Good morning!

Topps Tiles (LON:TPT)

Share price: 136.4p (up 3.9% today)

No. shares: 193.1m

Market cap: £263.4m

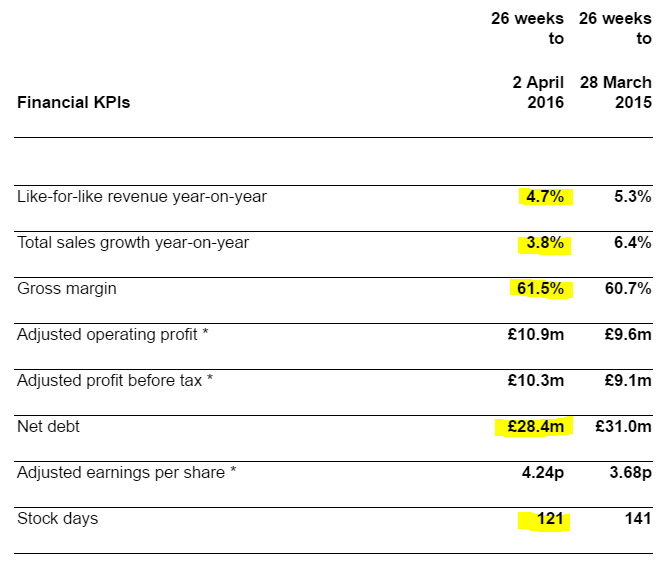

Interim results, 26 wks to 2 Apr 2016 - the numbers look solid. Here are the KPIs, with my comments on the highlighted items below:

Note that total sales growth of 3.8% in H1 is actually lower than the LFL sales growth of 4.7%. This must mean that the number of stores actually declined. The narrative confirms this is due to the closure of their Topps Clearance format.

This looks to me like a company which is becoming mature. So it looks to have taken a bit of a breather from expanding the number of stores, and instead focussed on profitability. That makes a lot of sense, it's not a criticism.

Gross margin of 61.5% is outstanding. You can't really fail to make money with that kind of profit margin. Although it will of course attract competition.

Net debt of £28.4m isn't a problem, given the strong profitability, which should be in the £20m ballpark for the full year. The Naked Trader suggests a simple reasonableness check, that net debt shouldn't be more than 2-3 times profit. Something like that anyway. I think that's an excellent & very simple way to double-check that debt is not excessive.

I think you could tweak that idea, by looking at the volatility of historic profits, and thinking about how cyclical the company is. So you might tolerate more debt, if the company is not particularly cyclical, and has churned our reliable profits every year, even in recessions.

Also, I always offset freehold property against net debt, because banks are very relaxed about debt where they hold freeholds as security. Also, in the worst case scenario, freeholds can be sold to raise cash, in order to reduce bank debt. In this case, TPT says today:

The Group currently owns eight freehold or long leasehold sites (2015: eight), including one warehouse and distribution facility, with a total net book value of £16.3 million (2015: £16.6 million).

So that makes me even more relaxed about the £28.4m net debt.

Interest cost has reduced considerably on the P&L in H1, which is handy.

Dividends - the downside of companies with bank debt, is that the divis can sometimes be a bit constrained. That's certainly been the case with TPT in the past. The history is that it (rather foolishly) geared up to pay out massive dividends, just before the financial crash.

So debt reduction has been a key priority over the last few years. That has now been achieved to a large extent, so I imagine divis are likely to grow quite strongly now that the company has the financial flexibility to do so.

This year's forecast yield is about 2.6%, set to rise to 3.1% next year. It's good to identify shares where the divis are rising quite rapidly, in my view. This can often be a catalyst to drive the share price up, as income seekers spot the improving yield and buy the shares.

Stock days - has improved significantly, falling from 141 to 121. The lower this figure, then the faster the stock is turning. So 121 days means that the company has enough stock to feed sales for about 4 months. That's actually quite high still. However, that's probably because of the nature of the product - I imagine the lead times on ordering batches of tiles would be quite long. So the company would have to order, and stock lots of different ranges. The clever bit is if you can persuade suppliers to hold the stock for you, and only draw off what you want, and pay for it 30-60 days later, but suppliers hate doing that, for obvious reasons.

If retailers try to squeeze stock levels too low, then it harms the business because they don't have the right products in stock when needed to make a sale. So there's a balance to be had - having enough stock availability, but not tying up too much capital, especially with slow-moving lines.

