Mulberry (LON:MUL)

Share price: 1096p (-0.3%)

No. shares: 60m

Market cap: £658m

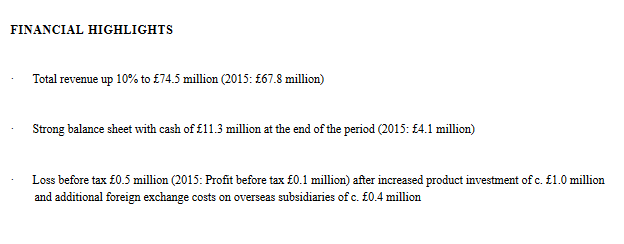

Results for the six months ended 30 September 2016

I hope you'll forgive me for venturing into mid-cap territory with this richly-priced luxury handbag designer.

Current trading: Besides the above figures to end-September, we also get an update on trading to the start of December. Total retail sales are up 4% (or 3% on a like-for-like basis).

Creative Director: Mulberry's new Creative Director has released his first collection of nine bags. He was hired last year, having previously been at Louis Vuitton. The collection is said to have been "well received by our existing customers and a new audience".

The success or failure of this type of business rests to a large extent on the inspiration of the designers. So it's important to have a look at who is behind the wheel in this regard.

While product diversification can reduce the risk, Mulberry is quite concentrated. Last year, leather accessories were 90% of sales, of which bags were more than 70%.

So the stock is almost a "pure-play" on a few handbags!

Related party agreement: Mulberry has a complicated relationship with Challice, its 56% shareholder. I don't think there is anything untoward, but the relationship is worth studying. Challice is going to own a minority share of Mulberry's new North Asian business (Mulberry will own 60%).

My opinion: I think that this company is going places, and the market cap might not be as overvalued as it appears at first glance. In FY 2012, on sales of £169 million, the company generated net income of £25 million (context: current market cap is £658 million).

That year, its H1 sales were lower than those which have just been announced.

Of course, things were different back then: gross margin was 66%, whereas it is currently 59%. Gross margin is still slipping, although the company says that this is just a short/medium term effect while the company invests in new product development.

Unfortunately, this is still far from certain. I'd have no desire, in its current stage of development, to bet my own funds on this company getting the formula right and recovering to prior performance levels. But I'd suggest that it's worth keeping an eye on, just in case things to start to pick up!

Caretech Holdings (LON:CTH)

Caretech Holdings (LON:CTH)

Share price: 306.5p (+5.3%)

No. shares: 64.2m

Market cap: £197m

Preliminary Results for the year ended 30 September 2016

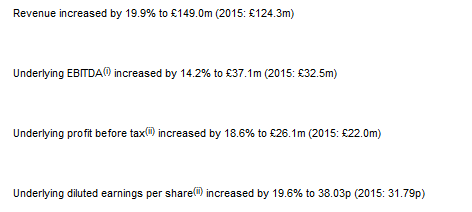

Excellent results from this provider of social care, which have been greeted positively by the market.

Final Dividend: Raised to 6.25p (from 5.6p). Full-year yield on current share price is 3.0%.

Property Portfolio: £304 million valuation, following acquisitions.

Freehold/Leasehold: Caretech raised £30 million by selling the freehold of 41 properties this year, so that it will have to pay a rising ground rent on these properties every year from now on. Apart from those rental payments, the deal is unlikely to affect existing shareholders, unless they are very young (the leases have a 150-year term).

Outlook: No concerns raised in the outlook statement.

The coming year shows every sign of being good for health and social care providers and especially for those with an established reputation for quality and innovation.

This year there has been significant policy development and we see some indicators that local authorities have recognised the need to maintain, or grow their social care budgets.

My opinion: Underlying diluted EPS of 38p looks cheap at first glance, but the risk of carrying £156 million of debt must be factored in here. That debt is worth about 240p per diluted share of the company.

For what should be an unexciting sector, I am impressed by the size of the operating profits (£30 million) and operating cash flow (£38 million, pre-working capital) which were generated on the company's assets (c. £260 million of PPE at the start of the year, much of it funded by debt).

So it looks like a high-quality performance to me, which could lead to further growth as the company reinvests its earnings this year. Depending on your view of the outlook for the social care industry as a whole, and your willingness to bear this company's financial risk, it could be worth further investigation.

Share price: 288p (-8.5%)

No. shares: 593m

Market cap: £1,708m

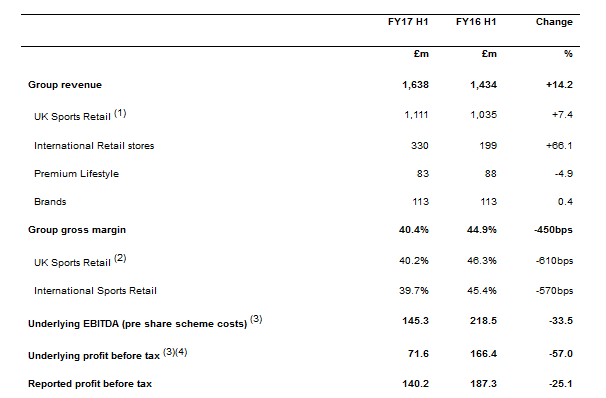

Interim results for the 26 weeks to 23 October 2016

Considerable share price weakness today.

