Edit: This report has taken shape now, so I've removed the initial introduction and am replacing it with a list of what we've covered today:

- Restaurant (LON:RTN)

- Trakm8 Holdings (LON:TRAK)

- Pressure Technologies (LON:PRES)

- Eddie Stobart Logistics (LON:ESL)

- Wey Education (LON:WEY)

- Churchill China (LON:CHH)

Cheers!

Graham

Thanks Graham! It's Paul here. We're trying to write the same article in relays. What could possibly go wrong?!

As regards Restaurant (LON:RTN) - I woke up thrilled that it looked as if there had been a 240p bid for Revolution Bars (LON:RBG) but then realised that I'd got the wrong ticker! I'm actually short of Restaurant (LON:RTN) - so was not best pleased with an 8% rise in its share price this morning, in reaction to interim results.

It's about £700m market cap after today's rise. RTN operates the Franki & Benny's chain, and some other smaller operations. About half its estate are near cinemas. I'm short of the shares because the main format seems tired. People I know tell me that the food is awful - microwaved frozen stuff, apparently.

There is over-capacity, and cost pressures (especially wages) in this sector. Although judging from the share price (now up nearly 10% at the time of writing), it sounds as if investor worries might be overdone. Could there be opportunities in the hospitality sector, I wonder?

A quick look at interim results from

Restaurant (LON:RTN)

(in which I (Paul) have a short position)

26 weeks to 2 Jul 2017

- LFL sales down 2.2%

- Adjusted profit of £25.5m in H1 - down 30% on prior year - note how operational gearing kicks in on the downside - a small drop in revenues = big drop in profits.

- Net debt of £19.3m, so company looks well-funded.

- Balance sheet looks strong, with NAV of £190.5m, and NTAV of £164.0m

- Interim divi maintained at 6.8p "as a sign of confidence in our plan"

- Outlook - current trading in line.

- Expect to deliver an adjusted PBT outcome for the full-year in line with current market expectations.

My opinion (Paul) - hmmm, the downside scenario hasn't panned out as I hoped.

I'll have a more detailed look later. I think for now, I'll leave my short position running. Consensus EPS for this year is 22.2p. So at 343p per share, the PER of 15.5 looks considerably too high. I think this share is probably worth about 200-250p, so I shall remain short.

Onto some small caps now.

Trakm8 Holdings (LON:TRAK)

(in which I (Paul) hold a long position)

I see that the FD has resigned. This is often a red flag.

However, the reason given is that he didn't want to relocate from Dorset to the W.Midlands. Who can blame him?! Dorset is lovely, which is where I originate from, so I'm biased!

Overall then I hope this is not a sign of trouble ahead.

Pressure Technologies (LON:PRES)

I see this one is down 14% today on a trading update. I quite like this company, but it's really suffering from the low oil price - it provides engineering services to that sector.

Oh dear, it's a profit warning;

...Notwithstanding the positive news that the manufacturing divisions are performing strongly and that cash flow is being well controlled, the Board expects that it will report results materially behind market expectations for the current financial year.

This relates to the year ending 30 Sep 2017.

This seems a rather confusing update. It says lots of positive things about its manufacturing division, but the problems seem to be in the alternative energy division. That's ironic, as those operations were supposed to benefit the group, by making it less dependent on oil companies.

The outlook comments seem quite positive, so I'm probably going to buy a few of these later. I do recall having some concerns about the balance sheet, so might do some more research on that before pressing the button.

Sorry this is all a bit rushed, as I have to dash for an investor lunch now.

I shall pass the baton to Graham now - will send him a text to encourage him to add some more sections, I think he has some free time this afternoon. Best wishes, Paul.

(The rest of this report is by Graham)

Eddie Stobart Logistics (LON:ESL)

- Share price: 159p (+0.3%)

- No. of shares: 358 million

- Market cap: £569 million

I like to write about stocks we've never discussed before, and Eddie Stobart is one of those. Its market cap is slightly above our official remit here.

This will be a well-known name to most readers, thanks to its distinctive trucks!

It has been listed since April this year, when it raised £130 million. That marked a return to the stock market having left its parent company Stobart (LON:STOB) in a go-private deal in 2014.

The IPO money was used to de-gear the balance sheet and also to buy iForce (link), a type of e-commerce logistics business (order fulfillment, returns management, stock clearance, etc), in a deal worth £45 million.

Alex Laffey, CEO, says in a video released this morning (link) that cross-selling opportunities between Eddie Stobart and iForce customers have already emerged, in both directions. Sounds promising.

Results

Today's results are in line with expectations.

There is a loss of £6.3 million but this is after £12.6 million of exceptional items

Given its strong belief in its underlying profitability, ESL declares a maiden dividend of 1.4p.

The outlook for growth is strong with the full effect of contract wins from last year and H1, and the iForce acquisition, to be felt in H2.

Management believe that Underlying EBIT was £16.9 million during H1, up 14% compared to last year.

That excludes the impact of an unprofitable activity in Ireland which was shut down, the amortisation of intangibles, and IPO/refinancing exceptional items.

For once, I'm quite well convinced that these are reasonable adjustments to make. Although perhaps I wouldn't exclude the discontinued activity, since not all future activities are necessarily going to be profitable either!

