Good morning from Paul!

Today's report is now finished, have a lovely weekend!

I hope you're enjoying the apparently brief spell of warmer weather. I'm off to Gozo again tomorrow morning, so might record the week's summary podcast early, this evening. Or it might be on Sunday, it depends.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

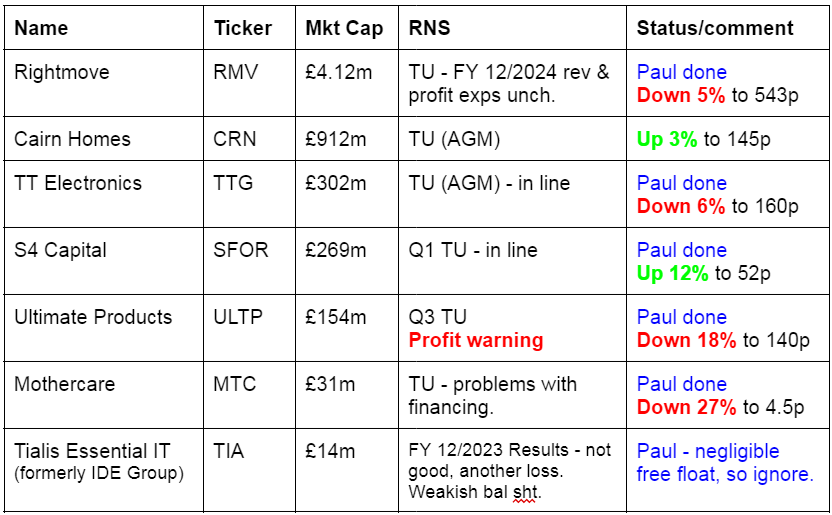

Companies Reporting

Other mid-morning movers (with news)

Genedrive (LON:GDR) - down 46% to 1.88p (£3m) - Discounted placing/open offer - Paul - RED

Raises £2.1m at 1.5p, a deep discount. Interestingly it’s also using the new REX platform to try to raise a further £3.5m from others (eg retail investors). Good luck with that! I welcome a new platform for us to participate in fundraisings on the same terms as institutions, but can’t help thinking it’s come about by necessity, since the instis aren’t interested in funding micro caps any more, as most of them are utter rubbish. It says that the REX raise has to deliver a minimum of £3.9m, or it won’t proceed. That’s bold. I wonder what their Plan B is?

Paul’s view - I’ve never written anything here about GDR, as the numbers have always looked so awful. It manages to accumulate heavy losses every year, whilst also reporting declining, and miniscule revenues. How do they manage to convince shareholders to keep pouring in millions in repeated fundraises? Always jam tomorrow I suppose, and on the cusp of great things. Yet hardly any of this type of company actually do achieve their goals. I see it did a marvellous speculative frenzy at the covid outbreak, 20-bagging briefly. The sooner all these jam tomorrow things delist, the better. They can probably achieve much higher valuations with private investors, so stock market listings at bombed out valuations are actually a hindrance, not to mention costly. We need a mass exodus!

Tirupati Graphite (LON:TGR) - down 10% to 4.75p (£5m) - Trading Update/Results FY 3/2024 - Paul - RED

Unusual formatting in this RNS, with some partial accounts (unaudited) and lots of bullet points!

Sales are up an impressive 70% to £4.9m, but the gross margin seems to have almost collapsed to virtually nothing. The balance sheet excerpt shows negligible cash, but about £5m tied up in Madagascar & Mozambique in bank guarantees and a pending VAT refund! You couldn’t make it up. Oh and the auditor has resigned because they haven’t been paid!

Paul’s view - as you can probably guess, I won’t be investing here, I’m out!

Polarean Imaging (LON:POLX) - up 26% to 4.35p (£10m) - New Order Received - Paul - RED

Newsflow here is starting to look interesting. A second order has been received, and it says that would result in $2.5m revenue for 2024, with additional orders in the pipeline. It’s starting to look as though POLX might, just might, be gaining traction with its commercialisation.

There’s one large negative though - it’s almost running on empty for cash. An update on 29/2/2024 indicated that cost cutting had extended its cash runway to Oct 2024. Some indications of fresh cash have been received, but the crucial point is we don’t know on what terms. So existing shareholders could get lucky, or more likely are lambs to the slaughter as new equity can dictate the price & potentially large dilution.

