Good morning from Paul!

All done for today, and the week. Have a smashing weekend!

Podcast is up here - mystery shares (my favourite share ideas of the week) are Warpaint London (LON:W7L) and Zotefoams (LON:ZTF)

My SCVR Summary spreadsheet here is now also up-to-date. It's a quick reference tool, where any company we've covered (588 in total) can be found by searching its ticker via CTRL+F. I use this spreadsheet before writing every section in the SCVRs, to get myself up to speed on this year's previous news from the company in less than 60 seconds. Also it provides a nice visual overview of the pattern of company reporting. You can hover over any cell, to see a pop-up summary of that company's news.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

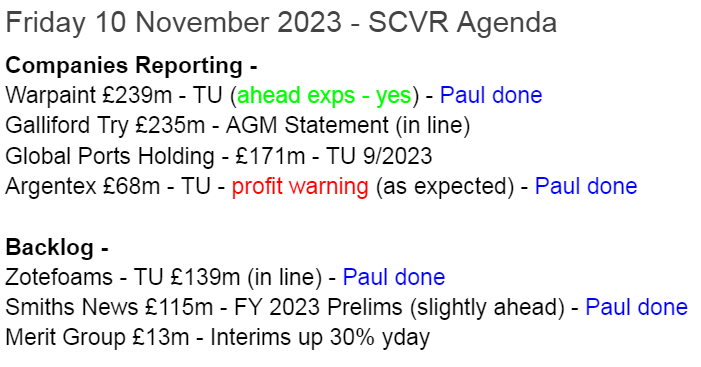

Summaries

Argentex (LON:AGFX) - 59p (pre market) £67m - Trading Statement (Profit Warning) - Paul - BLACK for spreadsheet, AMBER on fundamentals

Given the recent unexplained departure of both CEO & CFO, it was pretty obvious a profit warning was coming. Good to see some of the uncertainty removed today, with a profit warning that I see as: not as bad as it could have been, in the context of a halved share price. Looks due a bounce (which I wrote before 8am, before anyone accuses me of stating the obvious now it has bounced a little)

Warpaint London (LON:W7L) - up 6% to 333p (£256m) - Trading Update (ahead) - Paul - GREEN - (MYSTERY SHARE for podcast)

Another out-perform update from this makeup company. I remain a big fan of W7L shares, and even after a good run, I think the valuation still looks reasonable. Providing nothing goes wrong of course. One of the best GARP shares in the UK, remains my view.

Zotefoams (LON:ZTF) (Paul holds) - 285p (£138m) - Trading Update - Paul - GREEN - (MYSTERY SHARE for podcast)

I recap on the trading update earlier this week. The share price drop of c.30% recently seemed to imply a profit warning might be on the cards, but it's actually produced an in line update for FY 12/2023. Demand has been a bit softer, but higher margins have rescued the numbers to a very respectable outcome. On a valuation that now looks modest, I am comfortable keeping a positive opinion.

Smiths News (LON:SNWS) - 47p (£111m) - Audited FY 8/2023 Results - Paul - AMBER/GREEN

A quick look at recent results leaves me with a moderately positive overall view. The 9% dividend yield could go higher, if it renegotiates banking arrangements, which are now only showing modest debt. But is it just a cigar butt stock? We discuss that every time, what's your view?

Paul’s Section:

Argentex (LON:AGFX)

59p (pre market) £67m - Trading Statement (Profit Warning) - Paul - BLACK for spreadsheet, AMBER on fundamentals

This is one of several forex dealers listed in London, which seemed to have had a good run of success in recent years.

We’ve been speculating here that a profit warning was probably on the cards, due to the abrupt, unexplained departure of the (12% shareholder) CEO which I covered here on 26 Oct 2023.

Yesterday, the CFO also resigned, which I commented on here, demanding answers.

Understandably, some shareholders who could sell easily (a huge advantage PIs have over fund managers in small caps is the liquidity that comes with small holdings), decided to sell up and wait for answers, as evidenced by the plunging share price -

Profit warning

Today, we’re told this -

Argentex Group plc (AIM: AGFX), announces that following a review of its financial forecasts, the Board of Argentex expects to report revenue and operating profit for the year ending 31 December 2023 at approximately the same levels as for the twelve months ended 31 December 2022, which are below current market forecasts.