Outlook - things seem to be humming along nicely so far in H2 too:

We have delivered a strong first half performance and are benefitting from a well-executed and consistent strategy supported by continued investments in our business to lay the foundations for future growth.

We have made an encouraging start to the second half with acceleration in like-for-like sales growth in the initial seven weeks. We are confident our plans to extend the appeal of the Topps brand have significant further potential and are excited about the opportunities ahead.

The LFL sales growth is given as +8.4% in the 7 weeks to 21 May 2016, which is excellent. Although footnote 5 indicates that this figure is flatted by about 1.1% due to the timing of Easter. Even so, adjusting that to +7.3%, it is still excellent.

Broker upgrades - I see that Liberum has this morning increased its forecast earnings for this full year by 3.4%. That's roughly what the shares are up today too, which makes sense.

My opinion - I really like it. This looks a well-managed, successful business.

The valuation is probably about right for now, as growth is only modest at the moment. However, I suspect there could be another move upwards in the shares once the store opening programme resumes in future. Although with existing 345 stores, I'm not sure how much scope there is for many more? I seem to recall reading somewhere that Topps think there is scope for a further 100 UK stores, but can't remember where I read that. Do any readers have any info on the scope for further store openings?

I can see quite good potential upside on this share in the medium to long term. So it gets a thumbs up from me.

accesso Technology (LON:ACSO)

Share price: 1212p (down 3.8% today)

No. shares: 22.2m

Market cap: £269.1m

AGM trading statement & board changes - there's a positive-sounding update today:

"I am pleased to report that the first part of this financial year has got off to a strong start, with pleasing organic growth across all divisions of our business. Moreover, eighteen new contract wins have been secured, and in total 51 new installations of our various solutions have been completed. Every part of our business has continued to show encouraging levels of customer engagement and opportunity. Taken together, these signs reflect continuing momentum across our Group, and show us to be executing well against the opportunity we pointed to at the time of our preliminary results in March.

More detail is given, which I will skip over, to get to the conclusion, which says:

...Whilst it is of course still early in the season with, as is normal, less than 20% of the year traded to date, the encouragingly strong start means we are increasingly confident about our likely performance for the year."

Of course, with the shares on arguably a sky-high rating, then performance has to remain good, in order to let the numbers catch up with the valuation.

The wobble in share price today is possibly due to disappointment that the dynamic CEO, Tom Burnet, is now becoming Executive Chairman. So still in charge, but with a less hands-on role:

The first of these changes will see Tom Burnet move from the role of Chief Executive Officer to become the Group's Executive Chairman. Having led accesso's significant growth and internationalisation since becoming CEO in 2010, Tom will continue in his new role to lead accesso's medium and long-term growth plans. He will have particular responsibility for Group strategy, Investor Relations, and M&A activity.

As a reminder, here is my audio interview with him, which covers a huge amount of ground about the business. I just let him talk, as it was helping me better understand the business.

My opinion - this is a fantastic business, dominating a niche globally. So I think in all likelihood it will probably be a much bigger business in a few years' time.

However, there's no doubt that the shares have had a terrific run. There is still considerable institutional demand too, I hear. However, everything has a price, and for me I also pay close attention to Director selling. Follow the money, as the saying goes.

Therefore, after big Director sales recently, to Institutions, my policy is to almost always follow Directors out of a share, regardless of what reasons are given. Therefore I'm currently out of this share, and watching from the sidelines, purely on valuation grounds - it looks a bit toppy for now, in my view.

There again, niche technology companies like this, with a big moat, can carry on going up & up, far higher than anyone believed possible. So it wouldn't surprise me at all to be kicking myself later at having sold too early. The trouble is, when you can't really justify a valuation on fundamentals any more, then it's really passing from investing into speculating, which makes me uneasy.

Porta Communications (LON:PTCM)

Share price: 5.75p (down 6.2% today)

No. shares: 279.1m

Market cap: £16.0m

Results y/e 31 Dec 2015 - I always complain about the way in which this company reports it numbers, and today is no exception.

