Good morning!

New transcript - for anyone interested in my latest audio interview with renowned investor/trader Richard Crow, I published a transcript last night - which I know that several hard-of-hearing investors very much appreciate. Thank you to the kind readers who donated funds to enable me to pay a typist to produce it. Even then, it's time-consuming to edit, but worth it - and I usually sit down with a glass (or three) of fizz, to edit them in the evening, so the time flies!

James Latham (LON:LTHM)

Share price: 680p (up 0.4% today)

No. shares: 19.6m

Market cap: £133.3m

Trading update - for the year ending 31 Mar 2015. Short & sweet:

Revenue for the year ending 31 March 2016 is expected to be broadly in line with market expectations and profit before tax is likely to be higher than expected.

The Board anticipates releasing the Company's preliminary results on 23 June 2016.

It's unusual to see revenue a bit below expectations, but profit above. This suggests to me that either gross margins have improved, and/or that overheads have come in lower than expected.

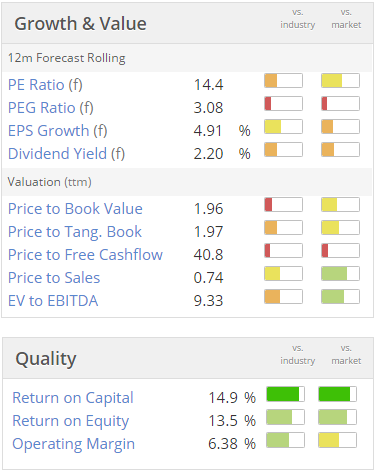

Valuation - bear in mind that the company has a strong balance sheet with plenty of cash too, so it's actually better value than the PER suggests;

My opinion - I reported here on 26 Nov 2015 when Lathams released its interim results. My conclusion at the time was that the forecasts for 44p EPS this full year looked light, and that 47-50p EPS would be my personal estimate, based on strong interims & reasonable outlook statement back then.I'm sticking with that view, which is reinforced by today's update.

This is a well-run company, with very sound finances, that looks priced sensibly. It's cyclical, but I don't see housebuilding, on which it heavily relies, slowing down any time soon - do you? We clearly need so much more housing in the South, that I imagine production is probably going to be increasing, if anything.

So there could be another leg up in Latham's share price building up, perhaps? It looks quite tempting to me at the current price, but bear in mind that it's a tricky share to trade, as so tightly held. The 2% divi yield looks surprisingly mean - the company could easily afford to pay out much more.

Hornby (LON:HRN)

Share price: 30.5p (up 7.1% today)

No. shares: 55.0m

Market cap: £16.8m

Update on banking covenants & trading - Barclays has given the company a bit more time to sort itself out;

The Group announced on 10 February 2016, that the Directors considered there to be a risk that the Group would breach the covenants of its banking facility in March 2016. The Group is engaged in constructive dialogue with Barclays Bank plc and is pleased to announce that the Bank has agreed to waive the March covenant tests.

That's clearly good news in the short term, and the shares have rallied a bit in response. However, the fundamental problem remains that Hornby needs to do another equity fundraising, to steady the ship. There's been quite a long delay now since this became apparent, which looks worrying to me - perhaps Institutions are baulking at putting in more funding?

I suspect the next equity fundraising could be at a deep discount. Look at what happened in similar circumstances at Stanley Gibbons (LON:SGI) recently. Therefore anyone buying the shares now could end up being a lamb to the slaughter, diluted heavily in the next Placing.

Current trading - this seems to be stabilising, which is encouraging;

The Group confirms that recent trading remains in line with expectations. Sales for the second half of the year to date*, have been down 2% year on year, within which the UK business has been up 4% year on year.

Whilst it seems that things are not getting any worse, do bear in mind that expectations are currently for a heavy loss for y/e 31 Mar 2016. The company guided previously to a range of -£5.5 to -£6.0m losses for this year. I reported in detail here on 10 Feb 2016.

