the leading global retailer for parents and young children."

Valuation - since they are trading in line with expectations, the current year broker forecast is a figure we can probably hang our hats on. This shows 9.5p EPS for y/e 28 Mar 2016, rising to 13.9 next year. So at 265p the shares look to be on a fairly racy rating - the PER being 27.9 falling to 19.1 next year. That's fine if the broker estimates turn out to be too pessimistic, but based on today's statement the estimates look to be bang on.

My opinion - I like the turnaround story here, but for the time being the shares look fully priced to me.

Vertu Motors (LON:VTU)

Share price: 66p (up 2% today)

No. shares: 341.1m

Market cap: £225.1m

Trading update - as you would expect in a time of ultra low interest rates, improving consumer sentiment, and the strong pound making imports cheaper, car dealerships are doing a roaring trade at the moment. Although the margins on new car sales are tiny these days apparently, with manufacturers squeezing out the maximum profit for themselves.

Today Vertu says;

During the four month period to 30 June 2015 (the "Period") the Group saw continued growth in like-for-like revenues and gross profits, both from its vehicle sales and in the higher margin aftersales activities. With overheads remaining under control, the Group's profitability in the Period was strong and ahead of last year. The Board expects that the Group's trading performance for the year ending 29 February 2016 will be in line with current market expectations.

That sounds fine, no surprises there.

Vertu also has a smashing balance sheet, with loads of freeholds - I went through the figures in some detail in my report here on 13 May 2015.

Overall, I like this share, but there's not much difference between several car dealerships, e.g. Cambria Automobiles (LON:CAMB) and Caffyns (LON:CFYN) also have very strong balance sheets too, and are on similar valuations. This one is bigger, so the shares are probably more liquid than those other two. I suspect there is likely to be a wave of consolidation in the sector sooner or later, so there could be nice upside from a takeover bid perhaps?

Bloomsbury Publishing (LON:BMY)

Q1 trading update - says the group has traded in line with expectations.

Interestingly, it sounds as if they are getting another bite out of the lucrative Harry Potter cake:

We are on schedule to publish the Illustrated Edition of Harry Potter and the Philosopher's Stone on 6 October. Rights in the illustrations have already been sold in 24 languages.

My opinion - it's so difficult to value this company, because nobody really knows what the long-term future of book publishing is going to be. I'm not interested in investing in book publishers, unless they are incredibly cheap, so it's not for me.

It's got a high StockRank at 97, although I don't think StockRank would really be able to anticipate the structural decline of a sector. Note that the divis are useful here, and it has a decent balance sheet.

Judges Scientific (LON:JDG)

Trading update - this seems a rather long-winded, and slightly confusing update. But the upshot seems to be that H1 will be below last year's H1, but the order book is strong, so they think the full year will be alright.

Notwithstanding a positive contribution from Armfield, your Board expects interim earnings per share to be below last year's level, with a stronger second half weighting based on the interim order book that has built up during the period. As a result, the Board remains confident in the Group's ability to achieve current market expectations for the full year.

If my memory serves me correctly, something like this happened before with Judges, and the full year figures were indeed alright. So I think the company's outlook statements have credibility - which is probably why the shares are almost unchanged on the day today, whereas most companies's shares would have sold off on an H2-weighted year type of statement.

My opinion - the shares look priced about right, on 16.4 times this year's earnings forecast, and 14.7 times next year's. Upside may come from more acquisitions, since David Cicurel has a terrific track record of buying good companies at bargain prices. So there is a good argument for paying a bit of a premium for management.

Ed has written a fantastic article about Dart (LON:DTG) - if you haven't seen it, the link is here - highly recommended.

I'll leave it there for today, and I seem to have inadvertently duplicated today's article, so I'll sort that out now.

See you tomorrow, which will be my last report from Spain.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions. A fund management company with which Paul is associated may hold positions in companies mentioned.

NB. These reports are just Paul's personal opinions. They are never financial advice, nor share recommendations)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.