Good morning from Paul!

That's it for today, have a smashing weekend.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Paul's 2023 share ideas, with live prices.

New SCVR summary spreadsheet from July 2023 to date, updated at weekends (very useful quick reference tool, search for ticker using CTRL+F). Hover over cell for pop-up notes.

Frozen SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Other mid-morning movers (with news) -

ITV (LON:ITV) - up 15% to 64.3p (£2.6bn) - Sells stake in streaming service BritBox Intl to JV partner BBC Studios for net proceeds of £235m cash. “The Board intends to return the entire net sale proceeds to shareholders through a share buyback which it expects to launch imminently after the full year results on 7 March.” - that’s 9% of the market cap, impressive. StockReport shows fwd PER 6.8x, and 8% yield. Cash-hungry pension deficit. Worth a closer look maybe? 8-year downtrend on chart.

Orchard Funding (LON:ORCH) - down 24% to 18.5p (£4m) - specialist lender says it has been hit by a £500k fraud. Reviewing all remaining loans & introducers. FY 7/2024 “material adverse impact “. Previous profit warning on 2/2/2024 due to 20% of its business being withdrawn (re GAP insurance) - also said to have a “material adverse impact”. Historically it’s been profitable & dividend paying. So now, at a quarter of NAV, it’s either cheap, or a can of worms. Controlled by CEO, holds 54% - delisting risk? AMBER.

Quick backlog comments -

Advanced Oncotherapy (LON:AVO) - shares still suspended - PAUL - an ominous update yesterday said there have been delays to its attempted refinancing. Now has “negligible” cash, and “significant debt”. Discussing a short-term bridging loan, but warns insolvency is looming. Paul’s view - I very much doubt this share will come back from suspension, looks increasingly like a zero, so holders need to prepare for the worst, and hope for a miracle.

ITIM (LON:ITIM) - up 8% to 32.5p (£10m) - Trading Update [ahead] - PAUL - AMBER - I mentioned this retail software company here (for the first time) 3 days ago, on news of a big contract win with QUIZ. Still loss-making & cash-burning. Yesterday’s trading update for FY 12/2023 is quite good - revs up 15% to £16.1m, ARR exit rate £13.2m (82% recurring revenues), EBITDA £680k (ahead exp of £300k). Cash £1.9m as expected, down from £2.7m in H1, so it’s still burning cash. Note it capitalises c.£2m pa costs, so EBITDA is not real cashflow. Paul’s view - I’m intrigued, this looks potentially interesting, but updates might be pumping share price ahead of a fundraise, as I think bal sht needs reinforcing. Founder owned/managed, with small free float.

Summaries of main sections

Eenergy (LON:EAAS) - up 27% to 8.35p (£32m) - Trading Update & Nat West deal - Paul - AMBER/GREEN

I've previously been negative on this energy services group, as it had a horrible balance sheet, and looked precarious. However, it has since disposed of the core business (positive, as I didn't like its business model at all), paid off all debt, and is now expanding other energy projects, using a new funding facility from Nat West. I need to do more research, but my initial inkling is that there might be an interesting punt here? So it's worth a closer look I suspect.

