Good morning!

What a busy day yesterday! I added loads more companies to yesterday's report, but there were so many companies reporting, in the end I had to do brief comments on the last 8 companies added to yesterday's report. So you might like to recap on that report here.

My CEO interviews seem to be popular, so I've got more in the pipeline. Yesterday afternoon I had a long chat with the CEO of accesso Technology (LON:ACSO) (at the time of writing, I hold a long position in this share) - very illuminating too, he's so bullish about the business, and its seemingly unique opportunities for growth.

Accesso seems to have a huge moat around it once clients are signed up - the company already has c.60% visibility of its revenues for 2022! The interview is just over an hour long, which I know some people baulk at - I can't understand why, because if I'm risking thousands of pounds on a company's shares, an hour of my time to listen to the CEO is time very well spent. The link for the audio is here.

Laura Ashley Holdings (LON:ALY)

Share price: 24p (down 0.7% today)

No. shares: 727.8m

Market cap: £ 174.7m

(at the time of writing I hold a long position in this share)

Results 52 wks ended 30 Jan 2016 - the company is in the process of changing its year end from 31 Jan to 30 Jun, so this will be an extended, 17-month year. Hence today's results are called "second interim results", but are 52 week figures, so I'll treat as a normal year's figures.

The share price has already come down a lot from last summer's peak of 35p per share. So clearly the market has been anticipating lacklustre performance. That's why the price has barely budged today, on publication of lacklustre figures.

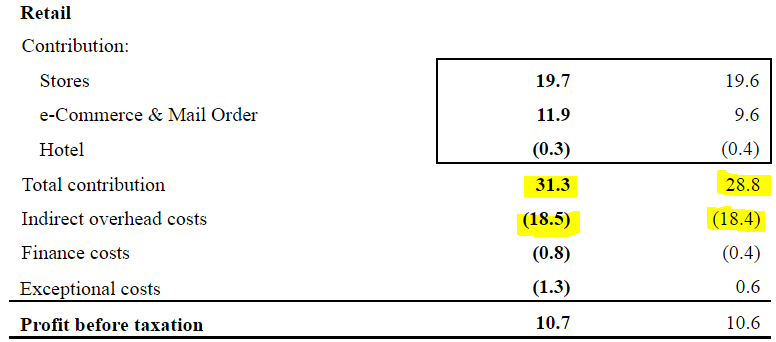

The core UK retail business performed pretty well in 2015/16, as you can see from the table below:

The highlighted items are what I regard as the underlying performance of the retail business. As you can see, "contribution" (i.e. the profits from the UK shops, before central overheads such as warehouse, Head Office costs, etc) rose 8.7% to £ 31.3m. That's a pretty good performance from a mature business.

Overheads were up a tad at £ 18.5m, so the net profit of the highlighted items above was an increase in profit from £ 10.4m to £ 12.8m. That's a good result from UK retailing. Note that additional finance costs, and a swing from an exceptional gain of £ 0.6m last year to a loss of £ 1.3m this year almost completely mask the good underlying improvement in profit.

Problems emerged in the biggest overseas market, Japan, and that has hurt profits at non-retail (which is mainly the group's overseas wholesaling operation);

Quite a sharp drop there, which has pulled down overall group results.

Put this all into the pot, and the overall group pre-exceptional profit before tax was £ 20.7m, down 9.6% against last year's £ 22.9m - so a bit disappointing, but certainly not a disaster, is my verdict on the P&L.

Outlook - current trading looks a bit disappointing, although they're up against quite a strong prior year, but that's no excuse - LFLs should not be negative.

Trading for the seven weeks to 20 March is down 0.4% on a like-for-like basis.

It's not clear whether this just relates to the retail division, or both retail and wholesale? I'm assuming that it probably relates to just retail.

I'm interested in what the group is doing to fix the problems with its international wholesaling business, and reassuring noises are made on this;

We will continue to work closely with our partners and remain confident that these challenges will be overcome. Work continues on establishing the Brand in new territories.

The acquisition of the Group's Asian head office in Singapore will help lead our Brand expansion into the Asian territories.

At the moment, the market is not attributing any value to the group's planned expansion in the Far East. This is quite surprising, as the group has already demonstrated that its international franchise business works, and is decently profitable.

The purchase of a large freehold Singapore office block last year spooked some investors. This is why fixed assets has shot up, and also a long term bank loan has appeared on this year's balance sheet.

It was certainly an unconventional decision, but the company's finances are strong, and its balance sheet does not look stretched at all.

