Good morning!

I hope you didn't miss me too much yesterday.

Cello (LON:CLL)

Share price: 97.6p (up 0.1% today)

No. shares: 86.6m

Market cap: £84.5m

Pre-close trading statement - this covers the 6 months to 30 Jun 2016.

This statement is ideally laid out - a brief description of the business first. Then a clear, and simple paragraph giving a summary. Then more detail below, for those who have the time & wish to read it. When we have lots of RNSs to read in just an hour, between 7-8 am, it's very useful when companies issue concise, and clear updates like this.

The Group has had a good first half, with robust performances from the core of Cello Health and from Cello Signal. Accordingly, the Board remains confident that the Group will deliver a strong full year result in line with current expectations.

More detail is given, concerning one division (consumer consulting) which is not performing very well, but this has been absorbed by better performances elsewhere within the group. Cost-cutting has been done, resulting in a £0.6m one-off charge.

Outlook - sounds fairly upbeat to me, and note the robust Brexit-related comment below;

The Group has delivered a good underlying first half, and the Board expects this to continue in the second half.

Whilst profits in the first half will be flat on the prior year as a result of the decline of the consumer consulting unit of Cello Health, overall revenue growth has nevertheless been good.

There has been no noticeable impact on client spending behaviour as a result of the EU referendum vote and income pipelines remain robust.

The Group will also continue to benefit from a stronger dollar in the second half if the dollar / sterling rate remains at current levels. The Board remains confident that the Group will deliver a strong full year result in line with current expectations.

My opinion - the big quandary at the moment is whether or not the UK economy is likely to go into recession? We've had very poor recent PMI data, which correlates closely with GDP. However, most companies that I've looked at are saying that it's broadly business as usual.

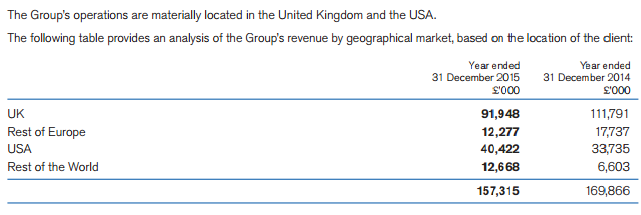

Also, a key question to ask with every company now, is what the geographic split of business is. A heavy UK weighting could be risky. Whereas a heavy overseas weighting could mean the company actually benefits from recent exchange rate movements.

I had a quick look in the 2015 Annual Report for Cello, and the main geographies it operates in are UK & USA;

My opinion - I reviewed the 2015 accounts for Cello here on 17 Mar 2016, and was underwhelmed by the extent of the adjustments, and the weakish balance sheet.

My main worry with marketing companies is that they usually suffer badly in economic downturns. This may not be evident yet, but perhaps UK clients might be considering reducing their marketing budgets for 2017?

For this reason, I'm not touching any companies in this sector right now. Risk:reward just doesn't feel right to me.

Speedy Hire (LON:SDY)

Share price: 33.8p (up 0.9% today)

No. shares: 523.4m

Market cap: £176.9m

(at the time of writing, I hold a long position in this share)

Requisition of EGM - there are 2 RNSs out today concerning this matter. The first one, issued at 7:00 today informs us that Toscafund has requisitioned an EGM in order to remove the Executive Chairman, Jan Astrand. Toscafund wants to replace him with David Shearer, a (in Toscafund's words) - "well-known corporate turnaround expert".

Toscafund then issued an RNS itself, giving a link to their website for their letter to SDY shareholders - which is here.

Toscafund doesn't mince its words about Jan Astrand;

Toscafund believes that;

- Jan Astrand has been indecisive as a business leader,

- failed to support Speedy Hire's executive management fully and

- failed to consult with shareholders regarding key board appointments.

In addition, his role as Executive Chairman is incompatible with the UK Corporate Governance Code when the Company already has an effective Chief Executive.

Toscafund notes that, since Jan Astrand’s appointment as executive chairman in July 2015, the Company’s share price has fallen 34%. Over three years it has declined by 43% from 60 pence to 34 pence.

Toscafund wants to replace him with David Shearer, who gets a much more positive review from them;

David Shearer is a highly experienced chairman and director and specialises in corporate turnarounds. Amongst his numerous roles, he was chairman of Mouchel Group plc from 2012 to 2014, a period of successful recovery, which culminated a £265 million Offer for the business from Kier Group plc. Previously he was a Partner at Deloitte and one of the leaders of its Corporate Finance business.