The interim CEO says -

"Obviously it is very disappointing that the numbers for this year are likely to show little, if any, improvement on last year and current market conditions remain challenging. However, Argentex continues to be a stable, profitable and cash generative business.

We are in the process of concluding a review of our strategy, which we will communicate to investors in the New Year, and we remain confident that there is a significant market opportunity for us to exploit."

My initial reaction is that it doesn’t seem too bad, in the context of a share price that has halved in the last 3 months.

I was struggling to work out the financial effect, because there’s been a change of year end, from March, to December. So we only have 9-month accounts to Dec 2022, and interim results to June 2023.

Ah, I’ve just spotted that they also showed pro forma 12-month figures to Dec 2022 within the 9-month accounts - revenues £50.4m, and adj operating profit of £12.3m. Adjustments boosted profit by about 10%, and finance costs were small at £0.3m, so profit before tax is fairly close to operating profit.

Singers to the rescue! A note has just come through on Research Tree, saying today’s profit warning is c.15% below existing forecasts at the EBITDA level, which is now expected to be c.£15m for FY 12/2023.

Singers has withdrawn forecasts and removed its BUY rating (now saying “Under Review”), until new management is “settled” (implying the interim CEP is staying on?) and the strategic review has been published (in early 2024).

Going back to an earlier Singers note from Sept 2023, its original forecast for FY 12/2023 was: £60.0m revenues, £17.5m adj EBITDA (now expected at £15.0m), and adj PBT forecast was £13.4m. So that’s a £4.1m drop from EBITDA to PBT.

So if I work from the new forecast of £15.0m EBITDA, this implies revised adj PBT of £10.9m, down 19% from the original £13.4m adj PBT forecast.

That’s about 9% down on 2022, at the adj PBT level.

Paul’s opinion - as you can gather from the above, this is a bit complicated to untangle when the clock is ticking, and I have to get this up before 08:00.

So my impression at this early stage is - not as bad as I feared, and I could imagine the shares might bounce at some stage.

I’ll stick with AMBER.

Publishing this just before the market open, so I have no idea what the share price will be, let's find out shortly!

Warpaint London (LON:W7L)

Up 6% to 333p (£256m) - Trading Update (ahead) - Paul - GREEN

Warpaint London plc (AIM: W7L), the specialist supplier of colour cosmetics and owner of the W7 and Technic brands, is pleased to provide an update on current trading.

Strong trading performance continues and results for the year ending 31 December 2023 now expected to be ahead of market expectations

Another forecast upgrade - not entirely unexpected, it has to be said - as flagged here on 20 Sept 2023, it looked as if there was possible upside on forecasts. I’ve just re-read my notes there, which are quite good (even if I say so myself!) as they included thoughts from a quick zoom with management on the day - including the point where they agreed with me that the numbers are still only small for a global makeup brand(s). The answer was yes, to my question that long-term global growth potential must be very considerable.

New guidance FY 12/2023 -

Revenue of £85m+ (up about 34% on LY - all organic too, I think)

Gross margin is “robust”, and above 2022.

Profit before tax (PBT) guided at £16m+ (the LY comparative is stated as £7.7m, but I prefer the adjusted comparative number, which is £10.0m for 2022, per Shore Capital’s note today [thanks!] - whichever number you use, it’s fabulous profit growth, especially considering tough macro.

Operational/outlook comments -

The Group's expansion strategy continues, with further scheduled launches in 2023 and 2024 with new major retailers and the expansion of the range of products stocked with certain existing customers. Launches in November 2023 include a range of W7 products in 400 Etos stores in the Netherlands and 100 Watsons stores in the Philippines, together with a range of Technic products being launched in over 200 Wibra stores in the Netherlands. Further expansion is also scheduled with existing retailers, including W7 being stocked in an additional 372 CVS stores in the US and 102 Boots stores in the UK during Q1 2024.

Shore calculates 16.0p EPS for FY 12/2023 - what’s the betting that the company has left a little reserve within that number, to end the year with a flourish? High, I reckon.

