Good morning!

RM2 International SA (LON:RM2)

Share price: 44.6p (down 23% today)

No. shares: 322.7m

Market cap: £143.9m

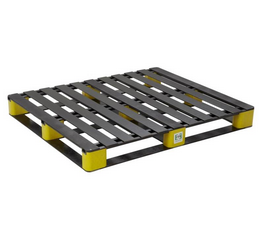

Advantages claimed (over conventional wooden pallets) are durability, strength, suited for automated warehouses, etc.

The trouble is, it's a blue sky share - so inevitably things go wrong - as per the update today - which explains a technical problem (with a friction coating) has necessitated changing to a gel-based coating. This means delays & reduced sales/profits:

As a result primarily of the decision to change to gel coating, the Company will not achieve the substantial upswing in production that had been expected to begin in Q3 this year and accelerate through Q4. This means that revenue and production numbers for the full year will be significantly below previous guidance. Production is expected to be not less than 2.5 million pallets in 2016, with a production run rate at the end of the fourth quarter of 2016 of c. 300,000 pallets per month. Based on current contracts and trials as well as discussions underway, the Company is confident of being able to deploy profitably all the pallets produced.

More detail is given. It sounds like a delay, rather than a disaster.

So what's the financial position like?

2014 results - these look scary! $2.0m revenue, and a $37.9m operating loss before IPO costs, which are obviously one-off in nature, and a $42.4m operating loss after IPO costs.

So the only thing that really matters, is how much cash is left? Unrestricted cash was $80.9m at end of 2014, which might sound a lot, but given that the cash burn is extremely high, and it sounds as if material revenues are still some way off, then the cash position could now be looking wobbly - it depends on how much they've burned through this year - will there be enough cash to support things through to large-scale production in 2016? What if more problems emerge & further delays?

Alarmingly, the company didn't release its calendar 2014 results until 15 June 2015 - that's a very sloppy reporting schedule, and late results is a big red flag to me - if things are going well, companies are keen to get the figures & narrative out. 5.5 months is ridiculous, especially as it's essentially a start-up business, so the figures should not be difficult to prepare.

The 2014 results contain these comments about cash burn, and the need for additional financing (presumably to fund leasing deals for end users of the pallets);

During the year under review, as previously reported, there was very limited production due to the factory move and other changes associated with a transition to a mass production facility and processes. During this period we have paid for all the plant and machinery and whilst there is some further capital expenditure being incurred in 2015, this is largely focused on areas in which the new production facility management have identified significant efficiency opportunities. Building a mass production facility with such production levels also led to very high operating costs relative to production which are expected to become much lower in the future with increased production.

Although the Company retains strong cash balances ($82.8 million at 31 December 2015), as actual production levels build up, capital requirements increase. As a result, we are reviewing financing proposals and are confident of putting satisfactory facilities in place to fund expanded production against contracts.

My opinion - I challenge anyone to show me a single blue sky company listed in the UK where things have gone smoothly, and in accordance with the original forecasts. It just doesn't happen! This is why investing in blue sky stuff is such a disaster area in nearly every case - people buy the story, then things go wrong, and before you know it, you've lost over half your money (if you're lucky - often far worse). Yet we're still suckers for a good story - not just PIs, the Institutions if anything are even worse at lapping up these blue sky things.

Forecasts are always far too optimistic, and for some bizarre reason, few blue sky companies which float seem to build in contingency reserves for problems & delays - surely such a requirement is a basic principle they should all follow?

Current market forecasts show a $18.8m loss for 2015, which presumably now will be revised down to a considerably bigger loss. Production figures are given above for 2016, but I don't know what the product sells for, or what the gross margin is - that is essential info in assessing whether this is a viable business or not.

It looks much too high risk to me, to consider dabbling. I'd want to see comfort that cash levels are adequate, and that an emergency Placing is not needed. Although I note that Directors have been repeated, heavy buyers of shares (well into 7-figures of £) which gives confidence that they seem to believe this project will work out well.

So it could be quite interesting, but it would need properly researching, to understand the economics of making these pallets, what margins can be achieved, the market size, barriers to entry for competitors - how easy is it to copy?, how much overheads will be, what customers think of the product, and what the financing arrangements will be, credibility & track record of management, are just a few things needing researching off the top of my head.

The trouble is, broker notes which give us this type of information are all too often essentially sales puff trying to induce us to buy the shares, rather than realistic forecasts.

Overall then, it's not yet clear to me whether this is a viable business or not, so I'll let other people take the risk. My portfolio returns greatly improve when I steer completely clear of blue sky stocks. It's usually best to hold fire until all the problems have been ironed out, and sales are underway & building strongly. The shares can often be cheaper at that stage too, since repeated disappointments & difficult fundraisings can leave bulls disillusioned, and unwilling to buy any more shares when they're at rock bottom, just at the point things are actually starting to work.