It's hard to find the positives in this statement, though of course most of the weakness had already been priced in over the course of this year.

The headwinds to underlying performance are given as follows:

o The deterioration of gross margin as a result of the devaluation of the Pound ("GBP");

o A requirement to increase the Group's inventory provisions;

o Increased provisions for onerous leases in International Retail; and

o Increasing investment in our people

While the first of these factors is beyond the company's control, the rest of them highlight prior mistakes or unsustainable business strategies.

So it's fair that the company's performance takes a hit this year.

Worryingly, the effects of the pound devaluation are likely to stick around for as long as exchange rates remain where they are. Indeed, the outlook statement is as follows:

The Group is currently facing a number of strategic

challenges across its business model and operations, and currency

headwinds, which we expect to continue to adversely impact financial

performance over the medium term.

Net debt: reduced to £72 million (cash of £188 million minus borrowings of £260 million).

Debt-funded property investment: Sports Direct has >£500 million spare capacity on its £788 million facility. Yet it says is planning to invest >£300 million per annum on property investments over the next 2-4 years.

The size of that program seems far too large to me. The market cap is £1.7 billion, and they might spend £300 million per annum on property for 2-4 years? Wouldn't there be other ways to generate shareholder value than this? Even if purchases are offset by sales, it suggests an enormous amount of change.

My opinion: Prior to this morning, brokers were forecasting EBIT of £145 million for this financial year. This will be nudged a little lower now, to the bottom end of the range of expectations.

The present market cap provides a cheap entry point against likely EBIT but I could not sign off on the company's property strategy. Based alone on what I know about this strategy, I could not consider investing here.

Private & Commercial Finance (LON:PCF)

Private & Commercial Finance (LON:PCF)

Share price: 29.25p (-2.5%)

No. shares: 170m

Market cap: £50m

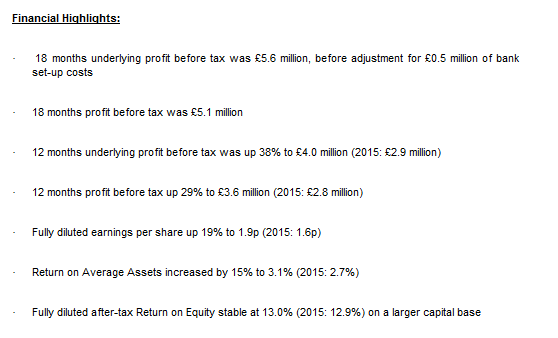

Preliminary Results for the 18 months ended 30 September 2016

Complications here due to an accounting reference change.

Thankfully, the company provides pro forma numbers for 12 months to September 2016 and also September 2015. So I'll refer to them in what follows.

This share price has increased ten-fold since its low in 2012.

PCFG provides finance for vehicles (everything from classic cars to HGVs), as well as plant and machinery. According to their online application form, they expect most loans to be at an APR of 10.9%.

In an exciting move for investors, the company announced yesterday that it has been approved by the PRA and FCA for a banking license, and is planning to accept deposits in summer 2017.

This could have fantastic implications for investors. Bank deposits are a very cheap source of financing. Deposits can replace existing sources of financing but also, as the company states that it intends, provide an opportunity to profitably scale the business. It should be able to compete for retail deposits while maintaining a healthy spread against their loan APR.

As for the current performance of the core business, it appears to be doing fine. Return on assets improved to 3.1% from 2.7% (financial companies like this are far more interesting to me than banks, which only tend to earn around 1% ROA).

Impairment charge: record low impairment charge of 1.0%, so that portfolio growth has not been at the expense of credit standards.

Dividend: The company's first dividend declaration in 13 years. The amount is 0.1p, with the intention that it will be progressive.

Outlook:

We have delivered excellent profitability in the period as the result of

a growing portfolio, combined with further gains in portfolio

performance and a continued focus on margin and costs. By establishing

itself as a bank the Group will, for the first time, be on an equal

footing with its competitors with regard to funding cost. We therefore

see opportunity and do not expect the forecast lower economic growth in

the UK to undermine our current strategy.

NAV: Balance sheet net assets are currently £24.7 million, or only about half the current market cap. However, the company also has £28.2 million of unearned finance charges which are set to be recognised in future years.

My opinion: I like this share. Of course, there is execution risk when you open a bank, and rising interest rates might make it more difficult to compete for retail deposits, unless the spread can be passed on to customers (who might be struggling in a rising interest rate environment). But I would still consider this company to be attractively priced, given the excellence of the financial performance and the opportunities opening up for it next year.

That's it for today, thanks again for tuning in while Paul has fun in the sun.

Hopefully these notes are stimulating your own creative, analytical juices. There are no Buy/Sell recommendations here - only one person's point of view.

Until tomorrow,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.