Good morning!

Synety (LON:SNTY)

This is the most interesting RNS of the morning for me, as I have high hopes for this small growth company.

Generally blue sky shares make bad investments - very few of them succeed commercially, and virtually all are over-hyped and hence over-valued. I've lost count of the number of times people have said to me, "This is going to be HUGE!", and it then turns out to be a commercial flop.

However, I like a good story as much as anyone else, but I look for very rapid sales growth combined with a good story. After all, if a company has sub-£1m turnover, and cannot generate 50%+ sales growth from that level, then what they are selling probably doesn't appeal to potential customers. Even if a product is good, it can be impossible to overcome the inertia of an established product from large competitors.

Therefore rapid sales growth needs to be combined with a product that is a no-brainer for customers - something that is not just an incremental improvement, but something that is obvious value for money, and provides a much better product or service than the one currently used by target customers.

Synety (LON:SNTY) ticks those boxes for me. It's cloud telephony, which integrates into CRM systems like Salesforce. Not only does that streamline making & receiving telephone calls with customers, but they are also recorded & instantly retrievable through the CRM system. It means that companies that need to record phone calls with customers can now do so without any capex at all on switchboard-based phone systems.

At the moment Synety have very little direct competition, so this is a land grab whilst they sign up customers of CRM systems such as Salesforce, Bullhorn, and others. The CRM market is very fragmented, so there are lots to go for, and integrations are fairly straightforward apparently.

So I like the company, and think it has considerable potential. Although as with all early stage growth companies, it's difficult to value, as on current performance it's loss-making, so you have to make assumptions about the future in order to value it at all.

This morning's update on KPIs is encouraging news in my view. I approve of the company's policy of releasing KPI numbers quarterly, which is exactly what you need with a rapid growth company. The key measure is annualised recurring revenue, which has risen 98% year-to-date, to £1.72m. So still early days, but that's exactly the type of very strong growth rate that I look for. I like the way the company is now reporting % growth rate against last year, as the previous quarter-on-quarter growth was meaningless. Although cynics might say that the change in reporting is because Q2 growth against the previous quarter slowed from Q1 growth - which is bound to happen because of the way the arithmetic works. You cannot continuously compound any growth numbers over short time frames, as even a static growth % rate would give you exponential growth!

Bear in mind also that the company has been setting up its USA operation, which is now already live and trialing customers, which must have been a major distraction for management time at such a small company. On top of that the company relocated in the UK to new offices in May, again a major disruption, so to continue growing sales strongly whilst that is going on, is impressive.

If they crack the USA, then the growth would go through the roof, and bear in mind that the CRM companies pulled Synety to the USA because their UK subsidiaries liked the UK product so much (many UK CRM companies are owned by American groups).

On the USA these snippets from today's update sound positive;

...in the US we are already receiving greater lead flows from Salesforce.com and Bullhorn CRM than we do in the UK.

"The board is increasingly confident about the exciting future the US business represents for Synety."

The USA market is about 10 times that of the UK, so there should be some explosive growth over the next year hopefully.

It's not for widows & orphans mind you, this type of share has to be seen as high risk, and difficult to value. The valuation is very much dependent on growth continuing. If competitors enter the space & slow them down to a crawl, then we could probably more than halve the current valuation. On the other hand, if growth accelerates as the USA operation builds, then I think this could quite possibly be a 3-4 bagger, and maybe more longer term. Time will tell. As always please do your own research, which is especially vital for small, more speculative shares like this one.

The company raised enough cash for about the next two years in a Placing and (small) Open Offer a little while ago at 250p, which probably acts both as a support for the share price, and also a magnet, as the temptation to flip stock bought in the Placing is probably too tempting for one or two placees.

Bear in mind that revenue is good quality - it's monthly recurring revenue, and once customers start using the product apparently they are very sticky - ideal attributes. Synety's product is cheap too, typically £25-30 per month, per user, so once a customer is using it, there's nothing to be gained from them moving to a competitor. The phone call charges are at wholesale rates, which helps make the customers very loyal to Synety once they start using it.

I find the market price movement this morning perplexing - but perhaps some investors had unrealistically high expectations for growth? When was the last time you saw a small cap grow its turnover by 98% in six months? It's not something I see very often, hence why I'm so keen on this company.

Jaywing (LON:JWNG)

This is a new one for me, it's a digital marketing company based in Sheffield, with a market cap of £21.6p at 29p per share.