Sounds an impressive track record to me.

SDY then put out a further RNS, saying it will respond to Toscafund's letter.

My opinion - Speedy Hire has clearly been in a mess for some time, although the most recent update which I reported on here, shows some improvement.

There's more detail in the Toscafund letter, explaining how they see events having unfolded in the last year. Toscafund also emphasises that it has not taken this activist step lightly - indeed it is the first time in their 16 years history that it has tried to oust a Director. It emphasises that it will not be seeking any further changes to the Board.

Given that Toscafund holds 19.5% of the company, I reckon they'll probably get their way, and the existing Chairman is probably already a gonner.

Looking at SDY's shareholder list, it's perfect for an activist. The top 7 holders (including Toscafund's 19.5%) hold c.62% of the company. So a few phone calls is probably all it takes to get the required number of votes - indeed that might already have happened.

I think it's great to see major shareholders shaking things up at under-performing companies. We saw this recently at Lakehouse (LON:LAKE) too - whilst a messy process, the shares are now recovering, with a more credible leader in charge. Let's hope the same thing happens at SDY too.

EDIT: A reader has just informed me that Lakehouse's founder, Steve Rawlings, died yesterday, aged only 62. That's very sad news, so I would like to send my condolences to his family & friends.

Unfortunately, because of the outdated nominee system, and widespread use of derivatives such as spread bets or CFDs, many private investors are disenfranchised - it's either impossible, or at least difficult, to obtain voting rights, so most people don't bother. Therefore, with a partially absentee ownership class, it's vital that the Institutional shareholders think & act like owners, properly engage with management, and keep them under control on issues like remuneration. Therefore a thumbs up to Toscafund from me, on this issue.

I was on the verge of selling my SDY shares, as it's been rubbish so far. However, with this latest development looking like a catalyst for improved shareholder value, I'm inclined to sit tight for now.

Volex (LON:VLX)

Share price: 47.4p (up 3.6% today)

No. shares: 90.3m

Market cap: £42.8m

AGM & trading update - this electrical power cords manufacturer has been a serial disappointer in recent years, and in my view probably came quite close to going bust a while back.

However, the newsflow today sounds a bit more encouraging;

"As reported on 9 June 2016, and confirmed today, our revenues have stabilized at close to the level seen in the second half of FY2016 and restructuring actions have had a positive affect on our operating margins.

I can confirm that Volex was profitable in the first quarter of FY2017 [PS: May-Jul 2016], reversing the loss experienced in the first quarter of last year.

Various other details are given.

My opinion - it doesn't interest me. I think the high margins achieved in previous years are long gone, not to return. That said, today's update does sound as if the company is at last emerging from its previous difficulties. That's already been reflected in the share price, which has risen considerably in recent weeks.

Victoria (LON:VCP)

Share price: 1218p (up 10.0% today)

No. shares: 18.2m

Market cap: £221.7m

(at the time of writing, I hold a long position in this share)

Preliminary results, y/e 2 Apr 2016 - many thanks to regular reader & commenter, "Ramridge", who gave me a nudge in the comments section below, on how good these figures are.

I previously thought that I'd missed the boat on this share, but after today's statement, and upgrades to broker forecasts, I think there could possibly be further upside. Hence I've dipped my toe in the water, with a small purchase.

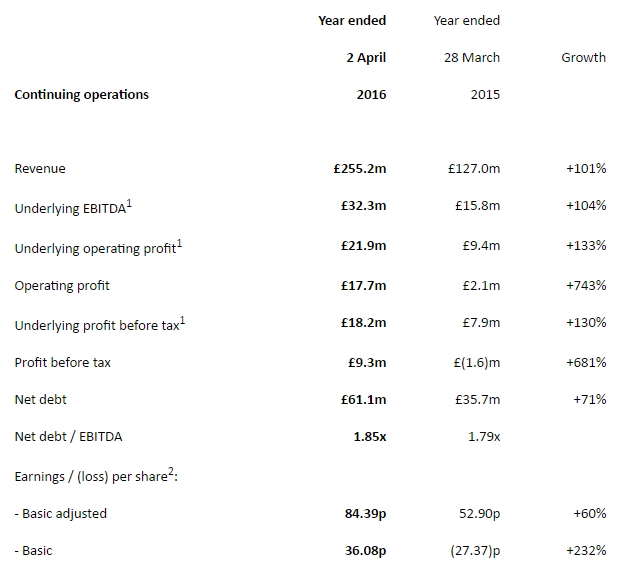

The financial highlights section shows an astonishing rate of growth in both turnover, and profits, driven by acquisitions;

