Good morning!

At last we have some interesting company results and trading updates, so I'll be able to get stuck into some proper reporting, rather than waffling on about chaotic market conditions!

US markets

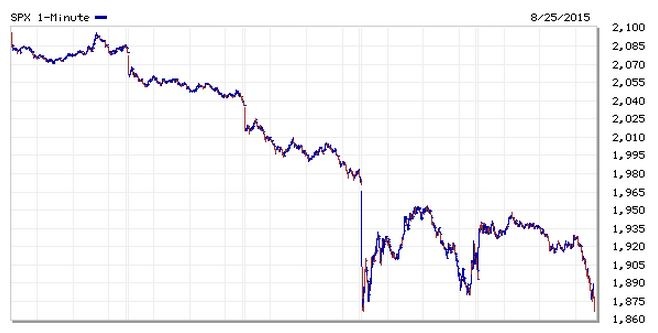

The amazingly strong recovery that we saw yesterday, fizzled out in the US markets in the last hour, as you can see from the five-day chart below of the S&P 500. It has bounced strongly this week, twice now, but closed last night's session at or around the lows (of around 1870) which have been hit three times now this week. So traders are looking to see if this level holds again. If it does, then the market will have probably put in a bottom, and it will be time to gear up & go long. If c.1870 doesn't hold, then we might see another lurch down, who knows? So far, so good this morning, with the S&P futures currently at 1900 (at 9:12 am)

This chart is the last five trading days, from Wed 19 Aug 2015, to yesterday, Tue 25 Aug 2015. So you can see the two big plunges on Mon, then a big bounce followed by another big fall, on Tue (yesterday):

I'll stick my neck out, and say that I reckon this could be the low point, and I'm leaning a bit towards a decent recovery from here. Although that's purely a hunch. Why? Because the economic recovery in the USA is looking good now, inflation is low, and lower oil is feeding through into more consumer spending. When the American economy grows, it tends to pull the rest of the world up too. Cheap oil has historically always been good for growth too - fairly obviously, as it gives people and companies more money to spend, more than offsetting the reduction in capex by oil companies.

Stock markets fundamentally go up & down because of expectations about future company earnings. So markets crashed in 2007-8 because the market realised that corporate earnings were likely to drop heavily, which they did. Then markets recovered, as the financial crisis stabilised and corporate earnings began to recover strongly.

So I don't think there is any particular reason for shares to have another big move down, unless the market becomes convinced that earnings growth is stalling, or even likely to go into reverse. It's obvious why resources stocks have sold off, but it's difficult to see much of a valid reason for everything else to sell off too, apart from pockets of over-valuation in some sectors. Unless you think that we're going into recession again, or even worse, that a new financial crisis is brewing (bank shares have sold off a lot, so the market is clearly getting jittery about that).

Debate is already raging about what caused the "flash crash" on Monday. High Frequency Traders (HFT) say it had nothing to do with them, and that they actually help create liquidity. I think most other people realise that's nonsense/PR, and that it's fairly obvious that computerised trading creates more volatility, because it rams through a much higher volume of trades at periods of peak market uncertainty, and sometimes does so at irrational prices.

I think we just have to live with the fact that modern, inter-connected electronic markets, are inherently more volatile than we're used to. So every now and then, there will be large & very rapid moves down. The last week has felt really bad, but it's only been a 10% move down - which is a normal market correction. It just happened so fast, that seems to be what spooked some people. Or at least, we're not used to this level of volatility anyway, since corrections have been few & far between in recent years. As they say, if you can't take the heat...

China ... again!

As regards China, what the TV news here last night forgot to report, is that the Chinese have had a stock market crash because it had previously gone on a wild, speculative frenzy. Amazingly the Chinese market is still actually up in the last year, even after having crashed recently! One year chart below, courtesy of Bloomberg:

Silly people, who don't know what they're doing, just bought stocks on margin because they thought markets would keep rising irrationally forever, even though valuations were already absurdly high. It's a classic stock market mania, which happen repeatedly throughout history, and mankind never seems to learn from them, despite there being striking similarities between all market boom & busts.

Why is it, that the financial sector seems to be an area where, unlike almost all other areas of human endeavour, we collectively fail to build on the knowledge and experience of previous generations? In almost all other areas (medicine, science, engineering, etc) each generation builds on the expertise of the last. Yet in finance, each generation seems to simply repeat the same mistakes made by previous generations.