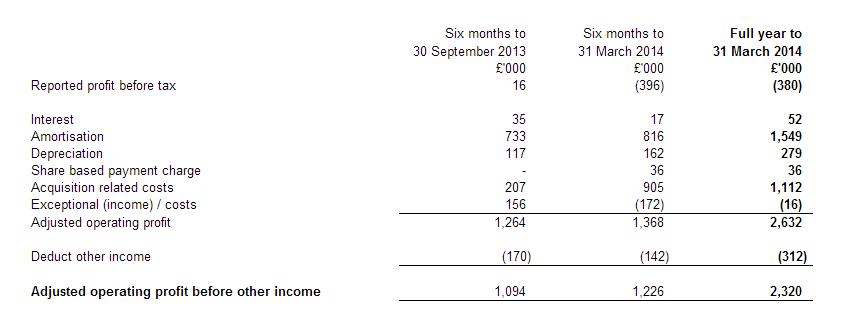

Results for the year ended 31 Mar 2014 have been issued this morning. The company helpfully provides a table to reconcile reported profit to adjusted profit, and an H1, H2, plus FY analysis.

The adjusted figures look OK to me, because the amortisation charge relates to goodwill, which is fine as that is a non-cash item. So the £2.3m figure for adjusted operating profit for the year seems a sensible measure of the underlying performance of the business.

I won't be investing here because the Balance Sheet is too weak - it fails my testing.

Net tangible assets are negative £8.3m, which is usually a no-no for me. I like to see tangible net assets, not net liabilities. Also there is too much debt in my opinion, which was taken on to part finance an acquisition last year. This results in current assets being only 76% of current liabilities, which is a long way short of my usual comfort level of 120-150%. There is long term debt too.

Too much debt, combined with a weak Balance Sheet, is asking for trouble in my view. It can work whilst a company is trading well, but if anything goes wrong, there is nothing to fall back on. So this one's not for me. There are no divis either, which is a big gap in my requirements - I like to be paid divis whilst waiting for a share to rise.

On the positive side, it's in an interesting & modern area - digital marketing, so there could be growth opportunities? Plenty of competitors too though I imagine.

On current trading the company says;

The start of the year has been in line with the board's expectations.

Cambria Automobiles (LON:CAMB)

There's an encouraging update from this growing car dealership chain today.

The key bit says;

The Board is also pleased to report that the Group's trading continues to perform well in a strong new car market and that it remains on track to at least match market expectations in the current financial year.

There is also news of a significant sized acquisition, of a Jaguar Land-Rover dealership in North London, from Lookers. The price is £10.5m, which is being financed from bank borrowings. That's fine in my view, as it includes a freehold for about a third of the purchase price, and I also very much like the way CAMB goes for freehold sites. That way shareholders gain the upside on the appreciation of the property, as well as profits from trading in it.

Remember that a turnaround specialist like Cambrian will increase the value of the property considerably when they turn around a struggling dealership. So to pass that gain over to a property company by leasing sites, would be ridiculous. It amazes me how so many investors have a complete blindspot about freeholds, and somehow think that owning them is "inefficient". That's crazy to me. If you can make money on a property as a bonus, then why give it away by leasing the property from someone else?!

This is another situation where buying these shares you are backing management. I was impressed with the CEO when he presented at Mello.

Stadium (LON:SDM)

This small electronics company issues a reassuring update, which says;

The Board are pleased to announce, trading in the first half of the year is in line with management expectations, and is significantly ahead of the equivalent period last year. Consequently, the Board remains confident about prospects for the year.

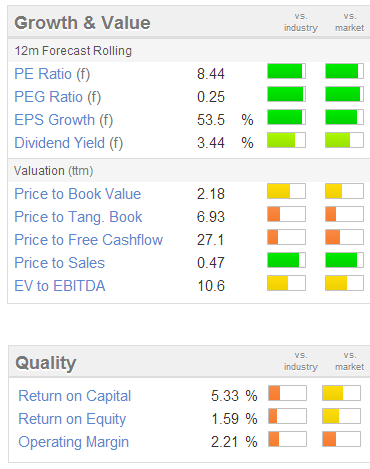

That sounds encouraging, especially when combined with an apparently very reasonable valuation;

The problem here is the large overpayments being made into the pension fund, to tackle its deficit. This was £866k last year, a highly material figure for such a small company, as touched on in a previous report of mine here.

Although it is interesting to see that some pension scheme deficits are reducing sharply at other companies, which should be the case as yields rise on bonds in a recovering economy. So there might be an opportunity to buy cheap companies with pension deficits, in the expectation of those deficits melting away with time. Although they are still a big risk factor - as a huge potential liability could open up if there's another financial crisis, or rather when there's another financial crisis.

If you're relaxed about pension deficits, then Stadium might be worth a look.

I'll leave it there for today. There's one Placing today for me to update on Placing Watch, so I'll get cracking on that next!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in SNTY, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.