Good morning. The most interesting results for me this morning are interim results for the six months to 30 Sep 2013 from Vianet (LON:VNET). This share has been a poor performer in my portfolio, since the group has been dogged by problems in the last year - the main one being a serious threat to its core business by the Government's proposed Statutory Code, which is designed to tackle the unfair treatment of Pub tenants in tied pubs.

The main thrust of the Statutory Code is to ensure that the tenants of Pubs which are tied to the brewery that owns them, are no worse off than if they were able to buy their supplies independently. At the moment breweries charge often much higher prices to tied pubs, in return for financing capex. However the concern in Government is that the breweries also squeeze tenants on higher rents too, leaving many pub tenants with virtually no income.

Vianet's core business is supplying the large breweries with beer flow monitoring equipment, which detects when tenants are using illicit supplies of cheaper beer, by flagging up imbalances in the stock reconciliations (i.e. more pints have been pulled than have been supplied by the brewery, indicating that the tenant is breaking the tie by sourcing their own supplies on the black market).

Therefore the possible threat to the brewery tie arrangements could undermine Vianet's core business, and in the meantime whilst it is in the consultation stage, it creates uncertainty, and makes it virtually impossible for Vianet to upgrade its existing clients to its latest iDraught product. Also, continued Pub closures means that their market (in which Vianet is by far the dominant player) is shrinking. So where they expected their installed base to stabilise at around 17,500 Pubs, it has actually shrunk further to just under 17,000 Pubs, and realstically I would expect that to continue falling slowly as more Pubs are closed - e.g. note the recent deal by Marstons to close 200 Pubs and sell them to Newriver Retail (LON:NRR) who intend turning them into convenience stores.

Therefore these figures from Vianet were never going to be good. Overall they're pretty much what I expected in what has been a very tough year for the company. They remain profitable, and most turnover is recurring revenue remember on 5-year contracts with the brewers.

Benchmark profit (before amortisation, share-based payments, and exceptionals) fell from £1.87m to £1.3m, which was a result of the following factors;

- iDraught sales being held back due to the Govt's Statutory Code uncertainty

- Pub disposals

- Increased investment in iDraught expansion in the USA

- Partially offset by improved performances in Vending & Fuel divisions

EPS dropped out at a mildly disappointing 3.37p (H1 2012/13: 5.26p), therefore it seems reasonable to expect about 7p EPS for the full year. So at 72p currently, the stock looks priced about right to me, on a PER of about 10.

The house broker consistently publishes overly ambitious forecasts for this company (why?!), so I doubt whether many people were expecting much more than this, considering what a disrupted year it's been for the company. So to my mind the share price is likely to blip down this morning, before probably recovering to about flat going forwards. I doubt there will be much downside from 70p, because the dividend yield is now a very strong 8%.

On the dividend, the company reassures, and has maintained the 1.7p interim dividend, and explicitly states their intention to also maintain the final dividend, so that should give a full year payout of about 5.7p, which is a very attractive yield if you think it can be maintained long term. Although it is not well covered since EPS are only likely to be about 7p this year, and that's before various items, so really we're looking at effectively all earnings being paid out in dividends.

Looking at their divisional performance, obviously the core business is being held back by the Statutory Code, and on that issue the company says;

The Board is hopeful of a positive final outcome from the consultation on a Statutory Code, but, in the short term, remains cautious about the outlook for the Group's core Leisure Division until the new provisions of the Code are announced, particularly as the process has now extended into the Christmas trading period.

Also the company gives specific guidance on full year profits, which is very helpful (note that Vianet is becoming much more investor friendly these days, which I applaud);

Against that background, the Board feels it appropriate to exercise continued caution, and as outlined in the Trading Update on 9 October 2013, anticipates that pre-exceptional operating profits for the year ending 31 March 2014 will be in the region of £3.0 million...

Based on this anticipated trading outcome and given the strength of the Group's cash flow, which is underpinned by high levels of recurring revenue, the Board has maintained the interim dividend and expects to do so with the final dividend.

So in my opinion that should give a pretty solid underpinning to the valuation, which is only £20.3m market cap at 72.5p per share. I can't see why anyone would sell now, having been through a difficult year, and with the bad news all in the price already, in my view.

Vianet seems to at least be making some progress in its other activities. Their fuel division has at last reached breakeven, which is a relief. If they can make something of this, then great, but personally I ignore it for valuation purposes - as long as it doesn't lose money, then I can live with it.