My opinion - Hornby's balance sheet doesn't look bad at the net assets level, but the trouble is that it chock-full of inventories. So I suspect the restructuring will have to involve a big write-down of slow-moving stock. If the company does a big de-stocking, then it might be able to get by without an equity fundraising perhaps, or just a small one? That would be the ideal scenario for existing shareholders.

At the moment, this share is really only for gamblers, as we don't know how events will pan out. Clearly, breaching banking covenants, and relying on the goodwill of the bank manager, is a precarious position to be in. The bank manager will almost certainly be applying considerable pressure for the company to raise some fresh equity, to reduce his own risk.

I think this situation should be salvageable, but it's anybody's guess what level institutions might squeeze the company down to, if another fundraising is required. At some point it might be a good turnaround share, but my feeling is that it's far too high risk to get involved in at the moment. I'd rather wait for a fundraising to be completed.

Bonmarche Holdings (LON:BON)

Share price: 181.5p (up 0.8% today)

No. shares: 50.0m

Market cap: £90.8m

(at the time of writing, I hold a long position in this share)

CEO appointed - you might recall that shares in this value, niche retailer plummeted on a profit warning, and the CEO who had impressed institutions at the time of the IPO then decided to leave. Not good.

As I reported here on 15 Jan 2016, I was very tempted to buy some shares in this, but given how bad stock market conditions back then were, I decided to defer that purchase, in the hope that it might be possible to get them a bit cheaper.

Well since then, stock market conditions have improved, the share price has remained solid, trading sideways, and today we have news of a new CEO being appointed. It looks quite a good appointment to me, someone with highly relevant experience;

The Board of Bonmarché is pleased to announce the appointment of Helen Connolly as the Company's new Chief Executive Officer. Helen will take up her position later in the year and a further announcement will be made at the relevant time.

Helen is currently Senior Buying Director for George at ASDA, where she is responsible for all women's clothing, non-clothing and male and female essentials. Previously, she was Category Director for Buying and Design, and Buying Manager of Womenswear at George at ASDA. She was formerly Head of Sourcing for Womenswear and Girlswear from China, Thailand, India and Sri Lanka at Next plc and has also worked within Arcadia Group as Head of Buying at Dorothy Perkins.

Helen brings significant relevant experience from the value retail sector, with particular expertise in women's apparel, which is Bonmarché's core market.

Whilst I can't comment on the individual concerned, as I don't know her, or know of her (yet), but her experience seems a perfect fit. In my view the best small to medium retailer CEOs are ones who understand the product, and the supply chain, inside out.

For this reason, and the shares looking good value, I've dipped my toe in, with a small, entry-level sized long position this morning. I'll then keep an eye on it, and see how things progress, and either add to the position later this year, or chuck it out, depending on how things develop.

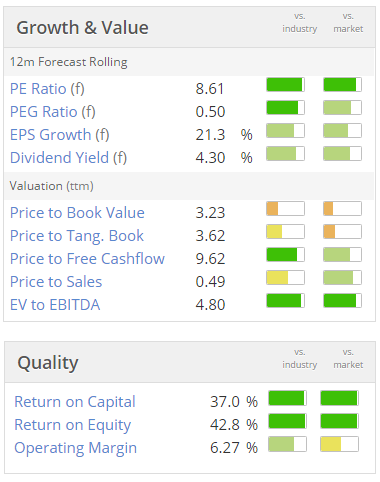

Based on current forecasts, it looks good value. All the more so because it has a good balance sheet, with plenty of cash. The risk though is that, having lost its previous CEO after a profit warning, there might be further problems yet to come? So it's a tentative buy from me. Position sizing is so important - so that when losses do occur, they're relatively small. I only really load up into big positions if I'm super-confident about the company performing well.

