Good morning!

Sorry I didn't get round to doing any more updates to yesterday's report. I was too tired after a 5-hour drive home, in heavy traffic.

Today is one of my "it's not a small cap, but it is a retailer, and it's interesting" days! I'm talking about this company:

Restaurant (LON:RTN)

Share price: 290p (down 22.5% today)

No. shares: 201.0m

Market cap: £582.9m

(I am actively trading this share today, and at the moment am long, but this may change throughout the day)

Trading update & Board change (profit warning) - key points:

The long-standing FD has left with immediate effect - so clearly some kind of Board Room bust-up has occurred. Not good - and suggests that there could be more problems ahead.

Current trading has been weak:

Since we updated on current trading with the preliminary results on 9th March, we have seen a further deterioration in trading conditions, with our Leisure business, in particular, continuing to be impacted by the structural and business challenges referred to in the March Preliminary results statement. As a result for the 17 weeks to 24 April, total sales are up 4.7% and like for like sales are down 2.7%.

Clearly that's bad news, but it's hardly a disaster. LFL sales down 2.7% over 17 weeks suggests to me problems that are probably fixable.

However, note that the company last reported LFL sales were down 1.5%, for the first 10 weeks of this financial year.

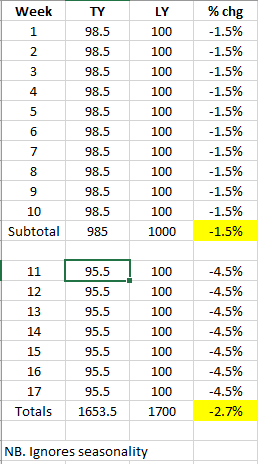

I want to quantify what the LFLs were for the last 7 weeks (not specifically stated today), so have created a very simplistic spreadsheet (see below) which calculates approximately what the LFL might have been in the last 7 week period. Note that I have ignored seasonality, which will skew the figures somewhat, since I do not have any data on the seasonality of the business on a weekly basis.

Here are my workings, which suggest that LFL sales down c.4.5% in the last 7 weeks - so a deteriorating trend.

Sales guidance given today for the full year, is LFL sales down between -2.5% to -5.0%

Revised profit guidance is given today of £74-80m profit, at the PBT level. So still a very substantially profitable business, on an excellent margin too.

Valuation - I've not seen any revised broker forecasts yet today, but using the old figures, and taking them down about 10% gets me to an estimate of around 28-30p EPS for 2016.

Given that the shares have fallen heavily again today, to 290p, we're getting into quite good value territory, for a PER of about 10.

The big unknown is whether things are likely to get any worse. The company is doing a dreaded "strategic review" - which usually means stored up bad news is unleashed in conjunction with write-offs, restructuring provisions, etc.

A comprehensive review of our current operating strategy has also commenced. This will include our property portfolio, site roll out programme, brand positioning and overheads. We will update on this review at the Interim results in August.

Mind you, looking at the 4 examples I have bolded above, these look fairly sensible things to be reviewing. Indeed, I would say the company should be reviewing all of those things every single day, just as the normal process of running the business. Isn't that just what management are paid (handsomely I might add) to do?

Listening to the webcast this morning - recording here - I can't help feeling that new management is needed, to breath some fresh energy & ideas into what is fundamentally a very sound business.

Balance sheet - this is good, and note that fixed assets includes £108m in freehold property.

Last reported net debt was only £24.8m, so nothing in relation to the size & profitability of the business, and in any case covered over 4 times by freehold property.

One concern is whether management is allocating capital correctly. I think this is a question mark. Also the £35m figure noted in the conference call today for "maintenance capex" seems extremely high.

I think this business is likely to attract Private Equity bidding interest, as it has the sort of strong balance sheet & cash generation which is well suited for such a buyout. Also the price is now appealing, after the share price halving in recent months.

Dividends - mixed messages from the company today, but there seems little doubt that a decent yield is likely to be a continuing feature.

My opinion - there are problems at this company - which seem to mainly surround issues with its brands becoming tired & needing a refresh. Plus additional competition in its out-of-town retail park sites.

