Kromek (LON:KMK)

Share price: 24.5p (-2.5%)

No. shares: 153m

Market cap: £37.5m

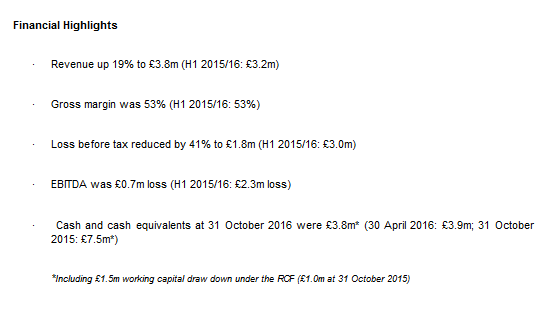

Interim Results for six months ended 31 October 2016

It remains in the category of unprofitable IPOs, sitting more than 50% down from the IPO price and now with 153 million shares outstanding, up from c. 108 million at admission. Unprofitable IPOs can sometimes be great opportunities, if the shareholder base is depressed, so they are worth a look.

In Kromek's case, there are a lot of promising signals in terms of the operations - contracts signed with customers from a variety of geographies and industries - so it remains possible that this could turn profitable in time, without needing to raise further funds.

Unlike some of the more speculative companies on AIM, this one has some serious intellectual assets, with 247 patents. It started life as a university spin-out, which is often a good sign.

Outlook: Broker sales forecast for the current financial year remains £8.9 million, rising to £12.5 million in FY 2017.

Today's outlook statement concludes as follows:

The momentum

of contract wins provides significant visibility of revenue. This

underpins the management team's belief in the sustained growth of the

business and commercial traction resulting from the increasing adoption

of CZT-based technology and other products. Consequently, the Board

looks to the future with confidence.

Cash flow: The operating cash flow movement (pre-working capital changes) was negative £0.6 million, and there was a further £1.9 million cash used in investing activities.

These negative movements were offset by positive working capital movements and research tax credits, so that free cash flow was negative £1.1 million for the six months.

Net cash: The company has £3.8 million in cash and a revolving credit facility with additional capacity, so it potentially has the cash resources to see it through to profitability.

My opinion: I never get involved when I feel that there is a risk of further dilution down the line, and even in the absence of dilution, very significant sales growth will be required in the coming years to justify a £37 million market cap.

But it does have some genuinely unique technology, so perhaps it will prove the doubters wrong!

Joules (LON:JOUL)

Share price: 194p (-4.2%)

No. shares: 87.5m

Market cap: £170m

Pre-Close Trading Update (26-week period to 27 November 2016)

Continued excellent sales growth from this lifestyle brand.

Revenue is up 16.2% overall, with 15.8% growth in the larger retail segment, and 17.2% growth in the wholesale segment, bringing total sales for the period to £81.4 million.

Profitability is higher too, gross margin improving by 100 basis points.

The shares are weak this morning, but they had risen very significantly from a low at 175p just two weeks ago.

My opinion: The statutory loss which this company announced in September, for the year ended May 2016, concealed a fantastic underlying performance. The company seemed to be in a sweet spot, with operating leverage driving the underlying figures rapidly higher.

It now has 107 UK/ROI stores and continued sales growth (with gross margin improvement) should hopefully see the leverage effects produce an excellent result for this financial year. Brokers are forecasting profit of c. £9 million.

In September, I expressed the view that a 190p share price was just too high, but today's RNS says to me that the company could be on track to grow into this sort of valuation over the next year or two.

Redhall (LON:RHL)

No. shares: 200m

Market cap: £17.5m

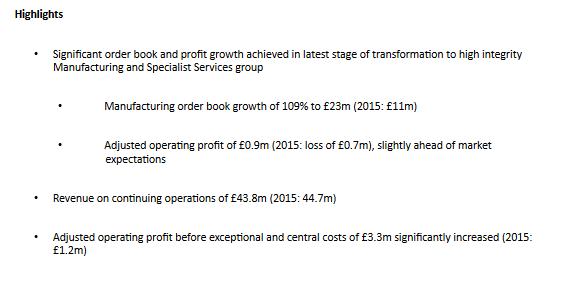

Preliminary Results (year ended 30 September 2016)

This engineering business has emerged from some very disappointing years for shareholders.