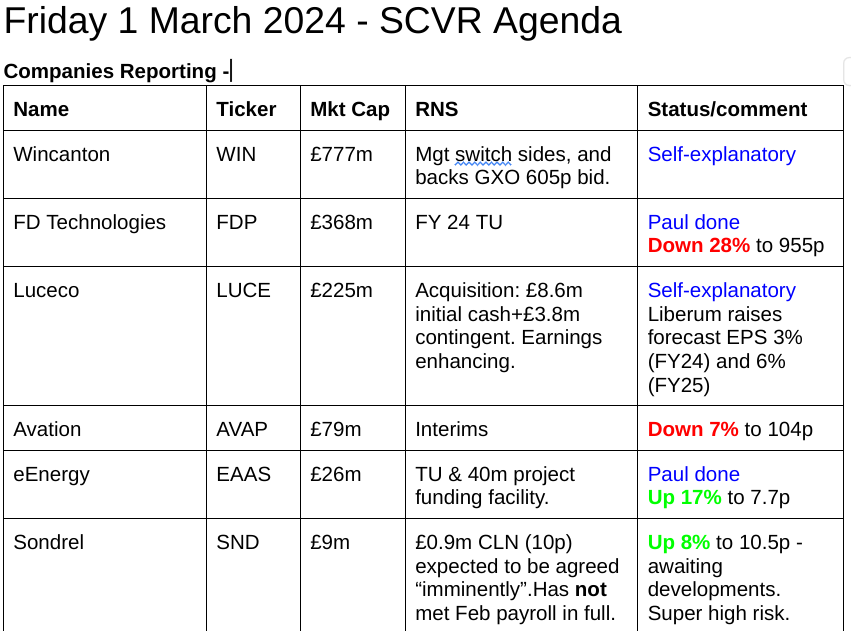

FD Technologies (LON:FDP) - down 28% to 955p (£268m) - Trading Update & Structure Review - Paul - RED

A very confusing update, but the market clearly hates it. A year-long strategic review has now concluded that it should separate its 3 businesses. I don't see how that will add any shareholder value. My reading of the numbers shows that this seems a poor quality collection of companies that don't generate any real world cashflows. So the market cap still looks extremely generous to me. Although tech investors may see things differently.

Paul's Section:

Eenergy (LON:EAAS)

Up 27% to 8.35p (£32m) - Trading Update & Nat West deal - Paul - AMBER/GREEN

Checking my previous notes for this energy consultants, I’ve only looked at EAAS twice before -

29/9/2023 - RED - Good: 12m interims break into profit. Bad: horrible balance sheet & cashflow.

8/11/2023 - AMBER/RED - said in talks to dispose of core business for £30m. My view - it badly needs to refinance. Luceco “invests” - query over unpaid invoices.

22/1/2024 - says it has “entered into an agreement” to sell for net £25m.

9/2/2024 - disposal completes, and cash received.

That’s brought me up to date, and has addressed my concerns over the balance sheet & funding.

On to today’s news -

£40m Project Funding Facility with NatWest and Trading Update

eEnergy Group plc (AIM: EAAS), is pleased to announce it has entered into an agreement with National Westminster Bank Plc ("NatWest") to provide up to £40 million of project funding (the "Facility") to finance energy efficiency and onsite generation technologies for the Group's public sector customers.

The Facility is a new financing solution created by both parties. The Facility has been designed exclusively for the funding of public sector energy transition projects across the full range of eEnergy products. The Facility will be deployed through a newly-formed special purpose vehicle ("SPV") owned by eEnergy, with eEnergy becoming the operator and retaining ownership and interest in the economics of each completed project.

The Facility is available for a period of 12 years with investment planned over the first 24 months. The Facility is split into two equal tranches to match the expected profile of drawdowns and optimise fees. The second tranche will become available to draw-down once 75% of the first tranche has been deployed, subject to customary final approvals.

The Board believes that this new Facility gives eEnergy a unique, compliant off balance sheet solution for public sector customers and will strengthen eEnergy's competitive position in tendering for large multi-site contracts. The Facility will lower eEnergy's cost of capital, delivering an attractive financial return on the retained project interests.

I would need more information to properly understand this. Surely if the new SPV is owned by EAAS, then it would be consolidated into the group accounts? That seems to conflict with what it says above the project being “off balance sheet”. OR maybe that means it’s off balance sheet funding from the customers’ perspective?

We need more details to understand this properly, so I cannot express any opinion on this specific deal for the moment. I shall await updates hopefully from Canaccord and Equity Development, who have covered EAAS before.

Trading update - this sounds like a profit warning below, but given the post period end disposal of its main business, then I would need to see accounts adjusted for discontinued operations -

Trading in the 6-month period ended 31 December 2023 was impacted by the Group's balance sheet constraints which have now been alleviated as a result of the sale of the Energy Management division. In addition, management have chosen to re-profile solar project revenue and adjust the FY23 results for the Energy Management division in relation to its subsequent disposal. As a result, the Board expects, subject to completion of the audit process, to report Group Revenues for 18-months ended 31 December 2023 of £46 million with Adjusted EBITDA of £5.1 million - £5.3 million.