Forecasts for subsequent years show only modest increases (17.3p FY 12/2024, and 19.3p FY 12/2025), again it looks as if the pattern of under-promising and over-achieving might well continue.

Paul’s opinion - my main point is I wish I held this share, after raving about it for ages now! Never mind.

With such strong organic growth, that looks set to continue, is it worth worrying about valuation at all? Yes, because it would probably be a mistake to pay say 40x earnings or more. I’d be happy to value this share on the likelihood that I imagine 20p+ EPS is looking achievable in 2024. Pop that on a PER of 20x, which I think is reasonable, and I get 400p as a realistic price target (providing nothing goes wrong).

At 333p, the price is well below that still. So I see further potential upside here.

Hence I’m happy to remain at GREEN with my view of this share.

You don't need to read any books to conclude that this is a good chart! -

(lovely StockRank too, and "High Flyer" status per the Stockopedia styles)

EDIT: My interview with W7L's CEO here in Jan 2023 is still very relevant I think.

Zotefoams (LON:ZTF) (Paul holds)

285p (£138m) - Trading Update - Paul - GREEN

7 November 2023 - Zotefoams, a world leader in cellular materials technology, today provides a trading update for the nine months ended 30 September 2023 ("year to date") and in respect of its financial year ending 31 December 2023.

CEO Succession - long-serving CEO David Stirling has announced his intention to retire “within the next 12 months”. This looks orderly, hence not a worry, providing of course a suitably competent replacement CEO can be found. It’s an interesting, and financially sound business, so I would expect it to attract some strong candidates.

Q3 Trading Update - issued much later this year (7 Nov 2023) compared with last year on 13 Oct 2022.

The most important thing is it’s in line -

"Delivering on strategy - profit in line with market expectations"

Other points -

Performance “resilient” despite “challenging economic backdrop”.

9-month sales “similar” to LY, helped by “modest currency tailwind” - suggesting constant currency sales would be slightly down.

Q3 sales down on LY “as anticipated”. “Volatility in demand”.

Good visibility from confirmed orders for the rest of FY 12/2023 - good, as that means little likelihood of a profit warning.

Revenue for FY 12/2023 will be similar to 2022, but with improved product mix (ie more profitable).

Positive factors - strong pricing actions, operational efficiencies, more favourable raw material & energy prices -

...this is expected to drive improved overall profitability, with margins significantly higher than the previous year.

ReZorce update - doesn’t say much really (this is the potentially exciting innovative recyclable drinks carton project) -

The Group has also continued to invest in the development of ReZorce® recyclable barrier packaging technology and, following the signing of a joint development agreement, has made further progress against the milestones set, in advance of commercial trials scheduled for early 2024.

In our MEL business unit, costs will increase as we further invest in ReZorce and address some legacy issues in the licensing and equipment business. The MEL business unit is now predominantly focused on the development of the ReZorce recyclable barrier packaging solution for beverage cartons.

Overall -

The Board is confident in the Group's ability to carry positive momentum through the remainder of the year. Based on its current sales forecasts and foreign exchange rates, and subject to there being no material disruption to the business, it expects adjusted profit before tax to be in line with current market expectations*.

* Current Zotefoams-compiled consensus expectations for adjusted profit before income tax and separately disclosed items, for the year ending 31 December 2022, is £12.5m.

Broker expectations have barely changed for the current year at c.20p EPS, which is not bad going considering tough macro, in my view -

Look at what’s happened to the share price over the last year though - it’s as if the market was expecting a profit warning, which has not happened -

Maybe the valuation got a little stretched, with hindsight, but now it’s really come back down to earth - this looks a bargain to me, for a good quality business that has demonstrated considerable ability to navigate the crises of the last few years, including big hikes in costs of production which were successfully passed on to customers -

Paul’s opinion - it’s been useful to refresh myself on ZTF shares. I hold a small position currently, and I’m feeling an urge to increase it with some fresh buying after doing the work above. There’s no cash available unfortunately, so it will have to stay on my top-up list for now.