That said, the core business remains highly profitable & cash generative. It also has a strong balance sheet - which is absolutely key when looking at falling knife situations. If a company is soundly financed, then it doesn't usually matter if you miss the exact low point to buy, because you can afford to sit back and wait for it to recover, with patience.

Therefore I feel this is a potentially interesting turnaround situation, where the share price appears to have overshot on the downside. The main risk is that we could easily have another lurch down in August, if the strategic review comes up with more nasties.

What would you rather do - pay a PER of 20 for a growth company, then lose half your money when something goes wrong (as has done here)? Or pick it up on a PER of 10, with a great divi yield, when something already has gone wrong, and disillusioned holders are throwing out the baby with the bathwater? I'll take the second choice any day - but only where there's a strong balance sheet to protect the downside.

Fyffes (LON:FFY)

Share price: 120p (down 2.4% today)

No. shares: 297.2m

Market cap: £356.6m

Trading update - the key trading message is that the group is in line with expectations:

Overall, the Group's existing business has performed in line with expectations in the year to date.

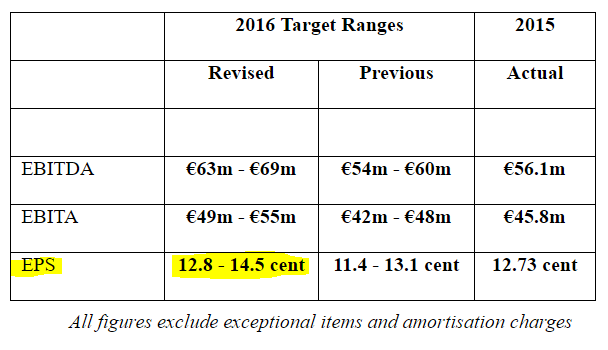

Although guidance is being raised due to the acquisition of a mushroom company. Look at this for a model of clarity:

You know what I'm going to say next! Why can't all companies do this?

Providing specific guidance, as above, removes a lot of the guesswork for investors, and means that private investors (who often can't get hold of broker notes) can make informed decisions. Businesses where profitability is more variable could still do the same thing, but with a much wider range of profit guidance, which would narrow as the year progresses.

My opinion - this is a decent value share, in my view. I like it, but don't currently hold.

The divis are a bit mean, but that seems to be because the group is growing by acquisition.

Also note that the shares are surprisingly illiquid, for the size of company - I had difficult when buying/selling these in the past. So you can get stung for a wide bid/offer spread if you're not careful. For that reason, it's best to consider as a long-term buy & hold, not as a thing to trade in & out of.

The guidance today has been raised due to an acquisition, so wouldn't necessarily cause any share price movement, as acquisitions have to be paid for. It's not free extra earnings.

Flowgroup (LON:FLOW)

Share price: 21.5p (down 14.8% today)

No. shares: 317.5m

Market cap: £68.3m

Results y/e 31 Dec 2015 - you know that any company releasing 2015 results now is going to be reporting awful figures, and that's very much the case here.

These are really terrible figures. An increased operating loss of £17.1m, on turnover of £40.4m.

The original product launch, of a new type of domestic boiler, flopped basically. Although possible changes to VAT rates didn't help. So it was withdrawn, and they're now trying to reduce the production cost, with the contract manufacturer Jabil.

It is however noteworthy that Jabil, a substantial company, invested £7.4m in FLOW's last fundraising, a considerable indication of commitment.

Balance sheet - if cash burn continues at a prodigious rate, then the company will need to do another fundraising. Will investors be quite so keen next time? I have my doubts.

My opinion - the valuation here looks nuts, for a jam tomorrow company.

A friend (who is an engineer) looked into the new boiler product, and told me a while ago that the claims made for it are questionable. In my view, FLOW has solved a problem that doesn't exist.

I haven't really looked into its other business, as an alternative energy supplier. The overall picture is too poor to make me consider investing here. It's going on theBargepole List, due to the initial product launch not working, and the need for more cash. This type of share nearly always goes wrong in some way, leaving "believers" in the story nursing heavy losses. Maybe this time it's different? Why take the risk?

Got to dash now.

I hope you have a lovely long weekend, let's hope we are blessed with some pleasant weather!

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.