Although note that net debt has risen considerably, up 71% to £61.1m. This is however, at a 1.85x EBITDA multiple, which looks OK. Banks are usually comfortable at up to about 3 times EBITDA. Although EBITDA is often a deeply flawed measure to gauge bank debt against - something that banks don't seem to have realised yet!

Outlook comments are strong;

"The strong revenue performance achieved in the UK and Australia has continued post-period end.

The Group have seen no drop off in demand for their products since the EU referendum in June and Victoria has enjoyed a strong start to the current financial year."

I love the narrative provided today by the clearly very confident Executive Chairman, Geoff Wilding. He has every right to be confident - he's presided over a remarkable transformation of this carpet manufacturer. This looks a very successful buy & build strategy - stripping out costs at companies acquired on relatively modest valuations (average of 6x EBITDA). Cost synergies are then applied, which has increased the operating margin by 130bps at the acquired companies. Another key focus is then to release capital by improving stock turn.

This seems to me a great example of a good buy & build situation - i.e. where shareholder value is created by making improvements at acquired companies.

This paragraph about the teams & culture at Victoria are illuminating, and very much the type of entrepreneurial culture which I like best;

The operational management team at Victoria is simply extraordinary at getting on with making things happen. They are already half way around the track when competitors are still putting on their running shoes! Remember, our entire management team consists of successful entrepreneurs who have built their businesses over many years - through all economic cycles - in order to become one of the very few outstanding companies Victoria has acquired.

It is difficult to overstate the benefit to Victoria of their experience and commitment. They have strong opinions and do not hesitate to express them. We operate as a 'team of teams', sharing information and co-operating extensively to increase earnings and reduce risk while maintaining a very flat management structure.

During the period we continued to seek opportunities to improve operations through better buying terms with suppliers, greater logistic efficiencies and the joining up of manufacturing capabilities.

Dividends - are not being paid at the moment, as cashflow is better deployed to reduce debt, and for further acquisitions. That looks fine to me, given the excellent results being achieved so far.

Brexit comments - these are pure gold!

The ludicrous over-reaction to the outcome of the EU referendum complete with hyper-ventilating commentators and hysterical luvvie wittering has become more balanced recently.

Although there will inevitably be further ups and downs over the months ahead, I expect the UK's decision to leave the EU to be positive for the Group's competitiveness in the foreseeable future.

He gives specific reasons for this confidence;

- Import replacement - about half the carpets sold in the UK are made in the EU, mainly Belgium & Netherlands. Due to the weaker pound, this imported product is now more expensive, thus making Victoria;s UK-manufactured product more competitive.

- VCP has little non-sterling denominated debt, so no issue there.

- Negligible amount of product is exported to the EU (although presumably now VCP has the opportunity to export more, as it's more price competitive now, with the weaker pound?)

- Australian earnings are c.20% of the group total, so will now translate into a higher sterling amount.

Balance sheet - not great. After writing off intangibles, NTAV is negative, at -£9.7m. Normally I would see that as a red flag, but I tolerate weak balance sheets at companies which are highly profitable relative to the shortfall, as this one is.

Dilution - note that there is a chunk of dilution to come, with 746k warrants that are now heavily in the money, at 286p strike price.

The only other slight funny that I spotted in the accounts, is a change in accounting policy to capitalise carpet sample books, and depreciate over 2 years, as explained in note 11. The figures are not particularly material though.

Broker forecasts - I see that Cantors has today upped its forecast for the current year, by 7% to 113.3p - for a PER of only 10.8. Even allowing for the net debt, and warrants, that seems good value for a group which is performing so well.

My opinion - I really like it. Some people may not like the very robust Chairman's commentary, but personally I think it's great! He's earned the right to deliver such a robust commentary, by producing fantastic figures.

Thanks again to Ramridge for flagging up this one for me to look at.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.