I've done this myself of course, so am not preaching. Even though I knew what the main mistakes were, I still made them (in 2007-8). My view now, is that many people (myself included) have to personally experience bad things before those lessons are seared onto your memory strongly enough to make you resist the powerful greed/fear urges in future.

Also, making a lot of money in a bull market can develop a sense of hubris, over-confidence, which again makes you over-ride your natural caution, and start doing things which you already know are dangerous, but you do them anyway. People see everyone around them making money by being reckless, so after a while they throw away their discipline and join the crowd - which is usually right at the top of the market!

I think the only way to avoid boom & busts, is through experience of having personally seen it before, and being badly burned. Then you're older & wiser next time things stoke up to boom time again, and you take your money off the table when things are getting too hot. Most of the best & richest investors that I personally know, are people who are happy to take their money out of the market, and sit in cash - if there are no suitable opportunities which give them adequately favourable risk:reward. That's the no.1 key skill for investors, in my view - the self discipline to sit on the sidelines, in cash, when investments are over-priced, thereby protecting your capital, and having a bulging wallet when you need it most, when the market has a big fall, and there are bargains to be had.

Boom & Busts

Here are the Wikipedia links to some famous boom & busts, which are interesting to refresh your memory if you have time: Tulip mania in 17th century Holland, the South Sea Bubble in the 18th century. Plus numerous stock market booms & busts since, with the most notable being the Wall Street Crash of 1929, and of course in our lifetimes, the Dot.com bubble in 2000, and more recently the Financial Crisis of 2007-8. There have also been numerous property market boom & busts as well, so it's certainly not confined to just stock markets. Any asset market is susceptible to boom & bust cycles, it just seems something that humans are fundamentally programmed to do, as waves of fear or euphoria alternate.

These boom & busts are nearly always caused by a bull market that gets out of control, due to punters with little knowledge of the fundamentals, chasing asset prices too high, often using gearing. That's exactly what happened in China this year. The Chinese are culturally massive gamblers, so they have a natural pre-disposition towards this kind of thing, so it really should not come as a shock that the Chinese market has blown itself up. It is likely to happen over & over again, maybe every 7 to 15 years (depending on how bad the last crash was), which seems to be how long it takes for memories to fade, and a new generation of mugs to appear.

I think the Chinese Govt made a fundamental mistake in trying to reverse crashing share prices, through a variety of ill-conceived interventions, all of which failed. They're learning the hard way, that markets will find their own level, one way or another. Although being a strange hybrid of a command economy and capitalism, China is unique in that the population expects the State to intervene and control market forces. The population seem to tolerate State control, and lack of personal freedom, in return for the economic miracle which has happened in the last few decades. If the Communist Party can no longer control the economy, then demands for freedom/democracy could resurface perhaps?

On a personal level, of course I feel sorry for the Chinese punters who have lost their savings, but life carries on. Sure, Chinese GDP growth might be slow, they could even be going into a recession, who knows (since the economic data is unreliable). However, whilst this might cause some problems for large, international companies, it really shouldn't affect the earnings of the companies that I invest in at all, in most cases. So, I'm gradually coming back round to my starting view, that Chinese stock market gyrations are fairly irrelevant, for my small caps portfolio anyway. That's why I haven't sold anything in my long-term, ungeared portfolio.

I said I wasn't going to waffle today, then proceeded to do exactly that, sorry about that! It's all fascinating stuff though.

International Greetings (LON:IGR)

Share price: 134.5p (unchanged today)

No. shares: 58.8m

Market cap: £79.1m

Trading update - in a bull market, today's update probably would have put 10% on the share price, however it looks like buyers are sitting on their hands, due to volatile market conditions.

This all sounds reassuring, particularly because it confirms that order visibility is fine, as well as current trading, and forex risks seem under control too, so that all seems to largely eliminate the risk of a profit warning this financial year;

Across the Group, sales during the first quarter, together with overall customer order levels already received for the balance of the year, have been in line with management expectations.

The Board believes the Group is on track to deliver against market expectations and is in good shape to combat the anticipated impact of a weak Euro and Australian Dollar exchange rate as we enter our peak operational and trading periods.