Tasty (LON:TAST)

Share price: 165.5p (up 2.2% today)

No. shares: 53.2m

Market cap: £88.0m

Results, 52 wks ending 27 Dec 2015 - as an aside, some retailers like to prepare their management accounts on a 4 or 5 week basis throughout the year, and then report the year as a 52 week period. Imy FD days, I tried that for a while, but it didn't work out well. The problem is that comparatives become difficult during the year, as you often end up trying to compare a 4 week period with a 5 week prior year period, or vice versa, which renders comparisons largely meaningless. Also, the full year accounts are skewed every few years by having to do a 53 week year. Monthly, and annual accounting, is far better in my experience.

Tasty currently operates 43 "Wildwood" and 7 "Dim t" restaurants, and is a straightforward roll-out - i.e. its using its cashflows, and bank debt, to expand the number of sites. What is interesting is that the people behind this chain are very experienced, having set up several very successful chains in the past, the Kaye family. So they know what they're doing. Therefore it is tempting to buy some of these shares, and tuck them away for 5 years, whereupon you'll almost certainly make a profit, based on management track record.

Revenue rose 20.4% to £35.8m

Adjusted operating profit rose 27.9% to £4.0m, driven by new site openings - that's a good enough profit margin, at 11.2% to confirm that the format works, and is worth rolling-out

Profit before tax is £3.1m (2014: £2.6m) - this is a more conservative measure of profit, as it is stated after £644k of pre-opening costs (for new sites), £133k share based payments, and £116k finance costs.

Diluted basic EPS is 4.58p. Although note that this is stated after only allowing for 697k share options, whereas there are 4,164k in the money options in total, but some may not yet have vested. Also there is further dilution from 500k A shares, and 600k B shares, which look like further management bonuses from what I can gather. So check this area carefully!

Valuation looks very expensive - it's currently on 36 times EPS. However, it's a roll-out, so it will be expensive during the growth phase.

Capex is heavy, due to the fit-out costs for new sites.

Operating cashflow is very good, so it's worth noting this, especially as the depreciation charge is becoming quite considerable - so once you strip that out, the existing sites are throwing off plenty of cashflow to finance new site openings - a virtuous circle.

Debt has risen significantly, but is not a problem due to the cash generation.

Has the restaurant sector reached excess capacity? There have been so many new restaurants open in recent years, that is a key question I think.

Director remuneration - this is an interesting point. Total Director pay at Tasty is low by listed company standards - the whole Board cost £404k in 2015. I'd say that's at least £300k (perhaps more) below what might be considered normal for this size of company. This has the effect of boosting profits by about 10%. That's worth considering, as it effectively puts about £8m onto the value of the company.

The Directors are also major shareholders, so I suspect they've twigged that they can create far more overall value for themselves by restraining their remuneration, thereby boosting profits, and having the company valued on a very high multiple of profits (because it's a roll-out), this has a material positive benefit to their overall wealth. It also means less dilution should they need to raise more equity. Smart thinking!

Although as investors, we really should normalise Director remuneration, before we compare valuations of companies. Normalising remuneration here would take the shares up to a PER of about 40. Pretty toppy!

My opinion - it's tempting, but the price is too rich for me, especially after all the share options, A, and B share potential dilution is taken into account, and once you've reduced profits to reflect normalised Director pay.

Have any readers eaten at the main Wildwood format restaurants? What did you think? I've found that Kaye family offerings tend to be very much me-too in terms of the menu. So basically a carbon copy of Pizza Express, with a few tweaks.

Looking at Wildwood's menu online, it seems to be following fairly closely to the standard Kaye format - lots of pizza & pasta options, which of course are very high margin. All a bit unimaginative.

IMImobile (LON:IMO)

Share price: 148p (down 1.0% today)

No. shares: 59.4m

Market cap: £87.9m

Trading update - there's an upbeat-sounding update from this software group today. The upshot is that they're trading in line, but lots of positive Directorspeak.

Key points today;

It's not the easiest thing to value. Very interesting company & terrific management.

I've run out of time today unfortunately, will have to leave it there.

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.