Franchising is a terrific way to expand internationally, as it means someone else finances all the capex, and takes the pain of any trading losses in the short term. However, the downside risk is that franchisees may go bust - as happened in 2015/16 when ALY's Australian franchisee went under, which is what the £ 1.3m exceptional item relates to. That's already known about, as was announced to the market on 11 Jan 2016 here.

Dividends - this share's main attraction is the monster dividend yield. Essentially all earnings are paid out as divis, and that has been the case for the last 5 years.

So it's pleasing to see the 1.0p second interim divi (on top of a 1.0p interim divi) has been maintained. The 2.0p annual payout represents a yield of 8.3% - pretty remarkable. Anything could happen, but there doesn't seem to be any inclination to cut the dividend, and the balance sheet is robust enough to make it look reasonably safe.

Ultimately though, the dividend payout is a policy decision, driven by the controlling shareholder(s). So it could change in the future. Some investors don't like the shareholding structure, but I've not seen anything to indicate that minorities are being disadvantaged in any way - quite the opposite, we're being showered in money, with the huge dividend payouts. I can live with that!

Balance sheet - overall looks fine to me. Note the pension deficit of £ 15.0m.

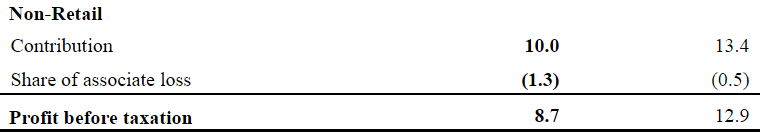

Cashflow - I don't give enough prominence to cashflow statements, which in some ways is the most revealing part of the financial statements. This one tells the picture of the year beautifully;

So the figures I've highlighted above describe the year's main events;

1. The business is a cash cow.

2. Paid out huge divis, but generated plenty of cash to do so.

3. Bought a massive office building in Singapore.

4. Took out a mortgage to part-finance it.

That's it, that's the year in summary!

My opinion - for me, this is a core long-term holding. Results today are a bit disappointing, and the outlook comments are not great, so I don't think there's any particular reason to rush out and buy the shares.

Having said that, where else can you find what looks to be a sustainable 8.3% dividend yield, plus potentially exciting growth plans underway (with little to no capex requirement, as being done through franchising)?

The brand has considerable value too, and at some point the controlling shareholder, who is getting on a bit now, will want to exit at the best price he can achieve. So I believe there is likely to be a nice payday here, at some point in perhaps the next 5 years? Who knows, it's icing on the cake if it happens. Meanwhile we're paid a monster divi to sit tight.

People moan that the shares never go anywhere, but if you include divis, the total shareholder return has been alright.

It's not for everyone, but personally I quite like it as a long-term holding, whilst accepting that today's figures are somewhat disappointing. The divi yield should put a decent floor under the price in my view. So risk:reward from the current price looks favourable to me.

Tracsis (LON:TRCS)

Share price: 495p (down 2.9% today)

No. shares: 27.4m

Market cap: £ 135.6m

Interim results, 6m to 31 Jan 2016 - revenue rose 19% to £14.3m, reflecting some recent acquisitions. Adj. pre-tax profit was flat at £3.2m. I seem to recall that the CEO previously said that the seasonality of the group would become more H2-weighted because the recent acquisitionsin particular SEP Ltd, is a summer-orientated business. So I don't think there's any particular concern that there hasn't been any profit growth in H1, as it covers slower trading at SEP over the winter.

Most importantly, the group confirms that it is trading in line with full year expectations.

Remote condition monitoring - this is the highest margin part of the business, but only did £1.3m turnover in H1, flat vs last year. This is due to the absence of any large orders (framework agreements) from this subsidiary's biggest customer (presumably Network Rail). Therefore it's good to see the group still performing well, without it's previously biggest money-spinner doing very much business. That suggests to me that the rest of the group is trading well, and that there's interesting potential upside if this product can successfully be sold in the USA. We've been told before that USA sales are a slow-burn in terms of opportunity. Today the group updates on this;

Outside of the UK our activities in North America continue and we are pleased to announce the appointment of a second technology partner in order to expedite sales channel progress for both Class 1 freight railroads and passenger transit operators. At this point in time, interest in our remote condition monitoring technology (RCM) remains high with good potential to win further pilot projects and test sites this year. We continue to view the US rail industry as being the largest and most directly accessible growth market for RCM although the specific timing for technology adoption to material level remains difficult to predict with any certainty. Given the inherent uncertainty of timing, our overseas strategy for US RCM remains low risk in terms of financial commitment and exposure given our model of using well established domestic resellers and agents. We are also targeting other overseas markets and also non rail applications, such as monitoring of micro-turbines within the distributed power generation market.

