Good morning!

Any more questions for my interview with Tracsis (LON:TRCS) later this week? If so, please post as a comment below, or message me via Stockopedia.

Also, just to flag up that I added 4 more companies (Quindell, Epwin, LPA, and Vislink) to yesterday's SCVR in the early evening, so to recap on that, here is the link.

Getech (LON:GTC)

Share price: 35p (down 19.5% today)

No. shares: 32.9m

Market cap: £11.5m

Results y/e 31 Jul 2015 - checking the archive here, I last reported on this small oil services company here on 7 Aug 2015, when the company put out a reasonably upbeat trading statement, saying that whilst "slightly below current market expectations", it would still be reporting a doubling of profit to c.£2.0m. The outlook statement at that time also sounded upbeat, saying that Directors were "increasingly upbeat about the prospects for 2016".

The shares were 53p when I reported on that, and are now 35p, so clearly something has gone wrong. Let's have a look at today's announcement.

Sure enough, the P&L for y/e 31 Jul 2015 looks terrific;

- Revenue up 26.9% to £8.6m

- Profit before tax up 99% to £2.0m

Taxation - note that prior year figures benefited from a £574k tax credit, and although it reverted to a tax charge this year, the rate looks low at 9% - so this will inflate EPS in both years, especially last year

Dividends - full year divi held at 2.2p - so a very nice yield of 6.3%, but that's getting into "is it sustainable?" territory.

Balance sheet - is strong, with NTAV at £5.0m.

The current ratio is good, at 1.77

Note that cash, whilst strong at £4.7m, is partially offset by new borrowings of £1.0m, so net cash is actually £3.7m. Furthermore, I note that trade payables are unusually high, at £4.6m plus (very unusually) a further £1.0m of trade payables in long-term creditors. This is almost certainly deferred income - i.e. the other side of the double entry for cash that has been paid up-front by customers. So I reckon the underlying cash position (once the deferred income has unwound) is likely to be much lower than £3.7m.

So for valuation purposes, I would treat this company as being cash/debt neutral, to be on the safe side.

EDIT: I am grateful to eagle-eyed reader, "markusm" who has pointed out, in a comment below this article, that the cashflow statement shows a huge increase in development costs capitalised in 2015, from £83k last year, to £977k this year.

Whilst this may be an acceptable accounting treatment, it does of course greatly boost profit. If these costs had been expensed through the P&L instead, then profit would have been substantially lower.

Contrary to what some people think, companies do in fact have enormous leeway over what they choose to capitalise or expense. They can spin any old yarn to the auditors, and present the numbers how they want, in practice. I've seen companies that never capitalise any of their development spend, whilst others stuff everything they can onto the balance sheet. Always remember that accounting rules are easy to bend, if you have a creative FD.

Outlook - with good figures under their belt, the share price fall has to be down to the outlook comments. Here is the bombshell, a serious profit warning for the current year;

...in the short-term there remains considerable uncertainty about the state of the market and its impact on our trading and accordingly we believe the year ahead will be trading substantially below current market expectations. In this context we will seek to mitigate the immediate effects of the lower oil price while at the same time pursuing attractive opportunities as and when they are available to grow our business in the medium to long term.

Forecasts - the current earnings forecast, which the company today says it will be substantially below, is for 6.2p EPS.

Looking at a WH Ireland note published this morning, it has dramatically slashed forecast profits from £2.7m to just £0.7m in the current year (ending 31 Jul 2016). That's a gigantic reduction. EPS similarly is slashed from 6.2p to just 1.7p. Although the divi is assumed to be held, but won't be fully covered by earnings.

My opinion - clearly this is a disastrous profit warning. However, when you buy a company's shares, you're not just buying into the current year earnings, you're buying all its future earnings. As we know, the oil sector is highly cyclical, and is in a dramatic downturn currently due to the price of oil being so low.

The question needs to be asked, why did management say they were increasingly upbeat about the prospects for 2016, back in Aug 2015, yet have delivered a major profit warning today? They surely should have been more prudent with their comments in Aug?