Hence at this stage it’s starting to look promising, but I’d only be interested in taking part in a new equity raise, not risk money now on old equity, when you know you’re going to be diluted, potentially ruinously. The value of their existing equity is now almost worthless, so I don’t see how existing shareholders have any incentive to protect the value of existing equity. Better to just put new money in at 0.1p or something like that, and take the company for themselves.

Hence it’s impossible to value right now., and with very high risk of dilution (well, it’s certain that you’ll get diluted), it has to be RED. Pity, as I’ve always liked the potential for this MRI scanning innovation, and it is now at the commercialisation point. But management made the terrible error of running out of cash, and just assuming more funds would be forthcoming - coinciding with a nasty bear market in small caps.

Summaries of main sections

Ultimate Products (LON:ULTP) - down 14% to 146p (£131m) - Q3 Trading Update (profit warning) - Paul - BLACK (AMBER on fundamentals)

Profit warning unfortunately, due to continuing softness in demand and customer de-stocking. Broker forecast is dropped by 21%, quite a hefty miss. Outlook for FY 7/2025 sounds better though, with order books improving. I think this deserves a c.20% drop in share price, as previous growth must have been flattered by customers stocking up.

S4 Capital (LON:SFOR) - up 17% to 54p (£314m) - Q1 Trading Update - Paul - AMBER/RED

Cost-cutting has allowed it to reiterate FY 12/2024 expectations, which also relies on an H2 weighting happening. Why is the technology division revenues down 31% in Q1, when its main US market is in a tech boom? It feels like something's not right here. Add in the terrible equity structure, with Sir Martin's golden B share giving him total control, plus the weak balance sheet relying on debt, and incomprehensible adjusted accounts, and I'm struggling to see any attraction here other than as a speculative recovery type trade.

Rightmove (LON:RMV) - down 5% to 543p (£4.32bn) - Trading Update - Paul - AMBER/RED

I mainly put this section up below to flag up Rightmove's interesting comments about the property market generally. However, it morphed into a criticism of RMV shares risk:reward, with a high PER, low yield (but buybacks help), and the risks to its price-gouging business model from two well-funded competitors. Can its network effect last forever? Let's have a debate! I see risk:reward as moderately negative overall at this valuation.

TT electronics (LON:TTG) - down 6% to 160p (£284m) - AGM Trading Update - Paul - AMBER/GREEN

In line with expectations, but some signs of softness (eg customer de-stocking). So I can see why recent share price gains have been given back. Graham's more positive on this share than me, so I've moderated it from green to AMBER/GREEN, mainly due to the bank borrowings, which still look too high.

Mothercare (LON:MTC) - Down 24% to 4.7p (£27m) - Trading Update FY 3/2024 - Paul - RED

Trading update isn't bad - in line with expectations, and the newish franchising model is making money. However, the finances are so stretched now (debt, and pension deficit) that is sends a clear signal that an equity raise is now highly likely, and/or bank refinancing & covenant waivers, etc. So the risk is existing equity could be clobbered in a discounted raise. Why get involved with all that risk, when the upside isn't exciting to start with? We'll watch from the sidelines for now.

Paul’s Section:

Ultimate Products (LON:ULTP)

Down 14% to 146p (£131m) - Q3 Trading Update (profit warning) - Paul - BLACK (AMBER on fundamentals)

Ultimate Products, the owner of a number of leading homeware brands including Salter (the UK's oldest houseware brand, est.1760) and Beldray (est.1872), announces its Q3 trading update for the period from 1 February 2024 to 30 April 2024.

This year is FY 7/2024.

Not good news I’m afraid, the reduced sales (4% down) in H1 has worsened to 7% down (vs LY) in Q3.

Blamed on “the broader slowdown seen in retail sales to consumers”, and customer de-stocking.

Expects similar conditions will continue in Q4.

Revised guidance - top marks here, for a footnote which details what previous expectations were, that’s incredibly helpful and deserves a round of applause, I wish all companies would do this, so that we can immediately see the extent of the profit warning -

Therefore, the Directors expect FY24 revenues to be at least £156m, with gross margin being in line with last year, and Adjusted EBITDA to be in a range of £17.5-18.5m.

* Consensus market expectations for the financial year ending 31 July 2024 are currently revenues of £166.7m, adjusted EBITDA of £21.5m and adjusted EPS of 15.6p

Outlook - more encouraging news here, this bit below reassures that this year is probably just seeing a temporary soft patch -

As the year progresses, we are continuing to see the gradual resumption of normal ordering patterns from our retailer customers as the overstocking issues brought about by the pandemic subside. The increase in forward ordering by retailers has primarily been benefitting our forward order book for FY25, and as a result we are already seeing significant growth over the FY24 order book. The Directors therefore have confidence in the Group's prospects for FY25.

