Hi there,

Today brings with it too many interesting updates for me to cover them all, but I'm planning to start with:

- Sprue Aegis (LON:SPRP)

- Fevertree Drinks (LON:FEVR)

- Empresaria (LON:EMR)

- PZ Cussons (LON:PZC)

Sprue Aegis (LON:SPRP)

Share price: 172.5p (-2%)

No. shares: 45.9m

Market cap: £79m

Trading Update (for the year ended 31 December 2016)

(this section written by Graham Neary)

As most readers will be aware, this company had a shocker in 2016, driven by a battery problem, weaker demand, and supply chain issues.

This is a mixed update which describes the company working through various challenges, as it tries to get back to normal performance levels:

Sales are expected to be approximately £57.1m (2015: £88.3m) and the operating profit* (post a £0.2m restructuring charge) is expected to be approximately £2.1m (2015: £12.8m).

The Group delivered an improved performance in the second half with an

estimated H2 2016 operating profit* of £3.0m (H1 2016: operating loss

of £0.9m before share based payments charge).

That sounds like a reasonable H2 result, in the circumstances, but note that it is before share based payments of £0.6m (which increased slightly, compared to 2015).

If paying out share awards was irrelevant to the operating performance of a company, it wouldn't pay them, I think - so share awards should always be included in operating numbers like this. There is nothing special about these annual payments which means that external shareholders can simply ignore them.

So I would argue that a more meaningful operating profit figure would be £2.4 million in H2, up from a £1.4 million loss in H1.

My opinion

Looking forward, I'd like to be bullish on the company's recovery prospects. What I really need to understand is how overstocking in France led to such a large sales collapse there - was management at fault? Were lessons learned? Perhaps the annual report will help to explain.

Cash is now £14 million, leaving the enterprise value (market cap minus cash) at £65 million. Further business recovery is due, and will be needed to justify this valuation.

Fevertree Drinks (LON:FEVR)

Share price: 1190p (+5%)

No. shares: 115.2m

Market cap: £1,370m

Trading Update (for the year ended 31 December 2016)

(this section written by Graham Neary)

An amazing year for Fevertree, as expected, and it continues to go from strength to strength.

The Board is pleased to announce that the strong growth

achieved in the first half of the year accelerated in the second half

of 2016. It is expected that sales in the second half will be ahead of

the prior year period by 75%. As a result, full year revenue is expected

to be circa £102.2 million, reflecting growth of 73% on 2015.

UK: full year revenue up 118% vs. 2015.

Continental Europe: up 39%.

USA: up 55%.

Rest of World: 88%.

Net Cash: ahead of Board expectations at year-end.

The last two months of the year were so strong that the outcome for the full year will be "materially ahead of expectations".

My opinion: Checking back on my notes on Fevertree, I gave it a neutral rating last July, when the shares were 839p. The shares are up 42% since then, in just six months - so I obviously missed something!

To be fair, management missed it too - as results are beating their own forecasts.

Gross margin has tended to be just over 50%, so perhaps the gross margin result in 2016 will be c. £52 million.

Administrative expenses will rise too, so I can see how brokers were previously targeting pre-tax profit of c. £31 million.

The bottom line is that I still don't think Fevertree shares are outrageously expensive, given the current profitability, the growth trend, and its status as a premium drinks brand. I don't own any shares in it, but I wouldn't be in a terrible rush to sell them, if I did!

Empresaria (LON:EMR)

Share price: 122p (+0.4%)

No. shares: 49m

Market cap: £60m

Trading Statement (for the year ended 31 December 2016)

(this section written by Graham Neary)

"Slightly" ahead of expectations:

Adjusted profit before tax growth is expected to be

approximately 23% year on year, representing a record profit level for

the Group. Net fee income is approximately 20% ahead of the prior year

and diluted adjusted earnings per share is expected to be up 12% on the

prior year.

Very nice international progress is reported, along with a few hiccups in the UK and the US.

In the UK:

As announced at the half year, following a short

period of uncertainty in the UK prior to the EU referendum, the UK

region has seen stable activity levels return. Overall in the UK, this

has led to profitability being down year on year, however the Group has

reduced costs and is encouraged by the increased business activity as it

moves into 2017.

Outlook:

"Overall, we are pleased with the record profit the

Group has delivered, once again showing the strength of the diversified

business model and the strategy the Group is delivering on. As such, we

continue to see exciting growth opportunities for the Group in 2017."

One thing which this statement does not mention is the currency effect. At the interim results, PBT was up by 15%, or 10% at constant currencies. That's important to understand how much of the result is due to the company's own success, and how much of it is due to luck.

The constant currency gain in PBT at the interims was 10%, so perhaps the full-year result will be something similar.

That's a healthy growth rate for a business trading at a low-ball PE multiple.

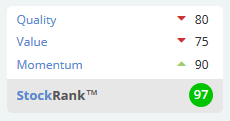

The StockRank is 97, so this is something you might want to look at, if you have any interest in the recruitment sector.

PZ Cussons (LON:PZC)

Share price: 305p (-9%)

No. shares: 428.7m

Market cap: £1,308m

Trading Statement (for the half year ended 30 November 2016)

(this section written by Graham Neary)

These are weak results, hampered by the following exceptional costs worth £15.3 million (see Note 4):

Transactional foreign exchange losses of £12.0m in Nigeria relating to long outstanding brought forward trade payables denominated in US Dollars that have been settled at higher exchange rates than originally recognised due to the introduction of the flexible exchange rate regime on 20 June 2016 which resulted in a devaluation of the Naira of greater than 40%

Costs of £3.3m relating to the Group structure and systems project to realign the organisation design to create a more effective operating model. These mainly consist of restructuring, advisory and IT system related costs

My concern here is that the company reported £19.3 million of exceptional costs last year too. Within that, £11.3 million related to foreign exchange losses on USD payables and the structure and systems project (i.e. the same reasons for this year's exceptional costs).

Maybe the Nigerian naira is going to keep sliding lower, and company spending on its structure and systems is not such a truly exceptional event, after all? Last year, the company also said that a supply chain optimisation project, and a provision against a receivable, were exceptional too.

Although in the case of PZ Cussons, it happens to be a company which deserves the benefit of the doubt - after 43 years of consecutive dividend increases!

Interim dividend: increases by 2.3%, to 2.67p.

If the final dividend increases by a similar percentage, that will take the full-year payout to 8.3p, for a total value of c. £36 million.

The pre-tax profit result for H1 is £25 million, down from £40 million a year ago (the corresponding "pre-exceptional" numbers are.£40 million in 2016 vs. £42 million in 2015).

Even accounting for H1's exceptional costs, the dividend should be well-covered.

Net debt is £191 million, unchanged against a year ago.

The company has suffered from exchange rates and conditions on the ground in Nigeria, its largest market, but it needs a couple of periods now without heavy exceptionals, to avoid giving investors any concern, that the dividend might stop growing.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.