As with so many shares at the moment, it looks as if this has been mainly sentiment-driven selling, rather than anything fundamentally going wrong at the company. It’s managed to maintain profitability, despite some softening of demand. That should leave ZTF nicely set up to show decent profit growth once the top line turns up again at some stage in the future. Usually we see the opposite - profits crashing due to operational gearing when demand softens, but not the case here. That tells me it’s well-run, has pricing power, and hence looks a good quality business, at a modest valuation currently, after the recent plunge from c.300p to 280p. Thumbs up from me!

There's are also 2 wild cards, in for free - ReZorce might "blow the bloody sperm whale off the beach" (see SCVR earlier this week) if it's a success, and boost profits from ending development spend if it's not a success. I wonder if NIKE (major customer) might be tempted to take over ZTF for the special running shoes performance soles?

Smiths News (LON:SNWS)

47p (£111m) - Audited FY 8/2023 Results - Paul - AMBER/GREEN

The precise period is the 52 weeks ended 26 August 2023.

SNWS is a distributor of newspapers & magazines. We’ve covered it in loads of detail here over the years, and been impressed with the successful turnaround.

Legacy problems have all been dealt with, so it’s now free of pension funds, loss-making bits, and excessive debt.

Although obviously whatever anybody says, investors are unlikely to ever give this share a decent rating, unless they find some other use (that isn’t shrinking) for its fast, overnight, distribution network to thousands of shops.

There’s a recording of the recent mgt webinar here.

I’m going to keep this fairly brief, but my reading of these numbers is pretty positive, in the context of an extremely lowly valuation of the shares.

Performance is good -

Performance ahead of expectations with further debt reduction and contract renewals

Plenty of encouraging things summarised here -

Key P&L numbers -

Revenue flat at £1,092m

Adj PBT slightly up at £32.3m (up 4%)

EPS flat at 10.8p (so a PER of only 4.4x)

Balance sheet - is negative, but shrinking nicely. So net liabilities of £(32.0)m last year, improved to £(16.3)m by Aug 2023. That only includes £2m intangible assets, we can ignore that as small.

Fixed assets are minimal, as things like vehicles are I believe outsourced to self-employed drivers. Correct me if I’m wrong there, that’s from memory when I spoke to mgt a few years ago.

Working capital are large numbers, which no doubt move about a fair bit on a day-to-day basis, dependent on when big customers pay, and big suppliers have to be paid. But they’re roughly in balance, with £157m current assets, versus £159m current liabilities. That looks fine to me.

OK, the balance sheet looks OK, nothing special, but no particular problems either.

Average cash/debt - this is a real breakthrough! Take note everyone in the City please, SNWS provides the “gold standard” of cash/debt reporting - it tells us the year end snapshot on the balance sheet date of £4.2m net bank debt, but also gives us the hugely more important & meaningful “average bank net debt” figure (average working day, I assume) of £25.0m - which has reduced 50% versus LY.

We need average daily net cash/debt figures from EVERY company, it should be essential reporting, and is a big gap in current accounting disclosure rules.

Outlook - reassures me -

The new financial year has started well. Our critical drivers of sales, margin and sustainable cost reduction are being closely managed and we remain attentive to ongoing inflationary pressures which remain above historic levels. Cost reduction initiatives are well underway and progress continues to be made with our growth strategy. We are confident in delivering results for the current financial year in line with market expectations.

Dividends - note these are capped at £10m, so 4.15p, under current banking agreements. Maybe there’s scope to re-negotiate that? If so, divis could rise, and that looks quite plausible to me, given modest bank borrowings.

Note the current divi yield of nearly 9% is covered 2.5x by earnings. So if SNWS could agree with a new lender to secure bank borrowings (which fluctuate a lot) against its debtor book, in return for releasing it from any upper limit, then in theory SNWS could pay out all its earnings, for a dividend yield of over 20%! That would be exciting if it happened.

Paul’s opinion - sorry this is quite a quick glance, rather than in depth rummaging.

Investors just have to weigh up the same question as always here - are investors buying a cigar butt type share, that is paying out nicely, but with limited remaining profitable lifespan? Or is there a more sustainable future for the company?

Nobody knows! But these numbers do naturally draw me towards it, but they’ve been doing so for years, and the valuation remains at rock bottom.

On balance, I’ve moderately positive on this share, given all the progress that has undeniably been made, so I’ll go with AMBER/GREEN.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.