Vending has exciting potential, but has had various setbacks (not Vianet's fault - e.g. a major deal fell away due to the customer being taken over & capex being put on hold). Vending is now trading profitably, and hopefully this will make further progress - it's a very interesting product which has obvious benefits to owners of vending machines, by enabling owners to monitor sales & stock levels remotely.

Finally, the USA expansion of iDraught is currently a drain on profitability, but has interesting longer term potential. The installed base is currently only 100 units though.

Overall then, my feeling is that, at this depressed valuation, Vianet results are OK overall in the circumstances. I am meeting with the company tomorrow, so please leave any concise questions you would like me to ask in the comments section below, and I will aim to report back after my meeting.

The company has, very helpfully produced an audio presentation of the results, click here to listen.

I'm scratching my head a bit over the interim results to 30 Sep 2013 from Sweett (LON:CSG) this morning. The company has issued a series of very positive trading updates throughout this year, but these results really don't justify their bullishness, and the shares are down nearly 8% this morning to 65.5p.

I don't currently hold this share, but if I did, would be pretty miffed - both at the overly bullish statements previously issued by the company this year, and the misrepresentation of these results - the headlines say that profit before tax is up 75%, and that basic EPS is up 89%, but this is totally misleading! The underlying profitability is only up 6.7% to £2.7m. What has generated the increase in profit further down the P&L is finance income of £1m - which is the unwinding of an Australian derivative contract, so clearly should have been disclosed as exceptional, but hasn't been. Funny isn't it, how companies are terribly keen to strip out exceptional costs, but are coy about stripping out exceptional gains.

All in all, I think this is a pretty appalling case of total BS presentation of the figures, and I'm afraid that from now on I simply won't believe any upbeat trading statements from this company.

There is another table that tries to compare this year's £3.5m "core trading" with last year's £910k. However, the £3.5m includes the £1m derivative gain, which should surely be stripped out to make it comparable? They're not comparing apples with apples in my opinion.

Net debt has fallen from £9.5m a year ago, to £7.1m at 30 Sep 2013, although that is flat against the 31 Mar 2013 figure.

The interim dividend has been raised to 0.5p (from 0.3p), so since 0.7p was paid at the final stage last year, in all likelihood the payout this year is probably going to be about 1.3-1.5p, which gives a modest yield of about 2%.

Being a people business, I wonder how much profit growth potential there is, since in an economic recovery the staff will (justifiably) want pay rises, as in many cases pay has been restricted in the last five years.

Overall, as you can probably gather, I'm seriously unimpressed with how these figures have been presented, and as such there's no way I'll be buying back into this stock, and will treat all future trading statements from this company with a large pinch of salt.

How to value it accurately?

Edit: 13:10pm

I've discussed the above issues over the phone with an adviser of Sweett (LON:CSG) and am happy to add a bit more colour. The company thinks my criticism was unfair over not classifying the Aussie dollar derivative gain as exceptional, saying that the original cost went through the finance line, so the credit also has to go through the finance line on the P&L, rather than being classified as exceptional. Also, that it was flagged clearly in the results today & in a previous trading statement.

That's fair enough, although I reiterated my view that as this is a non-recurring item, then adjusted figures should have been presented in the headline numbers, rather than non-adjusted comparisons which seemed to flatter the profit growth.

It was also then pointed out to me that the H1 2012/13 figures included a one-off gain of £1.2m from the sale of PFI projects, so if we adjust for that too then the profit comparison becomes £2.7m this H1, against £1.3m last year, an even better percentage gain than reported! This is a perfectly fair point, I agreed.

The key number I asked for, is what the latest broker forecast is for the current year (ending 31 Mar 2014) with the derivative profit removed - i.e. what is the underlying profitability? WH Ireland have estimated this at 4.8p before the derivative gain, and 5.9p after. So as it's clearly non-recurring, 4.8p is the forecast EPS figure for this year to home in on.

As such, at the current share price of 60.5p, the shares are rated at 12.6, which is probably about right in the short term anyway. Although if they can continue growing that EPS figure, then there's room for further upside in the share price.

So I maintain my view that these results were very poorly presented, making it difficult and ambiguous for investors to determine the true underlying performance of the company, and compare it to last year. However, having got to the bottom of the figures, I'm much happier with the position now, and think the shares are probably priced fairly at around 60p, and could see further upside on that price if trading continues to improve.