Broker forecasts - two helpful notes out this morning, from Cavendish & Equity Development.

ED has reduced forecast adj EPS (my preferred measure) from 15.4p to 12.2p, a fairly hefty -21% drop. Often share prices mirror the size of the forecast fall, or can be worse if the problems are seen as continuing. In this case, the more positive outlook for FY 7/2025 might catch the fall, but it depends on what market participants do.

FY 7/2025 forecast is also dropped by 12% from 17.0p to 14.9p.

Valuation - the share price has been trending up, reaching 170p yesterday. I’m writing this without having looked at the opening share price (at 08:01), but I’m expecting a c.20% lurch down on the open.

I would have thought we could probably value ULTP shares on 12x reduced current year forecast, which gets me to 146p/share (down 14%) as being a reasonable price. Although profit warnings can undershoot a reasonable price.

Investor presentation - next week at 11am on Tue 14 May. Signup link here. This is good transparency from management, who I generally trust and see as competent. They’re also significant shareholders too.

Paul’s opinion - undoubtedly a disappointment, and I’m expecting a sharp fall in the share price (I’ve still not looked, honestly!). It might be worth waiting for the dust to settle before bottom-fishing here, is my current inkling.

Overall it’s a fairly decent business I think, and I don’t have any worries about solvency/dilution, since the last balance sheet had fairly modest net debt, and positive NTAV of about £13m - adequate rather than strong I’d say.

On fundamentals I’ll go with AMBER for now, and wait to see what happens next. That’s down from my previous view of GREEN, because obviously it’s trading badly, and has lowered forecast by 21% today. Overall - disappointing for sure, but it should regain its composure over time, based on the more positive outlook for FY 7/2025. Providing nothing else goes wrong of course.

Share Buyback launched from today in this separate announcement. Authority to buy (for cancellation) up to 8.93m shares was granted at recent AGM. First tranche is £1m to 31/7/2024, so not material & probably won’t make much/any difference to the share price.

S4 Capital (LON:SFOR)

Up 17% to 54p (£314m) - Q1 Trading Update - Paul - AMBER/RED

Previously - S4 is Sir Martin Sorrell’s revenge company, where he (I think) overpaid for digital marketing businesses, and was in too much of a hurry to create another industry giant. This has resulted in a mess - with a hollowed out, overly indebted balance sheet, incomprehensible accounts full of huge adjustments, poor trading and multiple profits warnings in 2023, plus of course the outrageous B share arrangement (giving him complete control basically, as I recapped on here on 27/3/2024). On the plus side, I didn’t see any immediate worries over liquidity, so for that reason moved up from red to amber/red last time.

There could be a rebound trade here, which is what today’s +17% price move might be indicating?

Today’s update -

Q1 revenue down 12-15% on various measures, but it says this is “as expected”.

Q1 “operational EBITDA” in line with its expectations.

Cost reductions (mainly staff reductions) & focus on gross margin (a good idea when sales are falling)

Full year targets unchanged for FY 12/2024, with “broadly similar” EBITDA, relying on “significant” H2 weighting (which it says is the usual seasonal pattern).

Wants to improve shareholder returns, now “all significant merger payments have been made” - wouldn’t it be more sensible to focus on debt reduction instead, given the weak balance sheet?

Obligatory mention of AI opportunities.

Net debt £206m at 31/2/2024, that’s up a fair bit from £181m at 31/12/2023, not helped by share buybacks, but also some remaining acquisition settlements. It expects debt to fall in H2 2024. It’s long-dated, and with soft covenants, so OK for the time being I think. When refinancing is required, lenders might be more sceptical perhaps?

Broker update - thanks to Dowgate who publish an update today. It points out that as SFOR moves through 2024, the comparatives will get a lot easier. So it could be reporting a return to growth later this year possibly, which might improve sentiment.

Dowgate forecasts adj PBT of £44m (4.8p adj EPS) in 2024, and £69m (7.4p adj EPS) in 2025.

Factoring in all the debt, which is about two-thirds of the current mkt cap, then I can’t see why anyone would want to pay more than say 10x 2024 forecast. So I’m getting to a cautious target of 48p per share. It’s currently 54p at the time of writing, so maybe in the right sort of ballpark?