All the debt has now been repaid from disposal proceeds, as expected.

Webinar - this could be useful in helping to explain things a bit better. Also with this type of share, working out if management are capable or not is vital, so I like to see them present - it doesn’t have to be polished (too polished can be a red flag!) - but for small caps I want to see entrepreneurs from any background, who can explain the business properly, and are on top of all the detail, rattling off facts & figures, and answering questions directly & honestly -

Harvey Sinclair, CEO, and Crispin Goldsmith, CFO, will be hosting an online presentation for investors on the 7th March 2024, to provide an investor update on the Group following the sale of the Energy Management division. Presentations will be held via the Investor Meet Company platform at 11:00, and the Equity Development platform at 15:00. Both presentations are open to all existing and potential shareholders.

Paul’s opinion - I don’t have anywhere near enough information to make a properly informed view on this. However, the positives are that it has comprehensively fixed its balance sheet, eliminating debt. Also it has sold the part of the business I really disliked, the energy consultancy bit with a horrible extended receivables book. Similar companies have gone bust in the past and have opaque accounts. So EAAS now looks completely transformed, with debt eliminated, and an interesting project with Nat West (which could presumably be scaled up a lot if it works well, given their financial size?

At £32m market cap, I reckon EAAS could be an interesting punt, so I’ll go up to AMBER/GREEN, but please bear in mind that’s not a detailed analysis, or a conviction view, more an inkling that there could be something interesting here, that needs a lot more work to confirm. I look forward to reading reader comments on EAAS.

Note the founder CEO of Luceco (LON:LUCE) has joined the Board as a NED, which I like a lot - he must think there's something interesting here, and LUCE bought 35m EAAS shares at 5p late last year in a new issue - details here.

A nice trend emerging in the last year -

Zoom out on the chart, and it's not so good. Note that EAAS reversed into a cash shell previously called Alexander Mining, so the chart prior to Jan 2020 is nothing to do with EAAS - I've rejigged the chart below so it's a custom range from EAAS's first day of dealings on 9/1/2020 -

FD Technologies (LON:FDP)

Down 28% to 955p (£268m) - Trading Update & Structure Review - Paul - RED

We’ve only looked at this company once when I reviewed it here on 24/10/2023, since Graham’s last review in 2018. I was distinctly underwhelmed, on 24/10/2023 when it issued a profit warning with H1 results, and I noted its weak balance sheet, customer caution, and negative cashflow.

Slower than expected growth at its KX business seems to be the main problem reported today, although confusingly it also says -

We anticipate that Group revenue will be slightly below consensus at not less than £247m, and adjusted EBITDA will be in line with consensus at not less than £22.5m*

Although that excludes MRP, which it has decided to merge with something else, and make it an associate in future.

KX isn’t growing as fast as expected.

Management has decided to separate its 3 businesses in an attempt to create shareholder value.

Paul’s opinion - I’ve just been looking at the last H1 results again, and FY 2/2023 FY numbers, and I don’t think this group makes any real world profit at all! It’s quoting fantasy EBITDA numbers, but check out the cashflow statement to see that nearly all the supposed cash generation is spent on capitalised R&D costs.

So I’ll leave this share to tech investors, who often value things completely differently to value investors! And we are in a tech boom of course, thanks to excitement over AI.

For me, on fundamentals, this looks a low quality business operating around cashflow breakeven.

Management seem to be flailing around trying to figure out how to create shareholder value. I’d say the £268m market cap is already very generous, and splitting up the group might make people realise more readily that it’s a collection of low quality companies that don’t make any money at the moment. That could improve in future of course, I’m only looking at things as of today, not trying to imagine what the future holds.

This is a great example of how EBITDA can present a wildly distorted positive picture for software companies that capitalise a lot of their payroll. Hence valuing shares on a multiple of EBITDA in this sector can result in absurd over-valuations.

I could be wrong of course, but that’s just my reading of the figures.

FDP shares peaked in June 2018, and have been in a declining trend ever since, losing over ¾ of their peak value - so I’m dropping my view of this to RED, now it has another disappointment under its belt -

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.