Some of my earlier criticism was a bit harsh, so apologies for any ruffled feathers.

I hope no readers are still in Albemarle & Bond Holdings (LON:ABM), after the 5 Non Execs resigned yesterday. I think it could well go bust, or at least see shareholders all but wiped out in a deeply discounted fundraising. Mega high risk. The shares are down 28% today to 14.5p, looks terminal to me. Or at least so risky that it's not worth getting involved.

Another company that has disappointed this morning is Real Good Food (LON:RGD). It's worth noting that a trend is developing here - most small caps have shot up in price this year, especially since the summer, so that means results have to be good to justify the price rises. If they're not, they drop like a stone. So people need to be very careful. Certainly if I'm not confident about a company's results being good, and the share price has risen a lot, then I shall think hard about top-slicing before the results are published.

That's why I think momentum-based strategies are very high risk - you can suddenly find yourself owning something that is significantly overvalued when the results come out, and everyone rushes for the exit at the same time.

Anyway, back to RGD. It's down 14% to 59p at the time of writing, so let's have a look at their figures. Starting with valuation, at 59p with about 69.5m shares in issue, the market cap is currently £41m.

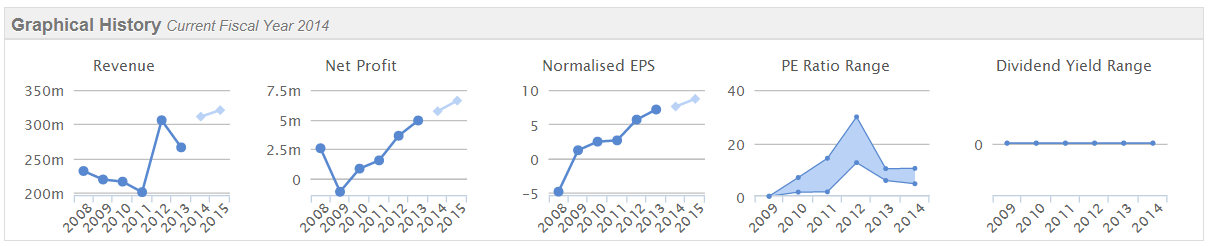

As you can see from the Stockopedia graphs below, there has been an good progression in profits since 2009, although it's on wafer thin margins;

The interim results to 30 Sep 2013 don't look good at all. Turnover is down almost 6% to £130m, and basic adjusted EPS has plummeted from 1.4p to 0.4p. Net debt remains stubbornly high at £31.8m, and becomes much more of an issue when profits fall - will they breach their banking covenants is the key question to be asking? Maybe the statement says something about that, I shall carry on reading.

The key banking covenant is usually net debt to EBITDA, and in this case EBITDA fell from £3.0m last H1 to £2.2m this H1. I wonder if they have any seasonal weighting, or whether it is safe to just double the interim figures to reach annualised numbers? I've checked back to the last full year results, which show turnover of £265.8m and EBITDA of £10.5m. So the turnover split last year was £137.8m (51.8% in H1), and £128.0m (48.2%) in H2. So there seems a slight H1 bias to trading.

However, EBITDA was the other way around, with H1 last year producing £3.0m, and H2 producing £7.5m, so I'm a bit confused here! Perhaps someone who better understands the business can comment on the seasonality of their trading. I'm wondering if the vagaries of raw materials pricing might just make their profit figures somewhat erratic throughout the year?

The narrative explains that the drop in EBITDA was due to planned additional expenditure on marketing to support growth, so that is reassuring. Their outlook statement mentions a seasonal boost to sales from Xmas. It also refers to a "significant challenge" at their Napier Brown subsidiary, following a dramatic drop in sugar prices. The outlook statement does not give any indication of how the group is expected to perform for the full year.

Overall I cannot see anything here to interest or excite me. There's no dividend, it has too much debt and a fairly weak Balance Sheet, and by the sounds of it a rather uncertain trading outlook. Plus it's a capital-intensive business, operating on very low margins. There's just nothing here to like at all, from an investment point of view, in my opinion. However, as usual that's based on a fairly cursory review of the figures. People who have looked into the company's business model in more detail might have discovered better future prospects here than are obvious to the fleeting visitor? I presume so anyway, or why hold the shares?

OK that's it for today.

Sorry if these reports sound negative, but with share prices now high in many small caps, the results have to be very good to justify high valuations.

See you tomorrow.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in VNET, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.