Good morning! Before I get into this morning's results, here are a couple of possible dates for your diaries, for London investor meet the management events (I will be attending both, so hope to see some of you there):

25 Sep, from 5:00pm - Equity Development Investor Forum - their usual quarterly meeting, hosted at Faskin Martineau's offices in Hanover Square. Companies presenting are: Nature Group, Global Energy Development, and Matchtech. Details of the meeting & how to book in, are here.

2 Oct, 5:30pm - ShareSoc Technology Company Seminar - similar format to last time, companies presenting are: Ideagen, Armour Group, and Regenersis.

Thank you to both ED and ShareSoc for organising these very useful events - personally I really enjoy meeting management of interesting companies, and they are also great fun to network with other investors over a few glasses of wine.

Results for the year ended 31 May 2013 have been issued by repair manual publisher Haynes Publishing (LON:HYNS). As you would expect, it's a declining market, and their turnover dropped 7.4% to £27.6m, with operating profit down a fair bit from £5.1m in 2011/12 to £3.8m for 2012/13. Basic EPS drops out at 16.4p (down from 20.0p). The dividend has been roughly halved too, to 7.5p, so it all sounds pretty disappointing. The outlook section of the narrative doesn't inspire much confidence either.

So at 193p, I think the shares look rather pricey, that's 11.8 times EPS, which is not cheap for a declining business. Having said that, they do have a very interesting niche, and the product is superb, as I know from personal experience rebuilding a Vauxhall Cavalier Mk I using a Haynes manual in the late 80's.

However, they seem to have used the cash pile sensibly, in making an acquisition post year-end which will pay for itself in four years, they say. This is a tricky one - declining sector, but making cheap bolt-on acquisitions. Overall, the dividend being halved puts me off, and I'd rather find cheap growth companies, rather than try to work out reasons why an old business might survive.

Oh, there's a pension deficit too, and I seem to recall there might be something funny about their share capital structure - two classes of shares from memory, so that would need verifying to the Annual Report, to be sure the valuation used is correct.

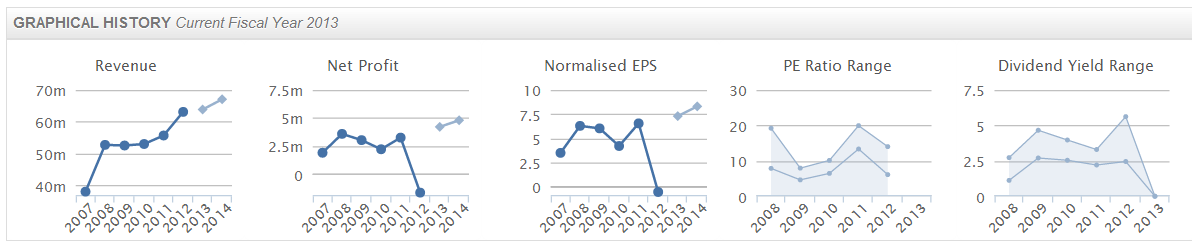

Software and consultancy firm to the oil refinery sector, KBC Advanced Technologies (LON:KBC) announce their interim results to 30 Jun 2013. The headline bullet points look good - revenues up 15% to £31.7m, and EPS has recovered from a loss of 1.6p in H1 of last year, to a profit of 4.9p this H1.

The outlook is good, with them saying that "we expect full year results to be slightly ahead of market expectations".

Their Balance Sheet passes my quick review, with current assets pretty healthy, at 161% of current liabilities, so no liquidity issues there. Net tangible assets are £11.4m.

Market consensus seems to be for 7.3p EPS this year, and 8.3p next year. So at 84p the shares look fairly good value, especially since they are expecting to be slightly ahead of this year's 7.3p, Hence the PER is probably about 11, by my rough estimate.

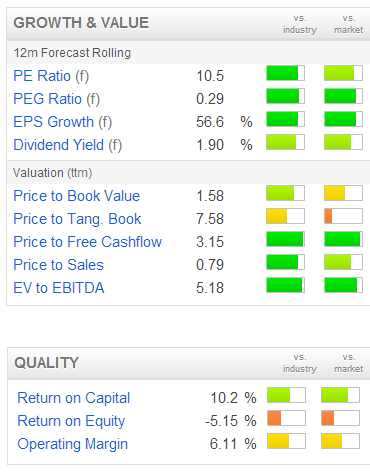

Plenty of green (i.e. good!) on the Stockopedia growth & value graphic shown to the right.

KBC has been somewhat accident prone in the past, so let's hope they have steadied the ship now. There is also an issue here with respect to a high taxation charge - caused by losses in low tax countries not being offsettable against profits in high tax countries, something like that anyway. Note 4 to today's results says their effective tax rate is 50%, so it looks like this is an ongoing problem. There is a one-off tax credit of £1.4m in respect of prior years, which masks this issue in these interims though, and I note there is only an overall tax charge of £66k on the P&L against £2,949k profit. So that will flatter the EPS figure.

This is a Simon Thompson (of Investors' Chronicle) favourite, so he tends to pull in an ethusiastic stream of buyers, but people who buy on tips in magazines or newspapers tend to have a very short attention span, so I might use any further surge here as an opportunity to lock in some profit.