If/when material USA sales do kick in, that could certainly be a catalyst for a nice upward move in share price.

Balance sheet - whilst still strong, the surplus cash is now effectively spoken for (EDIT: this is wrong - please see the company's comments below). So cash has fallen from £ 10.0m a year earlier, to £ 8.0m at 31 Jan 2016 - clearly still a very healthy position, and that's after making payments of £ 6.8m towards acquisitions.

However, note that new lines within creditors have appeared, namely a £ 2.8m deferred consideration liability due within 12 months, and a further £ 5.8m due after 12 months. Combined that's an £ 8.6m liability, which means all the £ 8.0m cash is now spoken for.

It's not a problem, but is a material point to note, hence me pointing it out.

EDIT: the company's CFO has been in contact, has given additional colour on the deferred consideration. I think his comments are really important, so have reproduced them verbatim below;

You are absolutely right in that the deferred consideration is a new line this year and a material one at that. The liabilities recognised are the maximum amounts payable in both cases.

Without going into the detail of both of the agreements, the deferred consideration in both cases is linked to profit targets, some of which are stretched and contingent on certain levels of profitability being achieved. So they should be self funding in that if the businesses perform as expected, then they should generate the profits and the cash to largely pay for themselves, which would mean that we still have a very strong cash position that should not really be affected by the earn out payments. If the businesses do not deliver, then the deferred consideration will not be payable. However, due to the deal structures, it is in everyone’s interests for them to succeed and for the earn outs to be paid but if not, we have de-risked for us by the deal structures we have entered into.

Valuation - broker consensus is 21.1p EPS this year, so the PER is 23.5 times - a rating that doesn't leave any wiggle room for disappointment. I think the high rating is probably anticipating some upside from future sales of RCM equipment in the USA.

Dividends - not material.

Outlook - this sounds reassuring;

Following the acquisitions of SEP and Ontrac, the Group will be significantly enlarged and will also benefit from new product development which will enhance the Group's offerings further; the benefit of which will be seen in the second half of the financial year and going forward.

Given a good start to the financial year, the Board is confident the Group is well placed to deliver full year results in line with market expectations.

My opinion - regulars here will know that I like this company, and particularly rate the CEO - whose disciplined approach to acquisitions has worked very well. What's interesting is that the group is now becoming bigger, and hence that's smoothing out performance somewhat.

It's an interesting collection of transport-related (mainly rail) technology businesses, with plenty of product innovation going on. The valuation is a bit too warm for my taste, so if I held it, would probably be tempted to top-slice at this level. However, I do still like the business, and management as a long-term proposition too.

Please note also (above) the CFO's clarification email to me, emphasising that the earn-out payments (deferred consideration) are the maximum potential payout, and should be self-funding as they are linked to profit targets. This is a really important point, so apologies I didn't pick up on it first time round.

I chat to the CEO every Nov, so here is the link to my most recent interview with him, from Nov 2015 (audio and transcript available).

Cello (LON:CLL)

Share price: 95.4p (down 1.7% today)

No. shares: 85.3m

Market cap: £81.4m

VAT Update - this sounds worrying. HMRC has rejected a £2.4m settlement offer from Cello for a VAT dispute. So it sounds as if Cello will have to increase its existing provision for this liability (which is £3.2m, to cover penalties, costs, etc).

The market doesn't like uncertainty, and the RNS today doesn't quantify the maximum extent of the potential loss. As this announcement was issued at 4:21pm today, there will probably be more damage to the share price tomorrow.

I think the company needs to update the market asap on the potential financial impact of this.

Quixant (LON:QXT)

Share price: 209p (up 10.9% today)