As Getech points outs today, the large oil companies are slashing costs, including their in-house exploration resource. So that could push demand towards consultancies like Getech, when exploration activity picks up again.

As with all oil services companies, it's all about whether you want to take a risk and buy the shares when they are bombed out, but that means potentially seeing the shares become even more bombed out, as there's not likely to be any good news soon. Or do you drip money into this type of stock perhaps, accepting that you won't time the bottom exactly, but will gradually build a position as you see how things progress?

Overall, I don't think anyone should be even remotely surprised by profit warnings from companies in this sector. Analyst forecasts should be taken with a pinch of salt, and can't be used to value the companies in this sector right now, as nobody really knows what the companies are worth.

At some point, they will be cheap though. WH Ireland also points out that companies with relatively strong balance sheets, like Getech, can make small acquisitions at "once in a cycle" attractive prices. The fact that it is reporting any profit at all, is quite impressive.

Overall then, for people who are risk-tolerant, I think this share might be one to consider for a very small, toe in the water type of purchase? It's going on my possible purchases list, but I need more time to think it over. There's almost certainly no rush though. To make really big long-term gains, you often have to be contrarian, and look a fool for a while, by buying bombed out, deeply unfashionable shares, in a smashed up sector. I've no idea about timing, but at some point this sector could provide some good future multibagger opportunities. Balance sheet strength, especially cash, is everything though - as that ensures survival. After all, you can't have a multibagger if the company goes bust in a downturn!

Hunting (LON:HTG)

Share price: 350p (down 2.7% today)

No. shares: 148.8m

Market cap: £520.8m

Trading update - continuing the oil services sector theme, this is a very much larger group. Today's update reinforces just how bad things are in the oil sector;

Given these weak market conditions and on the assumption that current levels of profitability prevail for the remainder of the year, our 2015 full year results are likely to reflect a year on year profit from continuing operations decline in the region of 90%. Should trading conditions materially change, then further trading updates will be released prior to the announcement of our full year results on Thursday 3 March 2016.

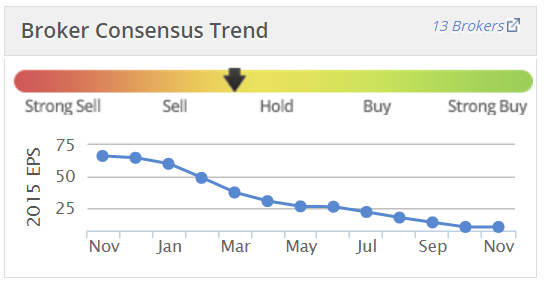

The reason its share price has not moved much today, is because, being a mid-cap, it's better researched by more analaysts, so the market has already priced-in a poor performance this year - look at how broker consensus has dramatically reduced over the last year;

Looking back at last year's results (y/e 31 Dec 2014), various profit measures are given. So I'm not sure which one they are referring to today. An explanatory note today would have been helpful, but none is given.

The possible figures from 2014 are $212.4m profit before tax from continuing operations, or the same measure, but after amortisation & exceptionals, which is $108.5m. Therefore, the company is saying today that 2015 profit will either be $21.2m or $10.9m, so a drastic drop. Again, we all know the reasons why, as the oil sector is in turmoil.

Bank debt - the company today says it had net debt of c.$165m at 31 Oct 2015. A new 5 year $350m bank facility was agreed in Oct 2015, so it should be in place until Oct 2020.

I've looked into what the bank covenants are, but (unless I missed it) this does not seem to be disclosed in the 2014 Annual Report. With profits down 90% in 2015, there must be a risk of the company breaching its banking covenants, so I've looked into this in a bit more detail.

It turns out that Hunting does have a very strong balance sheet. In particular, I like the $215.4m freehold property (in the books at cost, so current market value could be higher?). There is a further $152m of plant & machinery, which OK might have reduced resale value, but is worth something from the bank's point of view. The $89.7m in additional fixed assets, which is rental tools, again would have a value to the bank as security.

Over and above these large fixed assets, Hunting also has very high levels of stock. That is a concern, as it points towards an inefficient use of capital, but it's good when considering the bank situation.