Plus of course, as he showed with his bitter attack on IndigoVision a little while ago, hell hath no fury like a tipster scorned!

I'd like to see the dividends resumed at KBC, and they indicate today that their intention is to "return to a progressive dividend policy in respect of the current financial year", so that's encouraging. Anyway, the market seems to like it, with the shares opening up 4.5p to 88.5p. I would expect them to get to a quid fairly easily in the next few days, whereupon I intend selling mine.

As regulars will know, I've never lked Globo (LON:GBO), because they capitalise a load of costs into intangible assets, thus greatly inflating EBITDA. Plus Debtors are far too high, which is a massive red flag of aggressive accounting treatments, and probable problems ahead. It generates lots of profit, but no cashflow.

So let's see how their interims for the six months to 30 Jun 2013 look.

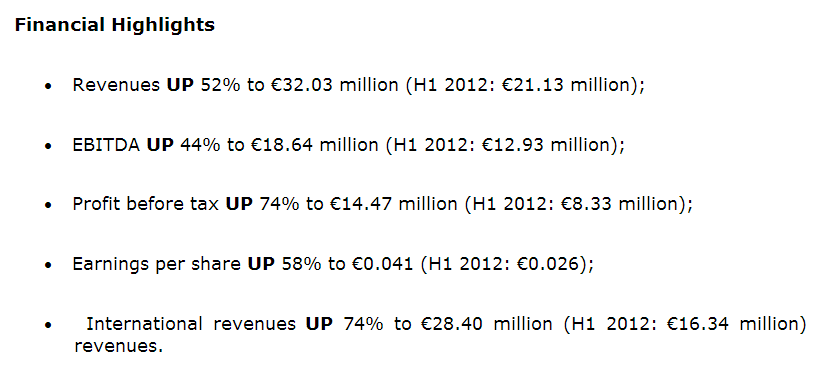

First red flag, the bolding of "UP"five times in the bullet points (see below). Quindell do this too. I just don't like it, it's rampy:

This may be a small point, but conservatively run companies don't do it.

At 65p per share, the market cap of Globo is about £216m, so that's a very high multiple of sales, even if you double the interim turnover to E64m, and convert it into sterling, that's annualised sales of £54m, so a Price To Sales Ratio of 4 - the sort of multiple you would only give a high growth company that achieves high margins.

The next red flag is that the profit margins are too high, which to me indicates either highly aggressive accounting treatments, and/or some sort of one-off gains. They report operating profit of E14.5m, on turnover of E32.0m, so that's an operating profit margin of 45%. That is too high to be believable as far as I'm concerned.

The biggest red flag for me is the Cashflow statement. It only generated E2.36m in operating cashflow, and then spent E6.0m on capex. Given that there are hardly any tangible assets on the Bal Sheet (only E1.4m in property, plant & equipment), then it is safe to say that this capex is actually internal costs which have been capitalised. So the true picture, for this highly profitable company with 45% profit margins, is that it is not generating any cashflow at all! It's consuming cash.

Finally, another huge red flag for me is the Balance Sheet, which is stuffed full of unexplained debits, where there shouldn't be any debits. For example, E9.3m in "other receivables" in non-current assets. Within current assets there is E6.1m in inventories (seems strange for a mobile phone software company, what inventory do they hold, given that presumably the product is an App that people download?).

Also, "trade receivables" of E27.9m are far too high, that's almost 6 months turnover! Do mobile phone App customers pay on 6-month deferred terms? No. Then we have "other receivables" of E2.9m, "Other current assets" of E15.6m, which if you tot it all up means that the profit is just all flowing into the Debtors, but not cash.

These figures just don't look believable to me, not by a long shot. That's just my personal opinion, but I wouldn't touch this share with a bargepole. It's not cheap at all, it's very expensive, and these figures look like something nasty will happen at some point when all those Balance Sheet items have to be written off.

DYOR as usual, but this share has a huge flashing neon warning sign from me over it.

Prelims for the 52 weeks ended 29 Jun 2013 from Finsbury Food (LON:FIF) look pretty good. Adjusted profit before tax rose 19% to £5.5m, despite a slight fall in turnover to £176.6m - note also the low profit margin, as with most food companies.

As reported before, they have done a great job in sorting out their Bal Sheet, with net debt drastically reduced to an acceptable level, of £7.4m (prior year £33.9m), mainly from the proceeds from a disposal, but also a small Placing.

The dividend is reinstated at 0.75p. The shares are down 5% to 73p this morning, so presumably these figures didn't match expectations. It's a bit confusing, as there are adjusted items, etc, which it's not always clear if brokers used in calculating their forecasts.

Anyway, by the looks of it, the adjusted PER is about 12.4, which is probably priced about right.

Having another look at the Bal Sheet, it's a lot better than it was, but actually still not great. Current assets are only 79% of current liabilities, with another £7.8m in long term creditors. So that looks a bit stretched to me, suggesting that they are probably relying on extended payment terms from suppliers to run the business - because it's unusual to see trade payables higher than trade receivables.

I'm not keen on food companies anyway, as margins are too slim, and there's a pension deficit here too, so overall it gets the thumbs down from me.

Time to sign off for today.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in KBC, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.