Paul’s opinion - it all depends how you view the group that Sir Martin has created. Does it have great recovery potential (in which case shares could double from here I think)? Or is it a group of not particularly good companies cobbled together in a rush, that’s now struggling and seeing considerable reduction in demand? To my mind, with the US (by far SFOR’s largest market) economy performing well, and huge interest in AI and a technology boom generally, SFOR should not be reporting declining revenues, and in particular its “Technology Services” division is doing really badly, with Q1 revenues down 31%. Those numbers tell me something is not right here. The business should be expanding, not getting rid of lots of staff to cut costs.

Maybe Sir Martin’s stardust might cause shares to re-rate upwards in future, but on fundamentals it’s currently looking weak. That could change of course. It’s moderately tempting to have a little flutter here, just as a potential recovery trade. However, given that it consistently forecast too optimistically last year, I wouldn’t want to hang my hat on its current forecasts, relying on an H2 weighting which may not necessarily happen. I think on balance I’ve decided not to gamble on this one for now.

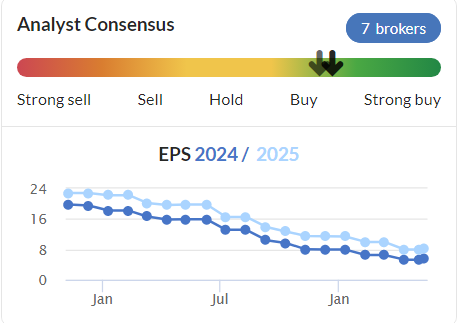

Ludicrous valuation previously, based on Sir Martin's amazing track record at WPP, but it just hasn't worked the second time around, so far anyway -

Broker forecast trend seems to be telling us there are deeper problems here too -

Rightmove (LON:RMV)

Down 5% to 543p (£4.32bn) - Trading Update - Paul - AMBER/RED

Trading update is in line for FY 12/2024 -

“Our expectations for revenue and profit for the full year are unchanged.”

However, its market update is interesting for general read-across, which confirms signs of an early stage recovery in the housing market -

“Our most recent monthly House Price Index[1] reported the average asking price for properties coming to market increasing by 1.1% month-on-month, with annual house price growth of 1.7%, the highest for 12 months.

Sales agreed between January and April 2024 are 17% higher than the same period last year, with both sellers and buyers now increasingly looking to transact, and we continue to anticipate total sales transactions of 1.1 million in 2024. Higher mortgage rates continue to stretch affordability for the average buyer, and the market is operating at different speeds across its many segments and areas. Completion times remain lengthy, with an average of five months between an offer being accepted and completion.

According to our latest Rental Tracker[2], the rental market remains very busy, with an estimated 50,000 properties needed to return the supply of rental properties to pre-pandemic levels. With an 18% increase in listings availability in the first four months of 2024 compared to the same period in 2023, rental agents received an average of 14 leads per available property, and average rents were 7.6% higher than the same period in 2023.”

Paul’s opinion - It's a wonderfully profitable business, but I’ve always seen Rightmove shares as potentially vulnerable to unexpected competitive threats, as they price gouge estate agent customers, making excessive profits. So far, the fortress has remained intact against ineffective competitors.

The network effect means RMV has remained dominant, but it now has 2 well-funded competitors, since OTMP was taken private.

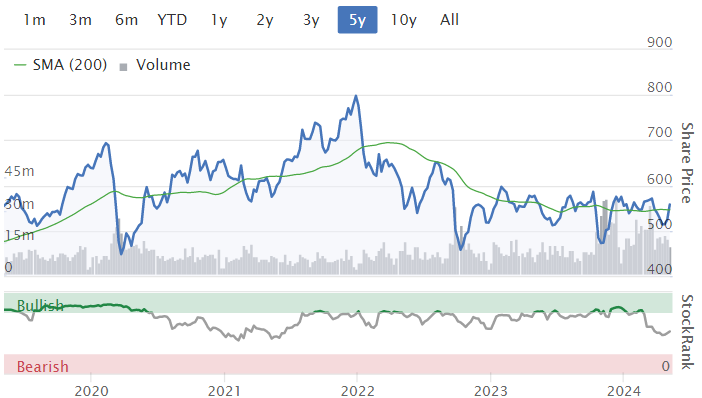

RMV shares have oscillated sideways for 5-years, so as a mature, cash cow business has it paid out monster divis? No! They’re rubbish, at just 1.7% yield. It has done a lot of buybacks though, but should a company on a PER of 21 be using its surplus cash to buy back shares? I’d say no. Also buybacks are often a screen for overly generous share options for management. The Directors transactions page shows that management seem to regard free share options as bonuses to be cashed in, rather than their intended purpose to allow them to build up a meaningful personal shareholding.