Further details are given about expansion in the USA, and launch of more toy products, e.g. Minions characters. Funnily enough, I recently saw these Minion items in Primark, when on my annual mission to buy 10 identical black polo shirts (£4 each) for the year, and I noticed that on the back of the Minion products the name International Greetings appeared.

Judging from today's update, the company seems to be expanding in toys, whereas in the past it was more about wrapping paper.

My opinion - for more details on the financials, I did a positive write-up here on 21 Apr 2015, when the shares were 96p, noting that there looked to be scope for the shares to go higher, as a convincing turnaround seemed to be happening. That's confirmed again today.

Note that the balance sheet isn't great, with too much debt, but it seems to be coming under better control, with excessive levels of stock being reduced, so I think it's alright overall.

The StockRank is tremendous, at 99, which gives me confidence this might still be a good buy, even though it's almost doubled in price, in the last four months.

Earnings forecasts have risen twice in recent months, and the forward PER is 11.0, which still looks reasonable. The divi yield of 1.79% is small though.

In normal market conditions, I would have bought some of these shares after today's announcement, but given market volatility, I don't want to add any new positions at the moment. So it's going on my watch list as a possible future purchase.

Gervais Williams of Miton was raving about this company when I had the pleasure of sitting next to him at a dinner earlier this year. He really rates the management, and thinks it's a good turnaround. Looks as if he's correct, judging from today's update. So it gets a thumbs up from me too.

HSS Hire (LON:HSS)

Share price: 83.5p

No. shares: 154.8m

Market cap: £129.3m

Interims 26 wks to 27 Jun 2015 - this chain of tool hire shops has only been listed just under 7 months (it joined the main market, as opposed to AIM, on 4 Feb 2015). The IPO price was 210p, and look at it now, down 60% at 83.5p - what a disgrace.

So who are the people responsible for this shambles? Well obviously the company's management must take the bulk of the blame, and it seems to me that the CEO's position is now untenable. It never should have been floated if problems were looming - I don't think it is at all credible to suggest nobody knew (or at least suspected) that profits were shortly going to collapse, so this leaves a very bad taste. I see that 19% of the IPO shares went to retail investors too, so a pity to see them take a hit - although if they had read the Prospectus, it was pretty obvious that the company was being floated at a high valuation. The deal only just happened too, with the 210p IPO price being the lowest point in the indicative range.

Looking at the IPO Prospectus, this was a Private Equity deal - the worst type of IPOs, as they nearly always leave behind a trashed balance sheet, and there's a very high likelihood that the deal will be over-priced, and that the PE owner might be selling because they've realised that there are problems, e.g. slower growth, ahead. The former PE owner still holds 37.5% of the company today, so it's good to see that they have taken a big hit today too.

This type of thing is hammering the nails into the coffin for future floats. Who would want to buy into any new floats now, given the lamentable recent track record of the city, in floating things at prices that are so high, and with so many recent floats warning on profits so soon after listing? You'd have to be certifiable to even consider investing in any more IPOs now, in my view, since it has been so clearly demonstrated by the city firms that their main intention is to earn massive fees, and they don't really care who they stuff in the process. Does nobody care about their firms' reputations any more? Doesn't look like it.

The lead role appears to have been taken by J P Morgan Cazenove, assisted by Numis as Joint Bookrunner. Berenberg is also mentioned, as "Co-lead Manager" but in a smaller font on the front page of the Prospectus.

Previous profit warning - I reported on HSS's profit warning here on 1 Jul 2015, a couple of days after the shares had plunged to 128p. So why have the shares dropped heavily again today, to 83.5p, and is this a buying opportunity?

The company says that today's results are in line with the guidance given on 29 Jun 2015, and this is true as far as it goes - the company said that adjusted EBITDA would be in line with the previous year, which doesn't sound too bad. The figures today confirm this, with adjusted EBITDA indeed flat against last year at £28.9m in H1.

However, it now transpires that adjusted EBITDA gave a highly misleading overall impression of performance (what a surprise!). There's been a massive increase in the D in EBITDA (depreciation), such that EBITA (effectively operating profit, before amortisation of goodwill) has plummeted by 60% to only £4.5m in H1 this year.

Ah, I've just discovered a fresh profit warning in the narrative!