Free cash flow was £11.1 million, helping to support the thesis that underlying performance was better than the reported net loss.

The group carries significant net debt in the region of £98 million. Banks have provided it with massive facilities so there is plenty of headroom. Given the underlying EBIT/cash flow, and the fact that H2 is supposed to be seasonally stronger than H1, it looks a manageable amount of debt.

My opinion: logistics companies come in all shapes and sizes but ESL is clearly one of the better ones, in my opinion. The clients are blue-chip and the services are essential.

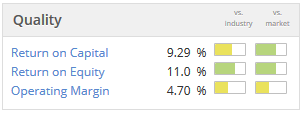

You'd expect it to be quite capital-intensive, however, and that looks like it's reflected in the Quality scores from Stockopedia. The debt load is necessary to improve return on equity, since return on capital isn't particularly good:

So I don't see this multi-bagging any time soon, sadly. But with the market predicting a forward yield of 4%. I could see it being a reasonable way to get some income!

Wey Education (LON:WEY)

- Share price: 22p (+2%)

- No. of shares: 103.5 million

- Market cap: £23 million

Taking a look at this in response to reader requests.

This is yet another first, a stock that's never been covered here before. It moved from ISDX to AIM in December 2015, at the same time as it created 50 million new shares in a placing.

One of the benefits of writing about the market is that you don't just bring other people information, they bring it to you, too!

Wey owns an online secondary school (link) and an educational consultancy business catering towards those who wish to sponsor free schools and academies.

Things started to kick off here back in February, around the time of an H1 trading update.

Revenues were reported significantly higher, and the Chairman agreed to have his annual salary paid in the form of new shares in company.

It was a mere £33k salary but the shares were issued at 3.88p, so it's turned out ok! And the same number of warrants, exercisable at the same share price for five years, were issued to him too. He now owns c. 20% of the company

(Incidentally, I think there is a typo in today's update it should say 850k shares were issued to him, not 950k.)

Today's update for the full-year reads as follows:

The results for the year will demonstrate significant growth in turnover and a vastly improved trading result. Pleasingly the significant increase in turnover reported in the Company's interim results continued in the second half. Turnover for the year is expected to have increased to at least £2.4 million, an increase of 60% over last year (£1.5 million) reflecting continuing growth in the core business and price increases.

It's all very bullish but I feel the need to point out that the company merely expects to report a "maiden adjusted pre-tax profit", adjusted for share-based payments. That is to say, it is only promising to not make a loss, on an adjusted basis!

I can see broker profit forecasts (presumably on an adjusted basis) of £0.2 - £0.3 million.

I also should point out that the market cap is now almost ten times revenue. Offsetting that, it does at least have almost £1 million in cash.

Wey is planning for "further significant growth" in the coming financial year.

The Company enters its new financial year with its various divisions well placed to accelerate growth. The recently completed upgrade of the online learning platform has been designed to allow significant, seamless growth over all business divisions and new, additional products are being introduced.

Despite the positivity, you've probably guessed by now that I'm a bit sceptical of the valuation here.

The top 3 shareholders have about 66% of the shares between them, leaving a tiny free float. That can easily exacerbate mistakes in the share price.

I agree with the Stockopedia ranking system: it's a High Flyer, but probably also Highly Speculative!

Churchill China (LON:CHH)

- Share price: 1005.7p (+4.7%)

- No. of shares: 11 million

- Market cap: £111 million

This manufacturer of tabletop products (bowls and dishes, cups, cutlery, glassware, plates etc) has been a winner in the currency markets, as its exports have enjoyed the massive tailwind of weak sterling.

It was already becoming more export-oriented anyway, in the years leading up The Great Devaluation. Exports are now 57% of revenue.

I've banged on about this before but I'll do it again: Churchill is a legendary company. It's been around since the 18th century, and it prints shares at a snail's pace. It had 9.4 million shares out in 1991!

Performance in recent years, has been excellent, and and today's figures show more of the same: modest revenue increases translating to very large profit increases.

- Group revenue up 8% to £25.8m (H1 2016: £24.0m)

- Operating profit up 33% to £2.7m (H1 2016: £2.0m)

- Profit before tax up 30% to £2.7m (H1 2016: £2.0m)

It doesn't take any financial risk, sitting on cash balances of £10 million.

Remember that the culture of this business is very different to most of the businesses we come across in the stock market: it's a family business, with many members of the Roper family still holding significant shareholdings, and two of them sitting on the Board.

The current outlook is fine:

"Trading momentum has been maintained since 30 June 2017 and we approach the key trading period in the year with confidence. We continue to expect that we will meet our targets for the second half year and remain positive in relation to our prospects for further progress."

My opinion: I've argued before that it would be wise to wait until general conditions, and especially the consumer markets which Churchill faces, turned against it, in order to achieve a better entry price.

But if I had to be fully invested now, I'd probably pick up a few of these. I think it has done just enough to warrant a PE ratio of c. 18x, after 220 years in business.

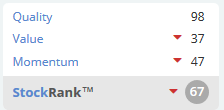

Stockopedia agrees on the Quality front, at least:

That's all for today, thanks very much for your patience as we pieced this together.

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.