Good morning! It's a quiet day for news again this morning, so a fairly short report today.

I met with managament of Solid State (LON:SSP 241p) recently, to be briefed about the business, and I like it - they are a small, niche maker/distributor of rugged computer equipment, high temperature batteries, antennae, and various other niche products. They have good barriers to entry, since they tend to supply bespoke products to many clients, in relatively small quantities. The market cap is only £17.4m at 241p per share.

So a nice business, and family owned/run, with a fairly small free float. That brings some disadvantages, e.g. illiquidity in the shares, and the risk of a de-Listing, but my view is that where dominant shareholders have behaved decently (e.g. not drawing excessive salaries/bonuses, and paying decent dividends) over a long period of time, then you should be reasonably safe as a minority shareholder.

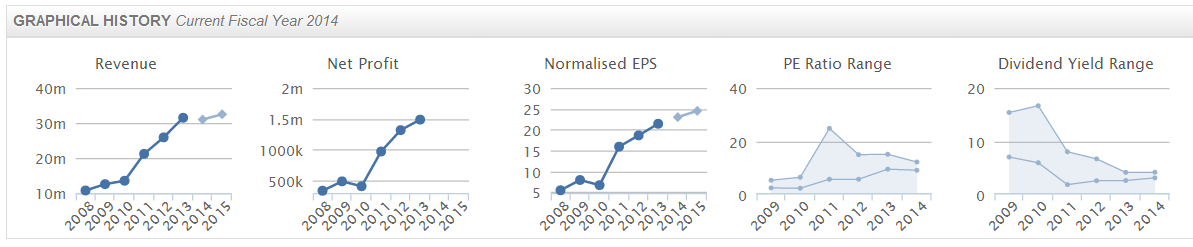

The Stockopedia graphical history shows a good progression over the last few years:

The reason I mention Solid State this morning is that they have issued an AGM statement. It has a 31 Mar year-end, so this covers just over 4 months of the current financial year ending 31 Mar 2014.

The key sentences in today's statement are (my bolding):

Solid State has made a reasonable start to the current financial year. Order intake remains strong and margins are holding well. We expect to see a repeat of the traditional second half weighting to our revenue, reflecting the buying patterns of our clients and their budgetary cycles...

...The Board believes that Solid State is demonstrating its resilience in markets that continue to reflect a cautious approach to capital expenditure. The niches that we service remain in demand with sentiment improving.

So that sounds OK, rather than exciting. It doesn't comment on the company's performance versus market expectations, which is a pity, as that is really the key point that a trading statement needs to convey.

Market expectations are for 23p EPS this year, so if we make a leap of faith and assume that the company will achieve those (which appears to be consistent with the overall tone of today's statement), then the shares are on a PER of 10.5, which looks reasonable value.

The dividend yield is reasonable too, at 3.5% forecast for this year, and 3.7% next year. Factor in some improvement in trading from a cyclical economic recovery, and there could be some good upside on this share price, if the company continues to perform well. They have also made a number of small, but successful acquisitions in recent years, at very low prices. So a good track record on that front too.

Quintain Estates And Development (LON:QED 88p) issue their Q1 Interim Management Statement (IMS). It gives general updates on their projects, but doesn't give the key NAV figure.

Their London Designer Outlet centre is now 70% let, ahead of opening in October, which is not great to be honest, it should be 100% let this close to opening, but it's being presented as if it were a positive.

There are updates on their two other key projects in Greenwich Peninsula, and Wembley.

Interestingly, they note that the London property market is strong, and characterised by an acute shortage of supply. Well that's hardly a surprise, considering property (especially new build) is being hoovered up by overseas buyers as investments, many of which are then left empty! What a ridiculous state of affairs. Also policy-makers have allowed the population to explode, without apparently giving any thought to where all these people are going to live.

So property prices in London & the S.East remain at dangerous bubble levels, with the Help to Buy scheme re-inflating the bubble even more. What we need is a massive new programme of affordable housing for rental by Councils, to meet demand, and to stop the lining of the pockets of Buy to Let landlords from the taxpayer subsidy known as Housing Benefit. Wouldn't it be better to divert that huge expenditure into building new Council Houses, and thereby create large numbers of badly-needed jobs in the construction sector? Sorry, I'll get off my soap box, but sometimes you really do despair at the lack of vision in our political class.

It is interesting to note that Quintain have supplemented their bank borrowings with a £115m 6.5% seven-year secured bond. This is a good example of how medium to large companies are getting round the shortage of bank lending, and making their own arrangements with investors, cutting out the middle man. This strikes me as a much healthier way to finance a property company, with a range of secure funding options, rather than relying on one huge source of finance from a bank or group of banks.

With the market cap now up to £457m, I'm inclined to drop update coverage of Quintain here from now on.

Cyprotex (LON:CRX 6.88p) results look good. I don't generally comment on the pharmaceuticals sector, as it's not an area I understand. This company issued a positive trading update on 20 June 2013. Their interim results to 30 Jun 2013, published today, show turnover up 22% to £4.55m, and an operating profit of £0.3m. The outlook statement indicates that they are on track to meet expectations for the full year.

Forecasts are for £10m turnover, £1m profit, and 0.3p EPS. So at just under 7p the shares are on a PER of about 20 times, and the market cap is around £15m. So it doesn't look cheap, but then growth companies never do. It's not my type of thing, as I have no way of knowing whether growth will continue or not.

Well, sorry this is such a short report, but I've looked at a couple of other things, but really nothing of interest today, so I'll sign off.

See you same time tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.