New profit warning today - this says;

Recovery and activity levels in the repair, maintenance and improvement ("RMI") and housing markets have continued to be slower and more erratic than predicted by most commentators and this has continued into Q3 15, with customer demand more variable than we would traditionally expect at this time of year.

While the Directors have seen more reasonable revenue growth in July, there is some softening during August across a variety of sectors and customers. This variability period on period and week on week is making it more challenging to predict the out-turn for the year. Against this backdrop, we now expect revenue and earnings for the full year will be below current market expectations.

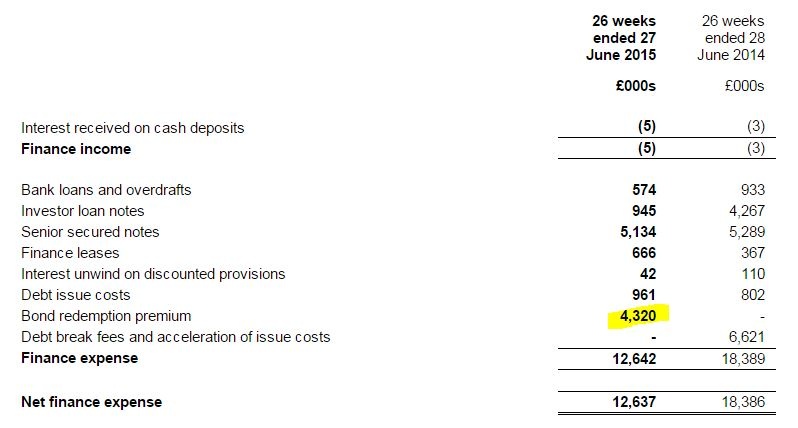

Going back to the figures, EBITA of £4.5m in H1 this year isn't the end. There are also large financing charges to take into account when considering profitability. Finance expense of £12.6m was incurred in H1, taking the company into a loss overall, of £14.1m. Although they do point out that £4.3m of the finance expense is exceptional.

Note 5 gives a breakdown, see below;

What concerns me is that the recurring interest costs are so high, given that adjusted EBITA was only £4.5m - the ongoing interest costs are almost double that, taking it into losses. Some of the debt was paid off as part of the IPO, but that happened near the start of H1, so the ongoing interest charges should, I imagine, be in a similar ballpark to the non-exceptional charges totalling £8.3m above, per half year. That looks way too high.

Balance sheet - this is in poor shape, as I would expect after the company has been owned by Private Equity ("PE") - a sector which is a scourge, in my view. They load up companies with excessive debt, as a tax dodge mainly (since the interest charges they effectively charge themself, eliminates corporation tax).

The trouble is, PE also have a tendency to leave behind far too much debt, and that's certainly the case here.

Net assets are £159.0m, but once you write off the intangible assets of £179.5m, then net tangible assets is negative at -£20.5m. Not good.

Current ratio - is less important for hire companies, as they always have debt, but in this case it's still very weak, at 0.77, so another black mark.

Long-term debt - as well as a weak working capital position, there's also a ton of long-term debt, in this case total long-term liabilities totals a whopping £166.3m, of which the bulk, £130.6m is borrowings.

Note there is also £11.5m trade payables in long-term creditors, which is very unusual, almost unprecedented. So on checking note 12, that is described as "obligations under finance leases", so it's really just more debt, not a trade payable as such, the way I look at it.

Note 13 then gives more detail on the borrowings. The bulk of it, £130.6m is a senior secured note, which looks to be left over from the horrible PE days, which has a fixed rate coupon of 6.75%, matures in 2019, and is listed on the Luxembourg stock exchange. The nominal value of the bonds is given as £136.0m, so that looks to be a £9.18m p.a. annual interest bill on those bonds, and of course the capital will have to be repaid in 2019.

There's an overdraft of £8.9m, and a revolving credit facility of £33.5m shown in current liabilities, so that's over & above the senior secured note.

Net debt is £197.2m, which is far too high, in my view, plus it's expensive at 6.75%, although the company mentioned refinancing its debt to get a lower interest rate. Although I imagine the company would have to raise some fresh equity to fix the holes in its balance sheet, before finding a lender who would charge a lower interest rate.

Fixed assets are £173.4m, so these are funded entirely by debt, which is higher at £197.2m (net debt). That's not good. I would expect net debt to only be about half fixed assets, for a hire company, which suggests to me that HSS has about £110m of excessive debt on that basis. That's close to the market cap now, so to fix this balance sheet would require a near 1 for 1 equity raise, in my view.