All in all, my conclusion is that, even if Hunting were to breach its banking covenants, I believe there is little to no chance of the bank withdrawing support. Existing facilities are actually unsecured, according to the 2014 Annual Report - which tells you everything you need to know, it means the bank are very relaxed about the company, and perceive it to be almost risk-free lending.

Hunting management are looking very smart for having substantially reduced net debt during the buoyant years of 2012-2014.

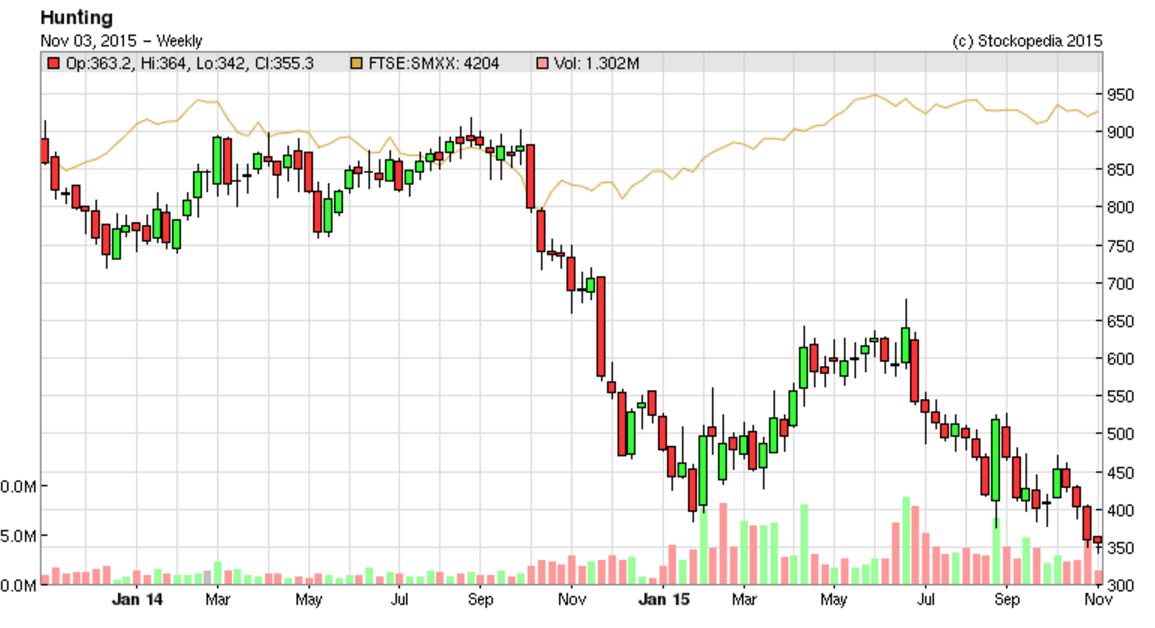

My opinion - this looks a very good potential recovery share to me, given its sound finances. However, in the short term, I'm not convinced that the shares have bottomed out yet. A £535m market cap looks rather too high still, given the risk of the oil price remaining low for an extended time.

So it looks possible that this share could possibly take another leg down? I'm not inclined to short it, as someone might bid for it, at a premium. It looks too early to buy the shares too, as the valuation hasn't yet adjusted down enough to make it attractive, in my opinion.

The chart does however give an idea of what the company might be worth again, in a more favourable oil price environment. Mind you, having stripped out so much cost, maybe the oil companies won't be tolerant about services companies trying to rebuild their margins once conditions are more favourable? After all, in any sector, if you know that you can squeeze a supplier down in price, you want to keep the price down at the new lower level - that becomes the new normal. So it could take years for profits to recover at oil services companies, unless shortages develop.

World Careers Network (LON:WOR)

Share price: 185p (down 17.8% today)

No. shares: 7.5m

Market cap: £13.9m

Results y/e 31 Jul 2015 - there are a few points worth making about this company's results, which are of wider relevance, so even if you're not interested in this company, it's still worth reading this section.

