Good morning.

The Greek election doesn't seem to be worrying markets unduly, with the FTSE100 down only 13 points at the time of writing. I suppose it will just mean more wrangling within the Eurozone, and eventually everything will muddle through somehow.

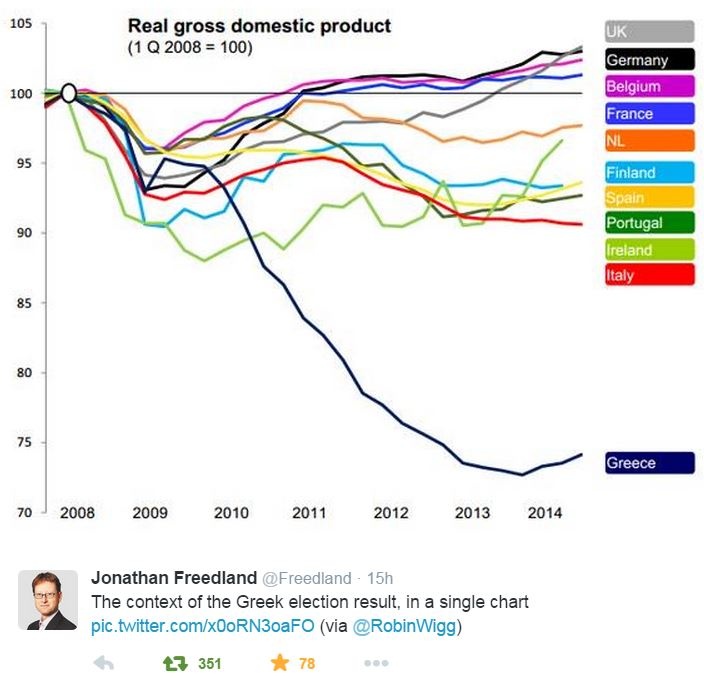

I spotted this interesting chart on Twitter (posted by Jonathan Friedland, of the Guardian - well, we all have our crosses to bear!) which is worth pondering. No wonder the Greek people are desperate for change. It remains to be seen whether change will be for the better or worse. In situations like this, getting in extreme socialists to sort it out is usually about as sensible as inviting a serial killer to babysit.

I can't help feeling Greece would be better off in the long run by defaulting & devaluing. Then see an economic recovery built on a tourist boom from low prices.

Anyway, let's look at some companies.

For anyone interested I recorded another audiocast yesterday, talking about small caps with expert investor/analyst Paul Hill. The link is here (it's long, so best to have a listen when you have spare time).

Flybe (LON:FLYB)

Share price: 67.6p (down 22% today)

No. shares: 223m

Market Cap: £150.7m

Trading update - bad news obviously leaked out last week, with the sudden share price plunge on Friday looking very much like some insider dealing was occurring. It might also have been stop loss orders just below 100p being triggered, possibly?

The market has done its usual thing today of shooting first, and asking questions later, with Flybe shares savaged this morning by 22%, coming on top of a c.10% fall on Friday:

This seems a rather extreme reaction to me, given that Flybe is a turnaround situation, and the issues are already known about.

The headline points for Q3 show an improvement in key metrics such as average revenue per seat (up 2.4% against prior year), and the load factor is up 68.7% to 74.3%. Aircraft utilisation has improved from 7.3 hours to 8.0 hours (this is positive, because the problem with short haul flights is that the planes are not actually flying for much of the time).

Fuel hedging - unfortunately, as the company has forward hedged the majority of its fuel requirements, it will not benefit from lower fuel prices in the current year (ending 31 Mar 2015), and only "minimal" benefit in 2015/16.

I'm interested to find out if the company is taking advantage of current low prices to more aggressively forward hedge for future years - this seems a good opportunity to lock in that low fuel price.

Forward bookings - are up from 34% to 36% of capacity, but the average revenue is down 3%, which is disappointing.

Surplus planes - the biggest issue the company has, is the considerable cost, about £26m p.a. of 9 planes which are surplus to requirements. The company says it is making "solid progress" on this issue, but one wonders if there might be an exceptional charge in order to offload these planes to another airline(s) in future?

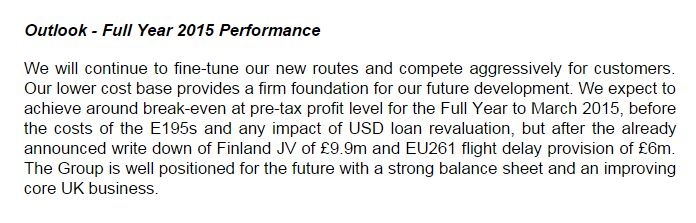

Outlook - if I'm reading this right (below), it seems to be saying that underlying profit will be c.£16m for the year ending 31 Mar 2015, but that one-offs (writing off Finland JV, and impact of EU ruling on passenger delay compensation) will take them to breakeven. However, there are then the grounded aircraft costs of about £26m, so the all in loss looks to be about £26m, which clearly is not good.

However, it also means that once they've disposed of the 9 surplus planes, the business should then be profitable.

My opinion - today's statement mentioned competitive pressures several times, and combined with ongoing issues (mainly the surplus planes) that are dragging on longer than expected, it's all rather disappointing.

