Good morning! Just a short report this morning, as there's very little relevant company news today. Also I have to prepare for my talk on the Stockopedia stand at the London Investor Show today, at 2pm. Hope to see some of you there. I'll be chatting about current issues with small caps - e.g. adjusted EPS manipulation, pension deficits, are shares getting too expensive?, how I use Stockopedia to keep on top of 500 companies, and anything else that pops into my head! There will also be Q&A. I hate doing public speaking, so will be glad when this is over, but hopefully people will find it interesting.

Software company Sanderson (LON:SND) issues a trading update for the year ended 30 Sep 2013. Results are in line with market expectations, for £13.8m turnover, and (unspecified) operating profit in line with expectations. Stockopedia shows broker consensus of £1.9m net profit, and 4.0p EPS.

Software company Sanderson (LON:SND) issues a trading update for the year ended 30 Sep 2013. Results are in line with market expectations, for £13.8m turnover, and (unspecified) operating profit in line with expectations. Stockopedia shows broker consensus of £1.9m net profit, and 4.0p EPS.

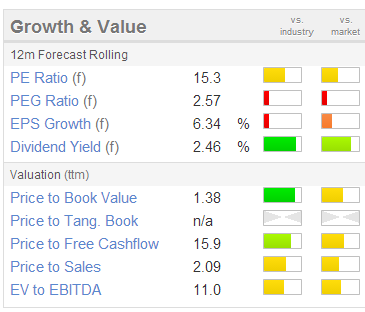

I thought this company looked pricey when the shares were just below 50p earlier this year, so the recent rise to 64p has left me puzzled. That gives a market cap of £28.5m, which strikes me as rather warm for what seems to be a mature business, with probably fairly limited growth potential.

It's got a ropey Balance Sheet too, with £22.4m in intangible assets. So once you write those off, from the £20.6m net assets, you end up with tangible net assets which is negative to the tune of £1.8m. Net cash was last reported at £4.5m, but it all relates to money paid up-front by customers (deferred income is £4.3m), so doesn't really belong to the company yet (until they deliver the services paid for in future periods).

Surprisingly, there is a pension deficit of £4.3m, which is very unusual for a software company, since most similar companies were created after final salary pension schemes had (rightly) fallen out of favour. It seems crazy now that companies willingly took on such massive potential liabilities without a qualm, but I suppose nobody foresaw the dramatic improvement in life expectancy. After all, for my grandparents generation, the main bread winner retired at 65, and died in his early to mid 70's, so the pension schemes were only designed to pay out for a few years. Whereas today, many people are living into their late 80's or beyond, hence a potentially crushing burden on companies which created these generous pension schemes in the past.

I cannot see how a PER of about 16 times can possibly make sense here, for a small and barely growing company, unless investors are expecting strong growth in future. There is a dividend yield, which has grown strongly in recent years, and is now about 2.3% forecast yield.

Having said that, the outlook statement sounds reasonably confident, with two acquisitions having recently been made which will kick in for the new financial year (ending 30 Sep 2014);

Whilst general economic conditions have shown some slight improvement in 2013, the outlook continues to be uncertain and business confidence, although increasing, still appears quite fragile. The Group's strong order book, improved market position and the two recent acquisitions provide the Board with an expectation that Sanderson will achieve significant progress during the current financial year ending 30th September 2014.

Although as mentioned recently for other companies, I am sceptical about applying a growth company PER multiple to groups which are picking up small, cheap private companies, and thus achieving growth by bolting on new stuff, rather than organic growth from their existing stuff. To my mind a growth multiple needs to be reserved for companies that have organic growth prospects. Otherwise you end up on a treadmill where you are essentially over-paying for the shares, but it will be fine as long as they can keep making cheap acquisitions. When the acquisitions stop, then you suddenly realise you've got an ordinary group of businesses (often with little to no real world synergies) priced as a growth company. That's more a general comment about acquisitive small groups, rather than specifically about Sanderson.

I Tweeted earlier this week about another De-Listing, this time from a micro cap called BlueStar SecuTech Inc (LON:BSST). It seems to have been Listed for about 7 years, and looks to be a Chinese company. Profits have collapsed in recent years, as has the share price, from 50p to just 2.5p now. So the game's up as a UK Listed company, and unsurprisingly they announced their intention to De-List from AIM. The shares dropped 50% on that news, as is usual, so this is a massive risk that all micro cap investors should consider.

A tender offer is being made for a maximum of 23.5% of the company's shares, at 2.5p (which was about half the share price at the time of the announcement).

This got me thinking about Chinese shares generally (which I avoid like the plague), and what the likely end game will be. It seems to me that few UK investors are now interested in Chinese stocks, with good reasons, so they are unlikely to wish to continue spending money on a UK Listing that gives them no benefit. The £150k cost of maintaining a UK Listing is one factor mentioned in BlueStar's reasons for de-listing, which is worth a read here.

I suspect we will see many more Chinese, and other foreign companies decide to De-List, hence regard this whole area as so fraught with risk that it's totally uninvestable in my view. The apparently low PERs are value traps in my view - because UK shareholders are unlikely to ever see any dividends, or any benefit at all from owning shares in these companies. All you have is a bit of paper saying that you own part of a business that you've never seen, and have no control over. So what is that actually worth? Nothing, in many cases I would suggest!

There's nothing else to report today, so I'll wrap this up now.

Have a smashing weekend, and see you back from 8 a.m. on Monday morning.

Best Wishes,

Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.