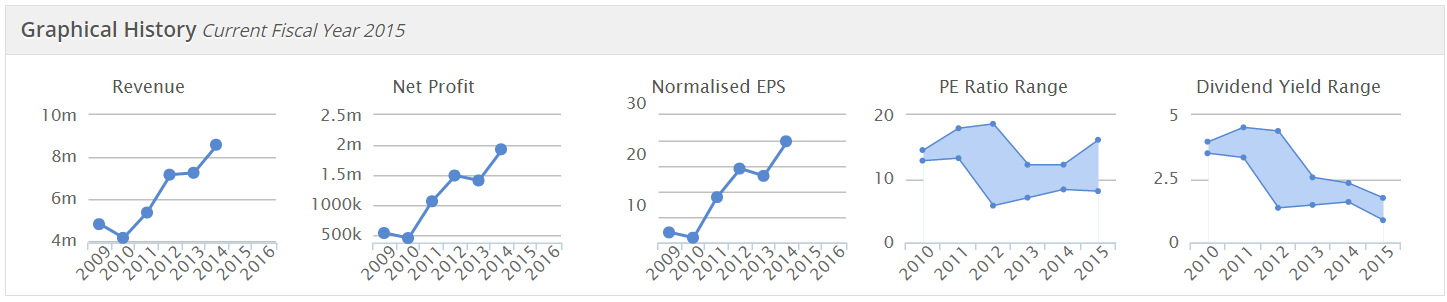

The company has a terrific track record, something that caught my eye a while ago, and I picked up a little stock (no longer held);

So, a really great progression in profit & EPS, historically.

That's gone out of the window today, with results for y/e 31 Jul 2015 looking like this;

- Revenue down 8.5% to £7.86m

- Profit before tax down 51.6% to £1.2m

- Diluted EPS more than halved from 24.82p last time, to 12.04p this time

Bit of a disaster - what's gone wrong?

Sales fell principally as a result of the renewal of a major contract at a significantly lower fee. New business performed relatively well, but only partly offset this fall in revenues. Increased sales in the second half of the year (£4.4m) versus the first half year (£3.5m)reflect these new contracts coming online.

At the same time we significantly increased our cost base as we made widespread investments in product development, delivery and customer support, sales and marketing and overseas expansion in order to provide a sound basis for the long term future of the business.

This demonstrates a key risk with small caps - over-reliance on a few, or even one major customers, or contracts. We saw the same thing trigger a collapse in the price of Solid State (LON:SOLI) this week, when a major contract seems to have been deferred.

A key question to ask management of any small cap, is "How much would your profits be affected if you lost your most profitable client?" If you get a straight answer (which you probably won't with many CEOs!), it could be quite revealing.

Therefore, valuations for small caps should be lower, to reflect this risk. Instead, we seem to be in a period where the opposite is happening - small caps are sometimes being given aggressive valuations, whilst investors ignore, or are unaware of the inherent risks.

A friend of mine who used to be a Non-Exec of a listed company said to me, "Paul, you think you know about the companies you research, as a shareholder, but the truth is, you hardly know anything about what's really going on at most companies". I've always remembered that remark, and it's true - no matter how well you research a company, there will always be important things you don't know or understand, about the company. Hence why it's so risky to over-concentrate into just one stock.

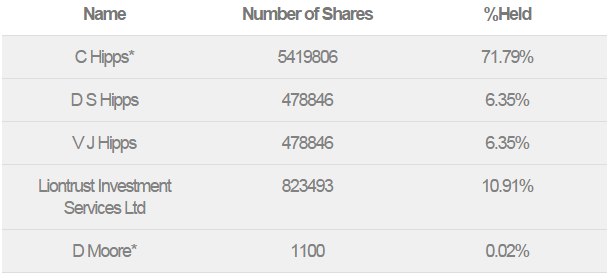

Director / major shareholdings - it's also always worth checking the major shareholder info, which you can nearly always get from the investor relations section of a company's website. In this case, the CEO owns most of the company;

To save you adding it up, that comes to 95.4% of the company. So the free float is only 4.6%, which for a £13.9m market cap company, means only £639k worth of shares are available to be traded amongst all other shareholders!