Having said that, the share price has been absolutely savaged, so the only question is whether the bad news is already in the price, or not? In my opinion the share price has possibly over-shot on the downside, and I'm more inclined to be buying now, rather than selling.

The reason for that is that the business is sound, financially strong (remember it did a huge Placing at 110p last year, so looks fully funded), and once the surplus planes are gone, it should be reasonably profitable. Set against that, there is clearly stiff competition, and the fuel hedges have worked against the company.

The company seems to have dynamic management, who have stripped out a considerable amount of costs (c.20% of the workforce were let go last year), so as a low cost operator they should be able to build a decently profitable business over the next few years.

It's clearly disappointed in the short term, but not disastrously so. The issues are fixable in my opinion, and don't threaten the company's survival. Investor sentiment is likely to be negative for a while though, as it always is when shares under-perform. So traders will probably have sold up & moved on, whereas investors with a longer time horizon will probably be happy to sit and wait for the issues to be resolved, and a share price recovery. A case can be justified for either stance, in my view - it's a classic situation where you either see the glass half empty or half full.

UPDATE: Looking at a new broker note this morning, they have cut back earnings forecasts a lot. It's effectively pushed back the turnaround by a year. The main factors being the new routes from London City airport taking longer than expected to develop, and surplus aircraft being retained for longer than expected. Although the broker says that despite these setbacks, they see "significant turnaround potential", and the 140p price target means with patience this could be a two-bagger from here. Not much consolation for those of us who bought at double the current price, but there we go, these things happen sometimes.

I can't see any point in selling now, as that would just be locking in a low price/valuation after bad news, when there's actually a reasonable expectation that performance should further improve from here. It's just a question of whether you're prepared to wait or not.

Porvair (LON:PRV)

Share price: 306.5p

No. shares: 44.2m

Market Cap: £135.5m

Results - for the year ended 30 Nov 2014 are published today. The company has given them a heading, which says "Record results ahead of expectations", so let's have a dig into the numbers to see if that stacks up!

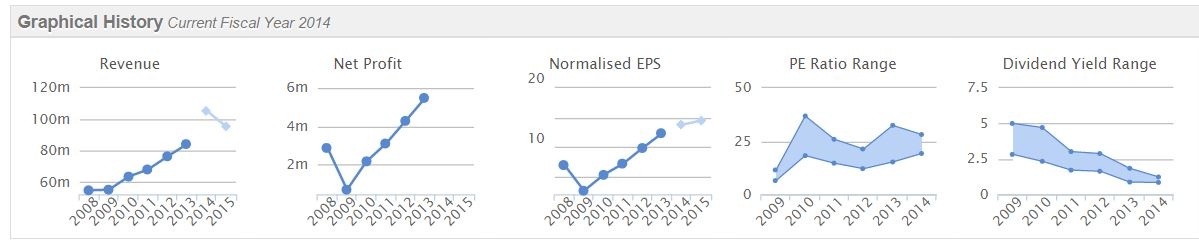

Basic EPS has risen from 12.3p to 14.4p, which is a little ahead of broker consensus of 13.8p. That puts the shares on a PER of 21.3, which seems a rather rich rating. That said, the track record in the last few years has been excellent, so there is a strong case for arguing that the rich PER is justified, if such good performance continues.

The current ratio looks reasonably healthy at 1.36, but note there is a £12.8m pension deficit in long term creditors. Again, not a huge issue, but worth factoring into your valuation of the company.

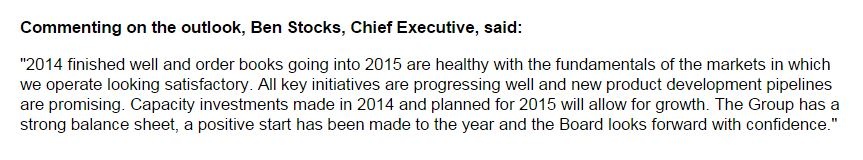

Outlook - this all sounds positive, although it sounds like I need to drop into the CEO's office and give him a brief tutorial on balance sheet strength (or lack of!)!

Large contracts - a bit more detail is given on the impact of some unusually large contracts, and this is reassuring, as it sounds as if profit is being fed into the accounts over a period of time, as warranty provisions are released. That should help smooth over any lumpiness in profit;

My opinion - it's a smashing company, but on a risk/reward basis, I'm struggling to see how it makes sense to buy (or hold) the shares at a PER of over 20. That is, unless you have reasons to believe that earnings are likely to grow considerably above forecasts - if that turns out to be the case, then the company's shares could continue going up.

There's no margin of safety though, so if something does go wrong, you could run into a double whammy of lower estimates, and a lower multiple.

I like the company, but the price is too rich for me. It could be a nice buy the dips type of share - to keep on my watch list, and then nip in and buy some on the next general market pullback perhaps?

Mission Marketing (LON:TMMG)

Trading update - this reads fairly well;

Stockopedia shows the company is on a low forward PER of 7.4, and has a high StockRank of 94. So I would say that's certainly a good starting point for doing a bit more research, especially after an in line trading update today. The bid/offer spread is rather nasty though.

All done for today, see you tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in FLYB, and no short positions. A fund management company with which Paul is associated may hold positions in companies written about here)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.