No. shares: 64.6m

Market cap: £135.0m

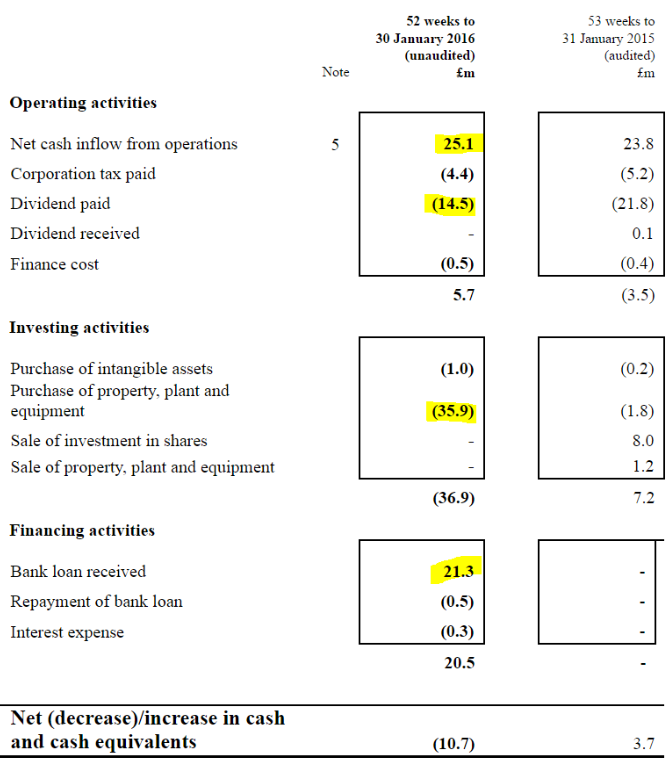

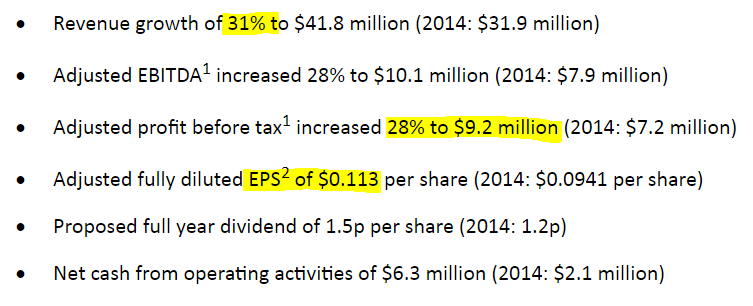

Results y/e 31 Dec 2015 - these results look excellent. The growth is nearly all organic too, as the company states that its acquisition of Densitron was the first acquisition in 10 years, and only happened near the end of the period.

Note not only strong growth, but also a very high operating profit margin;

The EPS figure of 11.3c looks to be a bit ahead of consensus forecast of 11c.

Outlook - comments sound upbeat, the company seems to be on a roll;

"We have had a strong start to 2016 in both our core business and also gaming monitors and with the potential opportunities Densitron provides in other markets, I am confident the Group is well placed to deliver strong growth in 2016 and beyond."

Balance sheet - at first glance I thought debtors looked too high, but that's because it would include the figures for the Densitron acquisition, which very little went through the P&L. So it's fine.

Overall it looks alright to me. There's a bit of debt, but it looks moderate in relation to the profits & cashflows of the business.

My opinion - this looks an interesting, high quality company, which is growing strongly. So definitely worth a closer look.

Densitron wasn't anything exciting when it was separately listed, but perhaps Quixant is doing something more interesting with it?

The shares could perhaps have further to rise, based on these excellent figures? Although the valuation is already on the warm side, and could end up over-shooting, with a resultant sharp correction perhaps? There's also the question of how sustainable the rising profits are? Sometimes this can be due to large orders which may not recur, so that's an important point to check out when doing more detailed research on the company.

A few snippets to finish off with, as I've run out of time & energy after a long day.

Eclectic Bar (LON:BAR) - a potentially interesting turnaround. Luke Johnson bought into the company last year, and became its Exec. Chairman. Interim results show an improvement from a loss last time, into a small profit of £276k this time.

The balance sheet's not great, but not a disaster either. This share is really all about piggy-backing on Luke Johnson, who of course is a hugely respected entrepreneur.

I've generally found that nightclub/bars make lousy investments, so decided to sling out the small position I took in my SIPP some time ago. That said, I'm toying with the idea of buying back in, as there is now evidence of the turnaround beginning to work.

SWP (LON:SWP) - profits down, but at least it's still profitable. ULVA subsidiary has been impacted by fall-out from oil/gas sector. Although Fullflow (rainwater systems) sounds like it's trading well. Interesting comments from management about shareholder value, and interests being aligned. Risk they might de-list, reading between the lines of outlook statement. Balance sheet looks satisfactory. Is it worth the £12m market cap? Questionable I'd say.

Cenkos Securities (LON:CNKS) - I don't usually cover financials, but keep getting drawn back to this one, on value grounds. It has a remarkable track record of dividends & share buybacks. In both 2014 and 2015 it benefited from one-off large transactions, being The AA, and BCA Marketplace. I'm tempted to revisit this one, once it has stopped falling.

All done for today! See you in the morning.

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.