Morning! Paul is off today, so there's no need to look for a Part 2.

The LSE is closing very soon - at 12.30pm.

It feels very quiet in terms of RNS announcements, as should be expected before the long weekend to ring in 2017.

Provexis (LON:PXS)

Share price: 0.87p (-6%)

No. shares: 1,750m

Market cap: £15m

I don't normally cover early-stage pharmaceuticals - the lack of news this morning has forced me into covering this one!

Half-year Report (for six months to 30 September 2016)

Make of it what you will, but this company has announced results on the very last day before it would have broken exchange rules. Not exactly confidence-inspiring to me!

Provexis develops Fruitflow®, a tomato extract which is scientifically proven to improve blood health.

It has been listed on AIM for 11 years, but revenues remain limited, despite trebling in the current period.

Key highlights

- Total revenue for the period £123k (2015: £41k), a threefold increase from the prior year. Revenue for the half year to September 2016 exceeds revenue for the full year to March 2016.

- Revenue from profit sharing Alliance for the period £88k, a 115% year on year increase (2015: £41k).

(GN note: The "Alliance" is the profit-sharing arrangement by which the company outsources manufacturing, marketing and selling)

- Underlying operating loss* reduced to £128k (2015: £196k), a record low for the Group

There are plenty of encouraging announcements/initiatives included in the statement, but I find it somewhat hard to believe that the company is on the cusp of major financial success, so many years after discovering its technology.

That said, the share price has performed extremely well this year (up about 200%), so investors have clearly been impressed by news flow.

On a bigger-picture view, the number of shares outstanding has increased by about five times over the last ten years, and dilution is set to continue in the short term:

Funding

The Company remains keen to minimise dilution to shareholders and it is focussed on moving into profitability as Fruitflow® revenues increase, but while the Company remains in a loss making position it will need to raise working capital on occasions...

Based

on its current level of cash it is expected that the Group will need to

raise further equity finance in the coming four months. The funding

proceeds which the Company expects to receive will help the Company fund

ongoing promotional activities for its Fruitflow® + Omega-3 dietary

supplement product, to include the further sales channel opportunities

which are currently being explored.

My opinion

If I was involved in a situation like this, where I believed in the company despite the fact that it needed to raise fresh funds, my preference would be to take part in the placings - not to buy in the secondary market.

The problem with the secondary market is that it only indirectly helps the company, by marginally increasing the share price.

The primary market investors are the ones who directly help (or save) the company, and so they are the ones who need to be treated like royalty in the negotiations! So you can get a much better deal that way, rather than buying on the open market.

As for Provexis, I like the sounds made in the announcement today, and will keep an eye on it to check if revenues can maintain their current momentum, but it's just not my style to buy into situations where dilution is on the cards. I also can't shake off the feeling that the company would have succeeded already, if it was going to.

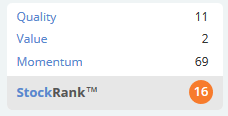

Stockopedia analysis looks consistent with my cautious point of view, as the StockRank is a lowly 16.

I'm having trouble finding anything else worth reporting on today, so unless something crops up, I'll leave it there for now.

Thanks for your comments and feedback this month - they are incredibly valuable to me.

Enjoy your new year celebrations, and I'll see you next week!

Graham

Update: It has been brought to my attention that Stanley Gibbons (LON:SGI) released their interim results at 11.15am. So I am adding a new section below, to cover them.

Stanley Gibbons (LON:SGI)

Share price: 12.4p (+2%)

No. shares: 179m

Market cap: £22m

Interim Results and Notice of EGM

What does it mean to release this at 11.15am on the last day of the year - was it not ready at 7am? Very unsettling!

The figures look as expected: heavy restructuring costs and difficult trading, as the company pulled itself through a difficult reorganisation process.

Note that of the company's current 179 million share count, 130 million shares were issued as part of the fundraising in March this year, at 10p. So as far as I'm concerned, the equity has been re-priced at 10p, and this is now the "par value" of SGI shares.

Results

Undeniably poor:

The performance in the first half of the current year is, as anticipated, slightly down from that seen in the second-half of the year ended 31 March 2016, with turnover for the six months ended 30 September 2016 at £20.2m (2015: £29.4m), down 31% on the comparative period. Trading losses before exceptional items and before pensions related finance charges, as detailed in the Operating Review, were £2.7m.

Outlook

Overall, the tone of the statement is quite positive.

The chairman talks about "giant strides" having been made, a possible "turning point" thanks to reduced operating costs, and signs of recovery/stabilisation in the divisions which were restructured first.

Expectations are kept muted:

The Board expects that following

an exceptionally difficult year for the business, with a marked

downturn in like-for-like revenue, gross margin and trading profits, the Group's revenues will better match its cost base in the second half of the financial year. Profits are likely to remain constrained by our continuing drive to release cash from the balance sheet where the Group is also working on a range of initiatives.

Strategy

The above paragraph must be a reference to the company's attempt to reduce its huge stock of inventory. Elsewhere in the statement, we are told:

A key objective is to reduce our stamp stock which stood at £40.1m at the 30th

September 2016. We have an ambitious marketing plan and are in the

process of initiating a range of sales initiatives aimed at reducing the

historical build-up of stock which had reached unsustainable levels.

The market for premium material remains strong, especially for British

Commonwealth items, but lower quality stock is slower to sell and

usually at reduced prices.

Putting two and two together, it sounds like the company is willing to take a hit on selling prices, if necessary, in order to get the inventory levels down.

Net debt

This sounds like a good plan to me, because the debt levels are still uncomfortably high, with net debt now at £16.5 million.

Debt consists of an £8.3 million loan (repayable in £500k quarterly chunks) plus a £10m revolving credit/overdraft facility.

At the time of the final results, the company said it had headroom of £1.1 million on the bank facility as at the end of September- this would not be enough to make me a comfortable holder of these shares!

Worse, the company is in technical default on these loans, thanks to the qualified audit report, and they are consequently repayable on demand. The bank is said to remain supportive.

Balance sheet

The balance sheet is still very messy, and the NAV reported today of £45 million should not be considered secure.

£19.5 million of the balance sheet is intangible, leaving a tangible book value of £25.5 million.

£59 million is inventories (of which £40 million are the stamps mentioned earlier). At the full year results, stock was written down by £1.4 million - I would be surprised if this is sufficient, and if further write-downs are not later deemed necessary.

The company is also having trouble collecting from debtors, making another £1 million provision, so there are question marks over the receivables figure too.

My opinion

While the company seems to be following the correct strategy of simplifying and liquidating as much as possible, the shares would definitely be far too risky for me. If trading fails to improve, and if it fails to sell off its stocks quickly enough, it could easily need a fresh injection of funds.

One way of looking at it is like this: the fundraising in March/April resulted in an inflow of £12.4 million, but that has done little more than to effectively pay for the company's £11.4 million cash outflow from operations over the past six months. So the fundraising has paid for the company's operating cash outflow, but the creditors still need to paid off.

With ongoing losses, technical debt default, and a liquidation process which is likely to prove testing for the company's stock valuations, I think this should be priced at a very heavy discount to the £26 million tangible NAV. A market cap of £5 - £10 million would make more sense to me.

That's just my opinion. As always, please do your own research!

Regards

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.