Cost-cutting - these points are mentioned today;

· | Rebase of cost structure to reduce operational gearing, targeting cost savings of between £8m and £12m in FY16 and £1.5m and £3m in Q4 15 |

· | Capex investment will be below FY14, matched to expected customer demand |

· | Assessing further cost saving opportunities through refinancing in 2016 |

That's good news, but what on earth are they doing, putting out profit warnings, moving into losses, whilst at the same time opening new branches at a frenetic pace? If a business cannot predict customer demand, and is having significant problems, surely the last thing they should be doing is opening 50 new branches this year? (39 already done).

On the other hand, I suppose the losses from the new branches might be obscuring decent profits from the existing branches? It would have been useful to quantify this, but I don't see that information in today's statement (unless I missed it, which is possible, as I have to skim read things to save time).

My opinion - HSS looks a real can of worms to me. A bit like Speedy Hire (LON:SDY) and its profit warning at the same time, these companies both seem to have management that are not in full control of the business. So who knows what more bad news could come out?

In the case of HSS, its PE owner has wrecked the balance sheet, so for me it's uninvestable whilst it remains so highly geared. Especially so, with all this bad news coming out about trading, and the company now loss-making.

Above all, it's reinforcing my inclination to avoid IPOs like the plague! I think new issues really should be treated like AIM overseas stocks - there's usually something wrong with them!

James Latham (LON:LTHM)

Share price: 697.5p (down 1.1% today)

No. shares: 19.4m

Market cap: £135.3m

AGM trading update - this reads well, with sales in the first 4 months up 7%, and at higher margins too. The key conclusion says;

Overall the Company is trading in line with full year market expectations.

Valuation - I went through the figures in detail here on 24 Jun 2015, when the Mar 2015 year end results were issued, and the shares are almost 6% higher now, but broker forecasts have edged up a bit too (as I predicted they would), so the valuation has remained about the same.

My opinion - it's a super company, well managed, and with a cracking balance sheet. It's rewarded very long term shareholders handsomely. However, I think it's priced about right now, so today's steady update is reassuring, but doesn't make me want to rush out and buy the shares, since expectations are unchanged.

So, a good company, priced about right.

SkyePharma (LON:SKP)

Interim results - there's only time for a very quick comment on these figures, which I skimmed through this morning on my iPad.

This is a company which I've reported positively on before, as it looks a solid GARP share. Today's figures and outlook read fairly positively, which has been reflected today in a 9% rise in share price to 291p.

It has a good balance sheet. It's quite a complex business, so I don't really feel qualified to plough through all the narrative, and try to explain the various moving parts - figures can be lumpy because of milestone payments dependent on product sales, etc.

Pharmas are really not my thing, and I don't really understand the sector, but I do like this stock, on a simplistic basis that it scores well as a GARP share, and the outlook comments have been strong for a while, with new products selling well.

Outlook - here is an excerpt from the detailed comments given today;

The Board expects continued substantial growth in revenues in 2015 compared with 2014, due to ongoing momentum from the products launched since March 2012, especially flutiform®, EXPAREL® and the GSK Ellipta®-range of products, as well as the exceptional performance of Solaraze® in the U.S. in H1 2015. Based on current forecasts by analysts who follow Pacira, the next sales milestone of U.S. $8.0 million (£5.1 million) receivable by Skyepharma, which is due when annual net sales of EXPAREL® (on a cash received basis) reach U.S. $250 million, is expected to be triggered in 2016.

The Directors expect that flutiform® product supply revenues for 2015 will be ahead of the Board's previous expectations given recent growth in customer demand forecasts. As a result, after allowing for the likely shift of the EXPAREL® milestone into 2016, the Directors believe that underlying trading for the year will be ahead of previous expectations.

That all sounds pretty good!

My opinion - I'm kicking myself for selling these shares a few days ago, as I wanted to de-risk my geared portfolio in the light of market volatility. So it's a stock I no longer hold.

I'm considering buying back on the back of today's update, which looks very solid, and the forecast PER is still quite reasonable. at about 14.

All done for today! See you in the morning.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned.

NB. These reports are Paul's personal opinions only, which like everyone else's, will sometimes be right, and sometimes wrong.)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.