Tungsten (LON:TUNG)

Share price: 61.2p (down 7.3% today)

No. shares: 125.4m

Market cap: £76.7m

Trading update - this company follows on rather well from RM2, as it's another jam tomorrow thing that has gone wrong - not least because Mr "billions & trillions" Truell ramped investor expectations & the share price into the stratosphere, and has failed to deliver anything like the original forecasts so far. So what does the company say today?

The e-invoicing business is heavily loss-making, but should act as a feeder for the Tungsten Early Payment service - so I'm looking for progress on early payment primarily. It doesn't look like much has happened there - the figures are still tiny;

We now have 238 suppliers registered to use Tungsten Early Payment with 89 live who have financed £62 million of invoices.

The numbers need to be running well into the £billions before this business starts to look interesting, so they've only really scratched the surface so far. I'm concerned that it's taking so long.

To meet our growth plans we need to increase the pace of bringing suppliers onto the Network, sign-up more new buyers to join the network, secure further buyer renewals at enhanced pricing and new suppliers to Early Payment. We have strong buyer and supplier pipelines and excellent relationships with our buyers who want to work more closely with us. We need to ensure each of these are fully leveraged over the remainder of the financial year to meet our targets.

This concerns me, as it's a list of the things they need to do, rather than what is actually happening!

Mention is made of revenues being 20% higher this year in May-Aug 2015 (the company has a 30 Apr year end), but for a heavily loss-making company, it's guidance on profit/(loss) that investors want, and there doesn't seem to be any steer given on that front in today's statement. I'll read it again, just to double-check. This bit does indicate cost-reduction measures are at least on the agenda;

We have further changes to make, notably in supplementing the new leadership team to accelerate supplier on-boarding and our Early Payment offering. In addition, we are undertaking a detailed review of our operating cost base to help us meet our growth plans in an efficient manner. We will provide a further update on the expected outcomes from this process when we report our 2016 Interim Results in mid-December.

Outlook - referring investors back to a previous announcement, without repeating it, is a bit annoying.

The Board remains optimistic about prospects for the current financial year and reiterates the outlook provided at the time of our full year results in July. We are grateful to shareholders for the £17.5 million equity raised at the start of the financial year and the Board continues to believe that the Company has sufficient cash resources to be able to deliver its current strategy.

It's good that they think cash resources are sufficient, but given that this has been misjudged in the past, and proven incorrect, then I personally am placing (geddit?!) little reliance on this.

Looking back at the Jul 2015 outlook statement, the key points seem to be;

- Revenue is expected to grow in 2015

- Revised pricing should increase margins

- Some one-off costs have now been paid for (implying cost reductions)

- More spending on sales & marketing

My opinion - I made the classic investing mistake last year, of getting too excited about the story here, and then over-paying for hyped-up shares, before successful delivery of the potential had even begun.

It seems to me that Tungsten management is executing very badly, and that the huge potential for the early payment product seems to be largely fizzling out. So really that just leaves a loss-making e-invoicing business, and a shell of a bank which doesn't seem to serve much purpose (although presumably could be sold to bolster cash reserves, if needed), other than providing regulatory licences in some countries possibly.

In my view, they might need to come back to the market for more cash next year, and the whole thing now looks nothing like the tremendously exciting story that was told to us with such enthusiasm, great gravity & self-importance by Mr Truell last year. Or at any rate, progress is costing a lot more, and going much more slowly than planned.

Will it ever reach profitability? Personally I doubt it now, but I'll keep an eye on the results every six months for signs of tangible progress.

Sorry this one hasn't worked out, and in particular I'm sorry if any readers were influenced by my former enthusiasm for this share. I got it wrong.

Sorry, I ran out of time, got side-tracked today. So here are just a few quick snippets of other announcements;

WYG (LON:WYG) - update on six months to 30 Sep 2015 from this building consultant. The key point is;

the Board expects profit before tax for the full year to be in line with recent market guidance.

There is more detail - UK sounds strong (order book up 15%). EU not so good, but expected to be better in H2. Looks potentially interesting, as the fwd PER is reasonable, at 11.6.

NWF (LON:NWF) - update says in line for Q1, and full year outlook is also in line with expectations.

Penna Consulting (LON:PNA) - looks interesting. Today's update says YTD profits are up "more than 25%" versus a strong equivalent period last year. Valuation seems reasonable, and StockRank is high, at 96. Worth a deeper look methinks!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned.

NB. These reports are just Paul's personal opinions, nothing more. So please always DYOR)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.