Good morning!

Being Friday, it's quiet for news, especially so today, with very little of interest in my section of the market. That's useful, as I'm busy in meetings all afternoon. So I won't have time to do a YouTube video today, sorry about that - also no point, when there's no material.

Character (LON:CCT)

Share price: 435p

No. shares: 20.8m

Market Cap: £90.5m

(at the time of writing, I hold a long position in this share)

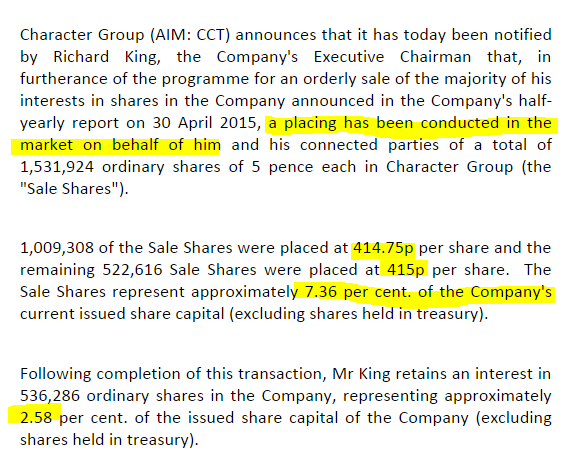

Director sale - I thought that yesterday's price weakness in this share was just a bit of profit-taking. However, it's more likely a bit of flipping (for an instant profit) from people who bought some stock from the Chairman in a secondary placing.

This is nothing to worry about, as the Chairman has had the stated aim of selling down his shareholding gradually for some time, and is doing so in an orderly fashion.

My opinion - it's pleasing to see that there was demand for 7.36% of the company, With this overhang now pretty much cleared, I am hopeful that the shares might make new highs - IF the newsflow continues to be strong.

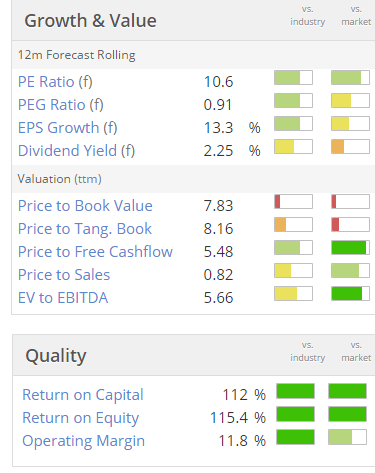

The valuation looks reasonable still, and note that this is one of the top ranked Stockopedia shares, with a StockRank of 98.

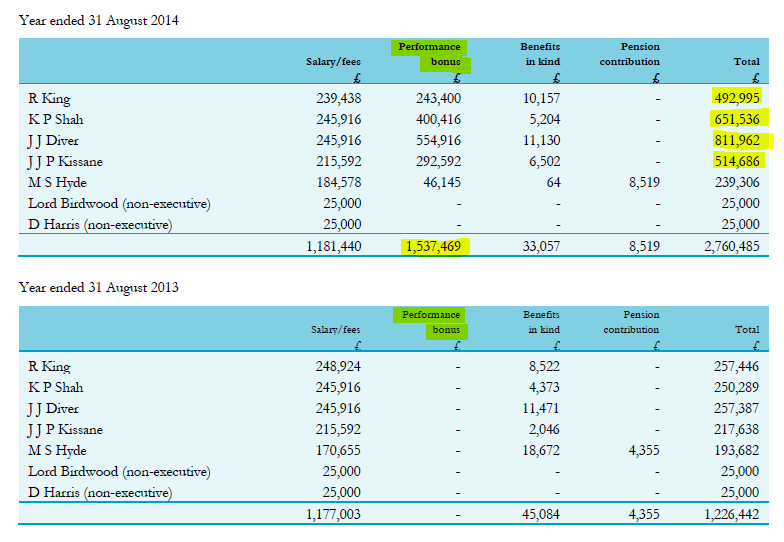

Director Remuneration - some readers have crticised the company for excessive management bonuses, and I think that's a perfectly valid criticism. Here is the Director remuneration table from the last Annual Report, where you can see that Director pay was pretty bonkers for what is still a smallish company (although note that they didn't get any bonuses the year before);

From my point of view, do I really want to cut off my nose, to spite my face? No. The shares have been a terrific investment in the last 8 or 9 months since I flagged it here (several times), and bought some myself. Therefore I can live with the Directors having a bit of a feeding frenzy too, even though bonuses of this size seem excessive.

A cap of about 50% of salary should I think become best practice for performance bonuses. Anything above that is rewarding people excessively for just doing their job, in my view. Often overly generous bonus schemes incentivise management to make bad decisions to chase short term personal gains too.

A few tweaks are needed to company law, to make remuneration votes by shareholders legally binding, and to give all shareholders (including those held via a nominee) an automatic electronic vote on AGM resolutions. If those two changes were made, then I think the ownership class would rein in the managerial class's excesses.

Although Directors are also big shareholders at CCT, which gives more scope for them to award themselves generous packages.

Bottom line for me, is that if I'm making a 100%+ profit on my shares in under a year, as is the case here, then I can live with overly generous management bonuses for the time being!

Bellway (LON:BWY)

Interim Management Statement - with a £2.9bn market cap, this is a giant company to me! The only reason I mention it is because, if I can find the time, I always find it worthwhile to read the market and outlook comments from the big housebuilders - as these are a very good barometer about consumer confidence, and the general outlook for the UK economy.

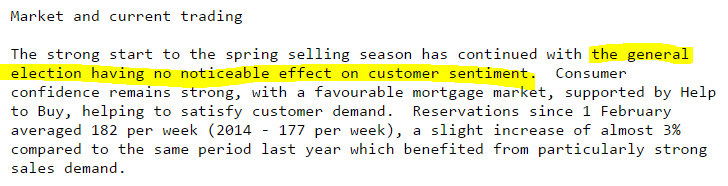

Do you remember how SCS (LON:SCS) blamed the General Election uncertainty for the slump in sales of sofas, causing them to warn on profits? At the time I remember commenting that this was a fairly ludicrous idea, and that is reinforced today by Bellway saying the following:

So people will happily spend £250k on a house, regardless of the General Election, but deferred the purchase of a sofa because they were worried about Ed Milband running the country! It just shows what utter tosh is put into trading updates sometimes.

This got me thinking though. Back in my days as a retailing FD, whenever sales dropped, the excuses given internally were nearly always weather-related. I can't remember ever hearing Area Managers saying that the product wasn't good enough - they didn't dare, as the Buyers would have ripped them to shreds! Or they might tell me in confidence that the product was no good, in hushed tones over a traditional English breakfast (a coffee & a fag!) outside the office, but they didn't dare say so in management meetings.

So perhaps companies on the stock market believe their own excuses when they under-perform too?

Well, apologies for today's report being so threadbare, there just wasn't any interesting news in my sphere.

Have a super weekend, and see you back here on Monday morning!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in CCT, and no short positions. A fund management company with which Paul is associated may also hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.