I know lots of readers will disagree with me here, which is fine, my stuff is just one individual’s personal opinions, frequently the market will do something different. We like a discussion of bulls vs bears, providing it’s kept polite, so I’d be keen to hear more bullish views on why you think RMV shares are a better risk:reward than I do!

One bull point might be that it could attract a US bidder, keen to price gouge customers even more, with aggressive price hikes (as we’ve seen in some horrible cases with important drugs) maybe? On the basis that estate agents don’t really have any choice but to list on Rightmove.

TT electronics (LON:TTG)

Down 6% to 160p (£284m) - AGM Trading Update - Paul - AMBER/GREEN

TT Electronics plc ("TT", "the Group"), a global engineer and manufacturer of electronic solutions for critical applications, publishes the following trading update on the Group's performance for the four months to 30 April 2024 (the "period"), ahead of the AGM taking place later today.

Full year outlook unchanged, on track for 10% operating margin target

The detail is a bit less positive though, with customer de-stocking mentioned (expected to normalise in H2), and an increased H2 profit weighting, which is bound to unsettle some investors a bit. Hence I can see why the share price has recently given up its sharp gains of the previous month.

Paul’s opinion - Graham normally covers TTG, and he’s been positive recently. The StockReport metrics look good, with a forward PER of only 8.4x, a reasonable yield of 4.4%.

Could it become a bid target maybe? Cheap, decent quality companies with fragmented shareholder registers often do.

My only reservation with TTG is that I think it made too many debt-fuelled acquisitions, but has been taking steps to reduce its rather toppy bank borrowings more recently. Hence perhaps it would make more sense to pause the divis to focus on debt reduction instead? Actually, I might moderate a little from green to AMBER/GREEN, let’s hope Graham doesn’t mind too much! (whoever writes the report gets the crayons to do the colouring-in!)

Mothercare (LON:MTC)

Down 24% to 4.7p (£27m) - Trading Update FY 3/2024 - Paul - RED

I last looked at this on 24/11/2023 - H1 results were better than I expected, but the debt & pension deficit are the big issues on which the survival of the company hinges.

Sales are now through franchisees, and fell 13% ni FY 3/2024 - not a healthy position.

Adj EBITDA is OK though, in line with market expectations and flat vs LY at £6.7m.

Net debt is now £14.7m, and pension deficit (accounting or actuarial?) unchanged at £35m. Note that H1 results contained a “material uncertainty” over going concern, specifically mentioning the willingness of the existing lender to continue supporting it.

Today’s update points very clearly towards the likely need for an equity placing -

With interest rates remaining at an elevated level, the interest rate on the Group’s existing loan facility is currently approximately 19.2%, which coupled with the extended time to return to pre-pandemic retail sales levels, particularly in our Middle Eastern markets, highlighted above, means the Board’s current forecasts for continuing operations show the Group requires waivers to our covenant tests.

We have therefore commenced refinancing discussions with our lender to vary, renegotiate or refinance this debt facility.

Additionally, we are well advanced in looking at various financing alternatives (including equity and equity linked structures) to give us both additional flexibility and reduced cash financing costs. For the avoidance of doubt the Group does not require (and is not seeking through this refinancing) additional liquidity.

Paul’s opinion - you know my view on struggling micro caps that need more equity! Why get involved, when you often end up being a lamb to the slaughter, powerless as new equity providers just name their price, and can easily largely wipe out existing holders. What’s the betting we end up with a 1p equity raise here, and existing holders then feel forced to average down, sucking you in deeper than you ever intended?

I actually think this is a salvageable business, because the newish capital-light model, where MTC doesn’t buy any stock, just charges franchise fees, is actually quite good. Although franchisees might go bust or close down unprofitable sites, so it’s not a long-term solution if sales continue falling.

If it manages to refinance, then shares could be worth considering, but for now there’s too much risk for fairly limited upside, even if things do work out, you might only value it on an EV of say 7x EBITDA, so maybe £50m debt-free, less the debt is £35m for equity - which isn’t much above existing equity of £27m. And that doesn’t even consider the yawning pension deficit. Risk:reward just isn’t right for me, so I’ll watch from the sidelines thanks.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.