In practice this means that these shares hardly ever trade, and there's no point at all in it having a listing. So checking the major shareholder info is always worth doing.

Outlook - it's unrelenting doom for shareholders I'm afraid;

Inevitably it will take some time for our investments to generate a meaningful return and for the coming year, we expect to see a continued and significant reduction in profitability as the full year impact of last year's cost increases and the further investments we are currently making impact upon the business.

My opinion - what appeared to be a wonderful business, was actually heavily dependent on one highly profitable client, by the looks of it, who has now driven a hard bargain.

With almost no free float, anyone holding these shares, who wants to sell, given the bad news, probably is stuck and unable to sell. So ultra-illiquid stocks like this are just not worth risking, because when something does go wrong, you can't sell.

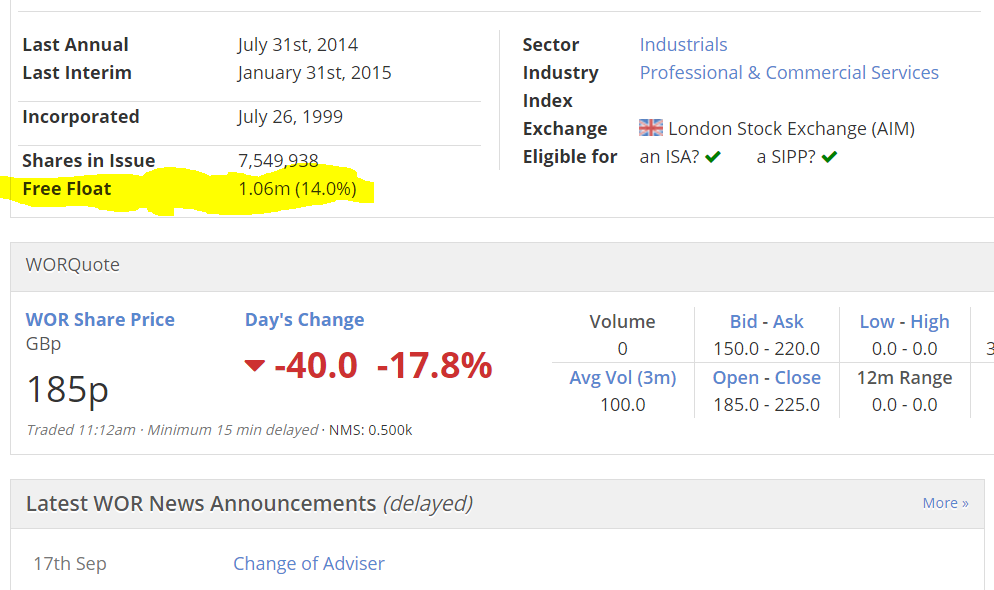

This is why these days, I really try to avoid the smallest listed companies, unless there is a reasonable two-way flow of trades in the share. So it's important to look at the free float, not just the market cap. The StockReport shows the free float, at the bottom left (see screenshot below, with the extremely wonky highlighter [well, I haven't used it for a while!]), although Thomson Reuters use their own rules for how they define free float;

Northbridge Industrial Services (LON:NBI)

(at the time of writing, I hold a long position in this share)

Just a quick note, that I see this share has shot up 25% today, which appears to be market reaction to Directors spending £595k buying shares at 70p. That's a big vote of confidence, given the market cap was £13.1m last night.

I've picked up a little scrap of stock myself, although I had to pay 31% more than the Directors paid, it still looks an interesting punt - the StockReport stats look quite attractive too, although recent interims were poor, as you would expect, due to its exposure to the oil sector (which has been today's theme). I hate buying after price spikes, so kept it to a fun-sized punt only.

So when looking for where shares may have bottomed out, I think major Director buying is a clear signal that we might be near the bottom for that particular share.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in NBI, and no short positions.

A fund management company with which Paul is associated may also hold positions in companies mentioned.

NB. These reports are personal opinions only, and NEVER recommendations or advice)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.