Strengthening the balance sheet required an increase in the share count by more than six-fold, with most of the currently existing shares having been issued last year at 5p each.

Thankfully, the situation is more positive now. The company is targeting opportunities related to the Hinkley power station, has a growing order book (£29 million now, up from £21 million) and a reduced cost base following the restructurings of recent years.

One very simplistic way of determining the success or failure of last year's restructuring is the share price: it has consistently stayed above the issue price. So investors seem to be confident that there is value being created above that watermark.

Outlook:

We are currently engaged in a number of very

significant tenders which if successful will provide Redhall with a

strong and sustainable long term order book. These tenders include

major door and fabrication packages for the nuclear new build project at

Hinkley Point C. They also include initial inquiries for further

nuclear new build projects of which there are currently plans for a

further five developments.

Some of the key macro drivers here are nuclear plant activity, oil and gas projects, and defense spending.

The accounts are rather messy, and require detailed research, but the statutory numbers say to me that the company definitely needs sales momentum to continue, if it's going to push through to an acceptable level of profitability.

The reported loss before tax on continuing operations was £0.7 million before exceptional costs, or £1.1 million after exceptional costs.

Borrowings: Contributing to the loss was an interest bill on bank debt of £0.7 million. At year-end, the company had drawn £8.2 million of £11.2 million available bank facilities.

My opinion: I find it a little bit disconcerting that the company remains significantly indebted (in the context of its market cap).

Besides the simple matter of having borrowed £8 million through its banking facilities, the balance sheet is also in significant negative equity once you exclude intangibles (£13.1 million of current assets and £2.6 million of PPE, against £22.3 million of total liabilities).

Personally speaking, this level of financial risk is not something I'd be comfortable with.

It looks set for a period of high sales activity, though, so it's possible that I'm overestimating the level of risk.

Numis (LON:NUM)

No. shares: 113.4m

Market cap: £270m

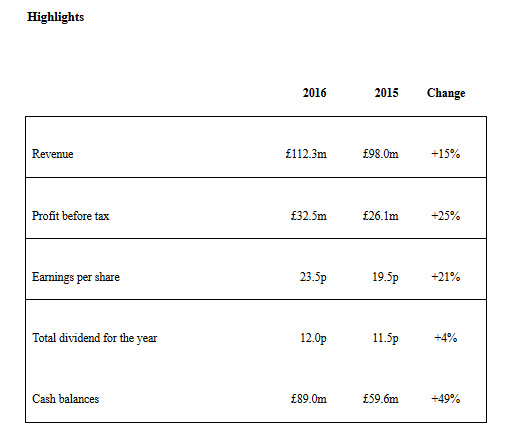

Preliminary Results for the year ended 30 September 2016

Financial companies like this are notoriously cyclical. Numis has now had four consecutive years of excellent profitability, but investors continue to refuse to give it a "normal" earnings multiple. The enterprise value is just £181 million, putting it on a trailing pre-tax multiple of less than six!

Dividend: Final dividend is increased to 6.5p (from 6p). This brings the full-year dividend to 12p.

Outlook:

Our new financial year has seen the

completion of 10 fund raises including 2 IPOs along with a number of

advisory mandates. Equities revenues are running slightly ahead of the

2016 daily run rate. Uncertainties surrounding a 'hard' Brexit coupled

with the result of the American presidential election will persist for

some time to come and we remain sensitive to the impact this may have on

market conditions.

My opinion: There is no denying that visibility is always going to be low, but Numis has weathered difficult macro conditions very well this year and on balance, I'd suggest that it deserves a higher rating than this.

The trailing yield of 5% is strongly covered, and the dividend track record is excellent. So for me, this is another example of a possible income play.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.