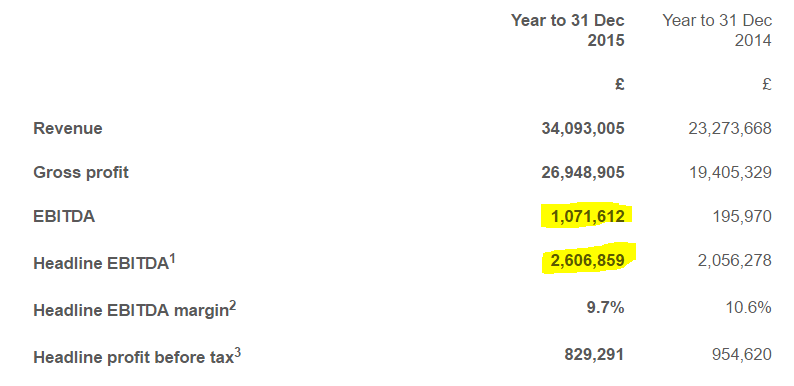

The headline figures create the impression that this is a successful & profitable business:

The trouble is, as I've been consistently saying for several years now, these figures are massaged so heavily as to give (in my view) a highly misleading impression.

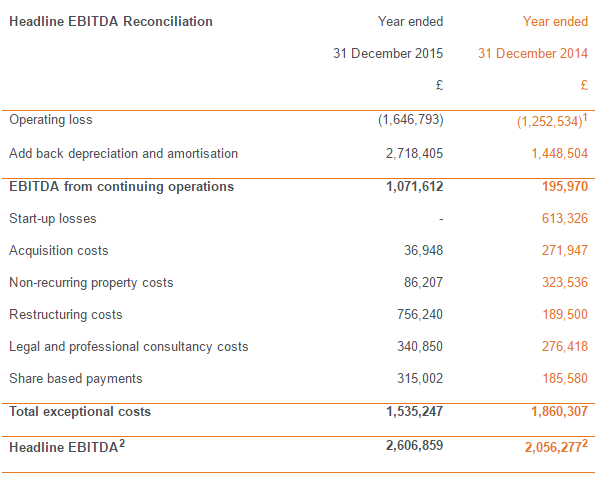

When you look at all the adjustments below, then I think we can safely ignore "Headline EBITDA" as being fantasy:

The £1,071k EBITDA figure is a bit more sensible. However, the elephant in the room are the enormous interest charges on the P&L, which cancels out all the EBITDA.

I had a half hour chat with management this morning, who pointed out that the interest charge rolls up, so the cash impact is less than the P&L charge. That's true, but of course compounding interest is creating a bigger problem in the future.

The intention is to seek cheaper financing as the group grows. So it's a bit chicken & egg - debt is needed to expand, but is expensive at the moment.

Debt arrangements - whilst this has been fully disclosed before, I am concerned at the related party loans from the Chairman, Bob Morton. He is living up to his reputation of being a shrewd investor, by loaning the company funds at 12% p.a. interest.

You could argue that this is a fair rate for a smaller company, which has been building up subsidiaries as start-ups. That's not an area where banks tend to want to get involved. However, it represents a big drain on Porta's P&L, and I think calls into question the value of the equity.

I would like to see the balance sheet strengthened with more equity. The danger is that might come on punitive terms, in a debt for equity swap at some point in the future.

Balance sheet - is weak. Net assets of £11.6m includes £17.1m intangibles, meaning that NTAV is -£5.5m. Not a disaster, but negative NTAV always makes me uncomfortable, especially at companies which are not properly profitable.

Value Creation Plan - I flagged up to management today, that many private investors hate this type of scheme. However, the company pointed out that, as a people business, such schemes are necessary to attract & retain the big fee earners.

With the hurdle set at 13p, that would be a (more than) doubling of the share price before the scheme pays out anything. I'm sure shareholders would be delighted with that. On the other hand, people who put money in at the 13p placing must be annoyed to see management potentially being rewarded for simply bringing the share price back up to where it started! I can see both points of view on this.

My opinion - my patience has run out today with this one, and I exited my long-term position this morning. The main reasons being;

- I've become increasingly uncomfortable with the expensive debt funding from the Chairman.

- Under-capitalised balance sheet

- I've consistently been critical of the way the accounts are presented.

On that last point, I'd much rather just see a reported loss, and understand that the company is experiencing growing pains, and that's that. Instead, the attempt every year to massage out positive performance by various definitions of EBITDA, is I think stretching credibility way too far.

On the plus side;

- The CEO has done it before - building up a highly successful and very valuable PR group

- There are some good businesses within Porta

- Once more established, the group might attract a bidder (the CEO mentioned 2x fee income as a multiple pertaining in the US for takeovers)

So I'll maintain a watching brief from now on. Hopefully the above is an even-handed review.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.